Part of the process when moving to France is setting up a bank account – here’s a useful website that can help you compare different banks and their fees.

Inescapable banking fees are part of the process when setting up a French bank account.

French banks charge a fee (frais bancaire) simply to hold an account, while some also charge for specific services such as international money transfers.

But in good news, there is a French government website that can help you navigate banking fees in different banks. It compares the fees for different bank services based on your chosen location in France.

First, head to tarifs-bancaires.gouv.fr.

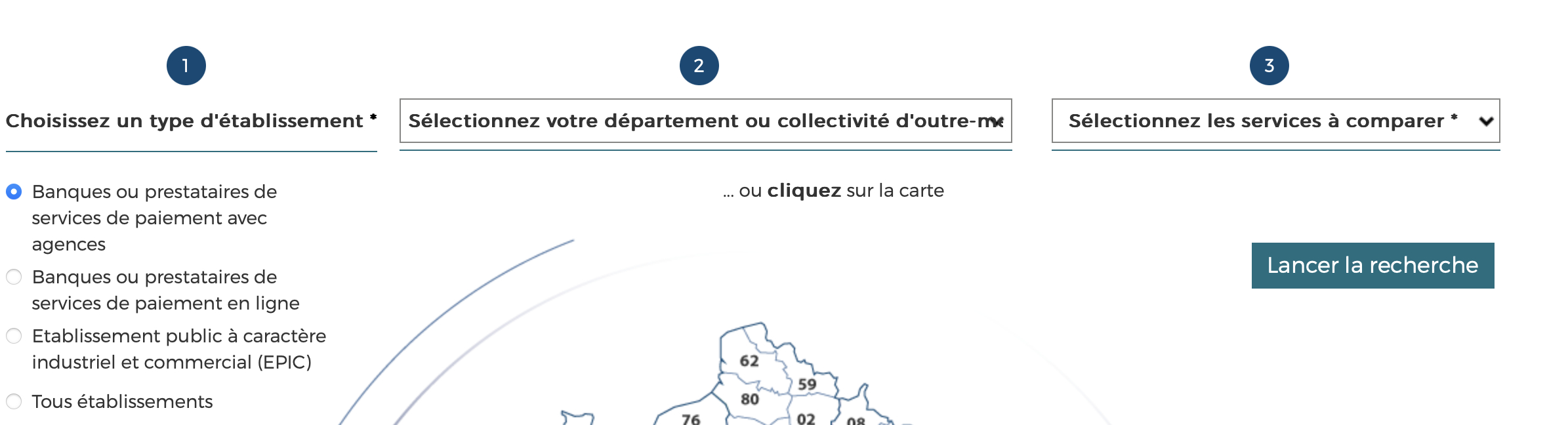

Screenshot of Tarifs-bancaires.gouv.fr

You will then be asked to specify three criteria:

Number one: Choose the bank type, meaning traditional (the first option) or online (the second option) banks.

Number two: Pick your département by either clicking on the map or selecting it by scrolling down in the list that appears when you click on sélectionnez votre département.

Number three: Click on sélectionnez les services à comparer to choose which banking service fees you want to compare. You can tick six in total. Each option has a little “?” right next to it to explain what they represent. Amongst your options are account maintenance fees, different payment cards’ fees, money transfer fees, etc.

Then click on Lancer la recherche.

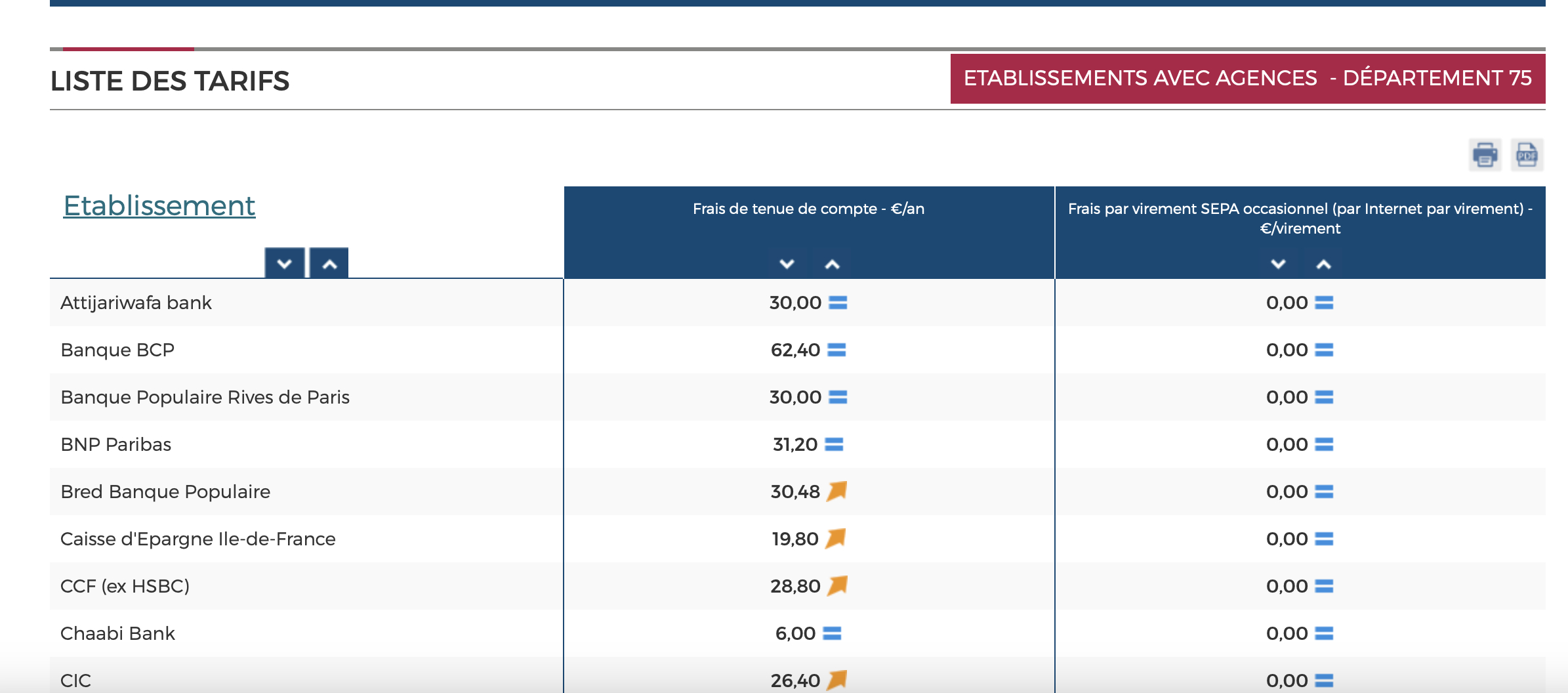

A chart, like the one below, should appear. The example below shows traditional banks in Paris (75) and compares account maintenance fees and fees for occasional transfers done through an online app.

Screenshot of Tarifs-bancaires.gouv.fr

On the far right of the chart, you have the list of all the banks (établissement) that fit your first choice — traditional or online banks.

In the middle of the chart, you have account maintenance fees in € per year and little arrows or = signs that tell you whether the price increased or decreased or stayed the same.

On the left side of the chart, you have the fees for occasional transfers in € per transfer, which in the above example are all free.

Given that most French banks will set up various fees for different services, this is a good site to figure out how much all this will cost.

It might also help to figure out what services are provided by different banks. For example, if “NC” shows up for a service, it means the price is not communicated. In this case, the site states when you scroll down under the chart that “the failure to disclose this rate may be due to the fact that the bank does not offer the product or service.”