Sarah Munson and Callum Ashworth

In recent years, retail investors’ demand for UK government bonds (gilts) has increased, marking a change in the composition of market participants. The growth of retail investors, comprised of individuals managing their own portfolios, has been a global phenomenon (Foxall et al (2025)). But what’s driving this change, and what does it mean for the gilt market’s role in monetary policy and financial stability? In this post we explore how UK-based retail participants’ presence in the gilt market is changing and what that might signal for the future. We find that retail holdings of gilts remain modest, with positions concentrated in a handful of bonds. This has limited impact on aggregate liquidity indicators but can impact liquidity in these specific bonds.

Growing retail demand for gilts

Individual gilts have different properties that appeal to various investors. One is the time until the gilt matures. We place gilts into buckets depending on residual maturity (ultra-short: less than 3 years, short: 3–7 years, medium: 7–20 years, and long: greater than 20 years). In addition, gilts can have different fixed annualised interest rates, known as the coupon, which are expressed as a percentage of its face value.

In this post, we use Markets in Financial Instruments Directive II (MiFID II) transaction-level data to uncover UK-based retail participants gilt market flows. This data provides insights into secondary market activity in the gilt market that takes place on a UK trading venue or involves at least one UK-regulated entity, which represents a large share of gilt market activity. In our analysis, we focus on trades that involve a retail entity. This allows us to break down transactions to see the individual gilts of interest to this investor base.

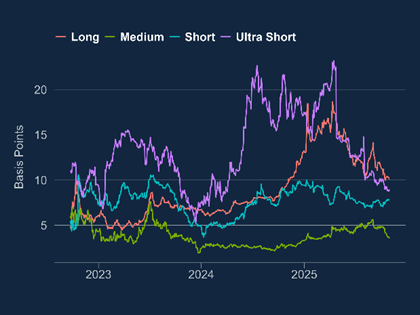

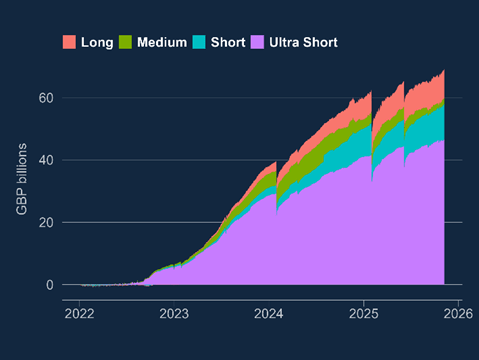

Retail demand has been concentrated in a small number of gilts. Holdings tend to be in ultra short-dated bonds that mature within the next three years (see Chart 1). In addition, holdings tend to also be focused on gilts that have a low coupon, ie government bonds that pay a relatively small amount of interest to the bond holder each year, with over 80% of estimated retail gilt holdings being within the bottom quartile of available coupon rates. While the estimated overall size of retail holdings remains modest in aggregate terms (less than 4% of all gilts in issue), the rate of change has been notable. In addition, retail investors sometimes hold a significant proportion of the ‘free float’ of an individual bond, ie the amount of a gilt that is available for trading in the secondary market, which excludes gilts held in the Bank of England’s (BoE’s) Asset Purchase Facility (APF) which were purchased for monetary policy purposes when the Bank engaged in quantitative easing. Chart 2 highlights the high concentration of holdings in predominantly ultra-short, low-coupon bonds.

When retail investors own a reasonable proportion of a maturing gilt, they tend to gradually reinvest the proceeds into similar fixed-income instruments (see Chart 1). This can lead to a sharp drop in holdings, followed by a gradual rebuild of gilt holdings in a selection of similar short-dated, low-coupon gilts.

Chart 1: Change in cumulative net retail positioning in gilts across maturities

Sources: MiFID II and Bank calculations.

Note: MiFID II data and the sector classification are reviewed on an ongoing basis in order to continuously improve the quality and coverage of the data set.

Chart 2: Largest retail holdings of individual ISINs as a proportion of free float

Sources: Bank of England, MiFID II, UK Debt Management Office and Bank calculations.

Note: Latest data to 7 November 2025.

What’s behind the growing retail appetite for gilts?

Several factors have driven the growth in retail gilt demand. Firstly, retail demand has increased more rapidly during periods when gilt yields have risen relative to cash savings accounts. In 2022, gilt yields moved higher as the MPC raised interest rates. This coincided with an increase in retail positioning. More recently, growth in demand has slowed as short-maturity gilt yields have moved marginally lower throughout 2025, although rates remain high relative to pre-2022 levels.

Secondly, the evolution of digital investment platforms and an increase in educational material from retail-focused firms have accelerated retail demand. Retail-friendly features, like real-time pricing and integration with Individual Savings Accounts (ISAs) and self-invested personal pension (SIPPs), have lowered the barriers to entry, enabling a broader range of individuals to engage with the gilt market. Recent initiatives have enabled retail investors access to primary gilt issuance through digital channels, further embedding retail participation in gilts. In addition, recent government reform announcements have looked to encourage retail investment more broadly in the UK, with other authorities proposing to make other assets such as corporate bonds easier to purchase as well.

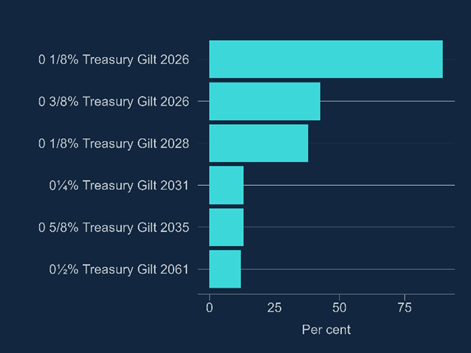

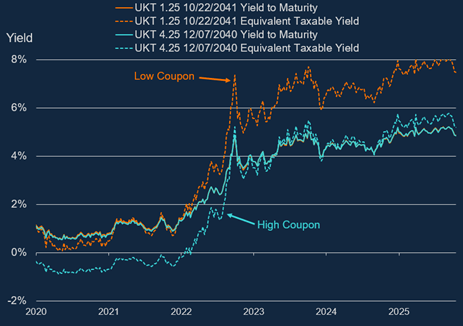

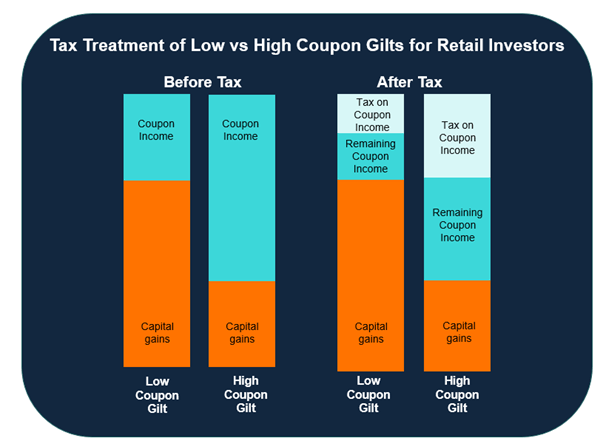

Finally, a significant driver in the UK is that capital gains on gilts are exempt from taxation, enhancing their relative appeal. It is worth noting coupon payments are subject to income tax for retail investors. This increases the focus on low-coupon gilts that generate a larger portion of their return through capital appreciation as they approach maturity, given they pay a lower rate of fixed interest (ie as the bond moves closer to its maturity date and its price moves up towards its nominal value). This results in a mechanically higher after-tax yield for retail investors compared to higher-coupon gilts (see Chart 3 and Figure A). This effect is more pronounced in a higher yield environment when lower-coupon gilts are trading at a lower value, increasing the capital gain at maturity. Chart 4 illustrates this dynamic, showing how the gap between the yield and equivalent taxable yield evolves for both a low- and high-coupon gilt.

Despite this dynamic, retail holdings of middle- and high-coupon gilts have grown over the past three years, possibly driven by the income tax exemption that can be gained from holding gilts in an ISA or SIPP.

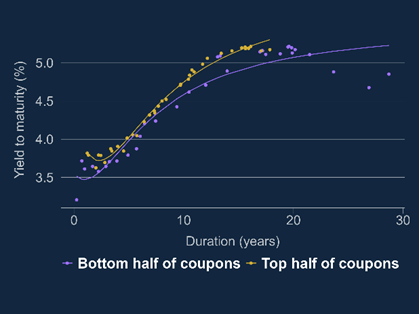

Chart 3: Tax-adjusted yields across different gilts (as of 31 October 2025)

Sources: Bloomberg Finance L.P. and Bank calculations.

Chart 4: Tax-adjusted yields of a low- and high-coupon gilt over time

Sources: Bloomberg Finance L.P. and Bank calculations.

Figure A: Illustrative example of tax treatment for individual investors across gilt coupon types

What impact does retail gilt demand have on core sterling rates markets?

The Bank closely monitors the gilt market given its importance for the transmission of monetary policy and financial stability. Ensuring stability in core markets helps mitigate the risk of severe disruptions that could tighten financial conditions for the real economy (Cunliffe (2022)).

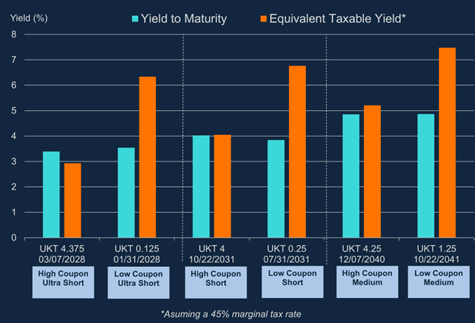

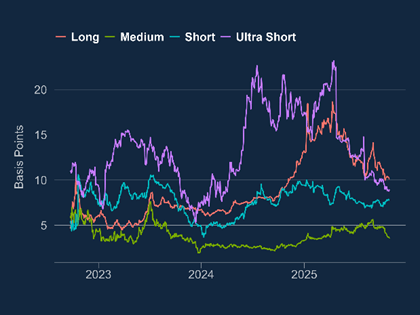

The impact of retail investor holdings on aggregate gilt market liquidity metrics remains limited, though activity may impact liquidity in specific gilts and thus make monitoring liquidity conditions more difficult. Previous work highlights that investor groups can have an impact on gilt pricing at specific maturities (for example, see Greenwood and Vayanos (2010)). In our context, market commentators have drawn connections between retail activity and the relative performance of high- versus low-coupon gilts of similar maturities (see Chart 5). This can lead to some measures of gilt market liquidity (‘Yield curve noise’) appearing artificially poor relative to the fundamental cost of transacting (see Chart 6), as they look at the degree to which yields deviate from a fitted curve (Kantor and Mundy (2025)). This was evident throughout 2024 where high- and low-coupon yields diverged significantly, driving these noise measures higher. As a result, some financial market participants tend to consider two distinct yield curves split by the coupon type.

Chart 5: Fitted gilt curves splitting out high- and low-coupon bonds

Sources: Bloomberg Finance L.P. and Bank calculations.

Note: fitted curves are constructed using a Nelson-Siegel-Svensson regression. Latest data to 11 November 2025.

Chart 6: Yield curve noise by maturity bucket

Sources: Tradeweb data and Bank calculations.

While increased low-coupon gilt demand from retail investors may have amplified ‘yield curve noise’ on the margin, other factors, such as their attractiveness to institutional investors for different cash management purposes, have also supported low-coupon gilt yields. These factors, alongside the fact that these gilts are ‘off-the-run’, meaning they’re no longer regularly supplied by the Debt Management Office (DMO), and are held in significant size in the BoE’s APF, will also contribute through the balance of demand versus available supply.

Over 2025, yield curve noise levels have fallen across different maturity buckets (Chart 6). This reduction is due to a number of factors, but likely linked to the comparative advantage of low-coupon gilts reducing as short-dated gilt yields gradually fall, profit-seeking behaviour by other investors, and the introduction of the DMO’s programmatic tenders which typically provide off-the-run bonds to the market.

Where are we now and what comes next?

Growing retail participation offers an additional investor base in the gilt market. A more diversified investor base in this market can help support the transmission of monetary policy and broader financial stability. Thus far, total retail gilt holdings have remained small and have had limited impact on aggregate liquidity metrics. However, their holdings can be concentrated in a small number of specific bonds and may contribute to reduced liquidity in certain individual gilts.

Looking ahead, the continued presence of retail investors in the gilt market will depend on the interaction of the broad array of factors discussed above. Structural factors may push up on demand. However, investor appetite may be sensitive to the absolute level of yields. The extent to which their demand is structural will become apparent as we progress through the current easing cycle.

Sarah Munson works in the Bank’s Sterling Markets division and Callum Ashworth works in the Bank’s Market Intelligence and Analysis division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Retail investors’ participation in the gilt market”