For investors tracking global custody and asset-servicing providers, these moves highlight how State Street is positioning its core business. The QNB alliance connects NYSE:STT with a major player in Qatar’s financial sector, while the work with Financial Recovery Technologies broadens what its clients can access on the class actions side.

Looking ahead, these agreements may influence how you think about State Street’s role in cross border asset servicing and investor protection services. They also add fresh context if you are comparing NYSE:STT with other large custody banks that are adjusting their offerings to match client demand in more regions and service categories.

Stay updated on the most important news stories for State Street by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on State Street.

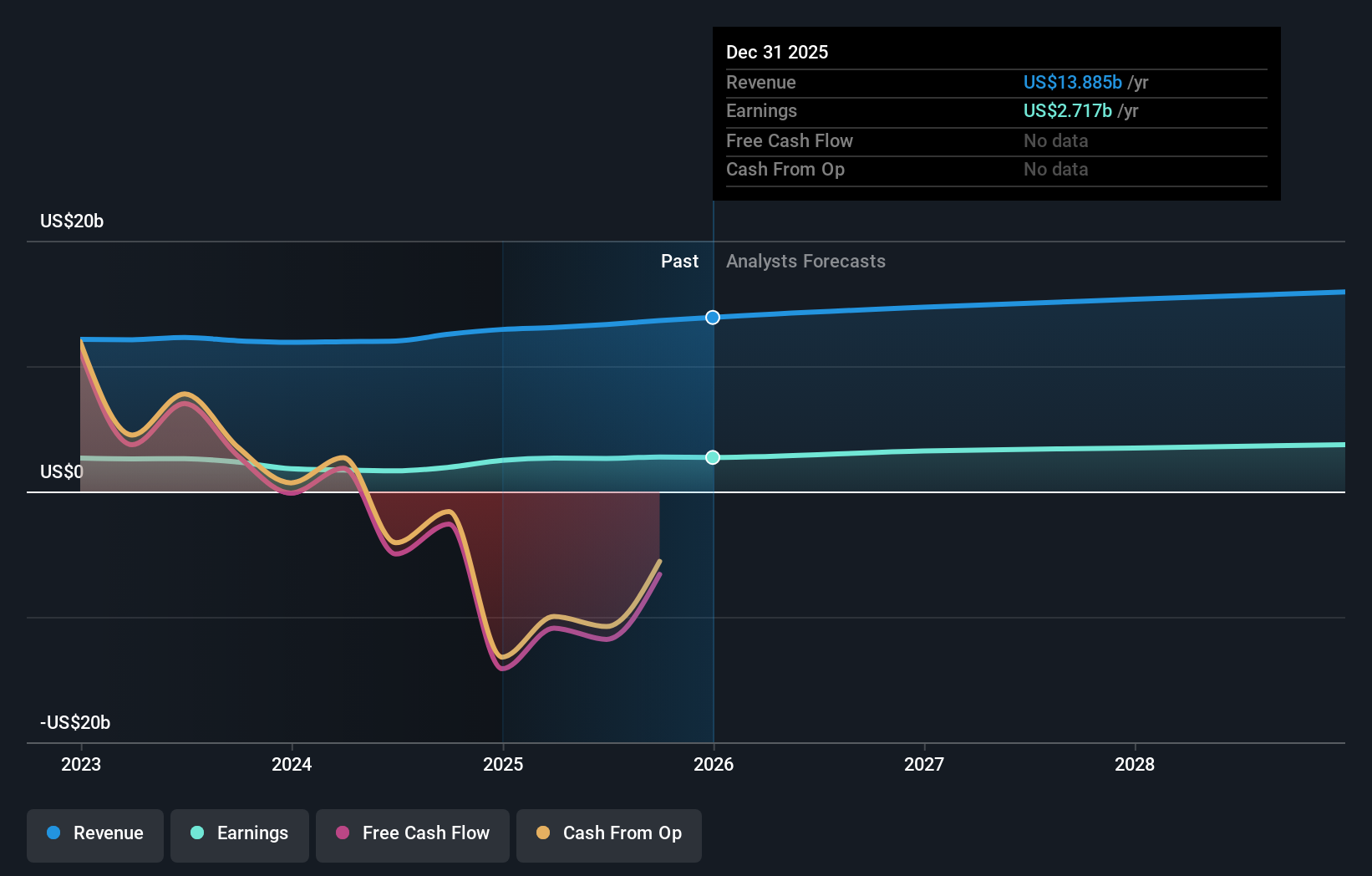

NYSE:STT Earnings & Revenue Growth as at Jan 2026

NYSE:STT Earnings & Revenue Growth as at Jan 2026

How State Street stacks up against its biggest competitors

These partnerships fit into State Street’s push to be a full service provider for large institutional clients, linking a deeper footprint in the Gulf with more comprehensive investor protection tools through class actions recovery. For you, the key question is whether this mix of local custody access in Qatar and outsourced specialist capabilities with Financial Recovery Technologies can help State Street keep large mandates and win new ones in regions where it is already present.

State Street narrative, refreshed by new partnerships

Recent news around earnings, the digital asset platform launch, new ETF servicing wins and now these alliances with QNB and FRT all point to a business trying to broaden its role across traditional and digital markets. If you see State Street as a long term infrastructure provider to global capital markets, these moves add another data point to that narrative rather than changing it outright.

Risks and rewards to keep in mind Wider custody access in Qatar, where QNB already has $65b in assets under custody, may support State Street’s ability to service existing regional clients more comprehensively. The FRT tie up brings specialist technology and process scale to class action recovery, which could make State Street’s custody proposition more attractive to institutions that care about maximizing recoveries. The QNB cooperation agreement still requires detailed service contracts, so there is execution risk around timing, scope and eventual client uptake. Integrating external partners and a growing digital asset platform with existing systems can add operational complexity that investors will want to see well controlled. What to watch next

From here, it is worth watching for concrete updates on signed service agreements with QNB, any disclosed client wins tied to the new model in Qatar, and evidence that the FRT relationship is lifting class action recovery outcomes for State Street’s clients. For a broader sense of how others are interpreting these moves, check out community views on State Street in the Community Narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com