It would not be unwarranted, for this year’s Hot Stocks edition, to look back in anger at 2025. It’s not that the markets were a particular pain point … far from it. But the overriding question is: how did most investors get it so wrong?

In short, last year investment professionals were wary of a growing bubble in US tech stocks, and fairly optimistic that the gradual overcoming of infrastructural challenges and firmer economic turf locally would prove a boon for South Africa Inc stocks.

South Africa Inc stocks fared well, in pockets, but lagged by a very large margin behind the gains notched up in gold and platinum stocks. Gold and platinum hardly got a mention in our Hot Stocks cover story of 2025.

John Biccard, a portfolio manager at Ninety One charged with value equity strategy, says: “If investors went back exactly a year ago and said that bond yields will fall 150 basis points, the rand will strengthen 12%, precious metals will go up between 60% to 120%, oil will go down and South Africa will run a trade surplus and the fiscal deficit will shrink, what do you think South Africa Inc stocks would do? Probably go up 40%.”

Biccard continues: “But all that has happened is commodity shares have soared, while South Africa Inc stocks have done OK … banks are up, retailers are down.” While there is no official South Africa Inc index, Biccard’s own model suggests those shares went up between 5%-10% on average during 2025 — which, he points out, lags a long way behind the bond market. “South Africa Inc valuations have not moved, which goes against the laws of finance. If bonds returned 30%, South Africa Inc stocks should have gone up by 50%.”

There is an argument that GDP growth has disappointed, which would put a dampener on South Africa Inc sentiment. But Biccard insists that history will show that if there is a marked improvement in terms of trade, growth has always followed six to 12 months later. “It’s no good waiting for GDP growth to pick up, you have to buy now.”

Another issue hampering South Africa Inc stocks in 2025 was fund manager FOMO. Biccard says gold and platinum counters now make up 25% of the JSE.

“Most fund managers were underweight gold and platinum … and they hate to be underweight. They had to buy gold and platinum stocks to close up, and to make space for these stocks, they needed to sell something — mostly South Africa Inc stocks.”

Anchor Capital noted, in hindsight, that investors were way too overoptimistic about the South Africa Inc renaissance. “Online gaming has been widely blamed for sucking the oxygen out of the consumer recovery theme. At the same time, there was little evidence of any GNU-inspired reforms feeding through into improved business confidence in other parts of the market dependent on the domestic economy.”

In its year-end note Anchor reckoned that 2025’s performance had been almost entirely driven by gold and platinum group metals (PGM) miners (“which have enjoyed an eye-watering rally on the back of rising metal prices”) and telecommunications companies (“thanks for the most part to their operations in the rest of Africa, which are finally managing to translate strong demand into reported earnings growth”).

The group added that Naspers/Prosus also rode the renewed investor interest in Chinese technology stocks via the key investment in Tencent.

Bastian Teichgreeber, chief investment officer at Prescient Investment Management, says valuations in several of the winning sectors are now above long-term averages, particularly in basic materials and technology.

Nick Kunze, macro portfolio manager at Sanlam Private Wealth, says that if investors learnt anything from 2025, it is that the global economy, along with the companies operating in it and the markets that reflect them, has proved far more resilient than many expected.

“Tariffs? Not an issue. Geopolitical alliances? We’ll worry about that later. Yet despite an impressive list of challenges, and despite markets briefly falling off a cliff after Donald Trump’s tariff announcement in April, equities have largely pushed higher, bonds have remained relatively well behaved and private assets have conspicuously failed to blow up.”

So, on to the scoreboards. As usual, taking our cue from the US markets: over the year the Nasdaq moved up another 21%, with the S&P 500 lifting almost 17%. Interestingly, the MSCI all country world ex-USA surged 29.2%.

But these did not match the JSE’s stellar 37% gain in its all share index (Alsi) over 2025, buoyed almost exclusively by the sustained bull run in gold stocks and the sharp recovery in PGM counters.

Anchor stressed that the Alsi performance has “papered over what was, in fact, a minefield of highly divergent outcomes for South African investors”.

Still, for the astute stockpicker, Sibanye-Stillwater — which combines PGMs, gold and more “new age” commodities — returned more than 300%. It seems churlish to remind readers that Sibanye was trading as low as R14 in late February last year. By contrast, Jubilee Metals — which sold its South African chrome and PGM operations to concentrate on its copper mining endeavours — was up only a smidgen. In fact, on the complete flip side of the stockpicker narrative, Copper 360 had a tarnished year with its share price down close to 70%.

The JSE’s big dual-listed “international” stocks, which had in previous years buoyed the overall bourse’s returns, were steady rather than spectacular in 2025. Naspers/Prosus were the best of the bunch with a gain of more than 50%.

Rupert-controlled investment company Reinet increased about 30% after selling off two of its biggest investments, while luxury brands conglomerate Richemont (also controlled by the Ruperts) and cigarette giant British American Tobacco were both up by roughly a quarter. Beer maker AB InBev — which acquired SABMiller in 2016 — showed a frothy 17% gain.

Sasol, arguably the share that most South Africans own, managed a solid mid-teens shift.

Those “passive investors” who bought the popular Satrix Resi 10 ETF at the start of 2025 would have more than doubled their money.

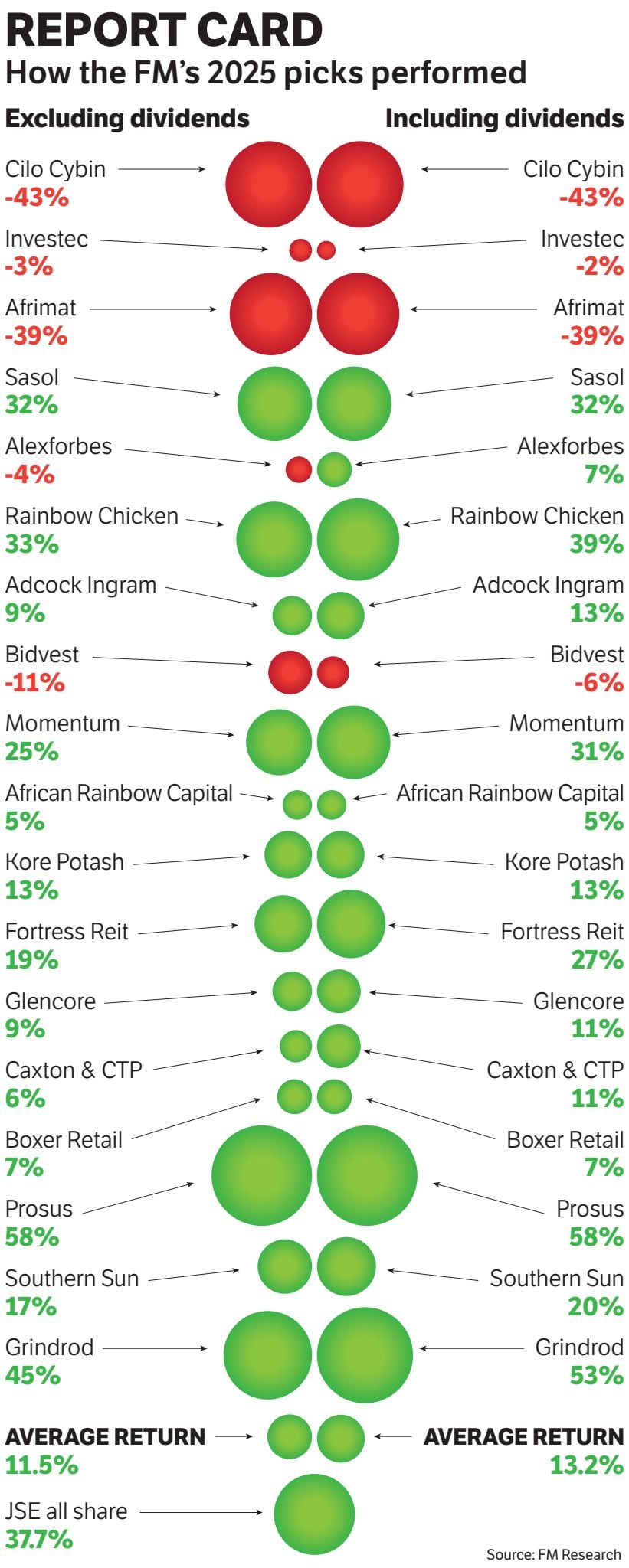

The FM’s Hot Stocks — or rather lukewarm — portfolio for 2025 lagged markedly. The 18-strong portfolio is inflexible in having equal weighting across the JSE’s main sectors — and that’s not an excuse, just a fact. The portfolio delivered an underwhelming 11.5% … 13.2% if dividends are worked back into the equation.

The FM’s portfolio was hammered by two unfortunate picks — Cilo Cybin and Afrimat — which both took a nasty beating. Our commodity pick, Glencore, had no exposure to platinum or gold, and was unluckily timed as the much-anticipated corporate action (with Rio Tinto) came after the close of the investing period.

How the FM’s 2025 picks performed (Vuyo Singiswa)

How the FM’s 2025 picks performed (Vuyo Singiswa)

Our star performers were assurer Momentum, logistics giant Grindrod and tech heavyweight Prosus. The FM managed to score from two buyouts in the form of African Rainbow Capital Investments and Adcock Ingram, though the former was a miserly offer when matched against the underlying value of the investment portfolio.

Only one of the FM’s commentators got it spot on for 2025: Afrifocus Securities senior analyst and investment veteran Des Mayers, who has been in the markets for about 60 years. Mayers punted Gold Fields, DRDGold and Pan African Resources, and threw poultry stocks Astral Foods and Rainbow Chicken into the mix. Any readers who followed this old hand’s picks would have been rewarded with a 144% annual gain.

Mayers suspects there’s more life in the gold market, even though much of the elevated bullion price is already priced in for the gold miners. He warns, though, that the intervening period could test investors’ nerves.

“There was a great bull market in gold in the 1970s. But gold slumped to $40 when [then US president Richard] Nixon closed the gold window. By 1974 the gold price was at $195, but in the next 20 months it drifted back down to $104. Gold shares in that pullback fell something like 70% … By January 20 1980 gold had soared to $850, and gold shares went through the roof.”

Mayers says circumstances today are not the same, but any pullbacks might be worrying. “I have taken some gold profits off the table.”

Outside of the mining stocks, Botswana-based retailer Choppies provided an unlikely 10-bagger in 2025. The share started the year at 77c and finished at 797c, before making a hasty retreat to under 500c in the first few weeks of 2026.

Two other nonmining gainers were also aligned to the retail sector, which in broad terms endured an unremarkable 2025. Weaver Fintech, which owns the Homechoice direct selling retail business, more than doubled its share price, and tiny furniture retailer Nictus was up by a similar margin.

Telecoms counters — specifically the big three in MTN, Vodacom and Telkom — rang up some strong gains. The listing of Cell C out of Blu Label arguably went much better than anticipated.

Private university business Stadio, small real estate counter Delta and financial services hub Finbond all registered annual gains over 90%.

Banks mostly had a decent run, with Capitec and Standard Bank (both up around a third) leading the pack. Absa and FirstRand managed gains of over 20%, while Nedbank was pretty much flat.

The JSE’s handful of asset managers, which have endured a few lean years, left the banks in their wake. Sygnia powered ahead by more than 45%, while PSG Financial Services, Ninety One and Coronation all pushed markedly higher. Momentum and the JSE Ltd were the other standouts in the financial services sector.

The food sector had its moments too. Tiger Brands and Premier (which intends acquiring RFG Holdings) were both up around 30%, with AVI lagging with a mid-single-digit gain for the year. Even small food producers like Libstar and Sea Harvest got some late-year buy-in from investors for their respective restructuring plans.

On the losing side, US-based renewable energy group Montauk was smashed down by more than 60%, while mining and aggregates group Afrimat — for so long a market darling because of management’s excellent capital allocation skills — was whacked down more than 40% after the large debt-funded acquisition of the Lafarge cement business.

Pharmaceutical giant Aspen still finished the year around 30% down, despite a last-gasp rally after the group unloaded international assets at a seemingly attractive price. Building supplies businesses Cashbuild and Italtile crumbled by around 35% each.

Looking ahead to 2026, it is a little worrying — noting the bullish trading patterns in the first fortnight of the year — that the bulk of our regular market correspondents, including the FM investment writers, are again tilting hard at South Africa Inc stocks.

It’s early days, but there have been some optimistic flickers across construction companies, building supplies firms and industrial stocks.

South Africa-focused investment counters such as Remgro and Hosken Consolidated Investments (HCI), which are diversified across numerous sectors but heavily discounted by the market, also finished 2025 with a mini-rally and can hopefully sustain this momentum into the new year.

Looking ahead, Teichgreeber believes valuations and fundamentals seem relatively more attractive in South Africa-focused sectors such as property, financials and banks, where expectations remain restrained.

“By contrast, sectors where optimism is already fully priced in leave little margin for error. In environments like this, cutting through the noise is not optional. A systematic, evidence-based approach helps distinguish between genuine opportunity and late-cycle enthusiasm — and that distinction is likely to matter more, not less, in the year ahead.”

Teichgreeber suggests a more challenging year ahead. “Equity risk is skewed to the downside, globally and locally. A key concern is the US labour market, where cracks are emerging … Historically, labour market deterioration tends to be nonlinear: it looks stable until it suddenly isn’t. Markets, however, are pricing in very little of this risk, reflected in unusually low implied equity volatility. That disconnect matters.”

Anchor Capital notes that while many of the supports for domestically focused companies remain in place — declining interest rates (albeit more slowly and tentatively than many would like), a stronger rand and a modest rebound in economic growth — current valuations across this cohort of companies suggest the 2025 experience means investors are waiting for evidence in results this time. “This presents some compelling company-specific opportunities. On the flip side, it is questionable whether the runaway winners of this year can repeat that feat in 2026.”

For the year ahead, Anchor has picked two domestically focused consumer businesses in Premier and KAL Group, as well as recently listed fintech business Optasia, platinum play Valterra and a “wild card” in Blu Label.

Looking offshore, Lyle Sankar, CEO of PSG Asset Management, believes investors will need their wits about them to survive the “everything AI” rally or bubble.

He points out that though AI exuberance has continued to drive stock markets, late October marked something of a sentiment shift as investors started questioning the circular nature of various deals and became concerned about a move away from funding AI capex from free cash flow to using debt financing instead.

Sankar adds that OpenAI has done deals totalling nearly $1.5-trillion with various suppliers of processing power, but only generated an estimated $12bn of revenue for the year and recorded a quarterly loss of $12bn.

“The AI boom has captured the public imagination, but while it seems clear that the technology has transformative potential, it is far less clear who will be the winners from this.”

Kunze also weighs in warily on AI. “If there is a reason for caution, the obvious one is the AI trade. Bumper technology revenues alongside massive spending on AI infrastructure mean valuations are already frothy. AI has also supported broader economic activity: the World Trade Organisation estimates that semiconductors, servers and telecommunications equipment accounted for nearly half of global trade expansion in the first half of the year.”

On the high conviction side, Kunze thinks copper is shaping up as the strategic trade for 2026, sitting at the intersection of electrification, AI and the energy transition. “Demand is no longer just about construction cycles or Chinese stimulus; it is being structurally boosted by the build-out of electricity grids required for the green transition and the power-hungry rise of AI data centres.”

Peter Takaendesa, chief investment officer of Mergence Investment Managers, maintains the local equity market has room to deliver double-digit total returns again in 2026, “albeit not as stellar as close to 40% in rands and almost 60% in dollars”.

Takaendesa says falling interest rates and strong export commodity prices vs relatively weak energy prices remain broadly supportive to earnings growth and the valuation multiple of the JSE.

But he cautions that there are major risks. “The key ones are an inflation shock forcing central banks to reverse interest rate cuts, major escalation in geopolitical tensions between the largest global economies and a collapse in AI infrastructure investment. These might look very remote to the South African economy and financial markets, but as the saying goes: ‘If the US catches a cold…’”

Takaendesa suggests a great outcome would be a “steady as she goes” in the US policy-macro mix accompanied by an orderly depreciation of the dollar. “Such an outcome would remain supportive to emerging markets, including South Africa.”

On a three-year view, Takaendesa believes that Naspers/Prosus remain solid assets, growing at three times China’s GDP with AI-driven efficiencies optionality in the longer term. He adds that the cash burn in the non-Tencent e-commerce assets is now at an inflection point, share buybacks remain accretive and the valuation remains attractive against its US peers.

He also believes AB InBev is a relatively cheap and defensive consumer staple that is likely to deliver a double-digit dollar earnings compound annual growth rate over the next few years, driven by volume recovery, operating leverage from cost optimisation and balance sheet deleveraging.

Takaendesa further pencils in AngloGold (a hedge on global fiat currencies debasement and geopolitical risks), Optasia (a high-growth vehicle), Absa (the year when operational improvements will play out) and Bidvest (the earnings mix is shifting towards higher-quality and more recurring international services businesses).

Mark du Toit, portfolio manager at OysterCatcher Investments, is picking FirstRand (well placed to benefit from the expected higher GDP growth) and Pepkor (which will continue to do well in a growing local economy).

Small-cap expert Anthony Clark, of SmallTalkDaily, lists AdvTech, Afrimat, Sabvest Capital, Rainbow Chicken, Premier, Copper 360, Argent, Reunert and Motus as his 2026 picks.

Biccard is backing African Rainbow Minerals, Bidvest, Woolworths and AECI, as well as private hospital groups Netcare and Life Healthcare.

Charles Boles, founder of Titanium Capital, is still firmly in the South Africa Inc camp and has taken a shine to AVI, Bidvest, the JSE Ltd, Motus, HCI, Remgro, Hudaco, Invicta and African Media Entertainment. His only non-South Africa Inc stock is AB InBev.

The last word must go to Mayers, after his stellar 2025 picks. The market veteran again punted for poultry stocks, but supplemented these with KAP Industrial, Sea Harvest and Pick n Pay, as well as long-shot bets on Gemfields and Sasol.

The FM Hot Stocks portfolio has shied away from adventurous picks, though there are a few recovery plays that will hopefully mesh during the year.

AltX

Maritz Smith (Supplied )

Maritz Smith (Supplied )

The JSE AltX of 2026 bears little resemblance to the broad incubator board of previous years. The successful implementation of the JSE’s main board general segment has fundamentally reshaped the junior market, efficiently graduating the exchange’s most robust industrial counters. With technology group 4Sight Holdings transferring to the main board in January 2025, followed swiftly by Sephaku Holdings in March, AltX has been stripped of its upper-middle-class diversified industrials.

What remains is a sharper, more volatile exchange dominated by the junior resources sector. AltX has effectively become a proxy for high-risk, high-reward commodity exploration, particularly in energy metals. Copper 360 epitomises this shift. Despite a punishing share price trajectory — down significantly over the past 12 months due to dilutive rights offers — trading volumes remain high as retail investors bet on its aggressive production target of 20,000t of copper metal for the 2026 financial year. It is a classic binary play: if production targets are met, the rerating could be explosive; if not, the cash burn becomes critical.

The survivors in the technology, media and telecoms space offer a counternarrative of stability. ISA Holdings, trading at 230c, has quietly become the board’s income champion. With a dividend yield pushing past 11% and a p:e of about 13, it offers a defensive haven amid resource volatility. Conversely, the board has shed its dead weight. The delisting of Workforce Holdings in February 2025 and the imminent removal of Renergen following its acquisition by ASP Isotopes have cleaned up the register, leaving a smaller but more active investable universe.

For 2026, the sector’s performance will be tied strictly to global commodity spot prices and the operational execution of three or four key mining executives. — Antoinette Steyn

Alphamin Resources

Share price: R14.60

Market capitalisation: R18.93bn

P:e: 10.82

Dividend yield: 9.65%

Year-end (12/2025)

Operating profit: $121m (interim)

EPS: 80c

Listed: 2017

CEO: Maritz Smith

Dividend paid: Alphamin share price (R) daily (Vuyo Singiswa )

Dividend paid: Alphamin share price (R) daily (Vuyo Singiswa )

Risks and opportunities

The primary opportunity lies in the global technology supercycle. Tin is the “glue” of the electronics world, essential for soldering in everything from semiconductors to solar panels. Alphamin accounts for a significant chunk of global supply, and with its Mpama South expansion now fully ramped up, volumes are set to peak just as a forecast supply deficit widens. The company also pays a consistent dividend, a rarity for junior miners, offering a yield that beats most cash accounts.

The risks, however, are geographic and logistical. Operating in North Kivu (in the Democratic Republic of Congo) carries perpetual geopolitical risk, and any disruption to export routes can bottleneck revenue instantly. Furthermore, as a pure-play tin producer, Alphamin offers zero commodity diversification; if the tin price collapses, the share price will follow. However, for investors seeking exposure to the green metals theme with a company that prints cash rather than promises, Alphamin is the standout pick. — Antoinette Steyn

Banks

Mary Vilikazi (supplied)

Mary Vilikazi (supplied)

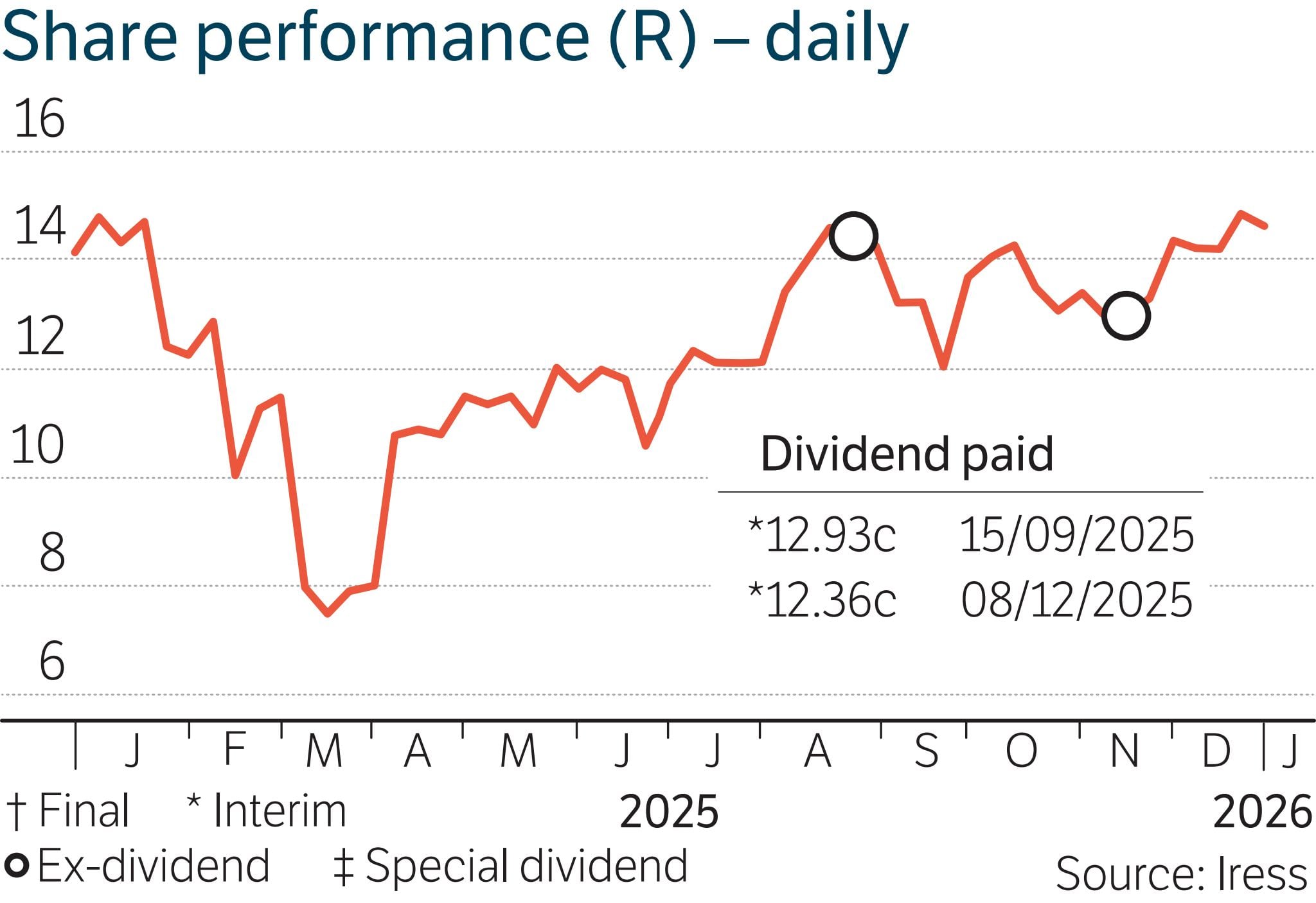

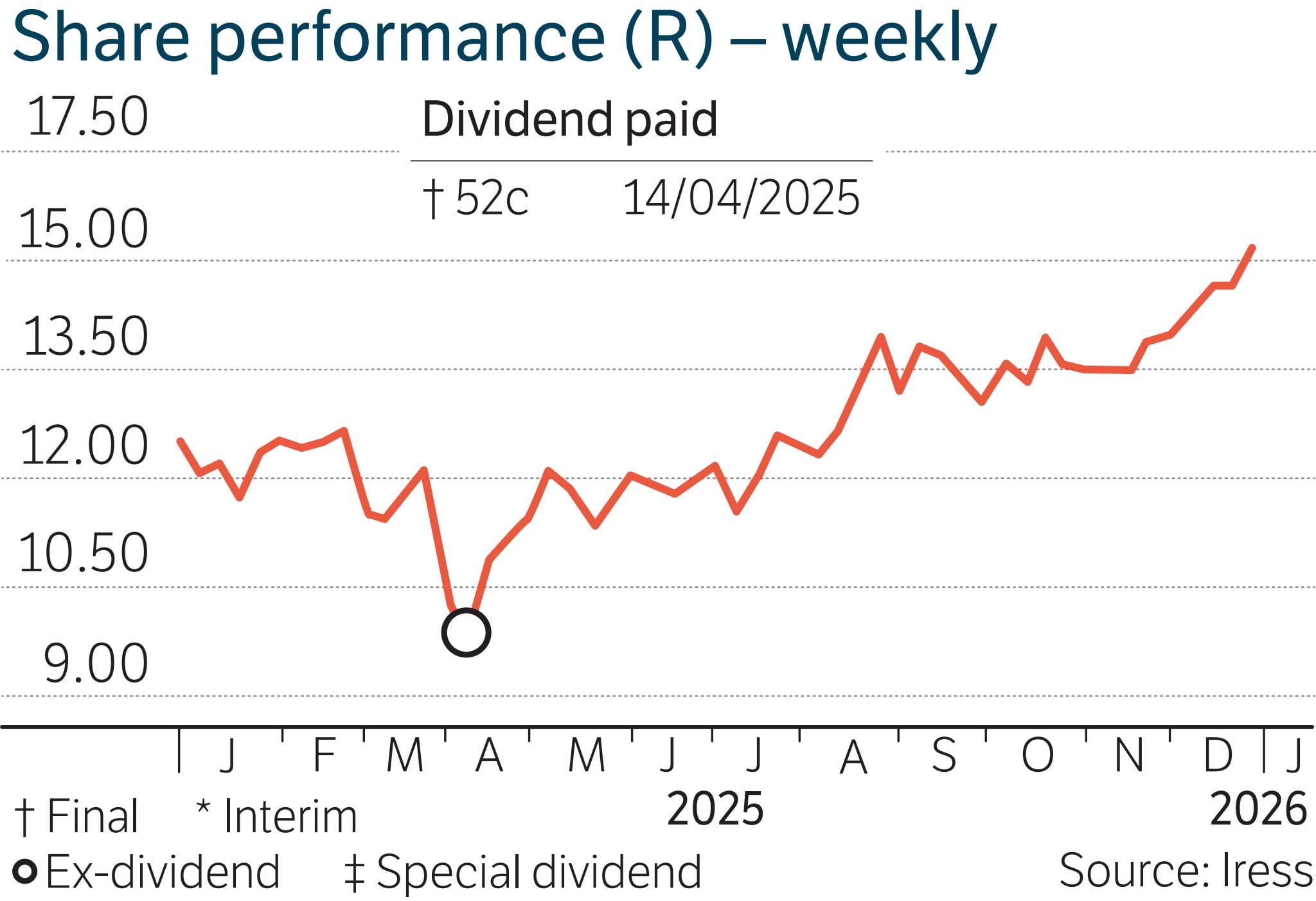

It was a satisfactory year for the banking sector, with an 11.2% increase in overall earnings in 2025. For international investors, South African banks with African exposure are particularly popular, which helps to explain the solid 30.5% increase in Standard Bank’s share price and 26.5% in Absa’s. In Absa’s case the appointment of Kenny Fihla as CEO was a turning point that should mark the end of the revolving door of CEOs.

The worst performers were Nedbank (down 6.8%) and Investec (down 2.5%). Nedbank is now just a pure South Africa Inc play, as at least 95% of earnings will come from this country after the exit from its minority holding in the West African bank Ecobank. Nedbank has the overheads of a universal bank, including a national branch network, with barely half the client base of Standard Bank, Absa or FirstRand.

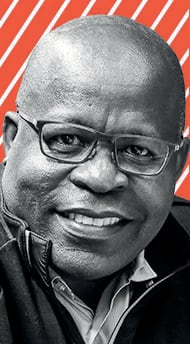

First Rand share performance (R) daily (supplied)

First Rand share performance (R) daily (supplied)

Investec was the FM’s Hot Stocks pick for 2025, the main thesis being that it has virtually no overlap with Capitec, which is eating the lunch of the other major banks. Capitec continues to defy gravity and baffle fund managers, with a 32.5% increase in the share price last year. Not that Investec did anything noticeably wrong. There was a seamless transfer of responsibilities from old-timers Richard Wainwright and Ciaran Whelan. The market is waiting to see the impact of Investec’s new mid-market initiative, which will compete in the commercial and business banking space, as well as the bedding down of the merger of Investec Wealth & Investment with Rathbones in the UK. Investec has negligible bad debts, so the overall decline in bad debts in the sector had a limited impact on its earnings. — Stephen Cranston

Building & construction

Matias Cardarelli (supplied )

Matias Cardarelli (supplied )

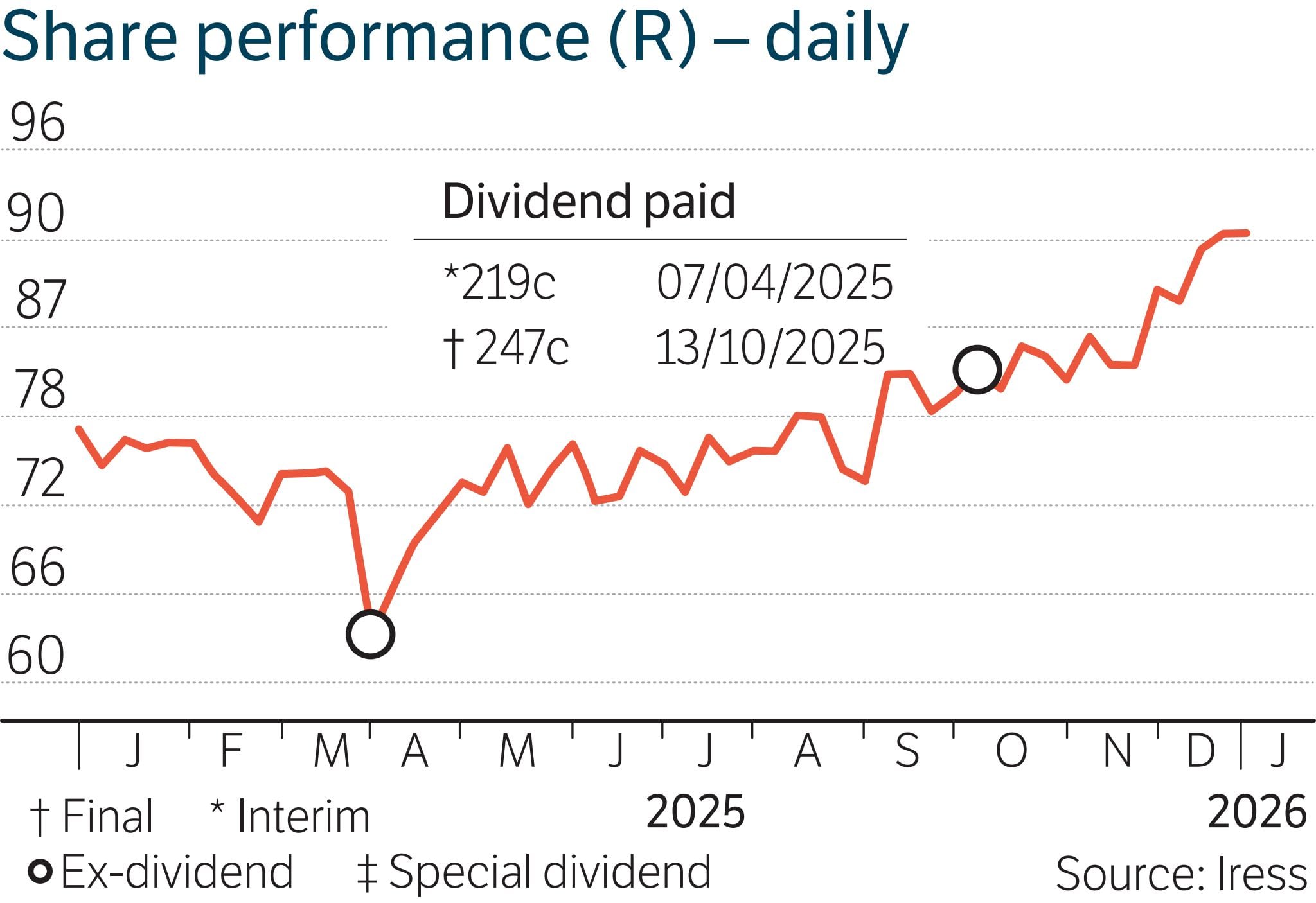

Construction and building materials counters on the JSE stayed resolutely cyclical and uneven in 2025, but this was the year discipline, rather than demand, defined performance. The shift was less about a rebound in orders than about tougher management choices: protecting margins, repairing balance sheets and lifting the quality of earnings.

On the construction side, Raubex and WBHO set the tone. Both made it clear that an order book without profitability is meaningless. The watchwords were selective tendering, disciplined pricing and execution certainty — even if that meant walking away from volume. Roads, renewables and public sector infrastructure dominated, but only where risk-adjusted returns justified the capital exposure.

In building materials, PPC reignited the debate on overcapacity and cost competitiveness. Elsewhere, Afrimat proved the virtue of diversification, integrating Lafarge South Africa while maintaining an 18%-20% margin and a return on capital in the high teens.

Sephaku Holdings, meanwhile, showed the defensive side of the sector, focusing relentlessly on pricing discipline, logistics efficiency and debt reduction. The macro backdrop finally turned constructive. Cement demand stabilised at about 13.8Mt, with forecasts of 2.5% annual growth to 2034. A R322bn public infrastructure pipeline, a softer prime rate of 10.25% and a rebound in provincial tender activity created the first genuine visibility in years.

PPC share performance (c) daily (supplied )

PPC share performance (c) daily (supplied )

The companies that prospered did so by focusing on what they could control: asset quality, working capital discipline and capital allocation. — Jeandré Pike

Energy

Ben Magara (supplied )

Ben Magara (supplied )

The JSE-listed energy sector in 2026 is defined by a strategic decoupling from state infrastructure reliance. While the national utility stabilises, listed companies are aggressively diversifying revenue streams — moving away from pure South African coal exposure towards renewable energy, future-facing metals and offshore assets.

Sasol remains the heavyweight of the sector, though it faces a pivotal transformation. The company’s share price has been under pressure, trading around R108, as it navigates the impending gas cliff — the depletion of its Mozambique gas fields. However, 2025 brought a critical stabilisation measure: the announcement of the methane-rich gas bridging solution. Strategically, CEO Simon Baloyi has signalled a potential unlocking of value by spinning off the international chemicals business by 2028, a move that would separate the volatile global chemical earnings from the core South African energy utility business.

Exxaro Resources share performance (R) daily (supplied )

Exxaro Resources share performance (R) daily (supplied )

Exxaro Resources has emerged as the preferred defensive play. Thungela Resources offers a different value proposition. It remains a pure-play coal exporter but has successfully hedged against local logistic risks. By acquiring the Ensham mine in Australia, Thungela has diversified its production base, ensuring that it is not solely dependent on Transnet Freight Rail (TFR). While TFR’s performance has improved to an annualised run rate of 56.6Mt, Thungela’s geographic diversification provides a critical safety net for investors. — Antoinette Steyn

Financial services

Magda Wierzycka (supplied)

Magda Wierzycka (supplied)

Financial services and asset management counters on the JSE continued to trade at material discounts to sustainable earnings power in 2025. With domestic savings structurally weak and fee tolerance thinning, the sector pivoted away from asset gathering towards defending unit economics, securing distribution and simplifying operating models.

Among pure asset managers, Coronation Fund Managers remained the sector’s reference point for disciplined capital allocation. While net flows were subdued, Coronation continued to convert scale into cash, sustaining operating margins in the mid-40% range and distributing the bulk of earnings. More importantly, the business advanced its transition from a South African yield proxy into a global emerging-markets boutique. Offshore mandates now contribute roughly one-third of group revenue.

Ninety One addressed the same structural challenge through architecture rather than cost. By securing preferred access to Sanlam’s distribution platform, Ninety One conceded some independence and equity upside in exchange for flow certainty. The trade-off was deliberate.

At the opposite end of the cost spectrum, Sygnia continued to demonstrate that fee compression is not fatal if the cost base is structurally advantaged. With ebit margins approaching 45%, return on equity above 40%, and a net-cash balance sheet, Sygnia’s economics compare favourably with local peers and global passive providers.

Distribution-led models again proved the most defensive. PSG Financial Services leveraged its entrenched adviser network to generate recurring earnings growth despite volatile markets. By monetising advice and platform access rather than relying solely on fund performance, PSG insulated itself from the active vs passive debate and continued to compound value through disciplined capital allocation, including selective share buybacks.

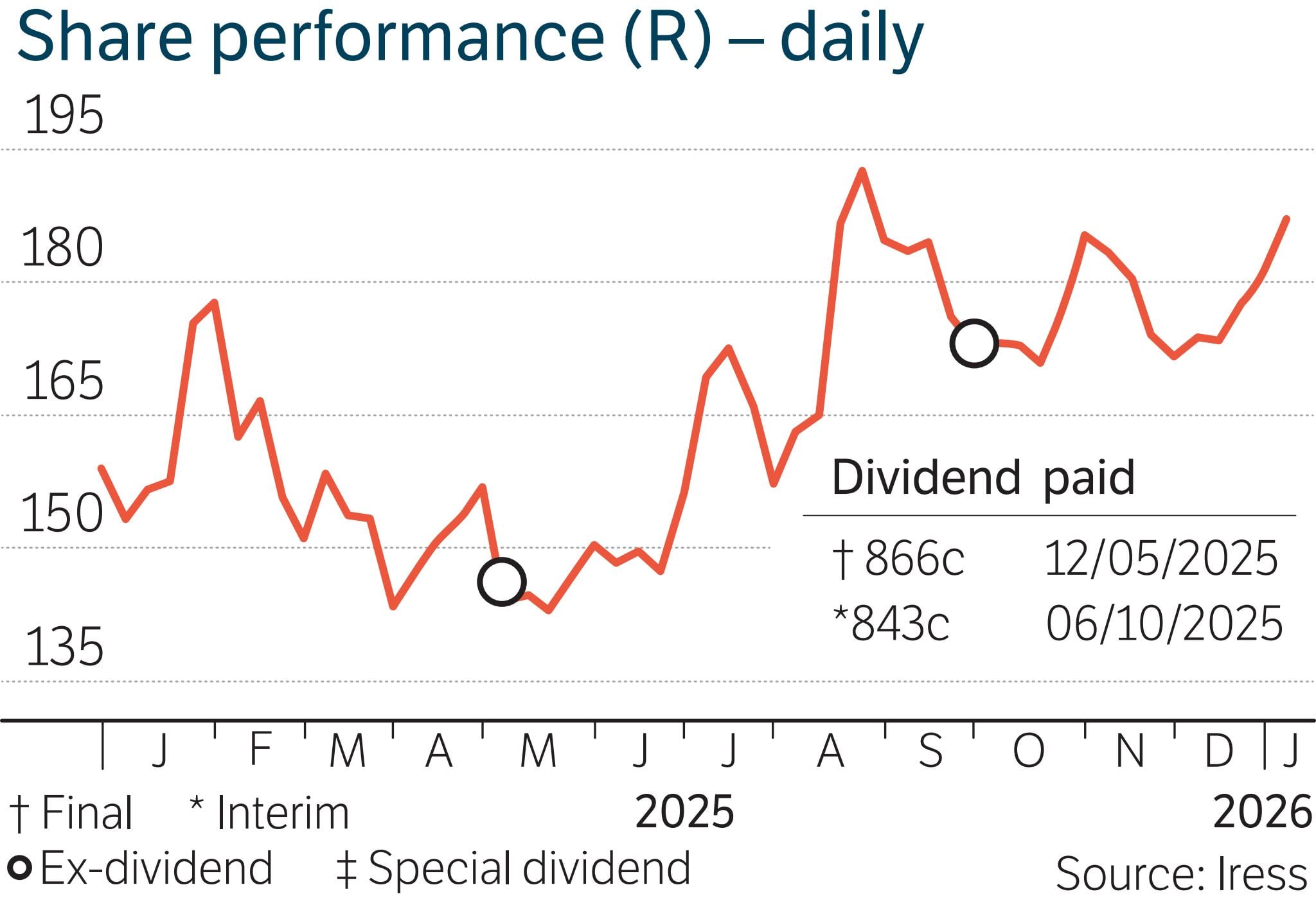

Sygnia share performance (R) daily (supplied)

Sygnia share performance (R) daily (supplied)

Across the board, 2025 rewarded structure over optimism. The firms that prospered focused on what they could control — costs, capital deployment and access to clients — rather than chasing marginal flows. — Jeandré Pike

Food & beverages

Tjaart Kruger (supplied. )

Tjaart Kruger (supplied. )

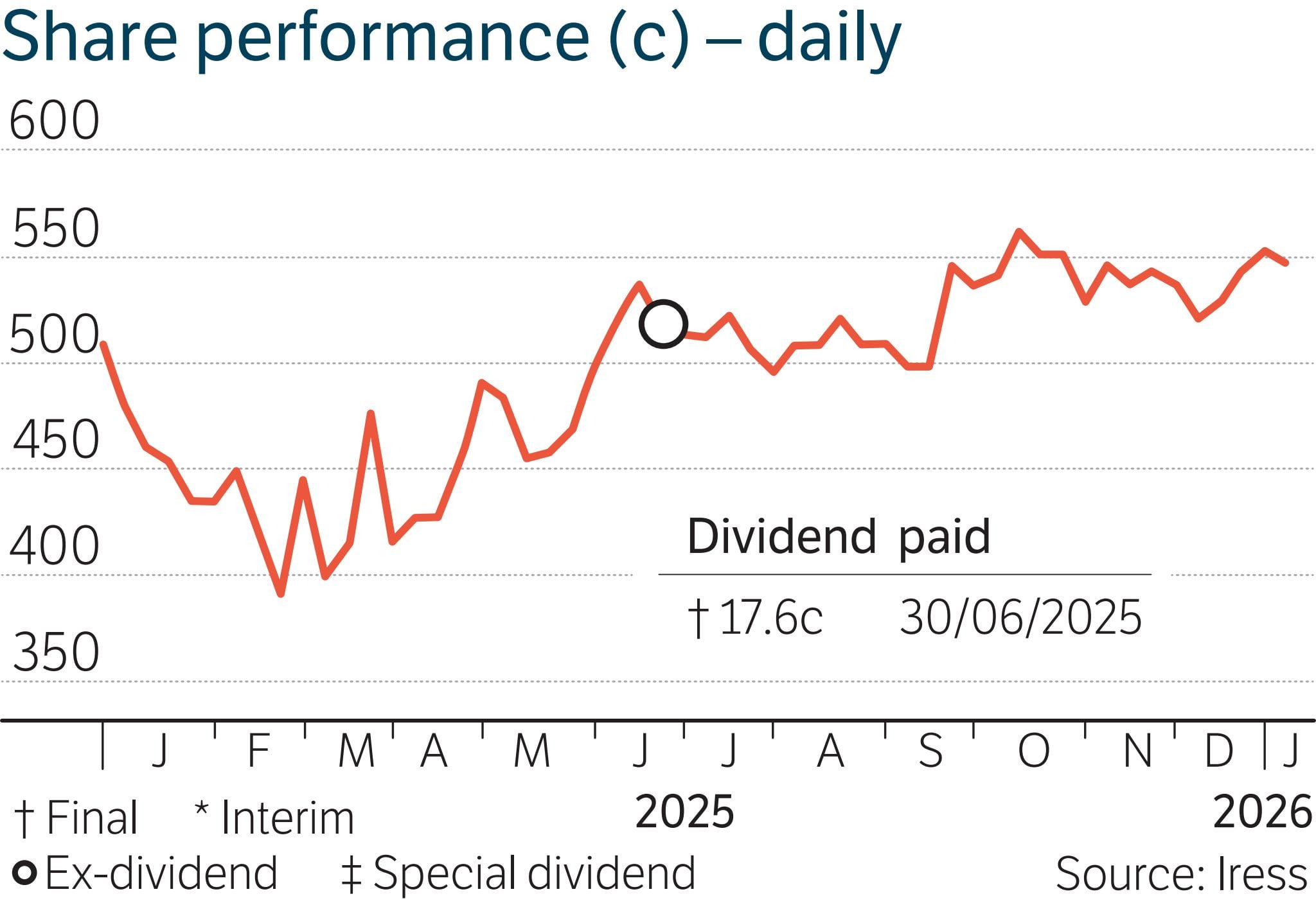

The food and beverage sector delivered a robust performance in 2025, supported by resilient consumer spending and a benign input-cost environment that allowed margins to recover across much of the value chain.

The standout performer was chicken producer Astral, where a rebound in selling prices coincided with a sharp decline in maize feed costs, while reduced load-shedding lowered production disruptions and energy-related costs. These factors drove a strong profit recovery in what remains an inherently cyclical business. Diversified food producers such as Premier and Tiger Brands also benefited from falling prices for key staples, including wheat and rice, which flowed through into improved sales volumes and gross margins.

A feature of the year was the emergence of corporate activity. Premier launched an all-share offer for RFG Holdings, seeking to diversify away from its bread-heavy earnings base by expanding its exposure to higher-margin grocery categories. Libstar, meanwhile, continued to trade under a cautionary announcement after receiving nonbinding, indicative expressions of interest for a potential sale of the entire company.

Tiger Brands share performance (R) daily (supplied )

Tiger Brands share performance (R) daily (supplied )

Looking ahead, currency dynamics remain an important swing factor. With many food input costs referenced to international benchmarks, a stronger rand should continue to exert downward pressure not only on direct raw material costs but also on distribution and logistics expenses, which are closely linked to hard currency energy prices. Together with improved electricity availability and a more disciplined competitive landscape, these factors suggest a structurally more favourable backdrop for sector earnings, even as volume growth remains constrained by a still-pressured consumer. — Raymond Steyn

Hospitals & health care

Stephen Saad (supplied)

Stephen Saad (supplied)

You would be forgiven for thinking that health care is a “safe” and “defensive” place to invest. If investors stuck to simple hospital businesses, that may be true (though margin squeeze is a risk). If investors ventured into pharmaceutical groups and wisely avoided the high-risk research & development-focused plays, then even a manufacturing and distribution operation like Aspen can display serious volatility. The past year has been proof of this, with a 52-week high of R185.95 and a 52-week low of R90.70 for Aspen’s stock.

At R113 at the time of writing, the stock needs to gain about 65% to get back to the high. Therein lies the opportunity; that’s why this is a speculative choice for many in 2026 — perhaps also fuelled by CEO Stephen Saad buying more than R180m in shares in May 2025 after the price drop, along with Aspen giving investors a Christmas present in December in the form of the announced disposal of Aspen Asia Pacific for R26.5bn.

Aspen share performance (R) weekly (supplied)

Aspen share performance (R) weekly (supplied)

The JSE’s two remaining private hospital groups, Netcare and Life Healthcare, looked relatively dull, though the latter gave shareholders a special dividend dose. Remgro still gave investors sight of the gruelling profit prescription at unlisted Mediclinic International, which has now been separated into South African operations (retained by Remgro) and the Swiss operations (to be retained by partner MSC). — The Finance Ghost & Marc Hasenfuss

Industrials

Frans Olivier (supplied)

Frans Olivier (supplied)

Elevated electricity tariffs remain a structural headwind for the sector, particularly for energy-intensive businesses such as metal smelters and heavy manufacturers. Several plant closures are increasingly likely unless sufficiently discounted power agreements can be negotiated with Eskom. This raises the risk of a negative feedback loop: as capacity exits the system, the domestic industrial base contracts, leaving remaining players with fewer customers, weaker demand and lower asset utilisation, which in turn further compresses margins.

In addition, the automotive and component manufacturing sector is under growing pressure as cheaper imported vehicles from India and China gain market share, eroding volumes and pricing power across the value chain.

On a more positive note, the sharp reduction in load-shedding has materially improved operating conditions for many industrial companies. A more reliable electricity supply has enabled higher output, improved asset utilisation and lower unit costs.

External risks remain elevated heading into 2026. US President Donald Trump’s renewed tariff regime introduces uncertainty for global trade flows and could indirectly affect South African industrial exporters through weaker global demand or disrupted supply chains. At the same time, excess global manufacturing capacity, especially from China, raises the risk of product dumping into emerging markets such as South Africa, intensifying competitive pressure on local producers.

KAP share performance (R) weekly (supplied. )

KAP share performance (R) weekly (supplied. )

Against this backdrop, balance sheet strength, cost discipline and the ability to access export markets or niche segments are likely to be decisive differentiators within the industrial sector over the coming year. — Raymond Steyn

Insurance

Jurie Strydom (supplied)

Jurie Strydom (supplied)

The life insurance sector remains more important in South Africa than in many other countries in view of its key role in the savings market. The life offices’ market share of lump sum savings has been in secular decline for 30 years with the growth of independent asset managers such as Ninety One, Allan Gray and Coronation.

But in the mass market, life insurers have the distribution infrastructure and the brand to dominate. Life insurance is a well-run and well-capitalised industry, with solvency levels of 1.99 — almost double the prudential requirement.

Market leader Sanlam had a pedestrian year with a 13.4% increase in share price, below the overall market. It isn’t yet enjoying the “Africa premium” that the market has awarded Absa and Standard Bank. Sanlam still did substantially better than Old Mutual, which was up just 1.5%.

Momentum was the best performer in the sector, up 26.4% as the market warmed to the transition from Hillie Meyer, who brought the business back from the brink, to current CEO Jeanette Marais. Discovery was the “Marmite” of the sector — either loved or hated — but the share price pushed up 17.4%. National Health Insurance, which looks like an ever more remote prospect, is now less of a concern for Discovery’s investors.

Nonlife used to be a one-horse show with just Santam still standing. Santam remains a reputable universal insurer, particularly in corporate and commercial insurance, but the real phenomenon in the sector is Outsurance, which had an extraordinary 68% increase in its share price. It now has a market cap of R110bn, ahead of the more diversified Old Mutual and Momentum. — Stephen Cranston

Old Mutual

Share price: R15.37

Market capitalisation: R72.3bn

P:e: 9.1

Dividend yield: 5.9%

Year-end (12/2025)

Operating profit: R8.7bn

EPS: 176c

Listed: 1999

CEO: Jurie Strydom

Old Mutual share performance (R) weekly (supplied )

Old Mutual share performance (R) weekly (supplied )

Risks and opportunities

Execution as the group rolls out OM Bank into an already saturated banking market is the primary risk in 2026. There are several new banking ventures testing the market, including TymeBank and Bank Zero, so there is pressure to show Old Mutual can bring something different. In the long term, Old Mutual faces the risk of an increased decline in market share, particularly in its recurring premium policies cash cow. The group’s poor decisions in its disastrous overseas expansion damaged the brand significantly. The opportunity is that Old Mutual has hit rock bottom and investor expectations are low. At least new CEO Jurie Strydom got to work out the challenges of the job when he was a nonexecutive director. Before that he was the de facto deputy at Old Mutual’s longtime rival, Sanlam. Some Old Mutual units, such as Old Mutual Insure, already look in good shape, which hopefully bodes well for 2026. — Stephen Cranston

Investment companies

Johnny Copelyn (supplied. )

Johnny Copelyn (supplied. )

Investment companies, for the most part, continued to trade at fairly deep discounts to intrinsic NAV in 2025. The difference last year was that there was more action in terms of attempts to unlock value and narrow discounts.

Reinet, the biggest investment counter on the JSE, led the way, exiting its second-biggest investment in British American Tobacco and securing a deal to sell its dominant stake in UK-based financial services specialist Pension Insurance Corp. Presumably by mid-2026 Reinet will have the vast bulk of its NAV in hard currency — and a good deal of optionality. Reinet’s corporate cousin in the Rupert family, Remgro, also clinched some important transactions in health care and telecoms.

EPE Capital scored from the listing of its biggest investment, the fast-growing fintech business Optasia, and now has an offer pending on the rest of its portfolio (aside from the remaining stake in Optasia). Hosken Consolidated Investments (HCI) stayed on its slow-burn course but took advantage of the gaping discount to buy back shares. It also offloaded key properties at premium prices. Brimstone was working hard on culling its debt and recently sold down its stake in Oceana to bring in a chunk of fresh capital.

The FM’s 2025 Hot Stocks pick, African Rainbow Capital, pitched a lowball buyout offer to shareholders and waltzed off the JSE with some promising investments (including TymeBank and Rain). — Marc Hasenfuss

Hosken Consolidated Investments

Share price: R147.97

Market capitalisation: R12.8bn

P:e: N/A

Dividend yield: 1.2%

Year-end (03/2025)

Operating profit: R6.7bn

EPS: R14.99

Listed: 1992

CEO: Johnny Copelyn

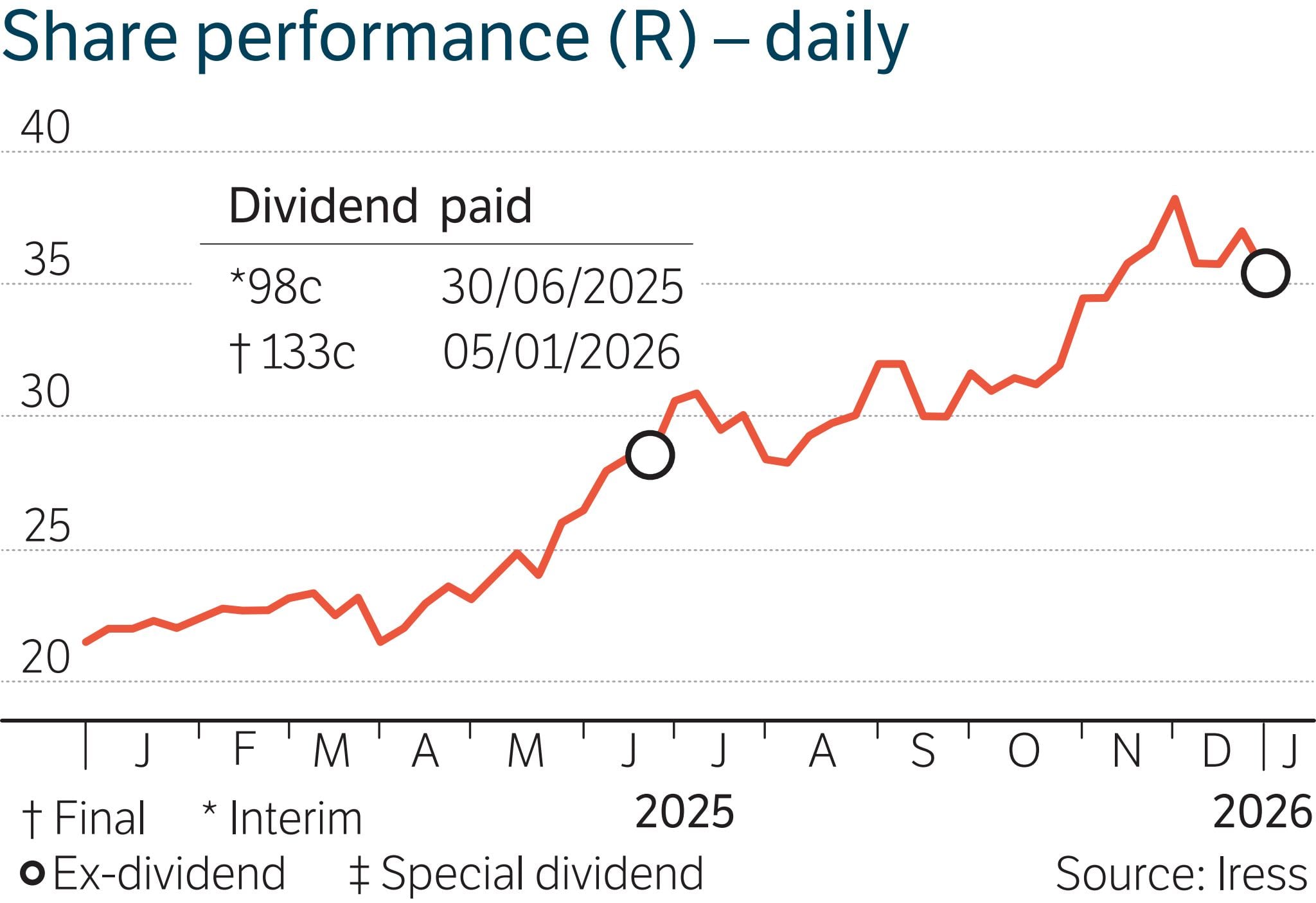

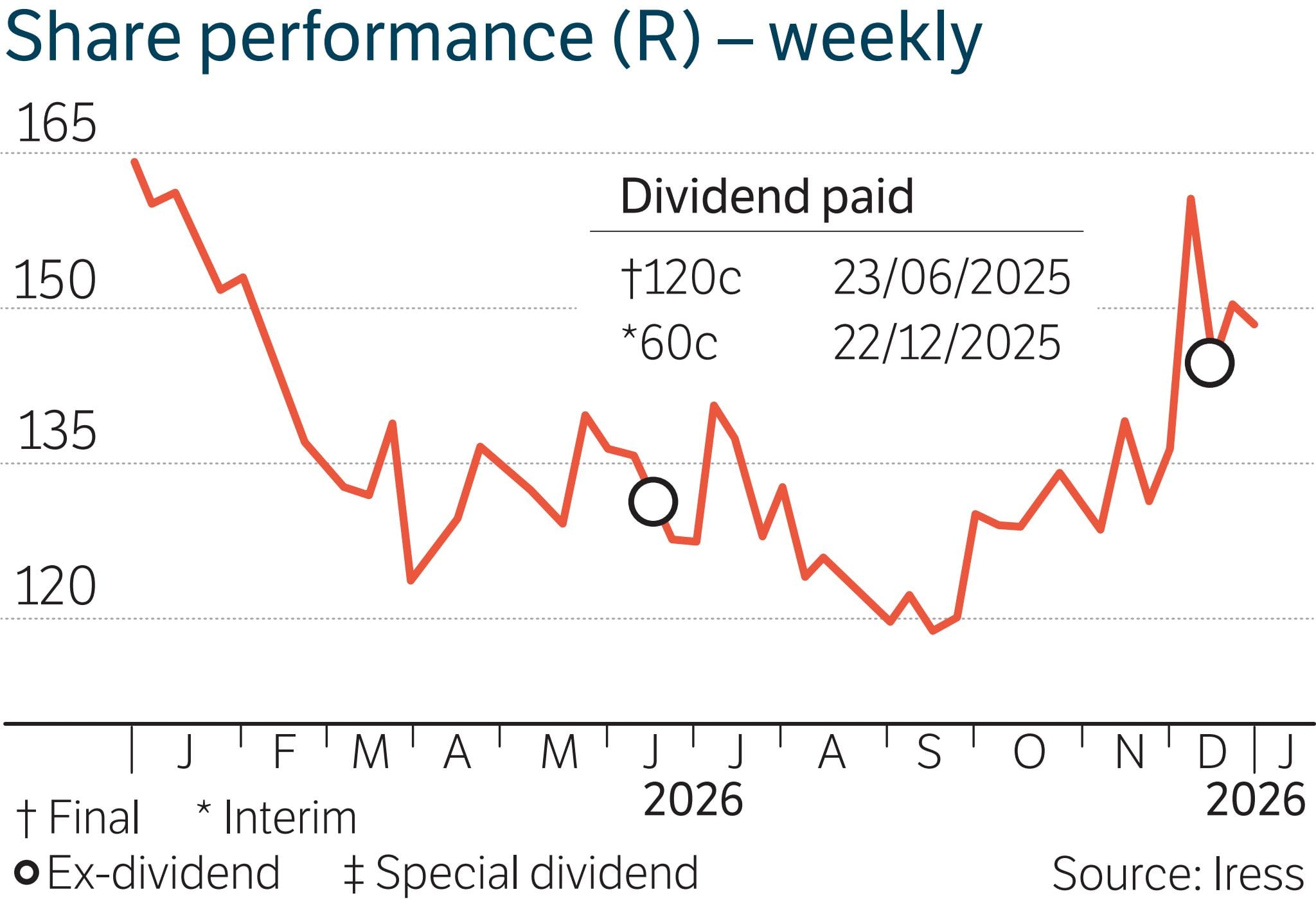

Hosken Consolidated Investments (HCI) share performance (R) weekly (supplied. )

Hosken Consolidated Investments (HCI) share performance (R) weekly (supplied. )

Risks and opportunities

Hosken Consolidated Investments (HCI) trades at an enormous discount (the FM thinks) to its conservatively stated R303 a share net asset carrying value. The obvious value unlock would be to unbundle the listed interests (Tsogo Sun, Southern Sun, Frontier Transport, eMedia and Deneb) to shareholders. With gearing edging down to more manageable levels, the unbundling option looks more likely, especially considering that activist shareholders are now persistently pestering HCI. History will show that CEO Johnny Copelyn plays the long game, and many shareholders will still back the corporate chessmaster’s value creation efforts. There is, of course, an exciting X factor in HCI in the form of its expansive oil and gas prospecting interests, as well as the significant shareholding in a promising platinum junior. But these “growth” assets might require substantial capital to develop — especially the local gas exploration interests, which have been stalled by environmental activists. — Marc Hasenfuss

Junior mining

Anthony Lennox (supplied)

Anthony Lennox (supplied)

While gold, platinum group metals and copper enjoyed one of their strongest years in decades in 2025, the majority of share price gains accrued to large-cap producers. JSE-listed junior miners, many of which remain pre-revenue and therefore do not immediately benefit from higher spot prices, have yet to see a comparable rerating despite the improved backdrop.

Bulk commodities such as iron ore and coal delivered relatively muted price performances, and with supply continuing to expand while demand remains subdued, there is little to suggest a material improvement in the pricing environment in 2026.

Events during the year again highlighted the elevated risk profile facing Africa-focused juniors. This includes the power woes of Jubilee Metals in Zambia, the military insurgency in the Democratic Republic of Congo that shut down operations at Alphamin’s tin mine, and the security issues affecting Gemfields’ ruby mine in Mozambique.

In this context, South African projects — operating in a more mature regulatory and infrastructure environment with fewer security concerns — are more attractive than those in frontier jurisdictions.

Looking ahead to 2026, access to capital remains the key swing factor. Risk appetite for smaller, early-stage projects remains constrained, placing a premium on balance sheet strength, funding certainty, near-term cash flow and credible execution pathways.

Among the strong-performing commodities, copper stands out as being underpinned by clearer structural supply-demand fundamentals, making it particularly compelling for juniors as markets increasingly distinguish between cyclical price strength and genuinely tight long-term markets. — Raymond Steyn

Orion Minerals

Share price: 24c

Market capitalisation: R1.9bn

P:e: N/A

Dividend yield: N/A

Year-end (06/2025)

Operating profit: N/A

EPS: N/A

Listed: 2017

CEO: Anthony Lennox

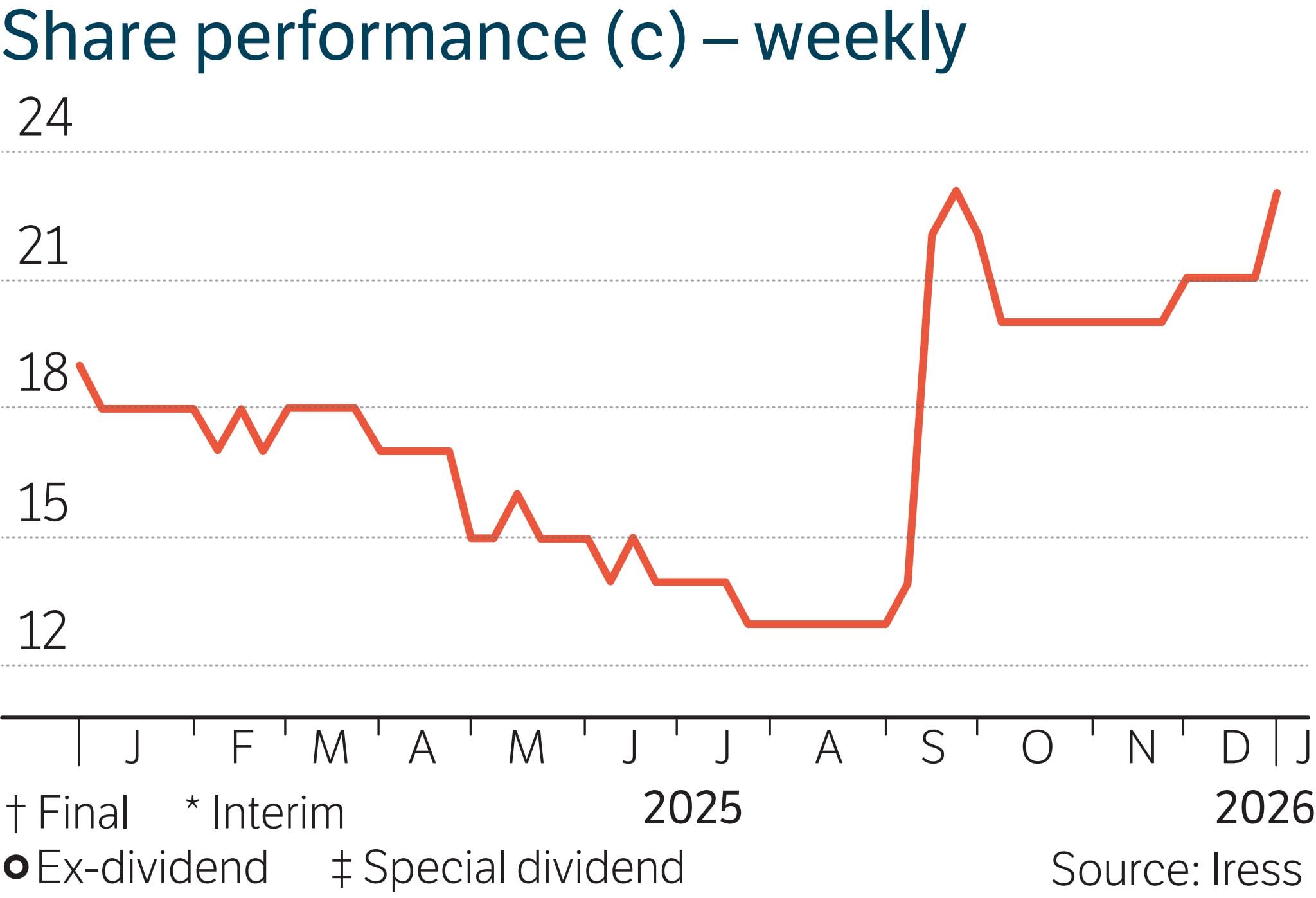

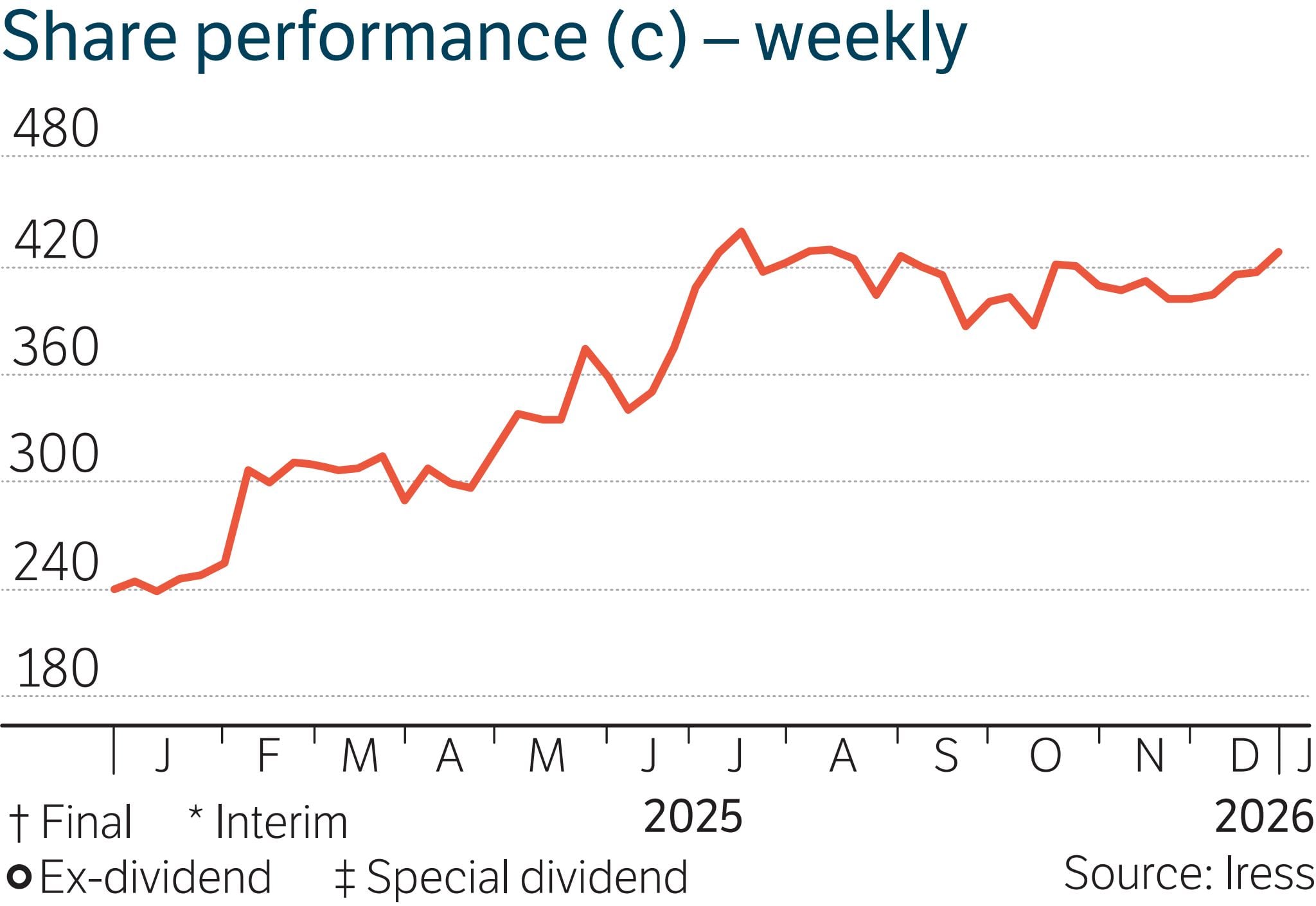

Orion Minerals share performance (c) weekly (supplied. )

Orion Minerals share performance (c) weekly (supplied. )

Risks and opportunities

Orion Minerals — arguably the poster child for the JSE’s junior mining sector — is transitioning from planning to development at its flagship Prieska Copper Zinc Mine in the Northern Cape. The mine was operated by mining house Anglo American for two decades before closing in 1991 due to weak copper prices. The key catalyst for 2026 is project financing. Securing a $200m-$250m financing and offtake package with Glencore would help fund construction and position the project to deliver concentrate from the upper levels in about 13 months, with deep-level mining commencing 15 months later. Prieska is expected to produce 22,000t of copper and 65,000t of zinc per year at steady state. Key risks relate to construction execution and cost overruns, though these are partially mitigated by having historical infrastructure in place. — Raymond Steyn

Media & entertainment

Terry Moolman (supplied )

Terry Moolman (supplied )

Executives of JSE-listed media companies made a common promise to the market in 2025: to aggressively cut operating costs. This promise has proved difficult to deliver on. Caxton & CTP, eMedia and African Media Entertainment (AME) faced one of their toughest operating environments in years.

Their business models in print, TV and radio remained exposed to South Africa’s fragile advertising market, subdued consumer spending and the costly shift to digital platforms. Investors have so far shown sympathy for these challenges. Goodwill towards the sector appears intact, given that both Caxton’s and AME’s share prices rose more than 7% in 2025.

In contrast, it was a period of bloodletting for eMedia, whose shares fell by 39%. Unlike Caxton and AME, eMedia’s net profit has fallen for two consecutive years since 2023. Its dividend payouts initially remained steady but dipped by 6.25% in 2025. Investors have also been worried about eMedia’s high operating costs — not driven solely by attempts to survive broader market challenges. A significant portion stems from legal fees incurred while fighting the government and MultiChoice.

The sector’s outlook remains discouraging, with Caxton MD Tim Holden forecasting no substantial economic or sector improvement in 2026.

MultiChoice may navigate sectoral challenges with relative ease, however. Its multibillion-rand acquisition by French giant Canal+ has been finalised, providing the company with a white knight. — Ray Mahlaka & Marc Hasenfuss

Caxton & CTP

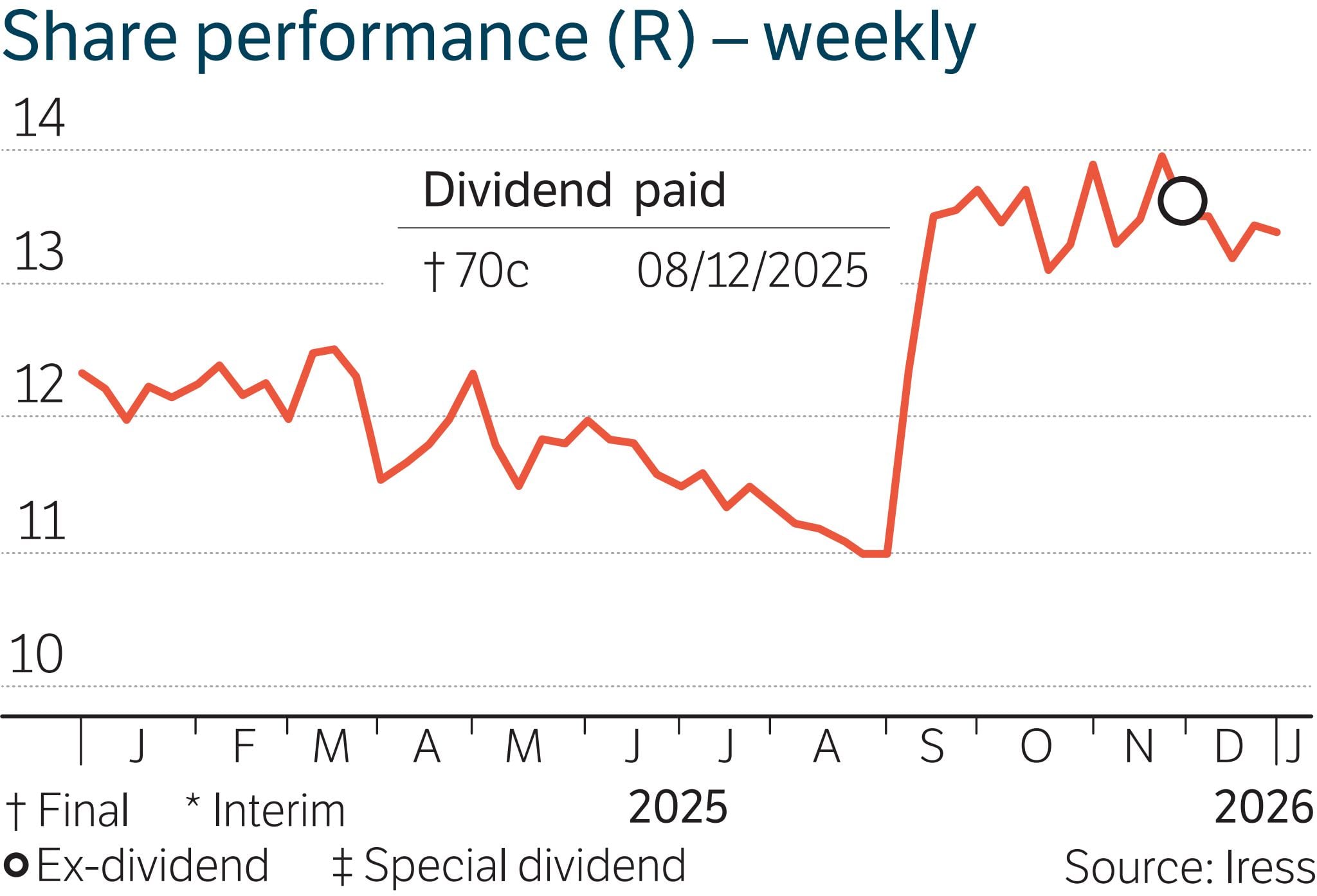

Share price: R13.79

Market capitalisation: R4.7bn

P:e: 7.3

Dividend yield: 5.3%

Year-end (09/2025)

Operating profit: R568m

EPS: 168c

Listed: 1947

CEO: Terry Moolman

Caxton & CTP share performance (R) weekly (supplied )

Caxton & CTP share performance (R) weekly (supplied )

Risks and opportunities

Printing, publishing and packaging are hardly perky business niches in South Africa, but Caxton earns a fair enough keep — close to R600m in profits — from its lean and mean operations. Factoring in Caxton’s cash heap and its nearly 35% holding in listed packaging specialist Mpact, investors are pretty much buying Caxton’s cash-spinning operations for free. A smidgen of extra growth in the (now larger) packaging segment could mean fair bottom-line growth in 2026 — and another decent dividend payout and further share buybacks. It’s not the prettiest business on the JSE, but it certainly is value-packed with very little downside risk. The big question, of course, is whether Caxton will mobilise its cash pile to pitch a buyout offer for Mpact or offload this stake. The latter option makes for intriguing speculation around a sumptuous special dividend — with not too many manageable acquisition opportunities apparent in local packaging aside from Transpaco and Bowler Metcalf. — Ray Mahlaka & Marc Hasenfuss

Mining

Gary Nagle (supplied. )

Gary Nagle (supplied. )

It’s hard to look past the gold price when it comes to the mining sector in 2026. The metal is trading at about $4,400/oz, and most banks expect further gains. Morgan Stanley has forecast $4,800 by year-end owing to falling interest rates, a change in leadership at the US Federal Reserve, and sustained physical demand from central banks and ETFs.

Most JSE gold stocks have run exceedingly hard, however. One that might offer value is Harmony Gold, which has been penalised by investors for its capital-heavy push into copper. But amid a fresh record high for the copper price this month, Harmony’s earnings potential could be reappraised. UBS has outlined a “fundamental bullish outlook” for copper. All the signs are there for a sustained price rally, with every little production surprise triggering purchases of the metal.

Another underappreciated stock is Glencore. Orion Minerals, a copper development company, plans to start first production in the fourth quarter from its Northern Cape operations. It, too, could be a beneficiary. Rhodium, a member of the platinum group metals (PGMs) suite, has soared to $9,000/oz in recent weeks. While the metal is only a minor part of the PGMs, its ability to add blush, especially when the other metals are also trading higher, is considerable.

PGM miner margins are probably exceeding those of their gold peers and should be trading way higher, says Noah Capital. Broadly speaking, the metals universe looks exceedingly healthy. Copper and aluminium are the best of a good bunch and should flow to the diversified miners, sometimes (unfairly) called the “diworsifieds”. — David McKay

Glencore

Share price: 427.95p

Market capitalisation: £48.94bn

Dividend yield: 1.76%

Year-end (12/2025)

Adjusted ebitda: $14.36bn

EPS: -0.1253p

Listed: 2011

CEO: Gary Nagle

Glencore share performance (R) weekly (supplied)

Glencore share performance (R) weekly (supplied)

Risks and opportunities

Until the evening of December 8, a merger between Glencore and Rio Tinto was an interesting possibility, especially as the combination had been touted twice before: in 2015, when Ivan Glasenberg was Glencore CEO, and again in 2024, when talks floundered. So the announcement by both companies last week that they were discussing an all-share takeover, led by Rio Tinto, should not be entirely surprising. But it comes with uncertainties about what to do with Glencore’s marketing business and its coal assets. Poor coal prices were behind Glencore’s underperformance last year, so a recovery in the fuel would be a reason to buy Glencore if not for the Rio deal. But Glencore also offers major growth in copper production after CEO Gary Nagle unveiled plans in December to double output by 2035. Copper is the in-demand “critical metal” for electrification, especially to power energy-hungry AI data centres. So whether the combination with Rio Tinto happens or not, Glencore is a buy. All day long. — David McKay

Property

Norbert Sasse (supplied )

Norbert Sasse (supplied )

Property stocks extended their rally in 2025, notching up a stellar 31% total return, which surpassed 2024’s 29%. Investor appetite has rebounded on the back of the sector’s return to inflation‑beating earnings and dividend growth. The latter has been underpinned by lower interest rates and stronger balance sheets.

South Africa-based real estate investment trusts (Reits) were the standout performers. Most reported a higher take-up of vacant retail, office and industrial space, which enabled landlords to start lifting rentals again. This marks a sharp turnaround after pandemic-induced lockdowns, load-shedding, rapidly rising operating costs and rate hikes forced many companies to cut or suspend dividends between 2020 and 2024.

Fortress Real Estate, the FM’s 2025 Hot Stocks pick, delivered a decent 27% total return — notwithstanding its 30% hard currency exposure to Eastern Europe via a stake in mall owner Nepi Rockcastle. But it was the pure domestic counters, such as Delta Property Fund and Fairvest B, that led the pack.

While the easy money may have been made, the Reit recovery is likely to retain momentum in 2026, with a more sustainable period of inflation‑beating dividend growth on the cards. Attractive forward dividend yields of an average 6%-8%, coupled with the fact that most domestic‑focused stocks are still trading at discounts to NAV, suggest that the South African Reit sector is still fairly valued. However, share prices are bound to rise at a more moderate pace in 2026 than in the past two years. — Joan Muller

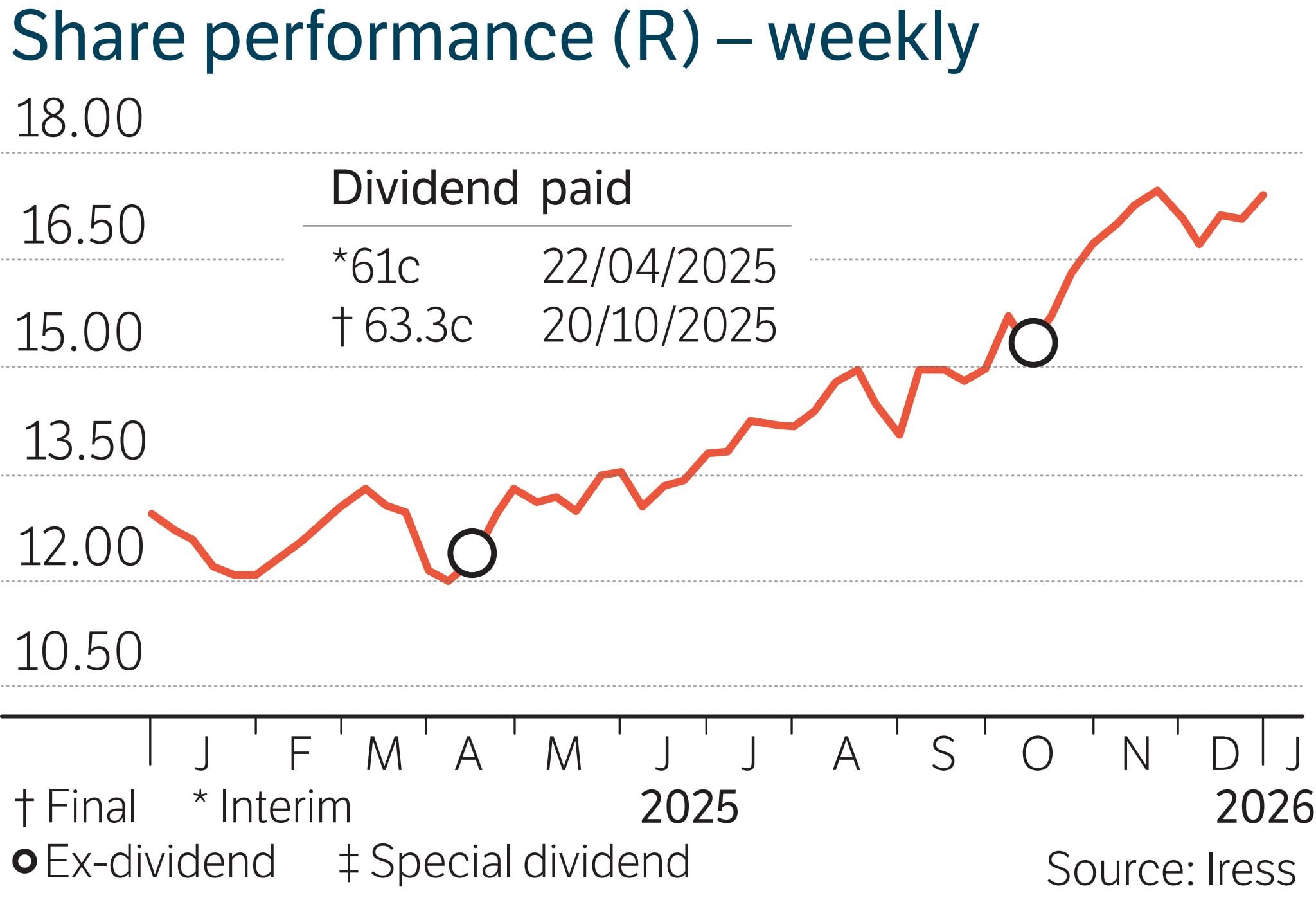

Growthpoint Properties

Share price: R18

Market capitalisation: R61.65bn

P:e: 11

Dividend yield: 8%

Year-end (06/2025)

Operating profit: R8.67bn

EPS: 161.1c

Listed: 1987

CEO: Norbert Sasse

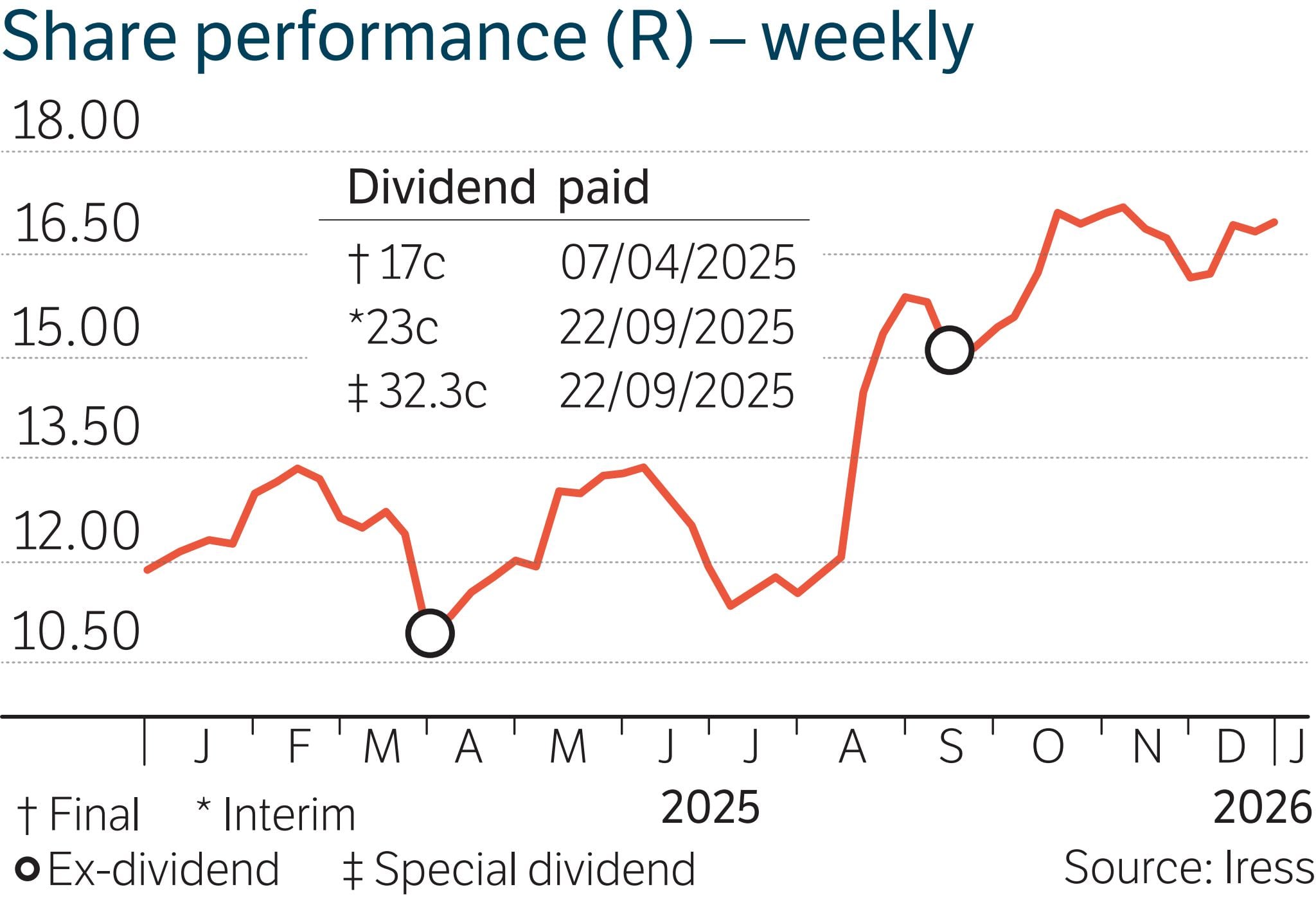

Growthpoint share performance (R) weekly (supplied)

Growthpoint share performance (R) weekly (supplied)

Risks and opportunities

After several years of underperformance, Growthpoint — the co-owner of the V&A Waterfront — has roared back to life, surging nearly 40% in 2025. Yet Growthpoint still trades at a 10% discount to NAV, suggesting there’s further upside to be had. In addition, management expects above-market dividend growth of 6%-8% for the year to June. The sector heavyweight’s rebound comes on the back of it exiting the UK, a stronger balance sheet and a more streamlined portfolio. About R2.5bn in noncore assets were sold last year alone, which saw the loan-to-value drop from 42.3% to 40.1%. Given its scale, liquidity and sector diversification, Growthpoint is the most likely entry point for offshore investors and generalist fund managers looking to get back into listed property. Potential risks include stalled rate cuts, political instability, a resumption of load-shedding and global shocks. — Joan Muller

Retail

Mark Blair (supplied )

Mark Blair (supplied )

The retail sector was an excellent example of where investors didn’t want their money in 2025. The apparel sector had a shocking year, and grocery didn’t do much better. Though there was improved South African sentiment and a drop in local interest rates, these were offset by either sharp declines in offshore subsidiaries (TFG) or a slowdown in growth against a demanding valuation (Shoprite).

It’s not obvious that 2026 will offer strong recovery opportunities for the apparel names that were slaughtered in 2025. Even Clicks Group — the health-care retailer that has become a darling among international investors — drifted down in 2025. Pick n Pay and Spar remain at delicate junctures of their respective turnaround stories, but Woolworths bucked the trend with a late spurt (even though the share was still slightly down year on year).

The one exception is Mr Price, where a daft decision to execute a large European acquisition (NKD Group) at a time when the market is terrified of such deals resulted in an entirely self-inflicted wound. The share price is down roughly 20% since the announcement, effectively wiping out the value of that acquisition. It might not be a smart deal, but it’s surely not a worthless deal.

Curiously, Choppies, the Botswana-based retailer, was the big gainer over 2025 — though subsequent (and sudden) share price movements down throw up some questions. — The Finance Ghost & Marc Hasenfuss

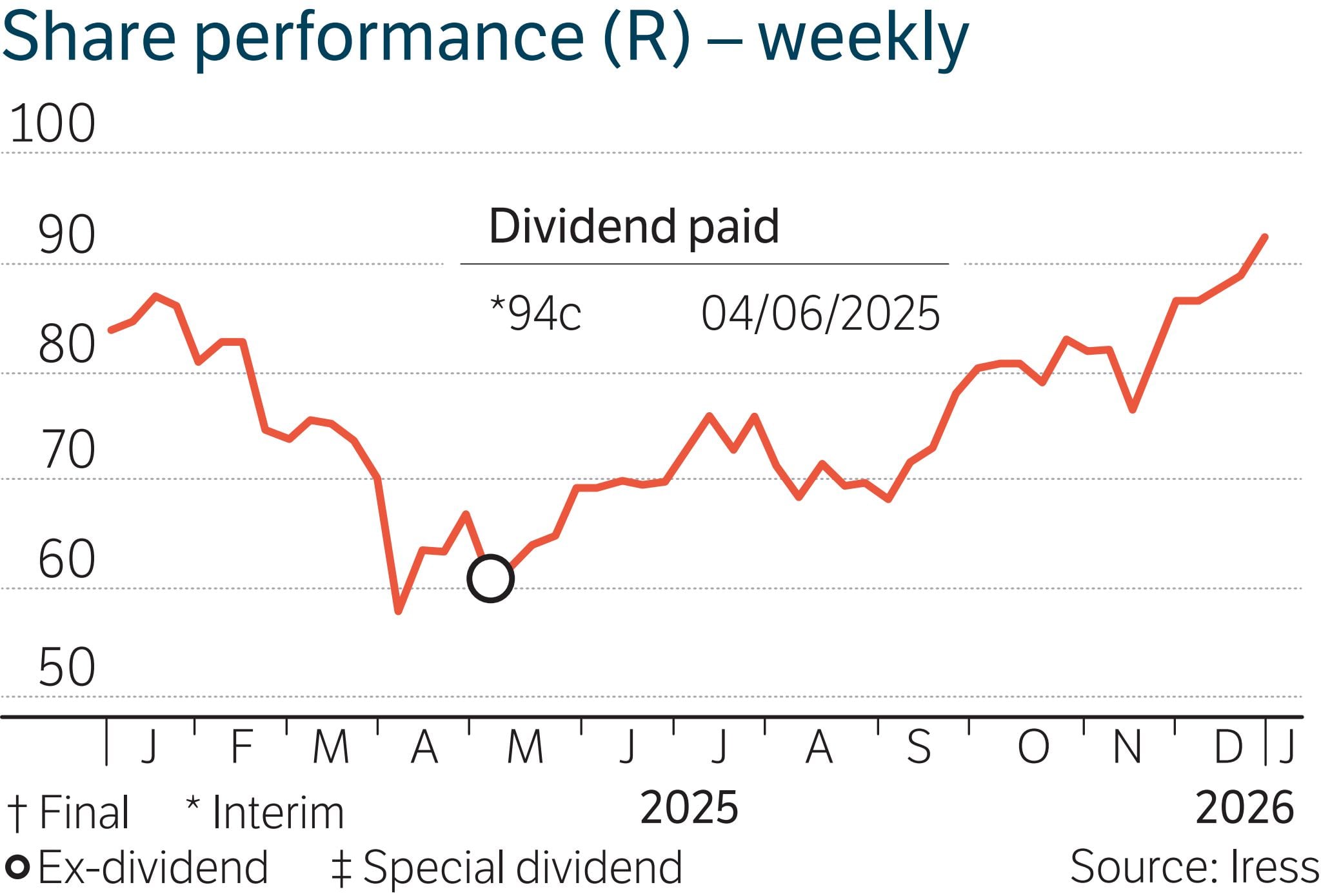

Mr Price

Share price: R171.70

Market capitalisation: R44.5bn

P:e: 11.7

Dividend yield: 5.4%

Year-end (03/2025)

Operating profit: R2.1bn (interim)

EPS: R5.12

Listed: 1994

CEO: Mark Blair

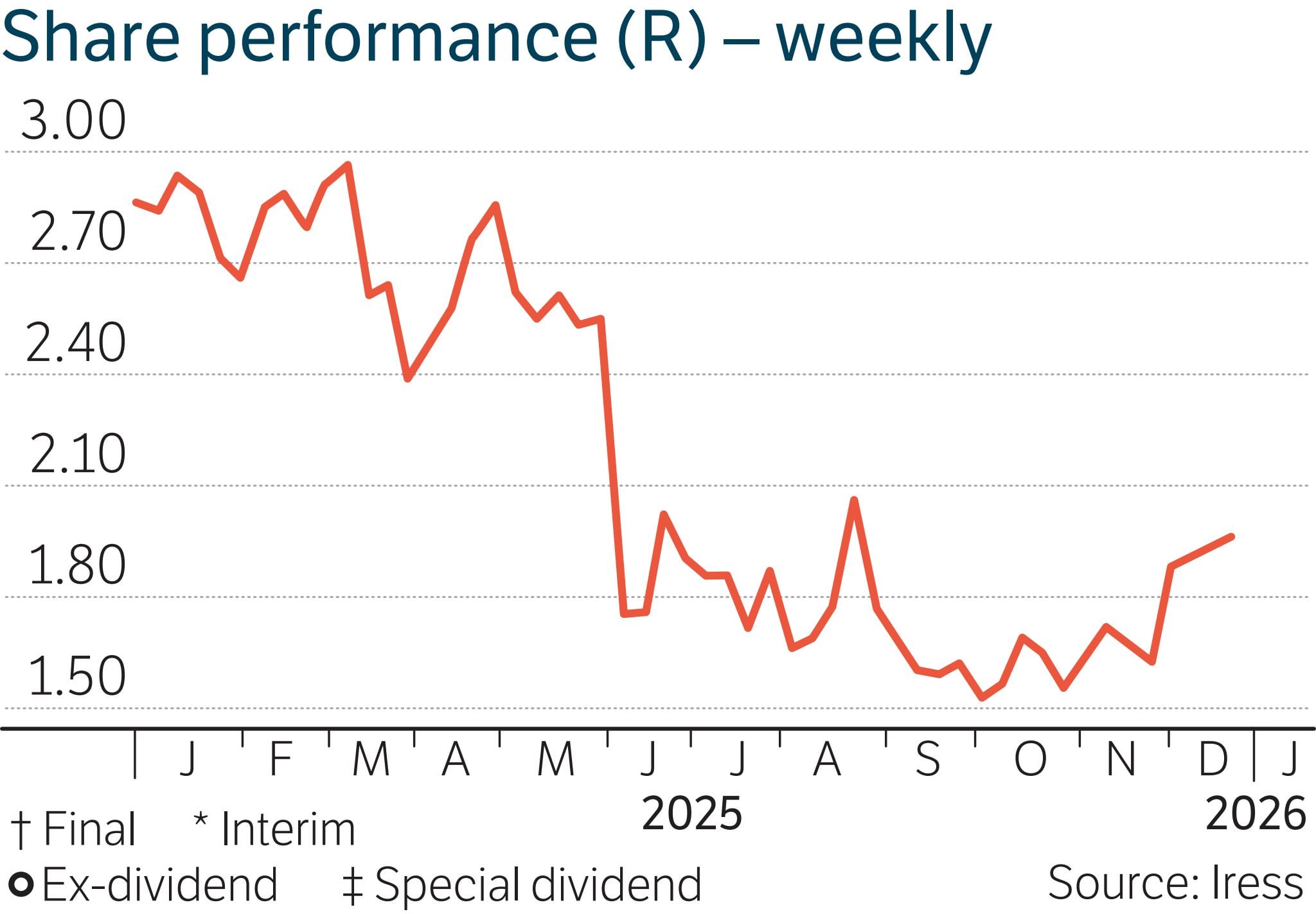

Mr Price share performance (R) weekly (supplied )

Mr Price share performance (R) weekly (supplied )

Risks and opportunities

The biggest risk at Mr Price is that the market’s jaundiced response to the NKD deal is warranted. The multiple being paid is significant. Investors have examples of South African retailers paying acquirers to drag away offshore assets that lost all their value. Management distraction is a serious concern. The additional debt required for the transaction adds financial risk. And perhaps above all else, management’s treatment of investors, level of disclosure and response to criticism have been far from ideal. These factors make this a speculative play based primarily on valuation. The opportunity is the converse: the NKD deal working out even reasonably well, while Mr Price continues to compete against other broken names in local apparel. In the sector of the blind, Mr Price has almost one eye. — The Finance Ghost & Marc Hasenfuss

Tech & telecoms

Rhys Summerton (supplied. )

Rhys Summerton (supplied. )

While technology stocks remain the central theme on larger international bourses — thanks to the wide-eyed wonder at AI applications — the JSE story still revolves mainly around Naspers and its more refined corporate cousin, Prosus. Investors taking these default options on the JSE would have been pleased with the outcome, with both shares up well over 50%.

Telecoms giants MTN (almost doubling) and Vodacom (up 40%) rang up some sterling gains, and the listing of Cell C out of Blu Label provided an intriguing side show. Telkom also made good and almost matched MTN in share price gain over the year. Interestingly, mid-cap tech stalwart Datatec outstripped both Naspers and Prosus over 2025, though fellow second-liner Bytes was down about 15%. Vehicle tracking specialist Karooooo was up about 16%, while Altron, which owns Netstar, reversed.

Arguably, most action took place among the small caps. Mustek got the attention of investment house Novus, while enduring and dividend-paying micro-cap ISA Holdings looks set for a buyout. PBT and 4Sight continued to build encouragingly on their respective business models, but their market valuations are distinctly “old economy” single-digit stuff. Labat Africa, which has seen more operational iterations than most investors have hot breakfasts, has now styled itself as a technology hub. But the company’s earnings multiple of one betrays overriding market scepticism. — The Finance Ghost & Marc Hasenfuss

iOCO

Share price: 430c

Market capitalisation: R2.7bn

P:e: 10.65

Dividend yield: Nil

Year-end (07/2025)

Operating profit: R421m

EPS: 40c

Listed: 1998

CEOs: Rhys Summerton and Dennis Venter

iOCO share performance (c) weekly (supplied)

iOCO share performance (c) weekly (supplied)

Risks and opportunities

Acquisition and roll-up strategies go badly at least as often as they go well. Poor discipline on valuations or misguided deal structuring can lead to disappointing returns. The risk is lower at iOCO’s current valuation, though, as the danger zone kicks in when the share price reflects “miracle” deal-making and the company trades at a premium in anticipation of transactions. The iOCO share price is nowhere near that level, which means that investors earn a strong free cash flow yield and will need to monitor how it is deployed (share buybacks are under way). The broader macro story is also encouraging, with improved sentiment towards South Africa likely to trickle down into the mid-caps on the JSE that have decent stories to tell. Overall, much of the success will depend on iOCO’s ability to unlock attractive local deals. — The Finance Ghost & Marc Hasenfuss

Transport & logistics

Kwazi Mabaso (supplied )

Kwazi Mabaso (supplied )

The transport and logistics sector punched above its weight in 2025 — and it remains curious why investors sometimes give the sector a wide berth. Though defined by risks such as port inefficiencies and high costs, there were clear opportunities in regional trade and integrated supply chain solutions.

Sector stalwart Grindrod was the outperformer, with its share price leaping by more than 45%. Profits were robust, thanks to its strategic port and terminal assets, particularly in Maputo, which bypassed South Africa’s port inefficiencies. This facilitates strong dividend potential.

Super Group, which sold off its Australian operations for a premium price, and KAP, which owns the sprawling Unitrans operations, faced pressure on earnings. The nimble and tech-driven Santova Logistics built on strategic capacity, though its share price was largely rudderless during the past year.

Frontier Transport, the Hosken Consolidated Investments subsidiary that owns the Golden Arrow bus fleet in Cape Town, again proved a reliable profit engine capable of driving sustained (and generous) dividends. After years of consistent performance, there are increasing numbers of punters asking whether Frontier should diversify away from its passenger transport core.

The outlook for logistics in 2026 remains cautiously neutral, contingent on economic recovery and slick operational execution. — Ray Mahlaka & Marc Hasenfuss

Grindrod

Share price: R17.34

Market capitalisation: R12bn

P:e: 27

Dividend yield: 2.3%

Year-end: (12/2025)

Operating profit: -R39m (2024 finals)

EPS: 47c

Listed: 1986

CEO: Kwazi Mabaso

Grindrod share performance (R) weekly (supplied )

Grindrod share performance (R) weekly (supplied )

Risks and opportunities

Grindrod’s resurgent interim period was encouraging enough, but it’s the link to Transnet’s rail reform that could be compelling in the longer term. Grindrod was recently awarded slots on Transnet’s rail network, which enables private sector participation in freight logistics. Key risks are the persistently weak operating environment and exposure to Transnet’s potential inefficiencies. A recent update noted mining commodity markets mostly performing poorly — “influenced by shifts in supply-demand dynamics, heightened geopolitical risks and seasonal trends”. That could change in the blink of an eye, though, with Grindrod adding that demand for both iron ore and chrome has stayed robust. Better news is that the dry-bulk terminal operated by the Port of Maputo exported 13.9Mt for the first 11 months of the 2025 financial year, with volumes through Terminal de Carvão da Matola reaching a record 9.1Mt (and exceeding 2024 full-year volumes of 8.1Mt). — Ray Mahlaka & Marc Hasenfuss

Tourism & leisure

Chris Du Toit (supplied )

Chris Du Toit (supplied )

The broader leisure sector on the JSE was a mixed bag, with a steady recovery in hotels contrasting a bets-off approach to gaming stocks.

Sun International came scuttling down from close to R50 at mid-year to finish under R40, where it offered an eye-popping 10% dividend yield. Tsogo Sun, which is running at the back of the field in the online gaming race, was whacked down more than 30%. Smaller gaming groups like Goldrush and Grand Parade Investments (GPI) were also not market favourites, despite the former winning the licence to operate the lottery.

Whether GPI — which holds minority stakes in the cash-spinning GrandWest Casino in Cape Town and limited-payout machine specialist Sun Slots — makes moves to build out its own gaming offering this year remains to be seen. Strong hints have been made around historical horse racing, though there is also talk of acquisitions of niche gaming operations.

Both City Lodge and Southern Sun benefited from higher occupancy levels. Southern Sun obviously scores more from the influx of foreign visitors, but if local economic activity is on the increase, 2026 could also be good for City Lodge’s budget-conscious business travel offering.

City Lodge and Southern Sun, it must be pointed out, both have operational footprints that might appeal to any international hotel operator keen on a presence in the Southern African accommodation market. — Marc Hasenfuss

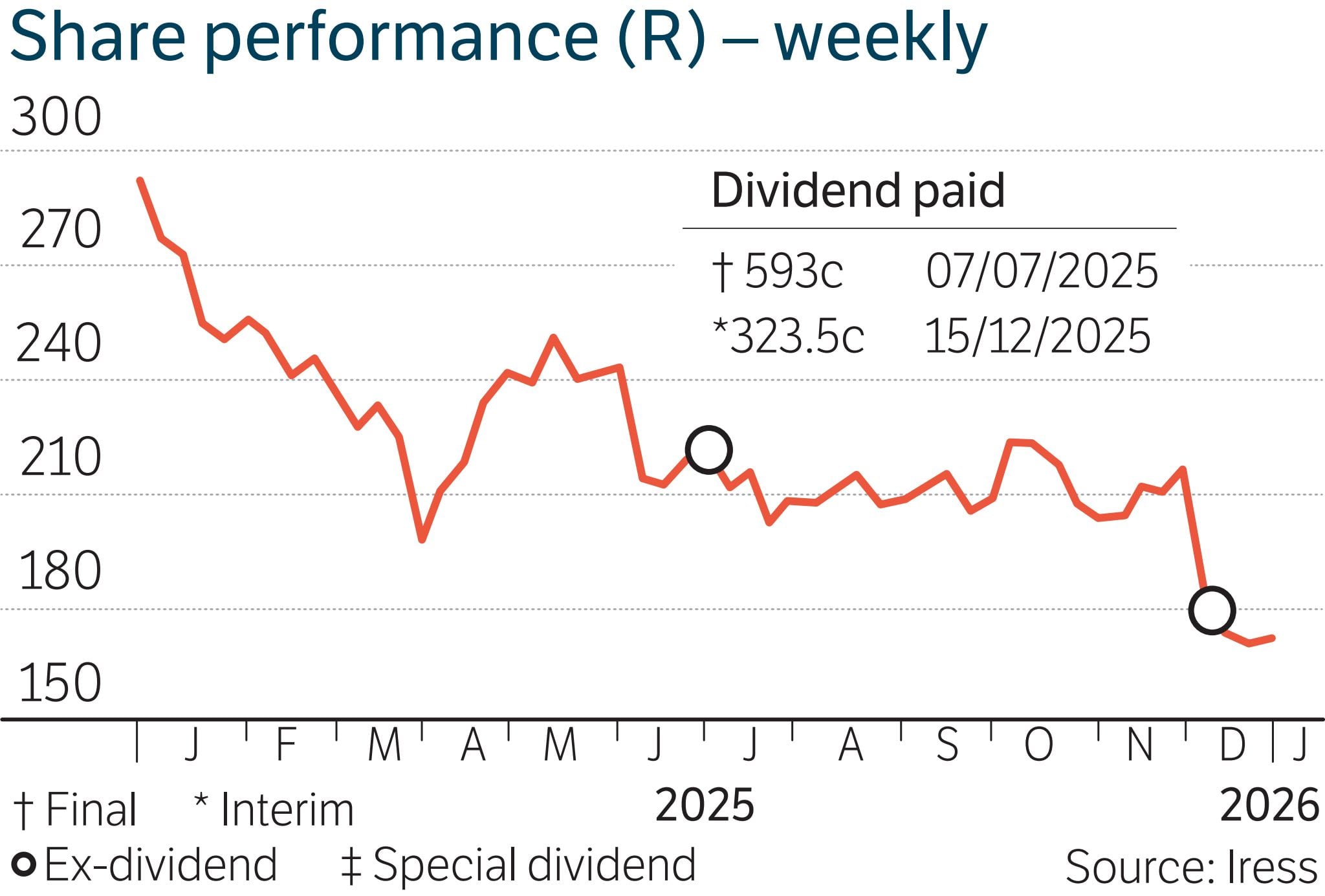

Tsogo Sun

Share price: 683c

Market capitalisation: R7bn

P:e: 5

Dividend yield: 6.5%

Year-end (03/2025)

Operating profit: R2.4bn

EPS: 120c

Listed: 2019

CEO: Chris du Toit

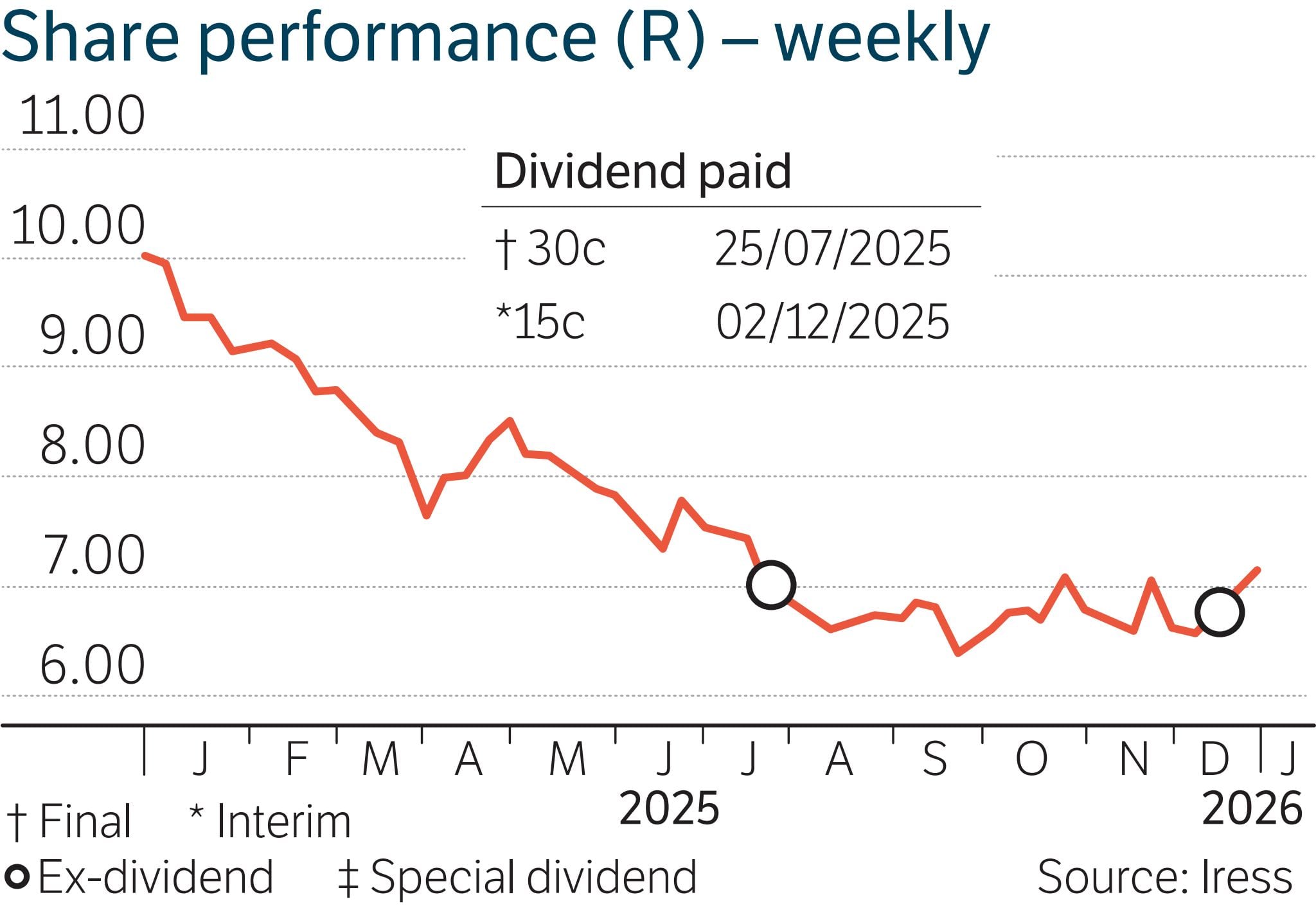

Tsogo Sun share performance (R) weekly (supplied. )

Tsogo Sun share performance (R) weekly (supplied. )

Risks and opportunities

The narrative looks horribly wonky at Tsogo Sun. The group is still investing in arguably ex-growth bricks-and-mortar casinos — including a sizeable new precinct in Somerset West — when the rest of the market is chasing market share in the more vibrant online gaming space. The group has decided to make a concerted (and admittedly belated) tilt at grabbing a viable slice of this market. Early efforts look fairly encouraging, but it seems likely Tsogo may need to make an acquisition or two to make up for lost ground. The casino planned for Somerset West is thankfully not a massive capex splurge (compared with Sun International’s Menlyn development) and may prove a worthwhile addition to the portfolio as it taps a large, well-heeled market. A gentle rerating for Tsogo might see the share price spark this year. — Marc Hasenfuss