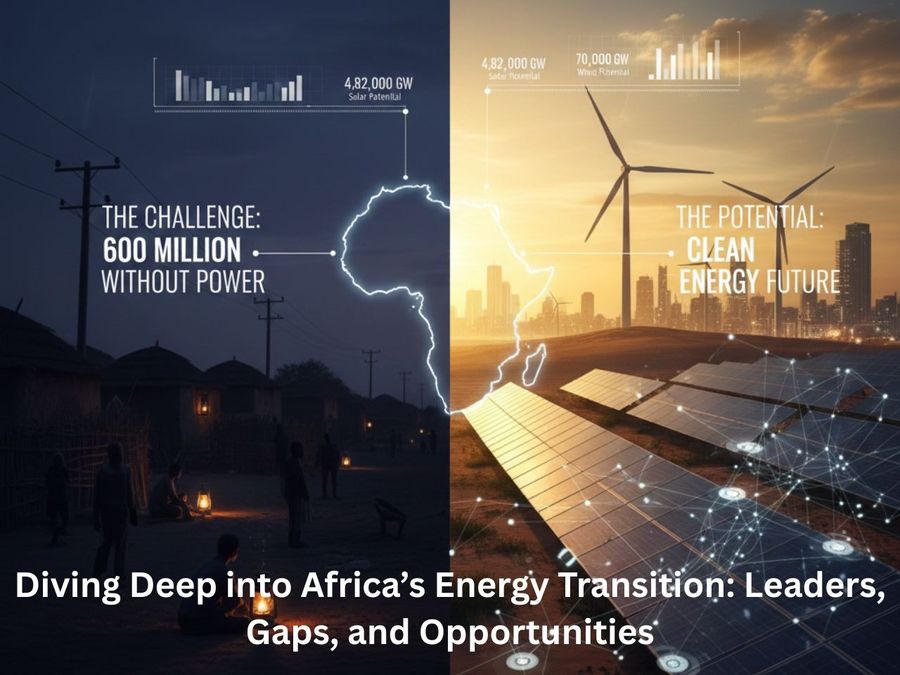

Africa hosts roughly 600 million people living without electricity, which constitutes more than a third of the continent’s population. This number also accounts for the majority of people woprldwide without access to power, after the strides made by Asia in the past decade, particularly India. Affordable power demand of the continent is rising fast, but the question is whether that demand will be met by fossil fuels or by renewables, a choice that could define the continent’s future growth.

The continent holds immense renewable potential, which needs proper planning, huge investment and political will to deliver its growing need. As per Africa Climate Insights, the continent holds over 4,82,000 GW of solar energy potential and over 70,000 GW of wind energy potential.

While most of the countries’ energy transitions are marred with bottlenecks that have so far hindered renewable growth, a few have taken a leap in the sector – South Africa, Egypt, and Morocco – leading the region and setting an example for the others to follow. That these belong to North Africa, with its traditionally strong European connects, and South Africa, is indeed a pity as a vast number of the continent’s 54 countries continue to struggle to catch up.

Leading the TransitionSouth Africa

The undisputed solar leader of Africa, South Africa, contributes over half of the continent’s solar capacity. According to the Africa Solar Industry Association’s (AFSIA) project database, South Africa currently has over 11.6 GW of operational solar, with over 1.3 GW deployed in 2025 alone, thanks to supportive policies like the Renewable Energy Independent Power Producer Programme (REIPPPP).

To support its renewable energy goals, several policies and initiatives have been introduced. These include the South Africa Renewable Energy Masterplan (SAREM), launched in March 2025 as a strategic framework to strengthen the renewable energy sector, and the Green Fund scheme to finance green initiatives that support a transition to a low-carbon economy.

The renewables are now projected to account for 31.3 percent of South Africa’s total power generation by 2035, up from 8.9 percent in 2024. De Aar and Jasper solar farms are some of its notable renewable projects.

Egypt

Egypt has rapidly positioned itself as a solar leader in North Africa, transforming its vast desert expanses into hubs for large-scale renewable energy projects. Alongside South Africa, it remains the only African nation to achieve gigawatt-scale solar capacity.

In its clean energy roadmap, Egypt aims for renewables to contribute 42 percent of total electricity generation by 2030, up from around 11.5 percent in 2024. Solar power is expected to play a pivotal role in achieving this goal, alongside the country’s strong wind potential. The government also anticipates that total renewable generation capacity, primarily from solar and wind, will reach approximately 12 GW by 2026.

At the heart of this transformation lies the Benban Solar Park in Aswan – the nation’s largest solar installation and one of the world’s most ambitious solar complexes. Spanning dozens of individual plants, Benban has a combined capacity of about 1.65 GW.

Complementary projects such as the Kom Ombo Solar Plant and several smaller installations have further boosted Egypt’s total solar capacity to an estimated 2.8 GW.

Beyond utility-scale projects, Egypt is expanding off-grid and distributed solar systems to power remote settlements and agricultural operations. This approach leverages the country’s exceptionally high solar irradiation levels, particularly across the Western Desert, reinforcing Egypt’s commitment to a diversified and resilient renewable energy ecosystem.

Wind energy development is concentrated along the Gulf of Suez and the Red Sea coastlines, regions known for some of North Africa’s most favourable wind conditions. Egypt’s installed wind capacity reached approximately 3 GW as of 2025, with major projects, such as the Red Sea Wind Energy project (approximately 650 MW), now operational or under construction.

Morocco

Morocco is another African nation which is leading the continent in terms of renewable energy installation. With over 2,400 MW of installed wind capacity across 23 projects and 885.2 MW of installed solar capacity.

What truly distinguishes Morocco is its visionary projects and integrated planning. The Noor Ouarzazate Solar Complex – a mix of concentrated solar power (CSP) and photovoltaic (PV) plants totalling around 580 MW – showcases cutting-edge solar technology on the edge of the Sahara.

In addition, Morocco is investing in newer PV projects (including recent 400 MW solar PV+battery installations) to reach its goal of over 52 percent renewable capacity by 2030.

Morocco recently announced the launch of the Solar Rooftop 500 program in cooperation with Switzerland.

The administration has been at the forefront of the energy transition for the country. This trend is set to continue in the new year, with Masen having recently approved a renewable energy development program that includes the launch of new projects totalling 1.7 GW of installed capacity from 2026.

Following the feat, other big states on the continent are also making renewable energy inroads. For instance, Nigeria, Africa’s most populous nation, took the lead in March with the creation of a new USD 500-million fund meant to develop and finance distributed renewable energy (DRE) projects in the country.

Uneven Distribution of Energy Investment

Despite being endowed with some of the world’s richest renewable energy resources, Africa attracts less than 2 percent of global renewable energy investment. This imbalance must change. According to the International Renewable Energy Agency (IRENA), the continent needs around USD 30 billion in annual renewable energy investments to meet its electrification targets by 2030—more than eight times the current average of just USD 3.7 billion each year.

Between 2020 and 2025, Africa invested roughly USD 34 billion in clean energy technologies, allocating 52 percent to solar and 25 percent to onshore wind. Yet, despite this growing momentum, the continent captured only 1.5 percent of global renewable investments in 2025, with projections suggesting a modest rise to about 2.7 percent by 2030.

Africa’s renewable landscape is also marked by stark regional disparities. North Africa and South Africa together account for less than 20 percent of the population but attract over 45 percent of the continent’s total energy investments. Since the launch of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) in 2011, South Africa alone has drawn more than R292 billion (USD 17.75 billion) in renewable energy projects. In contrast, most of Sub-Saharan Africa – home to the majority of the continent’s population – continues to receive a fraction of that level of investment.

Even within solar energy, funding disparities persist. Most investments target grid-connected projects, reflecting both investor priorities and government strategies to address acute power shortages. Countries like South Africa, Egypt, and Morocco dominate renewable energy procurement, but their efforts largely focus on utility-scale generation to meet industrial and urban energy demands rather than expanding rural access.

South Africa, for example, has implemented large-scale initiatives such as the REIPPPP and the Battery Energy Storage Independent Power Producers Procurement Programme, procuring several gigawatts of capacity. However, these programs primarily aim to tackle Eskom’s generation shortfall and sustain industrial power supply rather than drive rural electrification.

Bottleneck

Beyond the investment challenge, inadequate transmission infrastructure remains one of the most critical bottlenecks to Africa’s energy transition. Nearly 720 million Africans – about half of the continent’s population – live far from any sort of grid, leaving them without access to electricity. The gap between urban and rural electrification is particularly stark: while 78 percent of people in Sub-Saharan Africa’s urban areas have access to power, only 28 percent of rural residents share that privilege.

Recognizing this imbalance, several African states are beginning to focus more explicitly on improving transmission networks. For instance, Morocco plans to invest 27 billion Moroccan dirhams (USD 2.7 billion) over the next five years to expand its electricity infrastructure and boost the share of renewables in its energy mix.

At the same time, decentralized solutions such as minigrids are gaining traction as a practical approach to bridge access gaps. The launch of the Africa Minigrids Programme (AMP), led by the UNDP and a coalition of development partners, marks a significant step in addressing rural energy connectivity.

Historically, energy investments in Africa have been heavily skewed toward generation, with limited attention paid to transmission and distribution infrastructure. Rectifying this imbalance will be essential if the continent is to achieve universal and reliable access to clean energy.