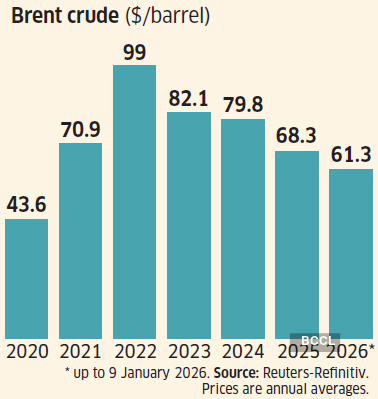

Oil prices in 2025Rising US output and OPEC+ supply, combined with weak global demand and swelling inventories, pushed oil prices steadily lower in 2025. Brent crude averaged about $68 a barrel—the lowest since the pandemic-hit year of 2020 and nearly 18.5% below 2024 levels, according to Reuters Refinitiv. Prices slipped toward $60 a barrel in early January 2026 after the US captured Venezuelan President Nicolás Maduro, raising fears that additional Venezuelan supply would worsen the global glut. Brent averaged $61.3 a barrel in the first seven trading days of 2026. Here’s what this means for your investment portfolio:

Supply shock

Brent crude prices under pressure amid global oversupply and muted demand. Brent crude ($/barrel)

Street picks

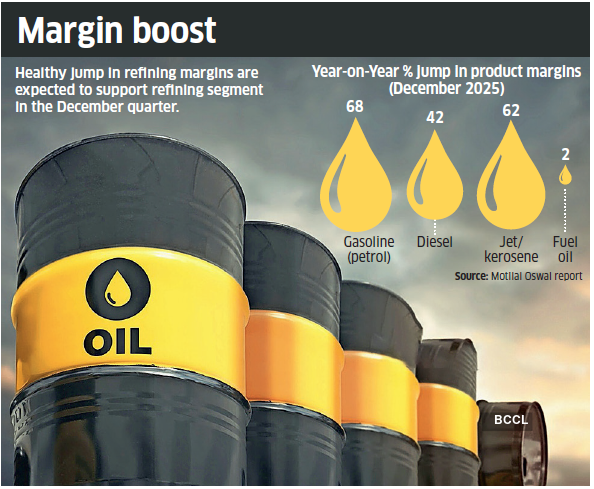

December quarterAnalysts at JM Financial, Elara Securities, Nuvama and other brokerages expect oil marketing companies (OMCs) to report strong earnings in the December quarter. The reason: refining margins—the profit made from turning crude oil into petrol and diesel—have remained elevated due to refinery shutdowns globally and disruptions to Russian supply from Ukrainian drone attacks. Add to this the government subsidies for LPG and cheaper crude oil costs, and you have a recipe for healthy bottom lines. Standalone refiners like Chennai Petroleum and Mangalore Refinery are also expected to post strong numbers.The winners? Fuel retailers and refinersOMCs: Refining segment

Refining margins stayed elevated due to maintenance outages and Ukrainian drone attacks on Russian refineries, tightening fuel supplies. Diesel cracks jumped 42% year on year in the December quarter, boosting refining performance.

A product crack is the price difference between an individual refined petroleum product (such as petrol, diesel or fuel oil) and crude oil. On the other hand, gross refining margin (GRM) is the weighted average of all product cracks. Higher product cracks translate into higher refining margins and vice versa. However, the sharp decline in crude prices could partially offset the gains. During the December 2025 quarter, Brent crude prices fell 15% yearon-year and 7.1% quarter-on-quarter, likely resulting in inventory losses for OMCs.

OMCs: Marketing segment

Marketing margins for OMCs remain robust, although rupee depreciation is expected to exert some pressure by increasing crude import costs. Marketing margins represent the profit earned from selling petroleum products to end consumers after accounting for costs beyond refining.

The catch: not all benefitUpstream companies

Falling crude oil prices are likely to strain oil producers such as ONGC and Oil India, as lower selling prices and higher costs weaken operating performance. A decline in domestic APM (Administered Price Mechanism) gas prices will further reduce gas realisations. Net realisation refers to the price a company earns from selling oil and gas in the open market after accounting for subsidies.

Company-wise estimates

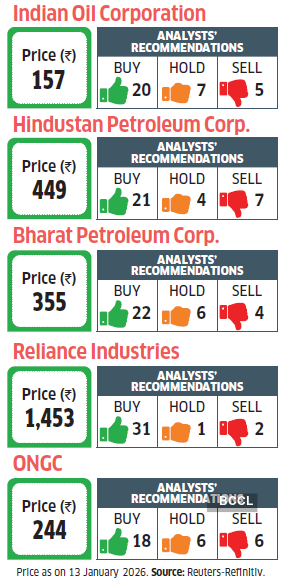

In the downstream segment, Indian Oil, Hindustan Petroleum and Bharat Petroleum are expected to report year-on-year EBITDA (earnings before interest, taxes, depreciation and amortisation), or, as it is more commonly known, operating profits, of 102%, 29% and 42%, respectively, according to Reuters-Refinitiv estimates. The upstream player ONGC is expected to report EBITDA decline between 11-16% year on year, according to earnings estimates from JM Financial, Prabhudas Lilladher, Elara Securities, and YES Securities.

Oil and gas price outlook for 2026

The outlook for 2026 remains subdued despite heightened geopolitical tensions, including the ongoing Russia–Ukraine conflict and US sanctions on Russian oil imports. While the recent capture of Maduro may spark short-term volatility, expectations of a gradual increase in Venezuela’s crude output are likely to add further pressure on global supply. According to a JP Morgan report, Venezuela could realistically ramp up production to 1.3–1.4 million barrels per day (mbd) within two years of a political transition. With renewed investment and institutional reforms, output could expand to 2.5 mbd over the next decade, up from current levels of about 750 thousand barrels per day (kbd). Price forecasts continue to point towards softness: JP Morgan projects Brent crude to average $58 per barrel in calendar year 2026, while the US Energy Information Administration expects prices to average $56 per barrel in 2026.

Meanwhile, liquefied natural gas (LNG) prices are also expected to decline in 2026, supported by new capacity additions and upcoming projects. HSBC estimates 40 mtpa (million tons per annum) of fresh LNG capacity will come online in 2026, with a cumulative 200 mtpa of new supply anticipated over the next five years.

For investors, the question is simple: which side of the divide are your stocks on?

Benign oil prices should boost OMCs’ marketing margins, ease working capital needs, and strengthen balance sheets, though analysts expect a possible excise duty hike as firms earn above-normal margins. A recent JM Financial report anticipates Rs.3-4/litre excise duty hike on auto-fuel ahead of the Union Budget. It says that this poses a risk to the sustainability of the current high marketing margins. Lower gas prices should aid gas consumers such as city gas distributors, while rising demand from refineries, fertiliser and power plants supports gas infrastructure players like GAIL and Petronet LNG. OMCs look strong near term, but upstream producers need caution as their recovery hinges on oil prices.