Live Nation Entertainment (LYV) has attracted investor attention after recent trading moves, with the share price at $148.85 and mixed returns over the past 3 months and year. This has prompted closer scrutiny of its fundamentals.

See our latest analysis for Live Nation Entertainment.

The recent 1 day share price return of 1.90% and 1 month share price return of 3.99% sit against a 1 year total shareholder return of 13.97% and a 3 year total shareholder return of 99.37%. This suggests momentum has cooled in the short term compared with the longer track record.

If Live Nation’s recent moves have you reassessing your watchlist, it could be a good moment to look at fast growing stocks with high insider ownership as potential fresh ideas beyond the live entertainment space.

So with Live Nation posting 3 year total returns close to a 2x multiple and trading at $148.85, is the current price still leaving upside on the table, or is the market already pricing in future growth?

Most Popular Narrative: 12.6% Undervalued

Compared with the last close at $148.85, the most followed narrative points to a higher fair value, built on specific growth and margin assumptions.

The experience economy is fueling robust, sustained consumer demand for concerts and festivals worldwide, as evidenced by record ticket sales, growing international fan attendance, and strong sell through rates; this dynamic underpins continued top line expansion and higher on site spending per event, supporting both revenue and margin growth.

Curious what kind of revenue trajectory and margin lift are factored into that view. The narrative emphasizes earnings expansion and a premium future P/E multiple. Want to see how those pieces fit together into a single fair value number?

Result: Fair Value of $170.24 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are still real swing factors here, including ongoing regulatory and antitrust scrutiny around Ticketmaster, as well as the risk that international expansion or venue build outs fail to earn their keep.

Find out about the key risks to this Live Nation Entertainment narrative.

Another View: Rich Pricing On Earnings

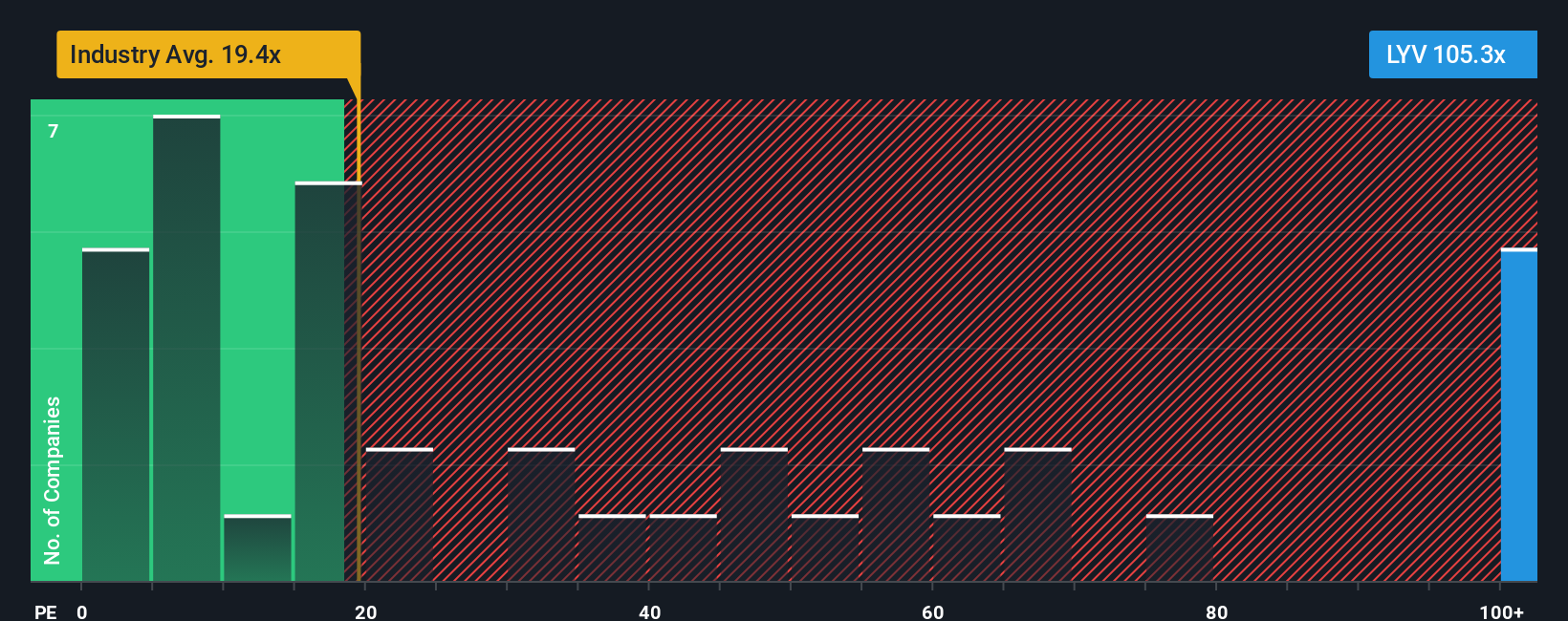

The fair value narrative points to upside, but the current P/E of 107.3x tells a very different story. That is far above the US Entertainment industry on 19.4x, peers at 83.2x, and even a fair ratio estimate of 40x. This points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:LYV P/E Ratio as at Jan 2026 Build Your Own Live Nation Entertainment Narrative

NYSE:LYV P/E Ratio as at Jan 2026 Build Your Own Live Nation Entertainment Narrative

If you see the numbers differently or prefer to test your own assumptions, you can review the data and build a complete view yourself in just a few minutes, starting with Do it your way.

A great starting point for your Live Nation Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Live Nation is already on your radar, do not stop there. Use the screeners below to spot other opportunities before they move without you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com