Marathon Petroleum (MPC) has just declared a US$1.00 per share common stock dividend, payable on March 10, 2026 to shareholders of record at the close of business on February 18, 2026.

See our latest analysis for Marathon Petroleum.

At a share price of US$176.19, Marathon Petroleum has seen an 8.34% 1 month share price return and a 6.69% year to date share price return, while its 1 year total shareholder return of 23.60% and very large 5 year total shareholder return underline how recent momentum sits within a longer period of strong value creation. The fresh US$1.00 dividend declaration and the upcoming virtual annual meeting on April 29, 2026, are likely to keep attention on how the market is weighing future cash flows against this track record.

If this dividend announcement has you thinking about other energy names, it could be a good time to scan aerospace and defense stocks for companies shaped by long term contracts and policy driven demand.

With the stock at US$176.19 after a 24% 1 year total return and a value score of 4, plus an intrinsic value estimate that is materially higher, you have to ask: is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative: 9.5% Undervalued

With Marathon Petroleum at $176.19 against a most followed fair value narrative of $194.61, the current price sits below that storyline of future cash flows.

Strategic portfolio optimization, including high return refinery “quick hit” projects and ongoing expansion in midstream logistics/NGL infrastructure (such as the Northwind Midstream acquisition), are enhancing operational flexibility and supporting incremental improvement in net margins and long term cash flow generation.

Curious what keeps that fair value above today’s price? It hinges on where margins settle, how earnings compound, and what multiple the market ultimately pays.

Result: Fair Value of $194.61 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, that fair value story can break quickly if long term fuel demand weakens faster than expected or if tighter environmental rules squeeze refining margins and asset values.

Find out about the key risks to this Marathon Petroleum narrative.

Another angle on what the price is saying

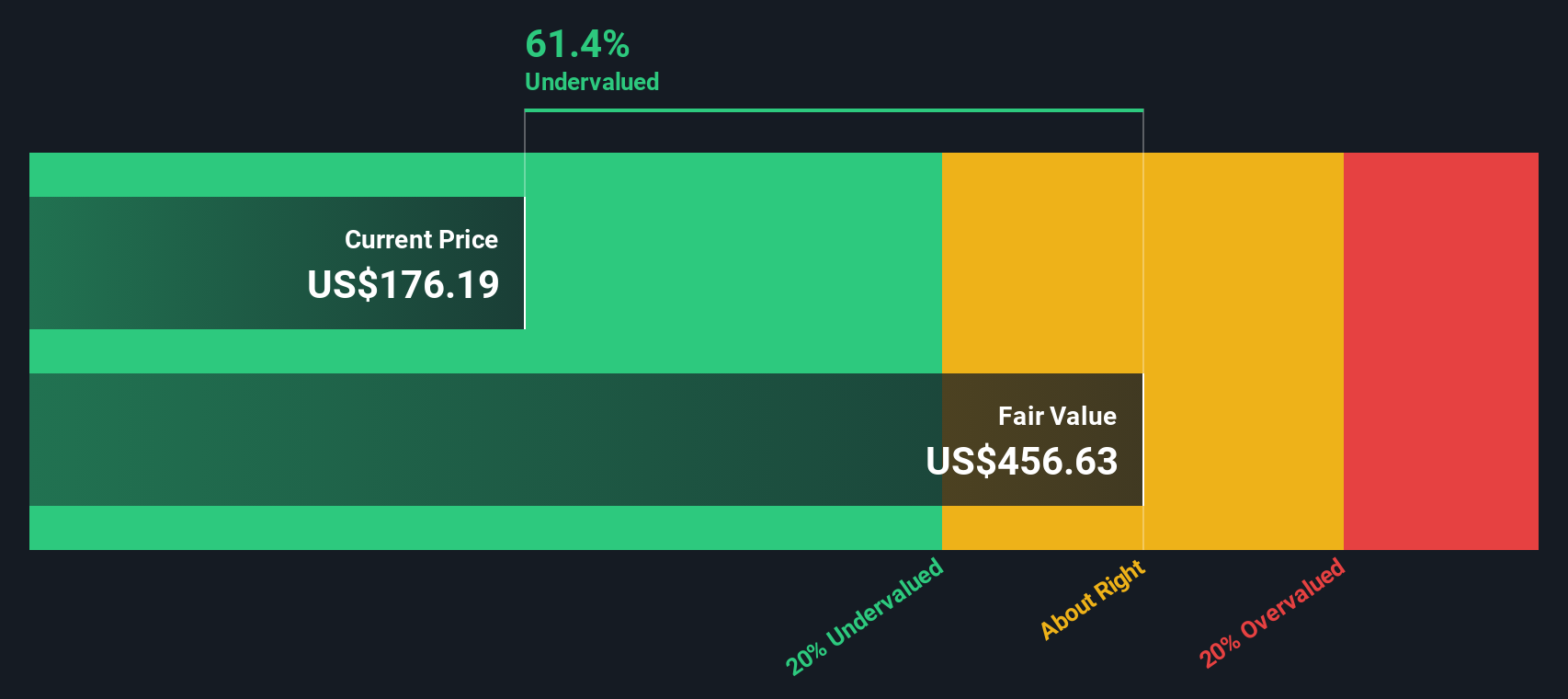

Our DCF work suggests Marathon Petroleum at $176.19 trades around 61% below an estimate of future cash flow value of $456.63, while the market is currently applying a P/E of 18.4x. If the cash flow story is that strong, why is the market still holding back?

Look into how the SWS DCF model arrives at its fair value.

MPC Discounted Cash Flow as at Jan 2026 Build Your Own Marathon Petroleum Narrative

MPC Discounted Cash Flow as at Jan 2026 Build Your Own Marathon Petroleum Narrative

If the conclusions here do not quite match your own view and you prefer to test the numbers yourself, you can spin up a custom thesis in just a few minutes using Do it your way.

A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Marathon Petroleum has sharpened your focus, do not stop here. Broaden your watchlist now so you are not catching up with the crowd later.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com