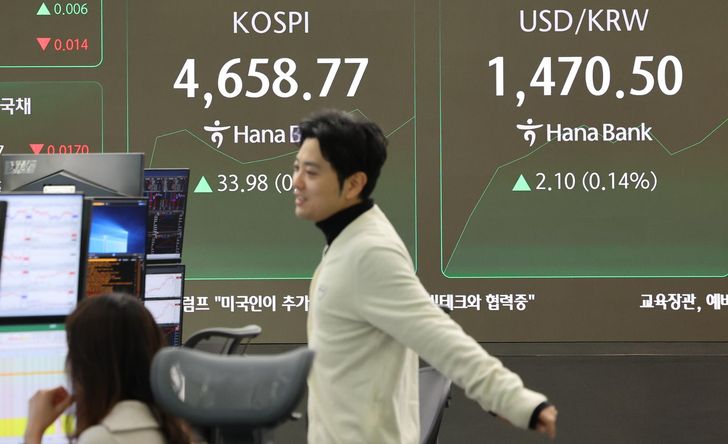

The right side of an electronic trading board at Hana Bank headquarters in central Seoul shows the won at the 1,470-level per dollar during intraday trading, Tuesday. The Korean currency closed at 1,473.7 won per dollar. Yonhap

The Korean won is once again weakening against the U.S. dollar after a temporary rebound sparked by aggressive verbal intervention from monetary authorities in late December, according to market analysts, Tuesday.

The won closed at 1,473.7 per dollar, Tuesday, down 5.3 percent from the previous day and moving back toward the 1,480-level it had hovered around before the Dec. 24, 2025, intervention — a level that reflected volatility similar to past financial crises.

The intervention measure led to a sharp rebound, with the won gaining 33.8 won, strengthening from 1,483.6 to 1,449.8 per dollar — its largest one-day gain in more than three years.

The won-dollar exchange rate stabilized over the next two sessions — Dec. 26 and Dec. 29 — reaching 1,429.8 won per dollar.

Beginning on Dec. 30, however, it resumed an upward trajectory, breaching the 1,430, 1,440, 1,450, and 1,460 levels before returning to 1,470 per dollar, Tuesday.

Economists and analysts said the government’s foreign exchange measures have yet to show a clear effect and that authorities should be cautious with further verbal interventions.

They noted that the won’s renewed depreciation reflects not only short-term supply-demand imbalances but also structural factors in both the Korean and global economies, limiting the impact of the authorities’ messaging on the market.

“It appears that sensitive geopolitical events abroad are increasing demand for safe-haven assets, such as the dollar and gold, in addition to domestic investors’ demand for dollars,” said Shin Se-don, professor emeritus of economics at Sookmyung Women’s University.

The professor pointed to last year’s massive dollar outflows and the won’s sharp decline, driven by a combination of factors.

These included the state-run National Pension Service’s expanded overseas investments, retail investors’ U.S. stock-buying spree, and export-oriented companies holding dollars rather than converting them into won.

Shin also cited U.S. President Donald Trump’s increasingly unconventional actions since the start of 2026, including the U.S. capture of Venezuelan President Nicolas Maduro and Washington’s aggressive push to acquire Greenland, an autonomous territory of Denmark.

The Japanese yen’s weakness has also been cited as a factor behind the won’s recent decline, amid close coupling between the two currencies.

The yen fell on speculation of a snap general election in February, with market observers expecting Prime Minister Sanae Takaichi to win a lower house majority and pursue aggressive fiscal policies, raising concerns over Japan’s economy.

Woori Bank analyst Park Hyun-joong predicted that the won could weaken to the 1,480-level per dollar if authorities do not implement corresponding measures to address geopolitical risks.

“The 1,480-level was identified as the first resistance point last year, and we could reach it as early as the first quarter,” he said.

Meanwhile, Minister of Economy and Finance Koo Yun-cheol is accompanying working-level officials on foreign exchange policy in his visit to the U.S. this week to attend a meeting of G20 finance ministers.

The move is raising speculation that the government is contacting the U.S. side to stabilize the won’s volatility.