The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

What Is Boot Barn Holdings’ Investment Narrative?

To own Boot Barn, you have to believe its Western and workwear niche can keep drawing customers even as discretionary spending ebbs and flows, and that management can justify a premium valuation with consistent execution. The preliminary Q3 fiscal 2026 guidance points to stronger sales and earnings than the company itself projected just a few months earlier, which supports the near term catalyst of continued revenue and margin expansion rather than a deeper rerating after the recent pullback. At the same time, this upside surprise does not fully resolve the key risks: a high earnings multiple relative to specialty retail peers, sensitivity to consumer spending, and recent insider selling that may make any stumble more harshly punished. In short, the guidance strengthens the story, but it also raises the bar.

However, one important risk could still catch newer shareholders off guard if conditions turn.

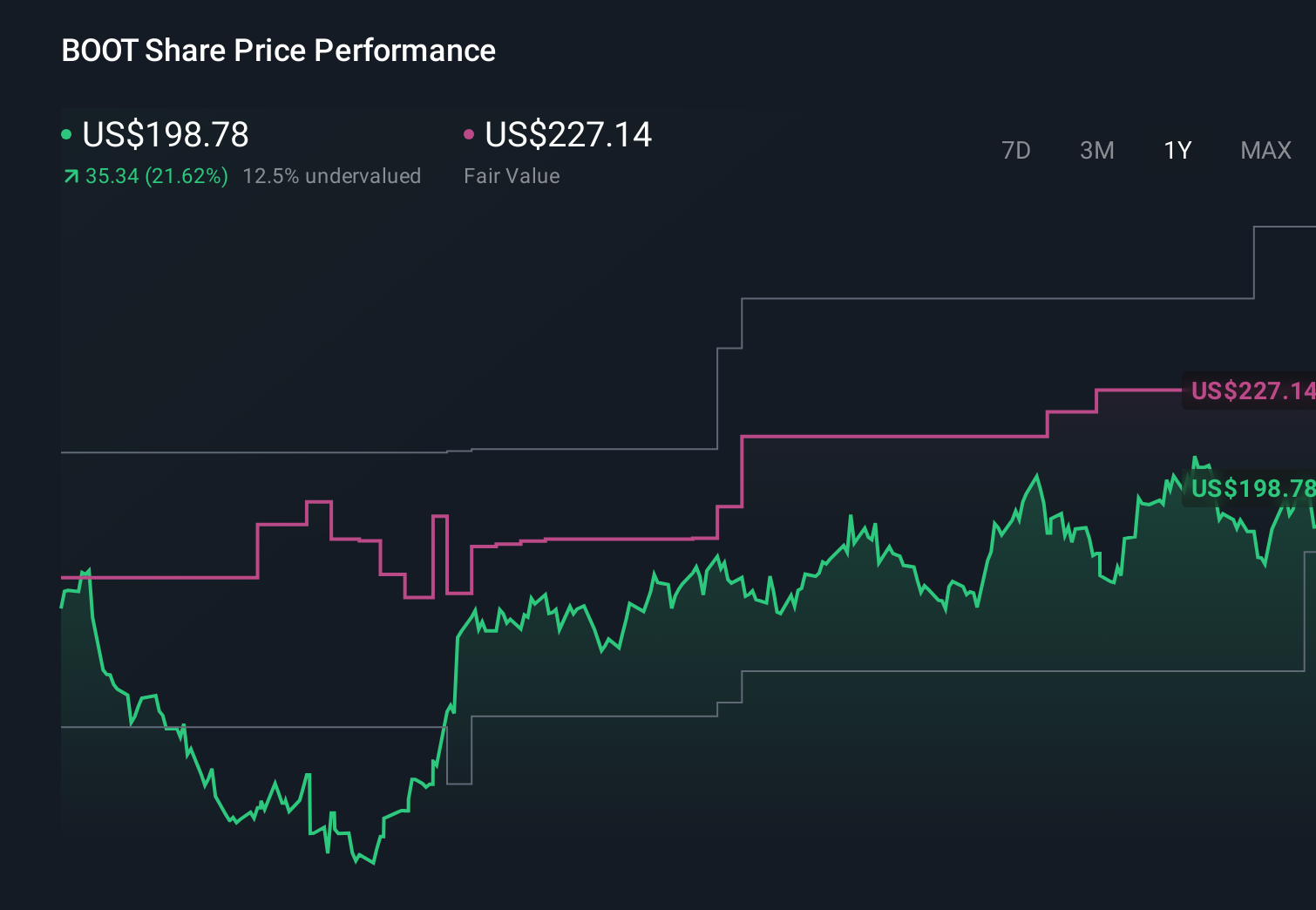

Boot Barn Holdings’ shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives BOOT 1-Year Stock Price Chart Five Simply Wall St Community fair values span roughly US$30 to US$275, reflecting very different expectations around Boot Barn’s future. Set that against the premium earnings multiple and consumer spending risk, and it becomes clear why you may want to weigh several viewpoints before deciding how this stock fits into your portfolio.

BOOT 1-Year Stock Price Chart Five Simply Wall St Community fair values span roughly US$30 to US$275, reflecting very different expectations around Boot Barn’s future. Set that against the premium earnings multiple and consumer spending risk, and it becomes clear why you may want to weigh several viewpoints before deciding how this stock fits into your portfolio.

Explore 5 other fair value estimates on Boot Barn Holdings – why the stock might be worth less than half the current price!

Build Your Own Boot Barn Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com