Dublin, Jan. 15, 2026 (GLOBE NEWSWIRE) — The “Nigeria Data Center Colocation Market – Supply & Demand Analysis 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

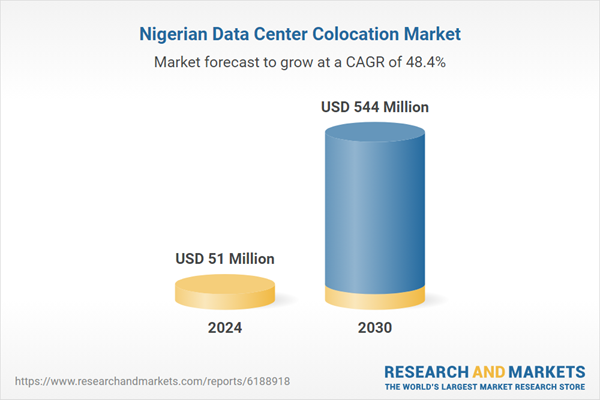

The Nigeria Data Center Colocation Market was valued at USD 51 million in 2024, and is projected to reach USD 544 million by 2030, rising at a CAGR of 48.37%.

Nigeria data center colocation market is one of the growing colocation data center markets in the Africa region. With the strong connectivity, strategic location and government support. While it faces some challenges in terms of power availability and infrastructure. We believe that these issues are expected to be addressed during the forecast period.

The country attracts investment from global colocation operators to invest across the country. For instance, in April 2025, Equinix announced that it had acquired Nigeria’s MainOne and plans to invest around $140 million to expand its digital infrastructure across southern Nigeria over the next two years.

Some of the leading colocation operators in the market include Africa Data Centres, 21 Century Technologies, Equinix, Digital Realty, Open Access Data Centres (OADC), Rack Centre and others.

The average occupancy rate of colocation data centers across the country was over 90% which is likely to rise to around 98%, maintaining the vacancy rate at the lowest of 2% by 2030, creating a significant impact in the industry.

WHAT’S INCLUDED?

A transparent research methodology and insights on the colocation demand and supply aspect of the market.Market size available in terms of utilized white floor area, IT power capacity and racks.Market size available in terms of Core & Shell, Vs Installed Vs Utilized IT Power Capacity, along with the occupancy %.The study of the existing Nigeria data center market landscape, and insightful predictions about Nigeria data center market size during the forecast period.An analysis on the current and future colocation demand in Nigeria by several industries.The study on the sustainability status in Nigeria.Analysis on current and future cloud operations in Nigeria.The snapshot of upcoming submarine cables in Nigeria.Snapshot of existing and upcoming third-party data center facilities in Nigeria. Facilities Covered (Existing): 15Facilities Identified (Upcoming): 16Coverage: 2 CitiesExisting vs. Upcoming (White Floor Area)Existing vs. Upcoming (IT Load Capacity) Data center colocation market in Nigeria. Colocation Market Revenue & Forecast (2024-2030)Retail Colocation Revenue (2024-2030)Wholesale Colocation Revenue (2024-2030)Retail Colocation Pricing along with AddonsWholesale Colocation Pricing, along with the pricing trends. An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the colocation data center industry in Nigeria.Competitive landscape, including market share analysis by the colocation operators based on IT power capacity and revenue.Vendor landscape of each existing and upcoming colocation operators based on existing/ upcoming count of data centers, white floor area, IT power capacity and data center location.

THE REPORT INCLUDES:

Colocation Supply (MW, Area, Rack Capacity)Colocation Demand (MW, Area, Rack Capacity) and by End-User (Cloud/IT, BFSI, etc..)Colocation Revenue (Retail & Wholesale Colocation Services)Competitive Scenario (Share Analysis by Revenue & MW Capacity)

KEY QUESTIONS ANSWERED

What is the count of existing and upcoming colocation data center facilities in Nigeria?How much MW of IT power capacity is likely to be utilized in Nigeria by 2030?Who are the new entrants in the Nigeria data center industry?What factors are the driving the Nigeria data center colocation market?

Key Attributes:

Report AttributeDetailsNo. of Pages53Forecast Period2024 – 2030Estimated Market Value (USD) in 2024$51 MillionForecasted Market Value (USD) by 2030$544 MillionCompound Annual Growth Rate48.3%Regions CoveredNigeria

Supply & Demand Analysis

Existing vs Upcoming Data Center FacilitiesList of Upcoming Data Center ProjectsMarket by IT Power Capacity (Core & Shell, Installed & Utilized (Mw))Core & Shell, Installed & Utilized Data Center Power Capacity by CitiesColocation Demand by IndustryMarket by Utilized AreaMarket by Utilized Racks

Market Growth Factors

Factors Attracting Colocation Investment in NigeriaImpact of AI in Data Center Industry in Nigeria MarketSustainability Status in NigeriaCloud ConnectivitySubmarine Cables

Colocation Revenue & Pricing Analysis

Colocation Market by RevenueRetail vs Wholesale ColocationRetail Colocation Pricing and AddonsWholesale Colocation Pricing & Key Pricing Trends10. Chapter 5 – Market DynamicsKey TrendsKey Enablers / DriversKey Restraints

Competitive Landscape

Competitive Landscape by Colocation OperatorsMarket Share by Colocation RevenueMarket Share by IT Power CapacityExisting Colocation OperatorsNew Operators

Existing Colocation Operators

21 Century TechnologiesDigital RealtyEquinixMTNOpen Access Data Centres (OADC)Rack CentreAfrica Data CentresExcelsimo NetworksOther Data Centers Facilities

New Operators

Airtel AfricaKasi CloudUniCloud Africa & BDIC

For more information about this report visit https://www.researchandmarkets.com/r/8l8qw4

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Nigerian Data Center Colocation Market