The Federal Government of Nigeria and top executives from global professional services firm, KPMG, have held a high-level consultative meeting to resolve recent interpretive differences surrounding the implementation of the country’s new tax laws.

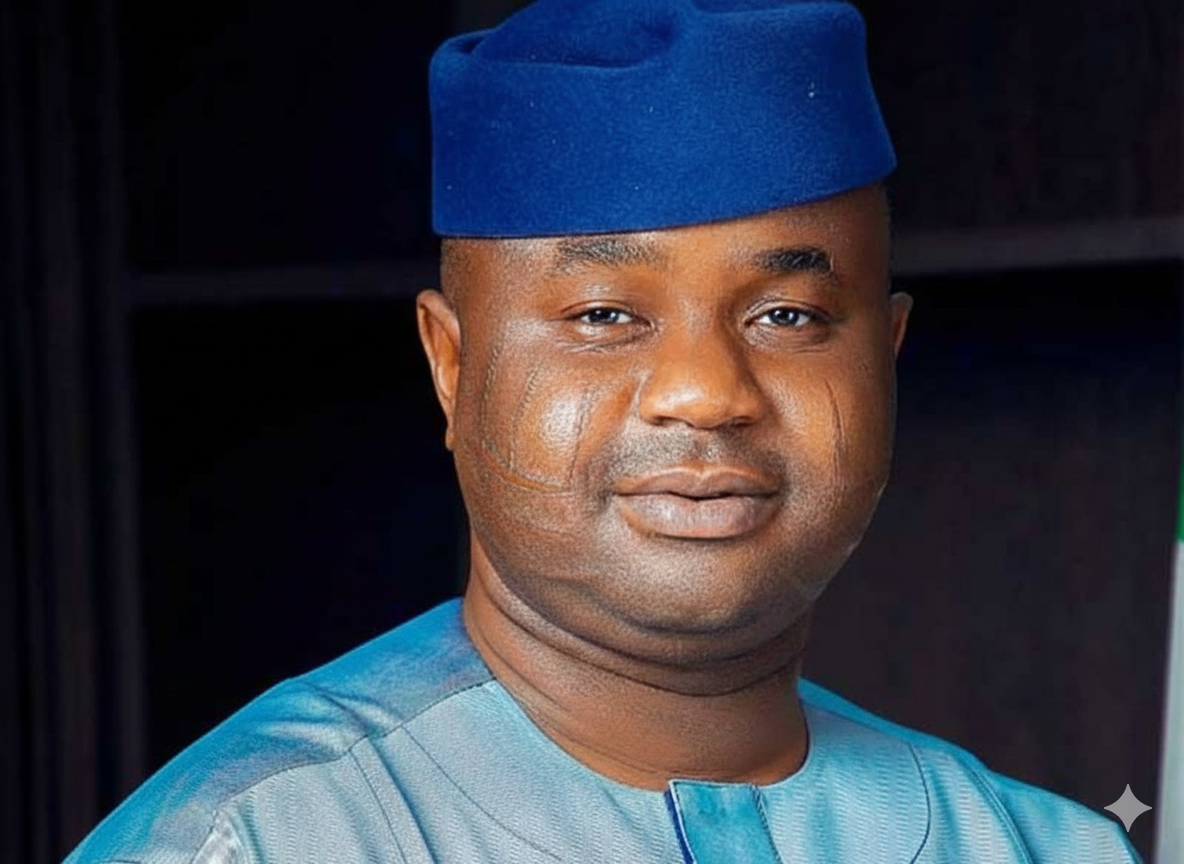

The meeting, hosted by the Executive Chairman of the National Revenue Service (NRS), Dr. Zacch Adedeji, follows a period of intense public debate after a KPMG report identified perceived “errors and inconsistencies” in the new tax framework.

Clarification and Reconciliation During the session, Dr. Adedeji provided technical clarity on several grey areas of the Act, including provisions related to the taxation of shares, dividend treatments, and foreign exchange deductions. The NRS leadership emphasized that the reforms were designed to simplify tax administration and create a more equitable fiscal environment.

In a significant turn of events, the KPMG delegation noted that their initial observations had been misconstrued in the public domain. The firm expressed regret over any misunderstanding and clarified that its intent was to seek further detail on specific provisions rather than to challenge the validity of the reforms.

A Shared Vision for Reform The KPMG team commended the NRS for its proactive leadership and the timely implementation of the new tax laws, stating that their initial apprehensions had been “significantly allayed.” The firm reaffirmed its stance that the reforms are both necessary and timely for Nigeria’s economic evolution.

Key highlights from the meeting include:

Sustained Dialogue: Both parties agreed to maintain an open channel of communication to address emerging implementation issues.

Interpretation Alignment: Recognition that differences in interpretation contributed to taxpayer confusion, with a commitment to providing clearer guidelines.

Economic Support: KPMG pledged continued professional engagement to support the government’s goal of effective tax administration and sustainable national growth.

Commitment to Progress The Federal Government reiterates that the new tax framework is a cornerstone of the current administration’s “fiscal reset,” aimed at reducing the cost of compliance for businesses while expanding the revenue base.

“The meeting underscores our commitment to transparency and collaboration with the private sector,” a spokesperson for the NRS stated. “By working with professional bodies like KPMG, we ensure that our tax laws are not only robust but also understood by all stakeholders to foster a business-friendly environment.”