Find companies with promising cash flow potential yet trading below their fair value.

Intercontinental Exchange Investment Narrative Recap

To own Intercontinental Exchange, you need to believe in the resilience of its exchange, data and mortgage technology franchises, despite cyclical and regulatory pressures. The new NYSE role as the U.S. options venue for MSCI benchmarks strengthens ICE’s equity derivatives ecosystem, but does not materially change the key near term swing factors, which still center on integration execution in mortgage technology and ongoing competition and fee pressure across its core trading businesses.

Among recent developments, ICE’s plan to invest up to US$2 billion in Polymarket stands out as especially relevant. It highlights how ICE is extending its reach into newer market structures built on digital and prediction markets infrastructure, which sits alongside growth efforts like MSCI index derivatives and could support its longer term electronification and data driven catalysts, while adding a different set of regulatory and technology risks to monitor.

Yet investors should be aware that rising technology spend and competition from alternative trading venues could…

Read the full narrative on Intercontinental Exchange (it’s free!)

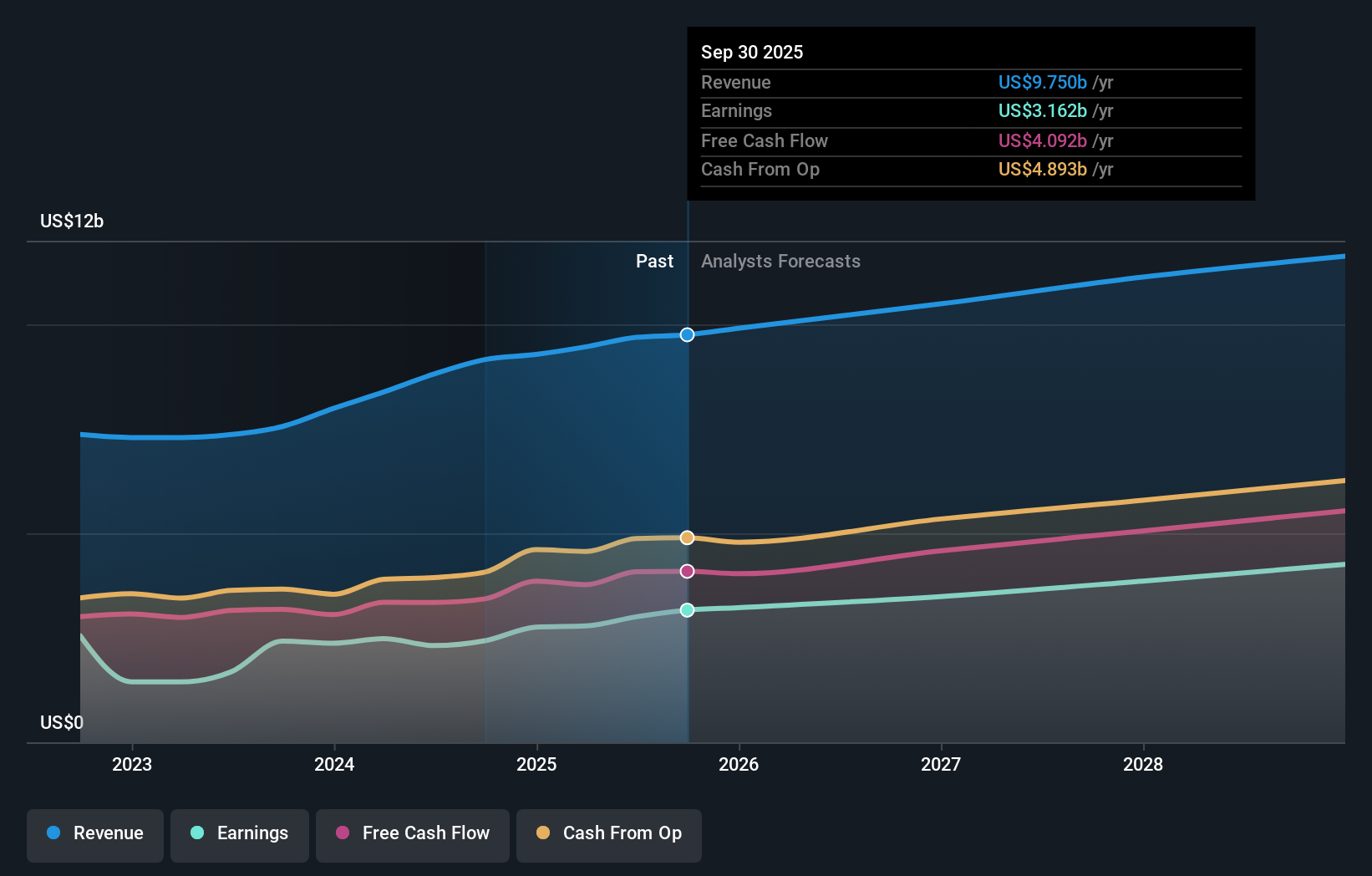

Intercontinental Exchange’s narrative projects $11.4 billion revenue and $4.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and about a $1.1 billion earnings increase from $3.0 billion today.

Uncover how Intercontinental Exchange’s forecasts yield a $189.36 fair value, a 9% upside to its current price.

Exploring Other Perspectives ICE Earnings & Revenue Growth as at Jan 2026

ICE Earnings & Revenue Growth as at Jan 2026

Five Simply Wall St Community fair value estimates for ICE span roughly US$115 to US$189 per share, underscoring how far apart individual views can be. Against this, the long term catalyst many of you focus on is ICE’s expansion in index linked derivatives and data, so it is worth weighing how that interacts with its exposure to cyclical energy and commodities volumes when you compare different valuation opinions.

Explore 5 other fair value estimates on Intercontinental Exchange – why the stock might be worth as much as 9% more than the current price!

Build Your Own Intercontinental Exchange Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com