Kenya’s trade relationship with China is becoming increasingly unbalanced, with imports climbing sharply while exports to the Asian nation continue to fall.

Latest figures from the Kenya National Bureau of Statistics (KNBS) reveal that the trade deficit reached Sh475.6 billion in the first nine months of 2025, up 16.7 per cent from Sh407.7 billion recorded during the same period in 2024.

Imports from China rose 14.5 per cent to Sh489 billion, compared with Sh427.04 billion a year earlier, reflecting ongoing demand for products used in construction, transport, energy, and manufacturing.

Exports, however, fell 30.8 per cent to Sh13.4 billion, down from Sh19.3 billion previously, showing that Kenya’s shipments remain concentrated in a small number of commodities and semi-processed products.

The gap highlights the structural challenges Kenya faces in expanding its export base and reaching larger Asian markets. While Chinese imports benefit from established supply chains and financing, Kenyan exports are more vulnerable to production issues and limited market access.

Reduced mineral shipments, including titanium from the closure of the Kwale mines, have sharply curtailed foreign exchange earnings from China over the past two years.

China’s influence on Kenya’s economy extends beyond trade, with the country supplying industrial inputs and supporting major infrastructure projects.

The landmark contract for the standard gauge railway from Mombasa to Suswa near Naivasha strengthened Chinese presence in Kenya’s domestic economy, even as the trade gap continues to widen.

The growing deficit has made its way into national trade discussions, with authorities focusing on ways to improve market access and reduce current account pressures.

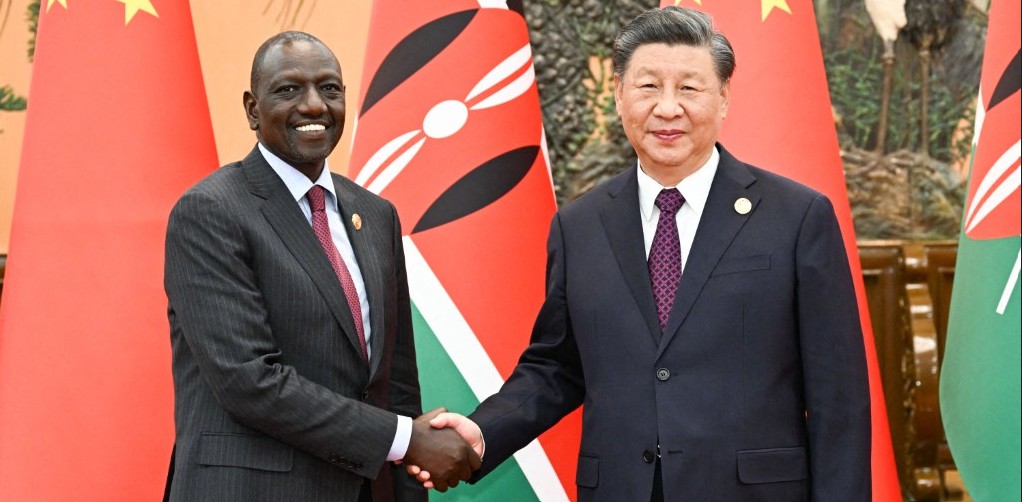

During his April visit to China, President William Ruto raised the issue of trade imbalance and pushed for reciprocal arrangements.

“We have concluded the high-level conversations with China. They have agreed to a reciprocal arrangement between Kenya and China…to remove all the tariffs on our tea, coffee, avocado, and all other agricultural exports,” he told business leaders in August 2025.

The government’s push aligns with the Integrated National Export Development and Promotion Strategy, launched in 2018 to diversify Kenya’s export markets beyond traditional Western destinations.

Envoys have been posted to key Asian capitals, including Beijing, to open new opportunities and reduce reliance on a narrow range of products.

Before the Covid-19 pandemic, the Kenya Export Promotion and Branding Agency had intensified marketing campaigns in China, targeting agricultural regions and tea-growing hubs.

Despite these efforts, structural constraints and logistics challenges continue to hinder Kenya’s ability to close the trade gap.