Uber has quietly cut off Visa card payments in Kenya, forcing riders who’ve grown accustomed to tapping their cards after a trip to scramble for alternatives.

The change took effect sometime in December, and it’s not a technical glitch. Uber Kenya confirmed it made the decision deliberately, citing rising payment processing costs that are squeezing margins across its global operations.

The company says it now reviews payment methods market by market to keep costs manageable without completely destroying the user experience.

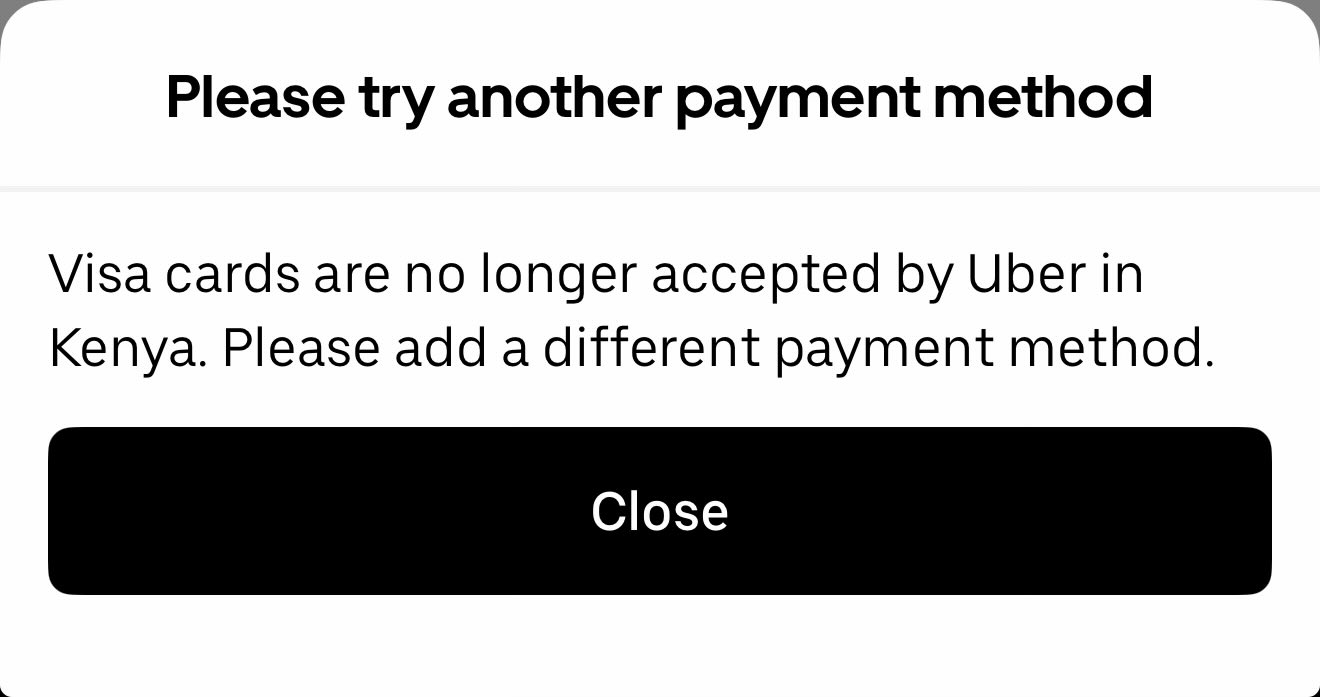

Kenyan riders who use Visa are now receiving a message reading, “Visa cards are no longer accepted by Uber in Kenya. Please add a different payment method.”

The available payment methods now include Mastercard, American Express, M-Pesa, Airtel Money, PayPal, cash, or gift cards. A source close to the matter told Techweez that Mastercard will not be affected by similar restrictions, at least for now.

Visa, for its part, says it’s aware of the situation and is working with Uber to resolve it. But there’s no timeline for when, or if, Visa cards will be accepted again.

Corporate travelers and business users who rely on credit cards for expense tracking, rewards programs, or simply to avoid dipping into their own cash will be the most affected.

READ: Survey Finds 94% of Kenyans View Ride-Hailing as Safer Than Other Transport

Mobile wallets and cash don’t always fit company travel policies, and this change effectively cuts off a payment method that local banks like KCB and Equity have spent years promoting as the gateway to digital services. Ride-hailing was supposed to be one of the showcase use cases.

For now, Kenyan riders will have to adjust to the new reality that for global platforms operating in African markets, local payment rails are cheaper, faster, and increasingly dominant.