With no single headline event setting the tone, APi Group (APG) is drawing attention as investors size up its recent share performance and the company’s role in providing safety and specialty services worldwide.

See our latest analysis for APi Group.

APi Group’s recent 1-month share price return of 7.9% and 90-day share price return of 23.9% indicate building momentum, while the 1-year total shareholder return of 72.9% and 3-year total shareholder return above 200% show that longer term holders have already seen strong gains at a current share price of $42.79.

If APi Group’s performance has you reassessing opportunities in the sector, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With APi Group trading at $42.79, only about 2% below one set of external price expectations and roughly an 11% intrinsic value discount estimate, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 1.4% Undervalued

With APi Group’s fair value estimate at US$43.40 versus a last close of US$42.79, the valuation gap is narrow and hinges on specific growth and margin assumptions.

Consistent expansion in recurring contracts, now targeted to reach 60%+ of revenue by 2028, is described as supporting higher adjusted EBITDA margins and predictable cash generation, which in turn is presented as improving earnings quality and financial resilience. Continued progress on digital transformation, AI-driven productivity tools, and process standardization is characterized as delivering operating leverage and SG&A efficiency, with the aim of enhancing incremental margins and overall profitability.

Curious how recurring revenue, margin expansion, and a future P/E reset all fit together? The most followed narrative lays out a detailed earnings and revenue roadmap, along with the profit margin profile that underpins its fair value call.

Result: Fair Value of $43.40 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, the story can change quickly if recurring revenue growth slows or if integration of acquisitions drags. Both of these factors could pressure margins and earnings expectations.

Find out about the key risks to this APi Group narrative.

Another Angle On APi Group’s Valuation

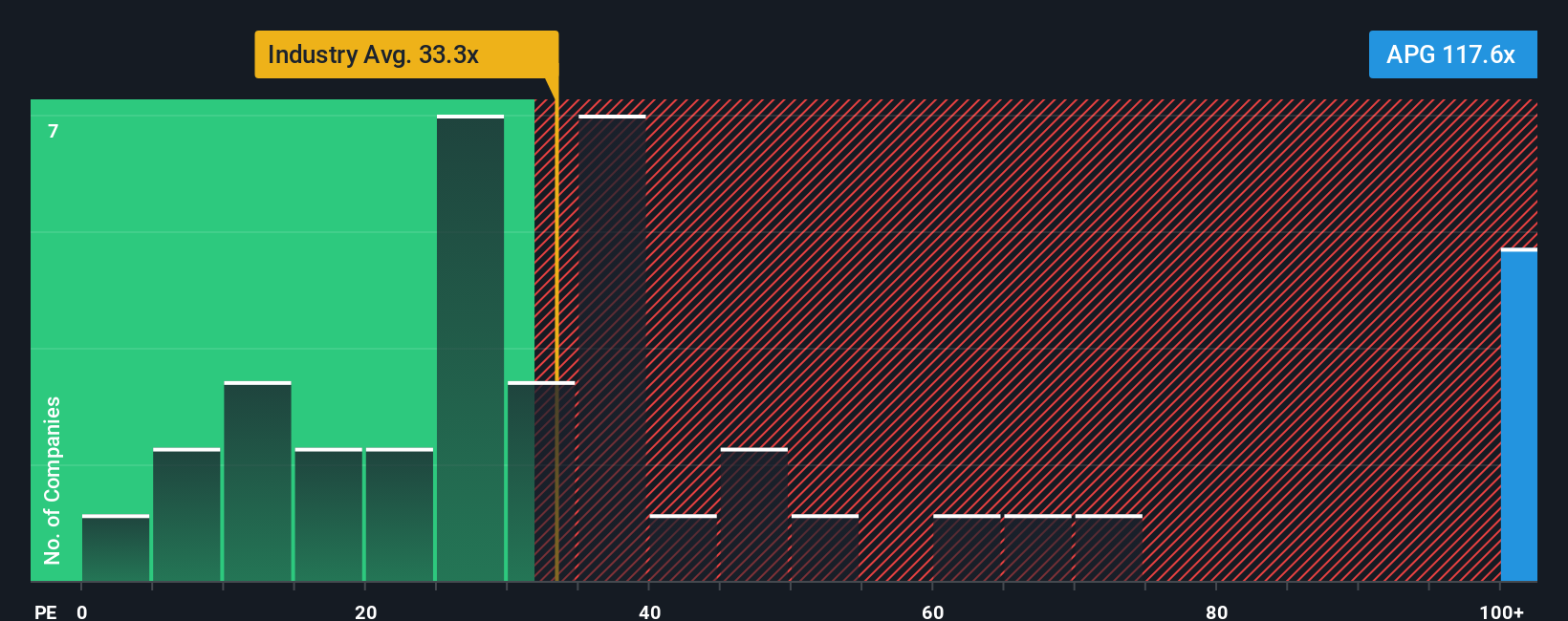

So far you have seen a fair value narrative that points to a modest 1.4% upside, but the simple P/E check tells a different story. APi Group trades on a P/E of 118.3x, while the estimated fair ratio is 55.1x and the US Construction industry average is 33.3x.

Put plainly, the current P/E is more than double the fair ratio and over three times the industry average, which suggests a lot of optimism is already reflected in the price and leaves less room if expectations slip. The question is whether you think APi Group’s earnings profile justifies paying that kind of premium today.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:APG P/E Ratio as at Jan 2026 Build Your Own APi Group Narrative

NYSE:APG P/E Ratio as at Jan 2026 Build Your Own APi Group Narrative

If you see the numbers differently or prefer to weigh the evidence yourself, you can build a personalised APi Group view in just a few minutes with Do it your way.

A great starting point for your APi Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If APi Group is already on your radar, do not stop there. Broaden your opportunity set now so you are not relying on one story alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com