BofA Securities’ downgrade of Comstock Resources (CRK) highlights the company’s exposure to natural gas prices, with concerns focused on high leverage, 100% dry gas output, and sector oversupply risks.

See our latest analysis for Comstock Resources.

Comstock’s share price has been choppy, with a 1-day share price return of 1.58% following the downgrade headlines, compared with a 7-day share price return of a 5.57% decline and a 90-day share price return of 16.31%. The 5-year total shareholder return is very large and suggests that longer term gains are still influencing market expectations even as shorter term momentum fades.

If gas focused names feel too volatile right now, it could be a good time to step back and scan aerospace and defense stocks for different types of opportunities.

With the stock trading near BofA’s reduced price target and an intrinsic value estimate that suggests a large discount, the key question now is whether Comstock is genuinely undervalued or whether the market already factors in expectations for future growth.

Most Popular Narrative: 4% Overvalued

Comstock Resources last closed at US$21.18, compared with a widely followed fair value estimate of US$20.36 that applies a 7.06% discount rate to future cash flows.

The analysts have a consensus price target of $19.036 for Comstock Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $10.0.

Curious why a gas producer with concentrated Haynesville exposure still commands this valuation? The story leans heavily on future earnings, fatter margins, and a richer P/E multiple on those projected profits. The tension is in how quickly those financials are expected to shift.

Result: Fair Value of $20.36 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on Haynesville concentration and ongoing production declines not biting harder than expected, which could quickly challenge the current optimism around margins and cash flows.

Find out about the key risks to this Comstock Resources narrative.

Another View: DCF Points To A Big Gap

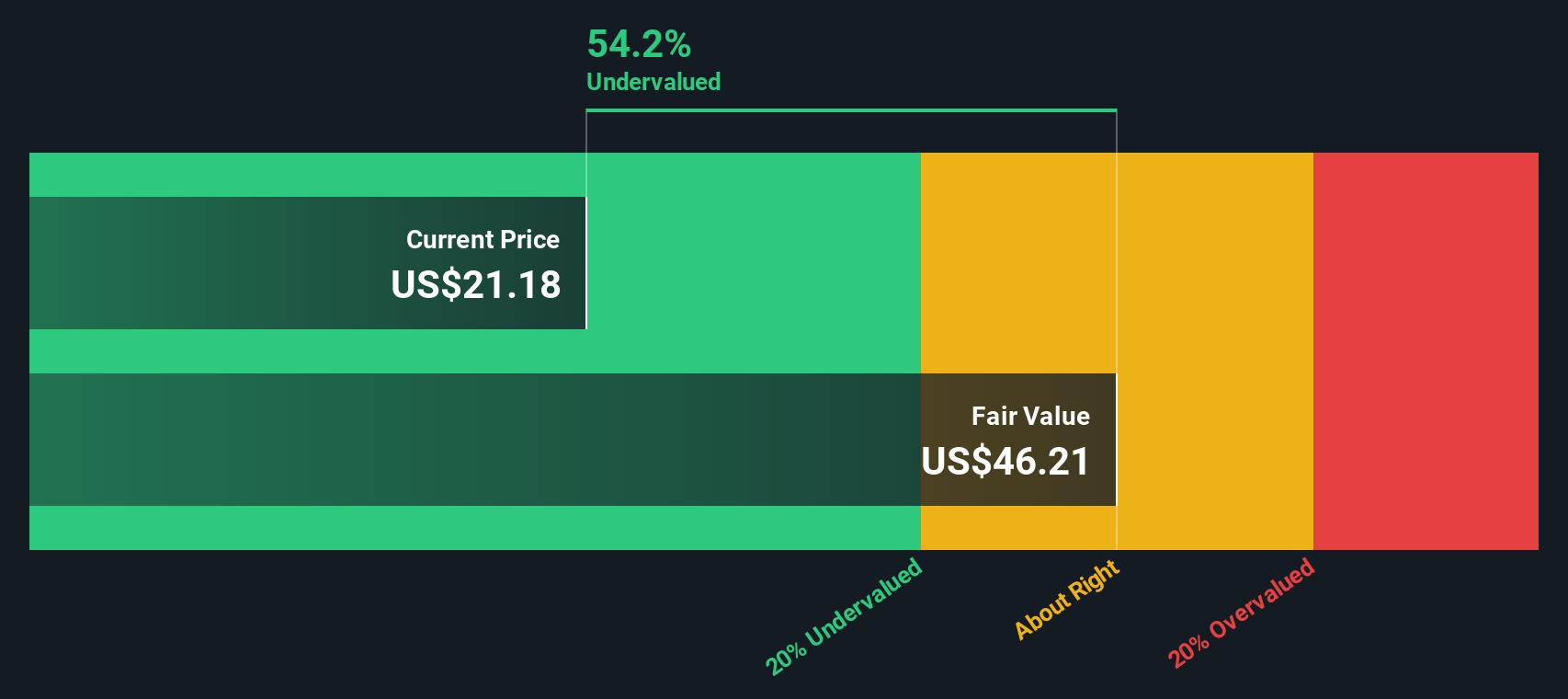

While the narrative fair value of US$20.36 suggests Comstock Resources is about 4% overvalued, our DCF model paints a very different picture, with a fair value estimate of US$46.26. At a share price of US$21.18, that implies roughly a 54.2% discount. Is the market being overly cautious about Comstock’s gas exposure, or are the cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

CRK Discounted Cash Flow as at Jan 2026

CRK Discounted Cash Flow as at Jan 2026

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comstock Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Comstock Resources Narrative

If you look at these numbers and reach a different conclusion, or prefer testing your own assumptions, you can build a custom view in minutes, then Do it your way.

A great starting point for your Comstock Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one gas producer when you can quickly scan other angles and spot opportunities that better match your risk tolerance and return goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com