“…one thing is certain: it’s deeds, not words, that count.”

– President Ronald Reagan, on signing the Child Support Enforcement Amendments of 1984, Aug. 16, 1984

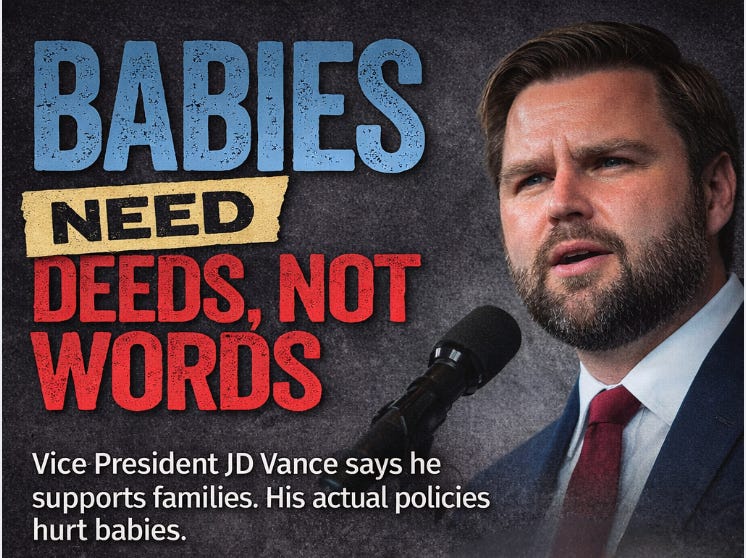

Over the past several years — as a senator, as a vice-presidential candidate, and now as vice president — JD Vance has repeatedly spoken about the need to support babies and families. But at each stage, moments of opportunity have revealed the same pattern: strong rhetoric that could resonate with the American people across the ideological divide, but that repeatedly fails because of weak or harmful policy choices.

First, as a senator, Vance worked with Sen. Tim Kaine (D-VA) on draft legislation to make birth free. However, Vance abandoned the effort once he became a vice-presidential candidate.

Fortunately, with Vance out of the Senate, Sens. Cindy Hyde-Smith (R-MS), Kaine, Josh Hawley (R-MO), and Kirsten Gillibrand (D-NY) have introduced bipartisan legislation, the Supporting Healthy Moms and Babies Act (S. 1834) this past May.

This example is one of many missed opportunities where Vance failed to act for babies and families. Later in 2024, Sen. Vance had the opportunity to provide leadership in support of a bipartisan bill, The Tax Relief for American Families and Workers Act of 2024, which had passed the House by a vote of 357-70 and would have helped alleviate “baby and child penalties” in the law. The bill would have changed the Child Tax Credit so that its phase-in would be adjusted per child rather than by family. This would have helped alleviate the “baby and child penalties” in the bill.

As then Senate Finance Committee Chairman Ron Wyden (D-OR) explained:

The discrimination against families with two, three, four kids is unacceptable. Those families need help buying food, diapers, and new shoes, you name it. Today those kids are stuck splitting a single tax credit. Four kids can’t split a single pair of shoes. They should not have to wait.

House Ways and Means Committee Chairman Jason Smith (R-MO) added:

It removes the penalty for families with multiple children and it still maintains the work requirements to get the child tax credit. That’s something that will help a lot of families.

The following chart shows how families with more children would have benefited from the bill.

Unfortunately for families having babies, Vance missed the vote, and it failed to pass.

Recognizing the vulnerability, a week later, Vance called for an even bigger expansion of the Child Tax Credit to $5,000 per child.

The words sounded promising. But children and families need politicians to back up their rhetoric.

Consequently, in Sept. 2024, I wrote an Op-Ed for the Boston Herald urging Sen. Vance to put words into action:

Politicians often talk a good game about children, but they rarely deliver. Kids need actions more than words. It is time for politicians to demonstrate who’s for kids and who’s just kidding.

Republican vice-presidential candidate JD Vance recently suggested that lawmakers increase the Child Tax Credit to $5,000 per child and that it “apply to all American families.”

Increasing and improving the Child Tax Credit — and applying it to all American families — is a great idea. Unfortunately, Vance skipped the Aug. 1 vote that would have demonstrated his leadership on this issue. The Child Tax Credit bill before the Senate that day failed to move forward….

I urged him to shift his words into deeds:

If Vance thinks we should improve the Child Tax Credit, he should make it happen.

As a senator, Vance has the power to introduce legislation that would create his $5,000 Child Tax Credit and have it “apply to all American families.” He should do so.

As a candidate for vice president, Vance has the opportunity to persuade his running mate, former president Donald Trump, to endorse his improved Child Tax Credit as part of their platform and their Agenda 47. This would be an easy lift if they were committed to it.

He didn’t.

And as a forecast of an opportunity that he just might have to help children as vice president, I added:

If Vance were to become vice president, he would wield the tie-breaking vote in the Senate. How can we be sure he would use it to protect America’s children? Based on his current record, we can’t. But there’s still time for him to put words into action.

If only.

“Well done is better than well said.”

– Benjamin Franklin, Poor Richard’s Almanack, 1737

After he was elected vice president, one of Vance’s first speeches was at the March for Life event in Washington, D.C., where he spoke again about babies and families.

The words are nice.

But even in the first few days of the Trump Administration, we had already seen that the policies being proposed were contrary to the “pro-family values” that Vance spoke to from the podium at that event.

After last year’s speech, I responded:

For example, the proposed cuts to Medicaid and the Children’s Health Insurance Program (CHIP), which provide life-saving care to millions of pregnant women and infants, the undermining of life-saving vaccines, the punitive changes to birthright citizenship that target babies for harm, the failure to strengthen financial support for families through a fully refundable Child Tax Credit, and the lack of support for child nutrition, paid leave, child care, and early childhood programs all make it harder – rather than easier – for parents to care for their children.

Later that year, as predicted, Vance had the opportunity to break a Senate tie on a vote of critical importance to mothers and babies.

H.R. 1, the so-called “One, Big Beautiful Bill” included an estimated $911 billion in cuts to Medicaid, which funds 41% of all births, or 1.5 million of the babies born in this country, and another $200 billion in the Supplemental Nutrition Assistance Program (SNAP).

H.R. 1 also failed children in another profound way, as it provided a Child Tax Credit of just $2,200 per child rather than $5,000, as Vance had urged during the campaign. Furthermore, the bill left in place the law’s “baby and child penalties,” which threatens a newborn’s qualification for the full credit if their mom loses income during pregnancy, childbirth, or postpartum.

If the “task of our government [is] to make it easier for moms and dads to afford to have kids, to bring them into the world, and to welcome them as the blessings that we know them are,” as Vance said, he could have used his position to push the House and Senate to change Child Tax Credit policy so that babies and families would not lose the credit due to the act of having a baby.

Unfortunately, he did not.

“There’s an old saying in Tennessee – I know it’s in Texas, probably in Tennessee – that says, ‘Fool me once, shame on…shame on you.’ Fool me – you can’t get fooled again.”

– President George W. Bush, on Teaching American History and Civic Education, Sep. 17, 2002

Last week, Vice President Vance spoke at the latest March for Life rally in Washington, D.C., and had more to say:

Our vision is simple. We want life to thrive in the United States of America. We want Americans, every American from all walks of life, to have happy, healthy children, and we want them to raise those kids with confidence that they’ll do well and grow up in safety and prosperity, that they’ll have access to good jobs, great schools, safe streets, and warm houses in which to raise their kids. And we want all of our American families to be able to do it with the confidence that their nation will stand with them, just as they have stood with the United States of America.

Once again, the words recognize some of the needs of children and families: “good jobs, great schools, safe streets, and warm houses.”

But here’s the problem: while Vice President Vance is identifying some important challenges and needs, the policies the Administration supports are repeatedly failing to meet the moment or the needs of children and families – especially babies.

The question for us is:

Is it that Vance identifies the need but ultimately supports the wrong policy answers or solutions?

In the end, Vance cast the vote in the Senate to break the tie to slash Medicaid and SNAP and shortchange children and families with a Child Tax Credit that is less than half of what he promised, while also penalizing families for having a baby. He has also publicly urged women to remain in violent marriages, supports eliminating the Department of Education, and advocates eliminating birthright citizenship, even though it would target enormous harm to one group: BABIES.

Or, is it that Vance intentionally speaks to the needs of children and families without having any real intention of working toward a real solution or providing real support?

There has been talk, but no legislation, no vote, and no evidence that he has put his political clout on the line to really support children and families.

Whichever it is, the result is the same: babies and families are left with fewer resources, less security, more risk, and increased poverty.

“I have a perfect horror of words that are not backed up by deeds.”

– President Theodore Roosevelt, Oyster Bay, NY, Jul. 7, 1915

If we are serious about “making family life possible,” we have to be honest about what actually makes life possible for families with newborns and young children.

First, it’s not speeches. Nor is it slogans. And it’s certainly not bad policy that keeps millions of children in poverty.

Instead, what families and children need:

Guaranteed access to health care at birth (and yes, that means something like passing the bipartisan Supporting Healthy Moms and Babies Act, restoring funding to Medicaid, increasing access to immunizations instead of imposing barriers, and increasing investments to prevent infant and maternal mortality rather than cuts)

Protected nutrition support so that infants and toddlers don’t experience food insecurity during critical developmental windows

An expanded Child Tax Credit that benefits all children, but at the very least, does not penalize families for the birth of a child or deny resources to children and families who need it the most

Stable housing, so parents aren’t forced into impossible tradeoffs

Affordable child care, so work and caregiving aren’t mutually exclusive

Paid family leave, so parents can spend critical time with their newborns

Protection of birthright citizenship, so that babies born in this country are not threatened with statelessness and pushed into the shadows of society

Yet time after time, the policy agenda advanced by Vice President Vance and his allies cuts or weakens these very policies.

Again, maybe Vance is identifying some of the right problems but pairing them with the wrong solutions. In his speech last week, Vance said:

…we must also choose policies that make family life possible. So we’ve done that as well. With the Trump Accounts, we started at the very beginning of life investing in every new American child from Day One onward.

First, the Trump Accounts do nothing to help families raise children, because the $1,000 cannot be accessed until a child turns 18 — long after diapers, strollers, car safety seats, child care, afterschool and summer school programs, and pediatric care are needed.

Vance went on to say:

We’ve stood with parents by boosting the Child Tax Credit as well because no family should be penalized for choosing to have kids. In fact, we ought to be rewarding families for choosing to have kids.

Again, with its “baby and child penalties,” the Child Tax Credit is cut or even eliminated for families choosing to have a baby. Young children are, therefore, disproportionately “left behind” with only partial or no credit.

Babies don’t experience policy in theory. They experience it in pediatric care visits missed, vaccines denied, formula stretched, rent unpaid, and parents pushed past the breaking point.

In his recent speech, Vice President Vance emphasized investing in children “day one onward.” Those words and that phrase do matter, as the earliest years of life are when investments in children yield the greatest and longest returns and pay-offs.

The science on this point is overwhelming. The first years of life shape brain development, health outcomes, and lifelong opportunity. Harm done during this period is not easily undone. And yet, under current policy:

That’s not “investment from day one onward.” And the threat of eliminating birthright citizenship would make matters much, much worse.

That’s retreat. If political leaders truly want more babies in America, they must stop making it harder – and more expensive – to raise children, particularly in their earliest years. Families are not “rewarded” when support disappears just as their needs rise.

Vice President Vance is right about one thing: families are struggling.

But words don’t feed babies. And verbal sentiments don’t stabilize households.

When policies consistently make life harder for families with infants — especially low-income families — the outcome is predictable: fewer resources, worse health, and greater instability for the very children politicians claim to champion.

Calling this “pro-family” is Orwellian.

“Actions speak louder than words, but not nearly as often.”

– Mark Twain

If the goal is truly to support life — not just at birth, but beyond it — then policy must reflect what babies actually need to survive and thrive.

That means:

Strengthening, not weakening, health coverage for mothers and infants

Ensuring every child benefits from a meaningful Child Tax Credit, starting at birth

Protecting nutrition programs that keep babies fed during their most vulnerable years

Making child care and early support systems accessible, not aspirational

Anything less is not a failure of messaging. It’s a failure of commitment.

Vice President Vance is right to say that family life must be made possible. But until policies match that rhetoric, especially for babies, those words will ring hollow.

Babies can’t wait for politicians, think tanks, and ideology to catch up. They need bipartisan supports and solutions now.