What to know about Kevin Warsh, Trump’s pick for Fed chair

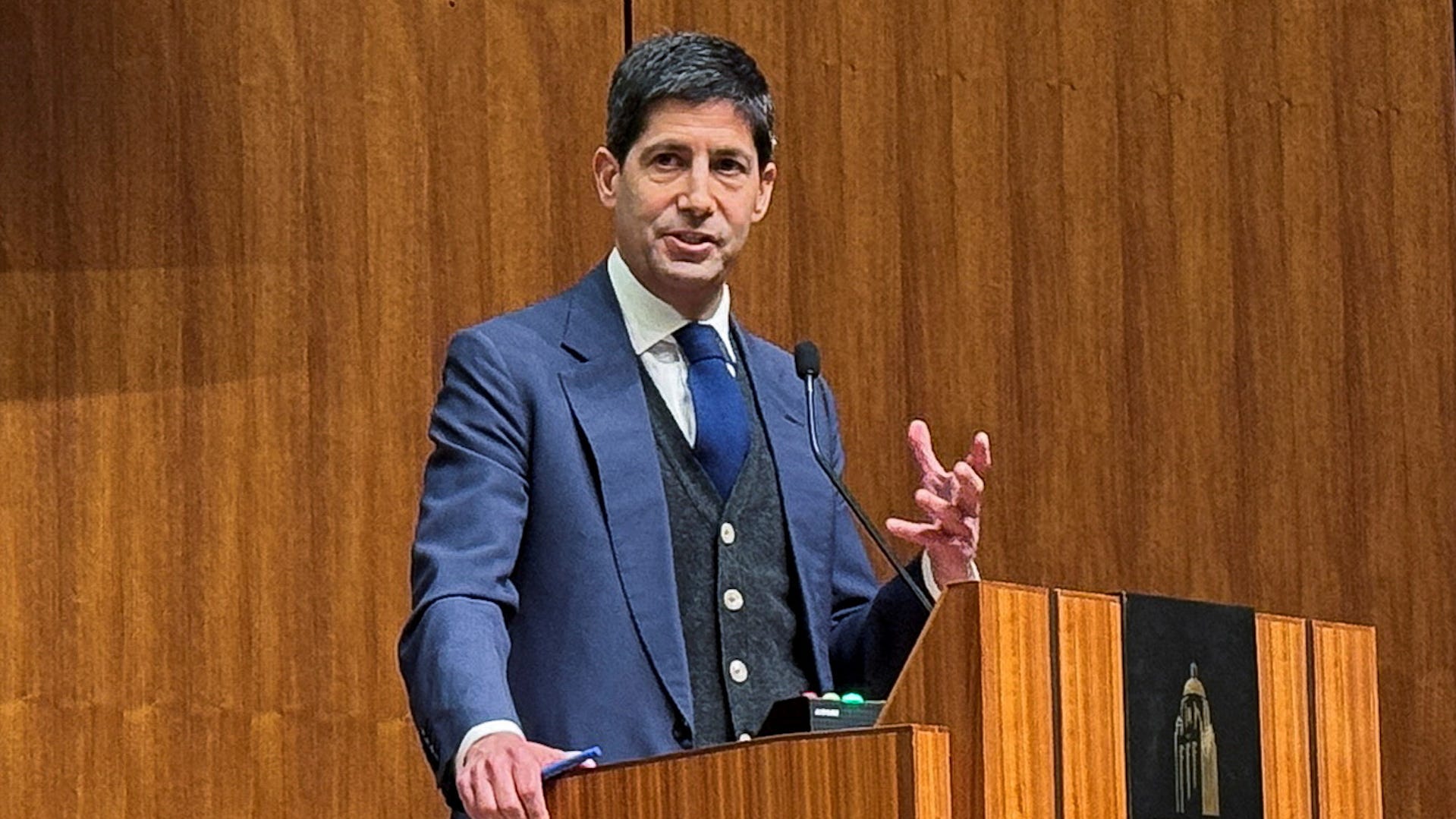

Kevin Warsh is a former Federal Reserve governor chosen by President Donald Trump to lead the Federal Reserve.

President Donald Trump on Jan. 30 nominated Kevin Warsh to lead the Federal Reserve and an increasingly divided Federal Open Market Committee once Chair Jerome Powell’s term ends in May.

Warsh served on the Fed’s Board of Governors for five years from 2006 to 2011, including during the U.S. financial crisis. During that time, he was seen as a bridge to Wall Street and pegged as a hawk, meaning he favored keeping interest rates high to curb inflation. However, Warsh has recently appeared more dovish, siding with the president in his calls for further easing of the Fed’s benchmark federal funds rate.

“No, but we talk about it,” Trump said Jan. 30 when asked by a reporter whether Warsh committed that he will push to cut interest rates as Fed chair. “I don’t want to ask him that question. I think it’s inappropriate. Probably would be allowed but I want to keep it nice and pure. But he certainly wants to cut rates. I’ve been watching him for a long time.”

In an interview with CNBC last summer, Warsh went so far as to call for “regime change” at the central bank, saying its “credibility deficit lies with the incumbents that are at the Fed.”

“Warsh has been critical of the Fed’s intervening in markets from a quantitative easing perspective over the last few years and basically the role of the Fed in general,” SoFi’s Head of Investment Strategy Liz Thomas said. “There’s the expectation that he’s going to drive some reform as far as what the Fed’s role is in markets. … If and when faced with a crisis, or if and when faced with inflation, there’s no knowing how he’s going to handle it.”

Warsh’s nomination didn’t come as much of a surprise to many Fed watchers. His name has been part of the conversation since talks about Powell’s replacement began last year. He beat out other frontrunners for the position, including Director of the National Economic Council Kevin Hassett, Fed Governor Christopher Waller and BlackRock executive Rick Rieder.

Before Warsh can assume the role, his nomination will need approval from the Senate Banking Committee. Then he’ll face a full Senate vote. That confirmation process may be complicated by Sen. Thom Tillis, R-North Carolina, who serves on the banking committee and has vowed to oppose any of Trump’s nominations to the Fed until the Justice Department concludes its investigation into Powell.

Who is Kevin Warsh?

Former President George W. Bush nominated Warsh to serve on the Fed’s Board of Governors in 2006, after Warsh served as special assistant to the president for economic policy, executive secretary at the National Economic Council, and a member of the president’s Working Group on Financial Markets.

Prior to that, Warsh served as an executive at Morgan Stanley, where he worked as a financial adviser to companies across several industries.

He holds a bachelor’s degree in public policy from Stanford University and a law degree from Harvard Law School.

After leaving the Fed in 2011, Warsh returned to Stanford, where he currently serves as a visiting fellow at the university’s Hoover Institution and lectures at the Stanford Graduate School of Business.

Does Kevin Warsh support interest rate cuts?

With experience on Wall Street, at the Fed and in Washington, Thomas described Warsh as “a known quantity,” but said because he has held both hawkish and dovish views, his approach to rates remains somewhat of an open question.

If he is confirmed as the next Fed chair, Wells Fargo economists said in a Jan. 30 note they generally expect Warsh to assume “a more dovish stance on monetary policy driven in part by his optimism over productivity growth as well as his view of the need for lower rates to support ‘Main Street.’”

After months of Trump pressuring the Fed to lower the federal funds rate, Bankrate Economist Analyst Sarah Foster said in a statement to USA TODAY the president has made clear he’d like the next Fed chair to share his desire for lower rates.

“But the chair is just one of 12 votes, and policymakers are likely going to need some convincing evidence to get them off the sidelines,” Foster said.

What Warsh’s confirmation could mean for Fed independence

The Justice Department’s investigation into Powell and a Supreme Court case involving Fed Governor Lisa Cook have recently fueled concerns about the central bank’s independence from politics.

If Warsh is confirmed, he will take on the Fed chairmanship at a time when maintaining the institution’s credibility will be part of the job. Although such concerns appear elevated today, they aren’t new.

“Central bank independence is precious,” Warsh said in a 2010 speech during former President Barack Obama’s administration. “It can be taken for granted in benign times, but it is tested when times get tough. And we still have tough times ahead of us. My colleagues and I must demonstrate that Fed independence has not been relegated, and the Fed’s long-term objectives not compromised.”

Not everyone is fully convinced Warsh is up to the task in 2026, including Mike Madowitz, principal economist at the Roosevelt Institute, a liberal think tank and the nonprofit partner to the Franklin D. Roosevelt Presidential Library and Museum.

“The independence of the Fed has rarely been tested as aggressively as it has over the last year,” Madowitz said in a statement to USA TODAY. “Warsh’s nomination to lead the Fed should not reassure Americans that those threats are behind us. The costs of getting this wrong could be dramatic: higher housing and car costs, greater barriers to starting a small business, and higher taxes with fewer benefits at the federal, state, and local levels.”

What is the current federal funds rate?

The FOMC held its key interest rate steady Jan. 28, with some policymakers signaling monetary policy is near neutral after concerns about the U.S. labor market prompted three quarter-point cuts late last year.

The decision, which wasn’t unanimous, left the federal funds rate, which serves as a benchmark for interest rates across the country, at a range of 3.5% to 3.75%.

During a press conference following the announcement, Powell appeared more upbeat about the U.S. economy, saying consumer spending remains healthy and the unemployment rate is showing signs of stabilization. He added, however, committee members are closely monitoring inflation as some companies seem poised to pass on more tariff-related costs to consumers this year.

Over the last few months, some committee members’ views on where interest rates are headed have diverged. While some remain cautious about inflation, others are concerned about slowing growth, according to SoLo Funds co-founder Rodney Williams.

“Warsh’s ability to negotiate and bridge these views will define his success in the new role,” Williams told USA TODAY.

Contributing: Joey Garrison, USA TODAY

Reach Rachel Barber at rbarber@usatoday.com and follow her on X @rachelbarber_