Liquidity stress in the U.S. economy is no longer a background condition.

Instead, it is the mechanism reshaping how different segments experience work, confidence and financial progress.

That was the core insight of “Wage to Wallet™ Index: Liquidity Stress Splits Higher Earners and the Labor Economy,” a December report from PYMNTS Intelligence produced in collaboration with WorkWhile and Ingo Payments.

While overall economic sentiment improved at the end of the year, that improvement masked a widening divide between salaried workers and the hourly workforce that underpins much of the service and logistics economy, per the report. Employment alone is no longer a reliable proxy for financial stability. Access to cash, timing of pay and perceived mobility increasingly determine who feels ahead and who feels stuck.

While overall economic sentiment improved at the end of the year, that improvement masked a widening divide between salaried workers and the hourly workforce that underpins much of the service and logistics economy, per the report. Employment alone is no longer a reliable proxy for financial stability. Access to cash, timing of pay and perceived mobility increasingly determine who feels ahead and who feels stuck.

The report framed this divide as a “mirror image” economy. Non-Labor Economy workers, largely salaried and higher income, increasingly view the broader economy as less relevant to their personal situation.

Labor Economy workers, by contrast, see their own finances lagging the national picture despite steady employment. The split matters because it influences spending decisions, credit usage and risk tolerance in ways that standard macro indicators do not capture. The economy, as lived day to day, now depends less on wage levels alone and more on how reliably earnings convert into usable money.

Advertisement: Scroll to Continue

Key data points illustrate the depth of that divergence:

Non-Labor Economy workers said they are financially better off than the national economy, at 41%, compared with 17.7% of Labor Economy workers, while 40.4% of hourly workers reported being worse off than the national average.

Nearly one-third of both worker groups incur overdraft fees or late payment penalties at least once a month, but the fixed cost of those fees consumes a larger share of hourly income, effectively creating a regressive “liquidity tax.”

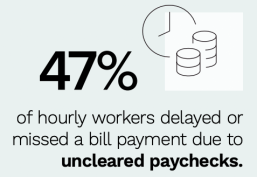

In the month before being surveyed, 47.3% of Labor Economy workers delayed or missed a bill payment because their paycheck had not yet cleared, underscoring that timing, not insolvency, is often the trigger for financial distress.

Beyond these headline findings, the report showed a behavioral shift with broad implications for banks, FinTechs and employers. Hourly workers increasingly describe themselves as “safe but stuck.”

Job security feels high, but confidence in finding new work remains low. That combination discourages risk-taking, from changing jobs to investing in training, and leads households to prioritize immediate stability over long-term optimization. Bills are not missed randomly. Medical payments, subscriptions and credit cards become safety valves, delayed strategically to protect housing and transportation.

For financial services providers, the takeaway is not simply that stress persists, but that its sources are increasingly mechanical. Faster wage access, real-time disbursements and short-duration liquidity tools directly address the timing gaps driving penalties and pessimism. Treating these gaps as collections problems rather than product problems risks reinforcing the very divide the data revealed.

The Wage to Wallet Index ultimately suggested that optimism in today’s economy is earned through liquidity design. Those with predictable access to money and credible paths to mobility feel resilient. Those without remain exposed to small disruptions that cascade into larger consequences. It’s a shift in structure, but not in impact.

At PYMNTS Intelligence, we work with businesses to uncover insights that fuel intelligent, data-driven discussions on changing customer expectations, a more connected economy and the strategic shifts necessary to achieve outcomes. With rigorous research methodologies and unwavering commitment to objective quality, we offer trusted data to grow your business. As our partner, you’ll have access to our diverse team of PhDs, researchers, data analysts, number crunchers, subject matter veterans and editorial experts.