Citigroup (C) is back in focus after its fourth quarter earnings fell short of Wall Street expectations, as the bank absorbed a large after tax loss tied to the planned sale of its Russian operations.

See our latest analysis for Citigroup.

The 1-day share price return of 4.49% took Citigroup stock to US$117.46, but that move comes after a 7 day share price return decline of 2.60% and a 30 day share price return of 5.55%. The 1 year total shareholder return of 53.76% and 3 year total shareholder return of more than 1.5x point to momentum that has been strong over a longer stretch, supported by restructuring news, earnings updates and ongoing portfolio simplification such as the Banamex stake sale.

If Citigroup’s recent swings have you thinking about where else capital might work hard, this could be a good moment to check out solid balance sheet and fundamentals stocks screener (None results).

Citigroup now trades at US$117.46 with an estimated 25% intrinsic discount and analyst targets about 13% higher. After a 65% 1 year run, is there still mispricing here, or is the market already accounting for future growth?

Most Popular Narrative: 49.6% Undervalued

According to ChadWisperer, the narrative fair value of around US$233 sits well above Citigroup’s last close at US$117.46, setting up a punchy valuation gap investors will want to understand.

Citi Token Services lets Citi position itself as the “killer app” for institutional cross-border payments, absorbing complexities and offering instant, cost-effective solutions;

Core business is firing on all cylinders, with record performances in Markets and Wealth, significant share gains in Investment Banking (especially M&A, LevFin, and sponsors), and robust growth in Services and U.S. Personal Banking, all contributing to strong revenue momentum;

Curious how a traditional bank can justify a tech style valuation gap? The narrative leans on faster top line growth, wider margins and a future earnings multiple usually reserved for premium franchises. Want to see which specific revenue mix, profitability uplift and P/E assumption drive that US$233 fair value? Read on to see how it all fits together.

Result: Fair Value of $233.04 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this depends on successful execution of the digital asset push and stablecoin framework, as well as credit and macro conditions not turning sharply against large global banks.

Find out about the key risks to this Citigroup narrative.

Another View: What The Market Ratio Is Saying

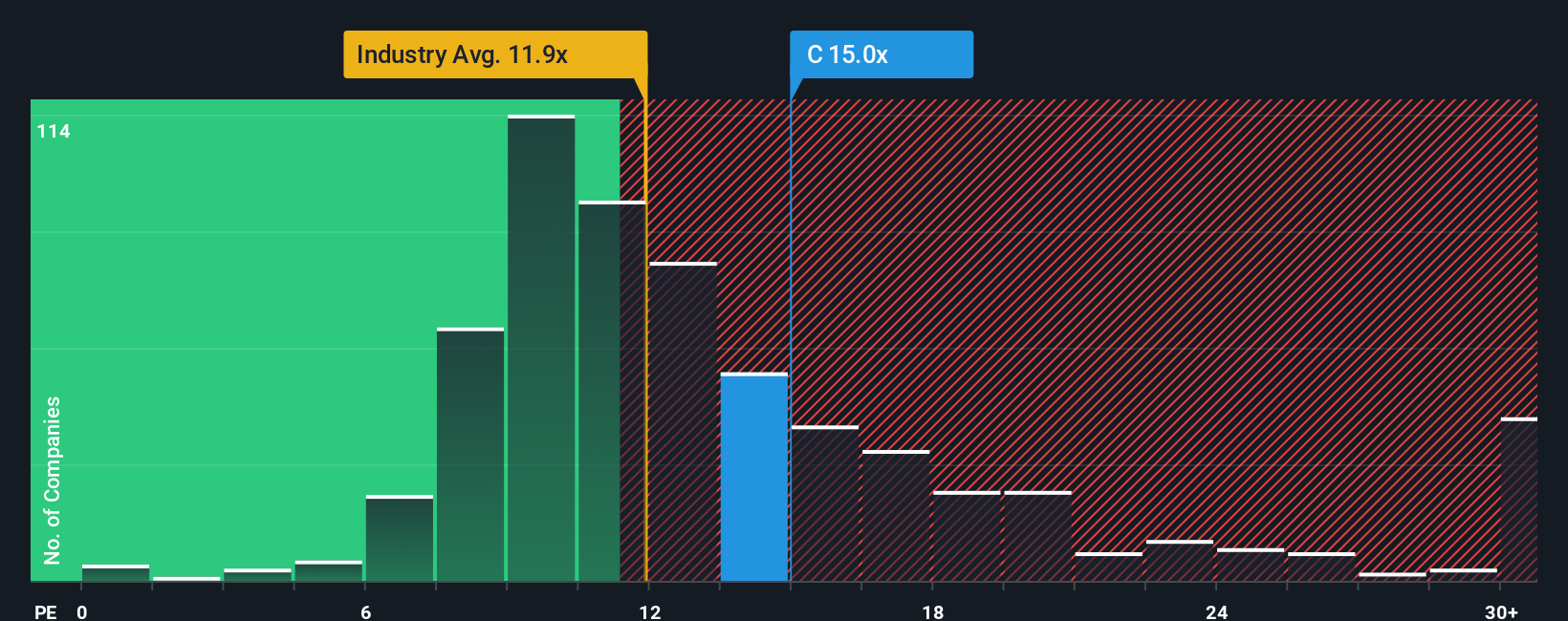

Our model-based fair value of US$156.95 suggests Citigroup is undervalued by about 25%, yet the current P/E of 15.8x sits above the US Banks industry on 11.9x and peers at 13.2x, and below a fair ratio of 17.6x. Is this a margin of safety or extra valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:C P/E Ratio as at Jan 2026 Build Your Own Citigroup Narrative

NYSE:C P/E Ratio as at Jan 2026 Build Your Own Citigroup Narrative

If you are not fully aligned with this view or prefer to test the assumptions yourself, you can build a fresh evidence based story in minutes by using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Citigroup.

Ready to hunt for your next idea?

If Citigroup is on your radar, do not stop there. The broader market is full of other potential setups that could fit your style and risk tolerance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com