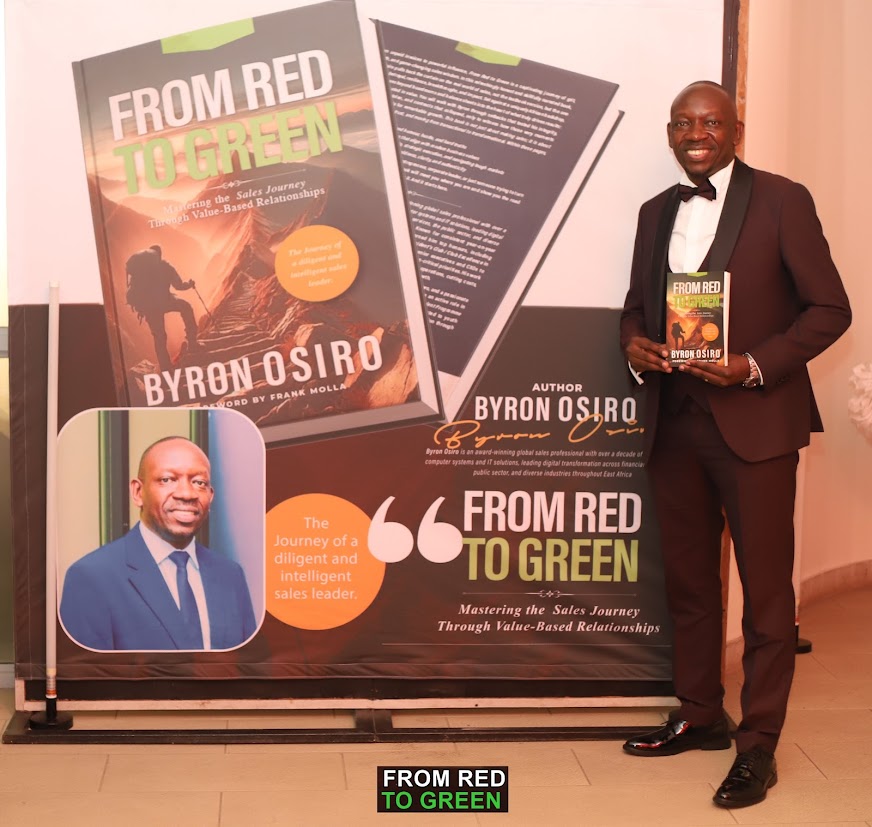

Byron Osiro

Byron Osiro

during the

launch of his

book “From

Red to Green”,

in Nairobi

/HANDOUT

Back in High School, Byron

Osiro had a dream of pursuing a degree in medicine. His career path, however, changed under his former headmaster at Bugema Adentist Secondary School in Uganda, Mugumya Mesusera, whom he credits for seeing what he had not recognized in himself.

His course of life shifted to pursuing a career in Computer Science. What

seemed like a detour turned out to be destiny in motion, as he says in his

recently launched book, “From Red to Green”, the journey of

a diligent and intelligent sales leader.

From earning a Sh1,430 salary to landing multi-million dollar deals, he now works for a Fortune 500

company, which is among the top global tech firms. Red to Green extends beyond sales to encompass

relationships, finances and mental health, emphasising moving from being stuck

to a state of clarity—mastering the sales journey through value-based

relationships. Osiro spoke to the

Star on his personal journey, the tech environment in Kenya, the region and the

future.

What stands out in your book?

First, we have

to start this with a clear disclaimer that the views represented here are mine

and not representative of any organisations I represent or work for out here. I

have been able to consistently over-achieve my sales targets, growing revenues

for the companies I have worked for in sales teams, for close to two decades

now.

This is evidenced by the top honours I have qualified for, like Oracle

Corporation’s President’s Club/ Club Excellence, or Million Dollar Club,

honours that are given to folks who achieve over 200 per cent of their annual sales

targets in the respective fiscal years.

Beyond the numbers, though, is the fact that I close business through

creating valuable and meaningful relationships consistently, with different

personas across these organisations, selling value rather than products or

features. I have embraced leadership along the way, often being designated

sales manager soon after taking on a new sales executive role.

God has also

been at the centre of my sales success. I would not have achieved the little that

I have without his divine providence. I talk about the destiny helpers He has

consistently planted in my path in the book.

What was your first role in tech and

how has the industry changed since then?

I was an

intern at an IT Reseller/ Partner in Kampala, Uganda, back in 2002-03. The

company was called Integrated Computers and Electronics Ltd. A client came and

bought computers, a network printer and a switch and asked that we go install a

LAN (Local Area Network) at his home for his research team. When we got on-site,

the senior staff were not able to do it.

The boss gave me the crimping tool and

asked me to sort it out. I did it and confirmed that all was well by printing

the test page on the network printer. This got me on the payroll immediately,

just weeks in on the internship, as an IT Support Technician.

So my career did

not start from sales but from IT support roles, given my computer science background.

Back then, we did not have AI to enable machines and computers to perform tasks

that typically require human intelligence as we do now.

You had to have been

trained formerly or at least studied systems to know how to troubleshoot and

resolve various system issues. The Internet was also delivered through very slow

speed, dial-up systems as opposed to the current high-speed 4G and 5G fiber

optic connections.

In general, hardware specifications for hard disks, memory

chips/ dimms and other computer parts have evolved drastically to support the

faster computing needs that consumers currently demand.

How does your educational background

contribute to your work today?

I am a

computer scientist, having earned a Diploma in Computer Science and a Bachelor’s

Degree in IT and Computing at Kyambogo University in Kampala, Uganda, between

2002 and 2007.

I also attempted the Cisco CCNA Certification during that period. I, however, transitioned to IT sales roles where I use my IT background to position

solutions that impact how organisations operate or drive their businesses, to

reduce cost and optimise efficiency in their operations, to innovate and stay

ahead of their competition.

My IT background makes it easier to understand

different technological concepts like network and security, database systems and

ways to optimise the same. However, the IT world is very diverse and systems

change daily.

I am now in an area where I am selling cloud ERP systems, a total

shift from what I studied back in university. So one has to keep unlearning and

relearning to keep abreast with the changes in the technology world.

Back in

High school when I did my A-Levels, my subject combination was Physics,

Chemistry, Biology and Subsidiary Mathematics as I had intended to be a medical

doctor. Chemistry Paper 2 was a very bad reaction on me that I am still yet to

recover from and hence ditching medical aspirations and opting for the

Technology world. No regrets, though.

How would you describe the current

state of the tech market in Kenya?

Very innovative

and mostly driven by fintechs and mobile money operators. Mobile lending has

become very popular, with many players getting licensed by the Central Bank of

Kenya to get their piece of the pie from the eager borrowers in the country.

We all know about M-Pesa, which has been globally recognised as a leading,

innovative solution from Kenya. Tech startups are raising millions of dollars

to further launch new disruptive solutions in digital banking, Agri-tech,

insure-tech, ride-hailing companies,s, to mention but a few. Kenya’s E-commerce

space is growing rapidly, with projections that this could hit Sh500 billion by

2027. All these innovations, however, must be supported by a solid infrastructure

backbone with fiber optic connectivity at the center of the action.

What technologies or solutions are

currently driving demand among Kenyan businesses?

Digital

payments come top in my view. Many SMEs are adopting digital payments, reducing

complexity in payments for their customers. Digital lending has become very popular.

Cloud computing comes second as businesses shift from traditional on-prem

infrastructure to SaaS models to reduce their Capex and move to Opex models,

reducing their annual spend on technology that drives the businesses.

Given the

growth in adoption of data-driven solutions and the adoption of cloud computing

and digital payments mentioned above, Cybersecurity has become more critical to

protect SMEs and Enterprises from exposure to cyber-attacks. A lot still

needs to be done here, though, as security is a concept that must be applied

consistently at different layers, like network, application, database, and not

forgetting the users themselves.

How do Kenyan customers differ from

those in other markets you have worked with?

Kenyans are

ahead of their peers in adopting mobile payment platforms, with M-Pesa known as a

global leader and as the rail for digital payments. Paybills and Till numbers

are fairly new concepts to most of Kenya’s neighbour’s while in Kenya, these

have become the modus operandi.

There is also faster adoption of technology as

a business driver in Kenya than in its peers in the region, primarily because of

strong policies for the digital economy, significant investments made in

digital infrastructure, a strong middle class and a young tech-savvy population

providing a ready market for digital goods and services.

Kenyan customers have a

stronger buying power, given that Kenya has the largest GDP in the region,

roughly 1.5 times larger than Tanzania’s and more than double the

size of Uganda’s economy. This makes technology more affordable in Kenya

than in the neighbouring countries and hence the faster adoption.

How do you navigate price sensitivity

while selling premium tech products?

This is very

personal from one salesman to another. It is important for customers to know

upfront the price ranges for the solutions they intend to purchase. That way, they budget correctly. Secondly, some

solutions may have a high upfront cost but have lasting value in the long term

and should therefore not be judged based on initial cost. I basically show

customers their TCO (Total Cost of Ownership), and their ROI (Return On

Investment), clearly articulating the benefits and when the same are to be

derived.

What are the biggest challenges tech

salespeople face in Kenya today?

First is

competition. There are many players offering customers too many options for the

solutions required in the tech space in Kenya. Second is long procurement

cycles. Some of these can last as long as 24 months.

This puts the salesperson

in a tough situation as one is required to close substantial deals quarterly to

meet their set targets. Third is budget constraints and price sensitivity. Many

businesses are cautious with technology spending and may prefer to go for

cheaper local alternatives. Then demand to sign local contracts. Many local

businesses require tech players to sign local contracts guided by local laws, yet many multinationals do not sign these and always insist on customers

signing the multinational’s contracts, which are protected by international

laws.

This causes further delays in closing deals as companies negotiate to

find common ground and eventually yield to sign the multinational’s

contract. One common one is being ghosted by clients, either when making initial

cold calls or when the deal is ready to be booked and phones or emails go

silent or unanswered.

How do economic factors such as

inflation, exchange rates, or local procurement policies affect tech sales?

Allow me to

answer this by citing the example of Safaricom’s Ethiopia subsidiary. Because

Ethiopia still lacks sufficient or adequate forex reserves and also because the

Ethiopian Birr was sharply devalued, the group company in Kenya is hit by forex

losses when it translates its earnings to Kenyan Shillings since it consolidates

the Ethiopian business into the group. This impacts their overall group

revenues as a tech company.

As mentioned earlier, some local procurement

policies do not allow customers to sign contracts not guided by local laws.

This limits opportunities for multinationals like the ones I have worked for to

participate directly in some tenders where they are otherwise fully qualified

to participate in. To mitigate this, the companies sign agreements with local

partners that act as an extension to their business but that can then sign the

local contracts.

Which sectors are leading in tech

adoption and which ones are lagging?

BFSI–Banking

and Financial Services and Insurance sector is clearly ahead. ICT and

Telecommunications and Cloud systems are also at the top end with Kenya positioning

itself as a regional Tech hub with strong growth in data centres, cloud

infrastructure and broadband connectivity.

Agri-Tech has also come up strong

with farmers adopting farming applications and digitising supply chains. Many

SMEs are, however, still relying on basic tools like Excel for basic accounting.

We also have not seen much digitisation in the manufacturing sector. This

presents a huge opportunity for market players.

What global or regional trends are

influencing local customer preferences?

AI is here

with us and has a great influence when customers are adopting digital

systems. I have already mentioned cloud computing. This helps customers to

reduce cost, innovate faster and use insights and more data-driven solutions to

predict business outcomes.

Cybersecurity is central to everything to mitigate cyber-attacks

and losses associated with them. High-speed connectivity: There is a

growing demand for 5G in Kenya to enable more data-intensive applications in

AI, IoT and edge computing. We cannot close this section without mentioning

Cryptocurrency.

Kenya has recently enacted a cryptocurrency/ Digital assets law

called the Virtual Asset Service Providers (VASP) Act, passed by Parliament in

2025. At the same time, President Donald Trump has signed the GENIUS Act into

law, a piece of legislation that is intended to pave the way for the US to lead

the global digital currency revolution.