2.1 Developed Nations: Gold as Financial Security Pillar

The world’s most stable economies maintain substantial gold reserves as a cornerstone of monetary policy and financial security. These nations demonstrate how gold backing strengthens currencies, provides crisis resilience, and maintains investor confidence.

Global Gold Reserves: Top 10 Nations (2026)🇺🇸 United States: 8,133 Tonnes (~$1,440 Billion)

Gold as Reserve Currency Foundation

Strategy: Largest holder globally since Bretton Woods (1944), zero sales since 1970sStorage: Fort Knox and other federal facilities with extreme securityReserve Ratio: 70% of total reserves in goldPer Capita: ~24 grams per personCurrency Impact

20%

Gold value as % of US monetary base

Inflation Crisis (2022-23)

8.5%

Peak inflation – USD strength maintained

Safe-Haven Status

Preserved

Gold backing crucial to USD credibility

Reserve Adequacy

1+ Year

Import coverage capacity

Key Lesson for Tanzania: During 2022-2023 inflation surge (8.5% peak), gold holdings helped maintain USD strength. Diversification from Treasury bonds provided credibility and contributed to USD attracting safe-haven flows during global uncertainty. The US has never sold gold reserves precisely because it underpins the dollar’s global reserve currency status.

🇩🇪 Germany: 3,351 Tonnes (~$597 Billion)

Repatriation & Monetary Sovereignty

Historic Move: Repatriated 674 tonnes from NY Fed and Banque de France (2013-2017)Rationale: Enhanced monetary sovereignty post-Eurozone debt crisisReserve Ratio: 70% of total reserves (highest in Eurozone)Crisis Role: Stabilized euro during 2010-2012 sovereign debt crisisMetricGermanyItalyFranceSpainGold Holdings (tonnes)3,3512,4522,437281% of Reserves70%65%65%17%Crisis OutcomeEuro survivedStabilizedStabilizedRequired bailoutInflation ControlControlledModerateModerateHigh volatility

Outcome: Euro survived existential crisis, German bunds remained safe-haven asset, and inflation stayed controlled compared to Mediterranean economies. Gold provided non-debt asset backing during crisis.

🇨🇭 Switzerland: 1,040 Tonnes (~$185 Billion)

Strategic Balance: Sold Yet Retained Significant Holdings

Sales History: Sold 1,550 tonnes (1999-2005) during gold bear marketRetained: 1,040 tonnes – still substantial reservesPer Capita: ~130 grams per person (highest globally)Reserve Ratio: 7-10% of total reservesCOVID-19 Response

2020

Gold prevented franc over-appreciation

Export Competitiveness

Maintained

Balanced monetary policy

Per Capita Holdings

130g

Highest in the world

Strategic Position

Flexible

Can buy/sell as needed

2.2 Emerging Markets: Active Accumulators

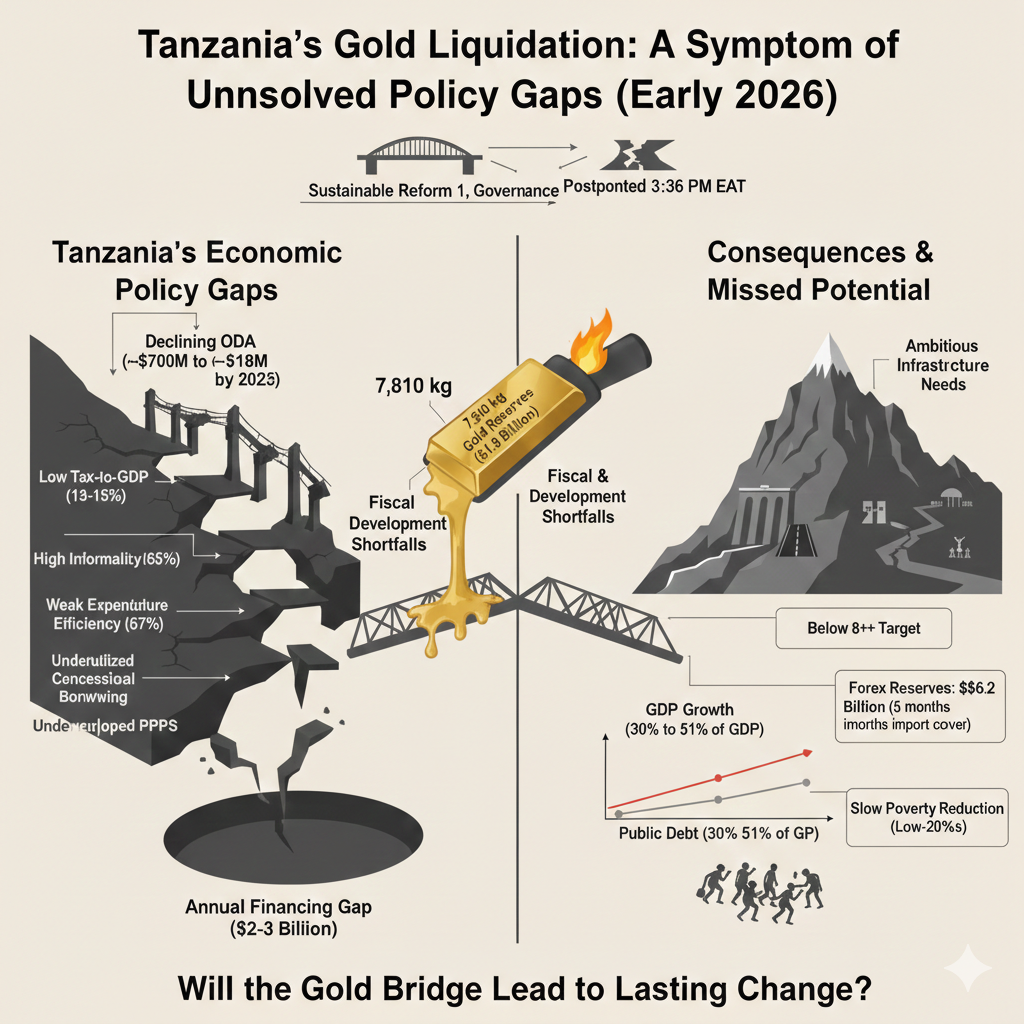

While Tanzania considers selling, emerging market peers are aggressively accumulating gold to strengthen currencies, reduce dollar dependence, and build financial resilience. This global trend makes Tanzania’s decision even more striking.

Emerging Market Gold Accumulation (2018-2025)🇨🇳 China: 2,264 Tonnes (~$403 Billion) – Strategic AccumulatorStrategy: Accumulated 1,448 tonnes since 2015 (gold reserves grew 178%)Motivation: De-dollarization and yuan internationalizationReserve Ratio: Only 5% of reserves (room to grow significantly)Target: Estimated goal of 8,000+ tonnes to match US influenceImpact: Yuan included in IMF’s SDR basket (2016), bilateral trade settlements expanding🇮🇳 India: 840 Tonnes (~$149 Billion) – Aggressive GrowthRecent Purchases: Added 190 tonnes in 2022-2024 aloneGrowth Rate: 29% increase in holdings since 2020Reserve Ratio: Increased from 6.5% to 9.6%Crisis Response: During 2022 rupee crisis, gold reserves helped prevent further depreciationOutcome: Rupee stabilized faster than Pakistan/Sri Lanka despite similar pressures🇷🇺 Russia: 2,332 Tonnes (~$415 Billion) – Sanctions ShieldMassive Accumulation: Quintupled holdings from 488 tonnes (2007) to 2,332 tonnes (2024)Reserve Ratio: Increased from 2.5% to 27.8%Sanctions Response: When USD 300B in foreign reserves were frozen (2022), gold remained accessibleCritical Lesson: Only 27.8% of reserves (gold) were sanction-proof vs. 72.2% frozenRuble Impact: Gold backing prevented total currency collapse during sanctionsCountryGold Holdings% of ReservesRecent ActionStrategic Goal🇨🇳 China2,264 tonnes5%+1,448 tonnes since 2015Yuan internationalization🇮🇳 India840 tonnes9.6%+190 tonnes (2022-24)Rupee stability🇷🇺 Russia2,332 tonnes27.8%Quintupled since 2007Sanctions resilience🇹🇷 Turkey590 tonnes33.6%+396 tonnes since 2017Lira support🇵🇱 Poland359 tonnes15.7%+259 tonnes since 2018Zloty strength🇹🇿 Tanzania7.8 tonnes~2%PLANNING TO SELLInfrastructure financing🇹🇷 Turkey: The Lira Stabilization Story

Turkey’s aggressive gold accumulation provides a direct parallel for Tanzania’s currency concerns:

✓

Holdings Growth: Increased from 194 tonnes (2017) to 590 tonnes (2024) – a 204% surge

✓

Crisis Context: During 2018-2019 lira crisis (lost 30% value), gold accumulation began

✓

Outcome: Reserve ratio jumped to 33.6%, helping lira regain 15% vs. dollar by 2023

✓

Lesson: Gold backing provided psychological market confidence even during political uncertainty🇵🇱 Poland: European Accumulation LeaderRapid Growth: Increased from 100 tonnes (2018) to 359 tonnes (2024)Reserve Strategy: Jumped from 3.8% to 15.7% of reservesRationale: “Insurance against financial cataclysm” – Central Bank GovernorEU Context: Building monetary independence within eurozone proximityImpact: Zloty remained one of strongest CEE currencies during 2022-2023 energy crisisGlobal Central Bank Gold Purchases (2010-2025)🌍 The Global Trend: Central Banks Are BUYING, Not Selling

Critical Context: Central banks have been net buyers of gold for 14 consecutive years (2010-2024), purchasing over 1,000 tonnes annually in 2022-2024. This represents the strongest accumulation trend since the end of Bretton Woods.

Tanzania’s Paradox: Selling when global peers are aggressively buying signals either (1) urgent financing crisis or (2) strategic miscalculation of gold’s long-term value to currency stability.

2.3 Cautionary Tales: Countries That Sold Gold Reserves

Several nations sold substantial gold reserves over the past decades. Their experiences reveal both the immediate benefits and long-term costs of gold liquidation, offering critical lessons for Tanzania.

🇬🇧 United Kingdom: The “Brown’s Bottom” Disaster (1999-2002)

The Worst-Timed Gold Sale in Modern History

What Happened: Sold 395 tonnes (56% of reserves) at $275-$300/oz averageTiming: Bottom of 20-year gold bear market (1980-2000)Revenue: Generated ~USD 3.5 billionOpportunity Cost: Same gold worth USD 20+ billion today (2026)Lost Value: Over USD 16 billion in foregone gainsCurrency Impact: Pound sterling lacked gold backing during 2008 financial crisisUK Gold Sale Disaster: Price TimelineSale Price (1999-2002)

$275-300

Per ounce average

Current Price (2026)

$5,520

18x higher than sale price

Opportunity Cost

$16B+

Foregone gains

Lesson

TIMING

Critical to sell at peaks, not troughs

Key Lesson for Tanzania: The UK case demonstrates the catastrophic cost of selling at market bottoms. However, it also validates Tanzania’s timing—selling near market peaks ($5,520/oz in 2026) versus the UK’s disaster at market bottoms ($275/oz). Tanzania’s acquisition at $2,000-2,400/oz and sale at $5,520/oz represents the OPPOSITE strategy—and could yield 130%+ gains.

🇨🇦 Canada: Complete Liquidation (1980-2016)Action: Sold virtually ALL gold reserves (from 1,000+ tonnes to just 0.6 tonnes)Rationale: “Gold is a legacy asset with limited value in modern central banking”Final Sale: Last significant sale in 2016 at ~USD 1,200/ozCurrent Reality: Canada now holds only 0.6 tonnes (~0.02% of reserves)Opportunity Cost: If retained, 1,000 tonnes would be worth USD 178 billion todayCurrency Impact: CAD volatility increased; more dependent on oil price fluctuationsPeriodGold HoldingsAverage Sale PriceCurrent Value If HeldOpportunity Cost19801,000+ tonnes-USD 178 billion-1985-2003Down to 100 tonnes~$350/oz–2004-2016Down to 0.6 tonnes~$900/oz–20260.6 tonnes-$0.1 billion~$178 billion lost🇳🇱 Netherlands: Partial Liquidation (2014-2023)Action: Sold 190 tonnes, reducing reserves from 612 tonnes to 422 tonnesSale Price: Averaged $1,250-1,400/ozRevenue: Generated ~USD 8.5 billionCurrent Value: Same gold now worth USD 38+ billionOpportunity Cost: Foregone ~USD 30 billion in gainsRegret: Publicly acknowledged by central bank officials in 2024🇵🇹 Portugal: Crisis-Driven Sale (2011-2012)Context: Eurozone debt crisis, required EU-IMF bailoutAction: Sold 80 tonnes (15% of holdings) at ~$1,600/ozRevenue: USD 4.1 billion to meet deficit targetsOutcome: Short-term fiscal relief but long-term regretCurrent Value: Same gold worth USD 14+ billion todayLesson: Crisis sales often occur at inopportune times🇻🇪 Venezuela: Desperation Sales & Economic Collapse (2016-Present)

The Extreme Cautionary Tale: Venezuela’s gold sales amid economic crisis illustrate the worst-case scenario of gold liquidation driven by desperation rather than strategy.

✗

Holdings Collapse: Sold 73+ tonnes (2016-2021) to fund government operations

✗

Fire Sale Prices: Many sales below market price due to urgent liquidity needs

✗

Currency Collapse: Bolivar lost 99.9%+ of value despite gold sales

✗

Lost Reserves: 161 tonnes frozen in Bank of England (sanctions)

✗

Critical Lesson: Gold sales without fiscal reforms only delay—not solve—economic collapseCountryAmount SoldSale Price RangeRevenue GeneratedCurrent Value (2026)Outcome🇬🇧 UK395 tonnes$275-300/oz$3.5B$20B+$16B+ opportunity cost🇨🇦 Canada~1,000 tonnes$350-1,200/oz~$30B$178BComplete liquidation regretted🇳🇱 Netherlands190 tonnes$1,250-1,400/oz$8.5B$38B$30B opportunity cost🇵🇹 Portugal80 tonnes~$1,600/oz$4.1B$14BBetter timing, still costly🇻🇪 Venezuela73+ tonnesBelow marketUnknown-Currency collapsed anyway🇹🇿 TanzaniaTBD (from 7.8t)$5,520/ozPeak pricing-TIMING ADVANTAGE vs UK/CanadaCritical Lessons from International Gold SalesTIMING IS EVERYTHING: UK lost $16B+ by selling at bottom; Tanzania selling at peak is strategically oppositeComplete Liquidation = Regret: Canada’s total sale cost $178B in opportunity lossesDesperation ≠ Strategy: Venezuela’s crisis sales failed to prevent economic collapsePartial Sales Can Work: Switzerland sold 1,550 tonnes but retained 1,040 tonnes for flexibilityPeak Pricing Advantage: Tanzania’s $5,520/oz sale price vs. $275-1,600/oz by others dramatically improves economicsGlobal Trend Reversal: Most nations now ACCUMULATING, not selling—Tanzania’s countertrend is notable

Tanzania’s Unique Position: Unlike the UK (sold at bottom), Canada (complete liquidation), or Venezuela (desperation), Tanzania is selling at a historic market peak with 130%+ unrealized gains. This timing advantage, combined with domestic production capacity to re-accumulate, creates a fundamentally different risk-reward profile. The question is not WHETHER to sell, but HOW MUCH and HOW to use the proceeds.