Autohome (ATHM) is back in focus after JPMorgan Chase & Co. cut its rating from overweight to neutral and reduced its outlook, just as the company announced a special dividend for shareholders.

See our latest analysis for Autohome.

At a share price of $23.09, Autohome’s recent moves, including crossing below its 200 day moving average and the JPMorgan downgrade, sit against a year to date share price return of 1.81% and a 1 year total shareholder return decline of 10.20%. This suggests near term momentum has faded while longer term returns have been under pressure.

If this mix of cautious sentiment and shareholder payouts has your attention, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Autohome trading at $23.09, after years of weak total returns yet showing annual revenue and net income growth and a discount to some analyst targets and intrinsic estimates, is this a mispriced recovery story or is the market already factoring in its future trajectory?

Most Popular Narrative: 16.7% Undervalued

At a last close of US$23.09 versus a narrative fair value of about US$27.71, the current pricing sits below what this widely followed model suggests, framed on an 8.93% discount rate and measured cash returns to shareholders.

• The analysts have a consensus price target of $28.869 for Autohome based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $25.0.

Curious what growth, margin and valuation mix supports that gap between price and fair value, and how much relies on future earnings power rather than multiple expansion? The full narrative lays out the projected revenue path, profitability profile and discount assumptions that hold this calculation together.

Result: Fair Value of $27.71 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on assumptions that could be challenged if ad demand weakens further or if direct digital channels pull more traffic away from Autohome’s platforms.

Find out about the key risks to this Autohome narrative.

Another View: Market Multiple Sends A Different Signal

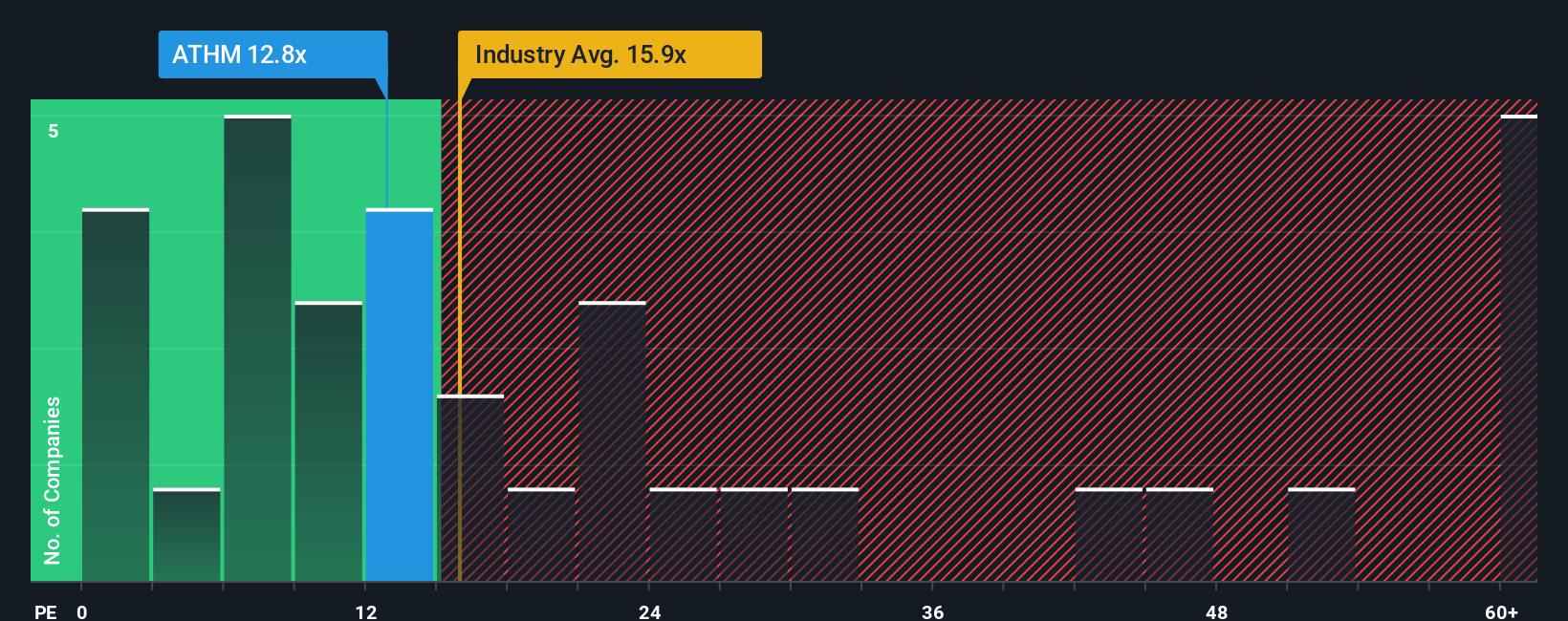

While the narrative fair value suggests Autohome is 16.7% undervalued, the P/E ratio tells a more cautious story. At 12.8x earnings, the shares trade above a peer average of 11.6x, yet below a fair ratio of 16.4x. Is that a warning sign or a margin of safety in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:ATHM P/E Ratio as at Jan 2026 Build Your Own Autohome Narrative

NYSE:ATHM P/E Ratio as at Jan 2026 Build Your Own Autohome Narrative

If you see the story differently or prefer to work from the raw numbers yourself, you can build a customised view in just a few minutes with Do it your way.

A great starting point for your Autohome research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Autohome has you thinking more seriously about where your money works hardest, now is the time to cast a wider net with focused stock ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com