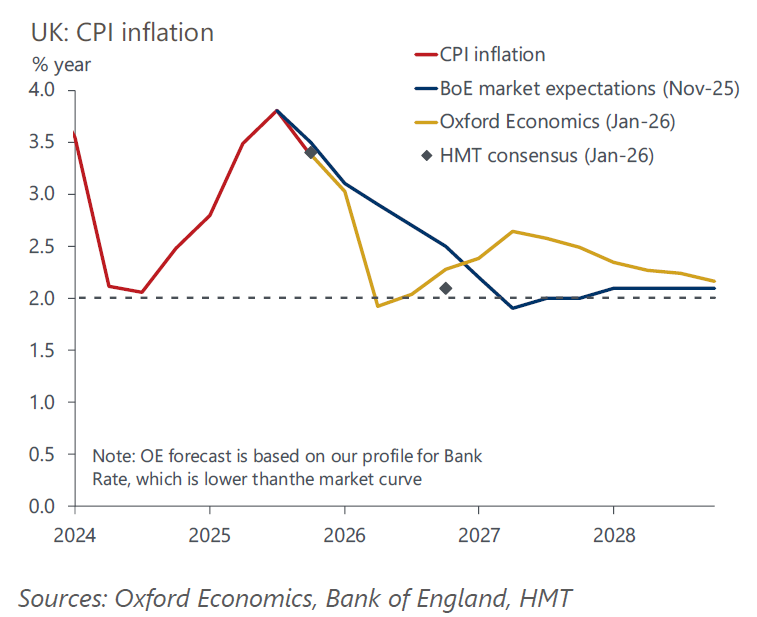

Allenby described the current backdrop as difficult for policymakers, with weak growth coinciding with persistent inflationary pressures. “The current bout of mild stagflation is likely to keep the committee divided on the timing of these future cuts, encouraging a gradual approach to loosening policy further,” he added.

Oxford Economics projects that the next likely reduction in Bank Rate will come at the MPC’s April meeting, provided forthcoming data give the committee more confidence that pay growth is cooling. The firm expects pay settlement figures to be central to the timing and scale of future cuts, as the MPC seeks to support activity without allowing domestic inflation to become entrenched.

“We see the end-April meeting as the most likely timing for the next cut,” Allenby said. “By then, the MPC should have a clearer view of the pay awards and whether this is further evidence of slack emerging in the economy.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.