Novo Nordisk (NYSE:NVO) has warned of a potential decline in sales and profit in 2026, citing intensifying US price pressures and upcoming patent expiries. The company highlighted rising competition in obesity and diabetes treatments, particularly in the GLP-1 segment, as a key headwind. Management changes, including the departure of the US chief, are occurring alongside a renewed focus on rolling out new products and expanding in select markets.

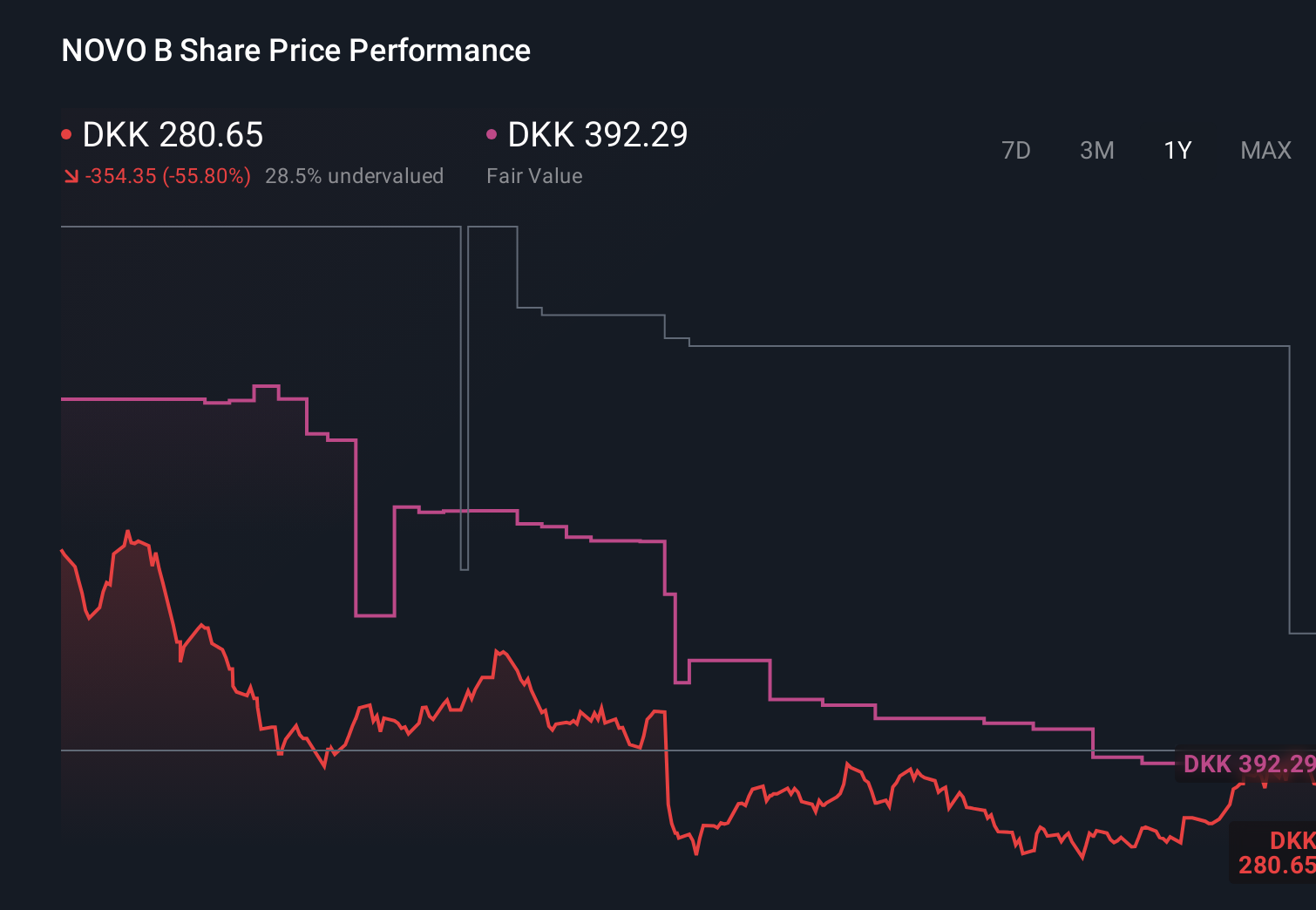

Novo Nordisk enters this period of pressure with its shares at $43.34, after a 27% decline over the past week, 23% over the past month, and 49.3% over the past year. For investors, those moves frame how sharply sentiment has shifted around a business long associated with leadership in obesity and diabetes treatments.

The company is pointing to new product launches and geographic expansion as priorities to respond to regulatory price cuts, loss of exclusivity for key drugs, and tougher competition. As these efforts unfold, investors will be weighing how effectively Novo Nordisk can defend its position in obesity and diabetes care while managing profitability and pricing in the US market.

Stay updated on the most important news stories for Novo Nordisk by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Novo Nordisk.

NYSE:NVO 1-Year Stock Price Chart

NYSE:NVO 1-Year Stock Price Chart

Why Novo Nordisk could be great value

Investor Checklist Quick Assessment ✅ Price vs Analyst Target: At US$43.34 versus a consensus target of US$59.60, the share price sits about 27% below analyst expectations. ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading roughly 69.5% below their calculated fair value. ❌ Recent Momentum: The 30 day return of about 23% decline flags clear negative short term sentiment.

Check out Simply Wall St’s

in depth valuation analysis for Novo Nordisk.

Key Considerations 📊 The 2026 sales and profit warning focuses attention on how pricing pressure, patent expiries and GLP 1 competition could affect future cash flows. 📊 Watch how quickly new products gain traction, updates on US pricing, and any guidance revisions relative to the current P/E of 12.2 versus the industry average of 21.1. ⚠️ The flagged high level of debt and concerns about dividend coverage may matter more if profit pressure from US pricing and competition persists. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Novo Nordisk analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com