The way we shop online is about to undergo its most significant shift in decades as AI agents move from simple chatbots to active participants in the economy. Mastercard has officially announced the completion of Australia’s first authenticated agentic transactions, marking a massive milestone for the local fintech landscape.

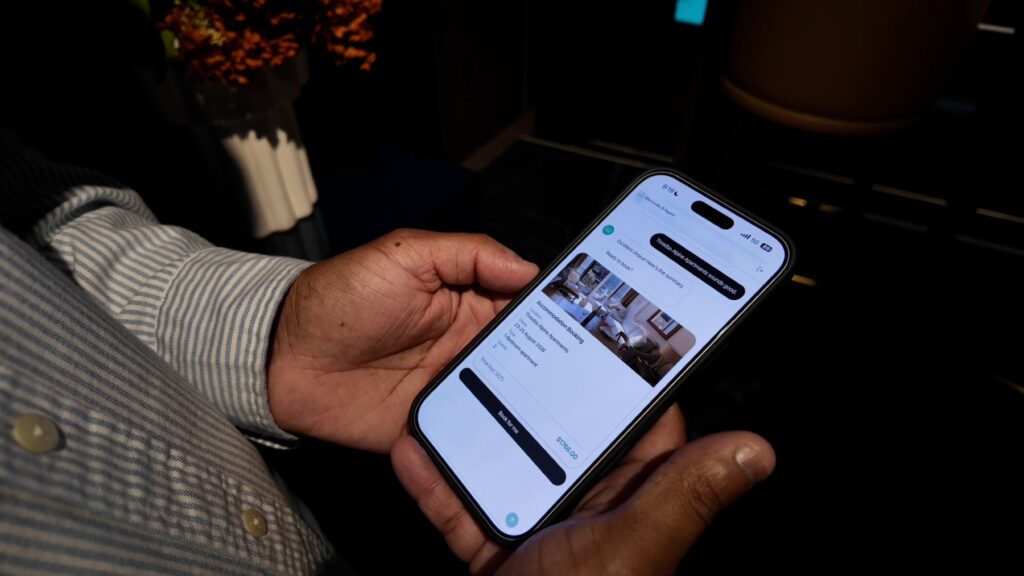

These transactions weren’t just a lab experiment; they happened in the real world using existing financial infrastructure. Using Mastercard’s Agent Pay solution, AI agents successfully purchased cinema tickets and booked holiday accommodation for Australian users.

This move signals the start of a new era where your AI doesn’t just suggest a product, but actually goes out and buys it for you. With research suggesting this tech could influence 55% of all Australian consumer spending by 2030, the stakes for getting the security right are incredibly high.

How the first agentic transactions worked in Australia

The first successful test involved a Commonwealth Bank of Australia (CBA) debit card being used by an AI agent to buy tickets from Event Cinemas. Shortly after, a Westpac-issued credit card was used by an agent to book travel accommodation in the snowy region of Thredbo.

What makes these transactions special is the level of visibility across the entire payment chain. Unlike previous automated systems, Mastercard’s framework ensures that the issuer, the merchant, and the bank can all see that an AI agent is the one driving the purchase.

The heavy lifting on the AI side was handled by a sovereign large language model called Matilda, developed by local outfit Maincode. These payments were processed through IPSI, proving that the tech is flexible enough to work across different payment environments and banks.

Why transparency matters for AI shopping

While the idea of an AI assistant handling your life sounds great, Australians are naturally a bit cautious about handing over the keys to their bank accounts. Research indicates that while nearly half of us have used AI to help with shopping, nine out of ten people still have concerns about privacy.

Mastercard is tackling this head-on by building a framework that treats AI agents as visible and governed participants. This means every transaction is fully authorised with cardholder consent, ensuring you remain in control of what your agent is doing with your money.

By following strict industry standards, Mastercard aims to create a consistent experience regardless of which AI platform or bank you happen to use. This interoperability is key to making agentic commerce a mainstream reality rather than a niche tech demo.

The scale of the agentic commerce opportunity

The financial implications for the Australian economy are staggering when you look at the projected growth. Estimates suggest that agent-led commerce could be worth up to A$670 billion in spending by the end of the decade.

“Agentic commerce represents one of the most profound shifts in consumer behaviour we’ve seen in decades,”

Paul Monnington, Division President, Australasia, Mastercard.

To support this growth, Mastercard is establishing a regional AI Centre of Excellence and deploying dedicated teams at its Sydney Tech Hub. These teams will work closely with financial institutions and merchants to help them transition to these new agent-led experiences.

Partnering for a secure AI future

The success of this pilot relied on a massive collaboration between some of Australia’s biggest financial and retail names. From the banks like CBA and Westpac to the entertainment giants at EVT, there is a clear appetite to lead the world in this space.

“As Australians explore more AI-powered ways to shop and pay, we’re proud to be participating in early, controlled trials with Mastercard to help shape secure and transparent agentic payment standards across the ecosystem.”

Monica Wegner, Executive General Manager Everyday Banking, Commonwealth Bank of Australia.

The focus from all partners involved seems to be on removing the friction from everyday tasks like booking a night at the movies or planning a holiday. If the AI can handle the boring parts of the transaction while keeping the security tight, it is a win for the consumer.

“Payments play an important role in our customers’ everyday lives, and giving our customers seamless, secure and simple ways to pay is a priority for us. Agent Pay will make those moments quicker and easier for our customers.”

Carolyn McCann, Chief Executive of Consumer, Westpac.

Building the local AI ecosystem

It is also great to see local tech expertise at the heart of this global first. Maincode’s Matilda LLM shows that Australia has the engineering talent to build the “brains” behind these next-generation commerce tools.

“The partnership with Mastercard grew out of a shared commitment to ‘doing the hard thing’ when it comes to figuring out how to tie AI, agents and payments together. Maincode’s hardware, software and design can deliver real results in boosting customer experience and increasing efficiency especially for payments.”

Lukas Wesemann, AI Research, Maincode.

As the global Agent Pay program expands beyond the U.S. and into Asia Pacific, Australia is positioned as a key testing ground. This ensures that the standards being set today will reflect the needs and security expectations of Australian shoppers.

What comes next for Agent Pay

Following these successful live tests, we can expect to see more merchants and banks jumping on board the Agent Pay framework. The goal is to move from these initial pilots into a world where your AI assistant is a standard way to interact with your favourite brands.

“Agent-powered commerce could fundamentally change how our guests engage with their favourite EVT experiences in the future, and we’re excited to be at the forefront of that shift with Mastercard.”

Andrew Turner, Group General Manager Technology and Digital Transformation, EVT.

Security will remain the biggest hurdle to clear, but with the visibility provided by the new framework, the industry is confident it can detect fraud more effectively. By treating the AI as a known participant in the payment flow, the system can apply the same robust controls we expect from any other card payment.

“Delivering safe, secure and seamless payment experiences to consumers is now, more than ever, front-of-mind for all of us. By leveraging the near limitless capabilities of Agentic AI, and coupling it with secure payment processing, Mastercard have unlocked a wealth of opportunity for consumers and merchants alike.”

Jarrett Baker, Head of Product, IPSI.

For more information, head to https://www.mastercard.com