nagement’s guidance range (EBITDA $4.5 billion–$7.0 billion; EBIT from a $1.5 billion loss to a $1.0 billion profit) highlights how uncertain the outlook is when the industry is juggling excess ship capacity and disrupted routes.

Why should I care?

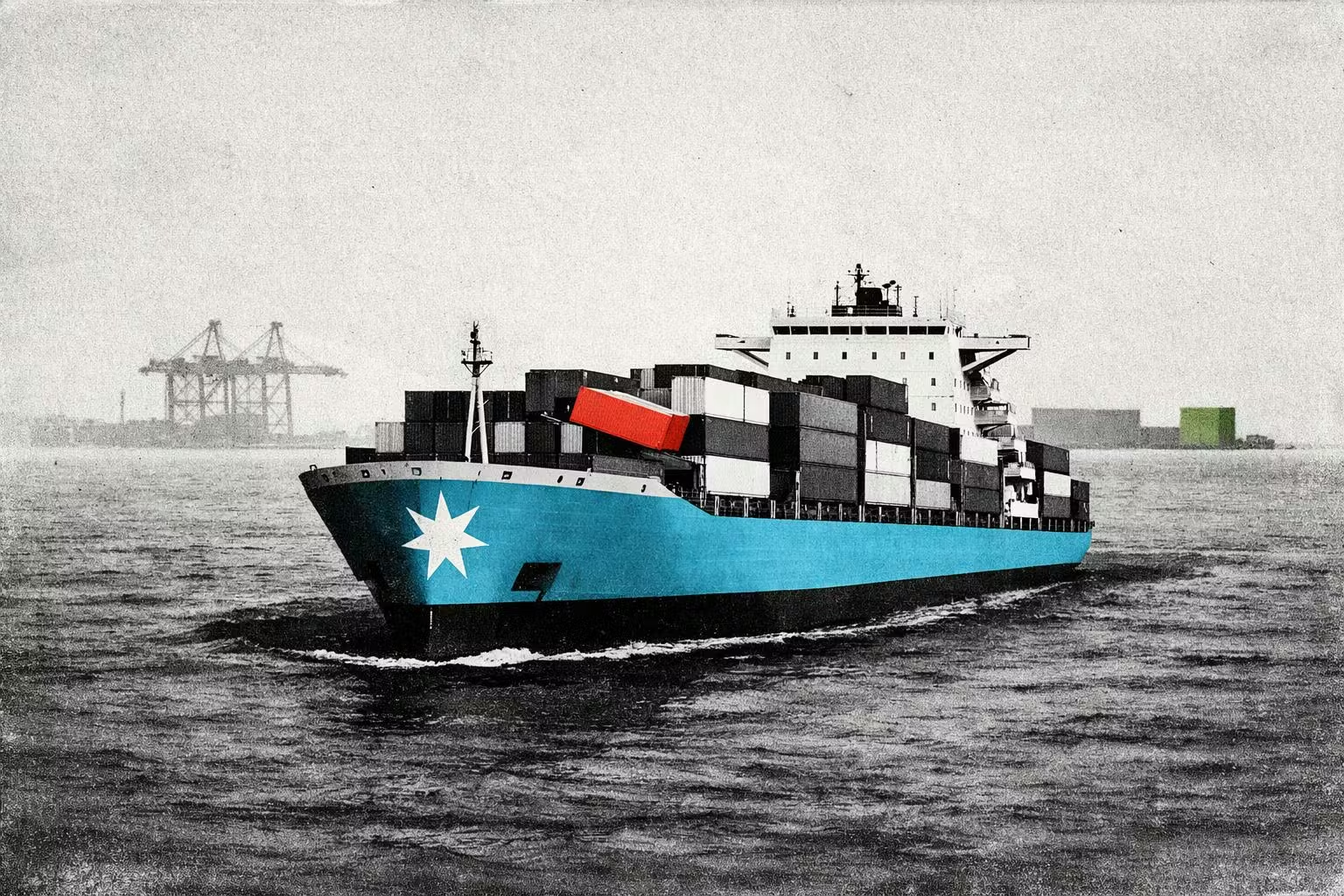

For markets: Freight rates still call the shots.

When spot prices slide, even big volume gains don’t protect profits – and Maersk’s Ocean division is still the core earnings engine. Investors are now looking past one quarter to the same big variables: new vessel deliveries adding capacity, and whether Red Sea shipping normalizes and pushes rates down further. One extra wrinkle is that some 2026 EBIT upside reflects accounting, not demand: Bernstein flagged about a $700 million boost from extending vessel useful lives.

Zooming out: Shipping is hunting for more predictable cash flows.

Maersk’s push to become an end-to-end supply chain player is why Logistics and terminals helped cushion a weak rate year. But the cycle still matters: the proposed dividend fell to 480 Danish kroner per share from 1,120, even as the firm stuck to its 30%–50% payout policy. At the same time, a buyback of up to 6.3 billion Danish kroner over 12 months shows it’s trying to stay flexible while the industry works through overcapacity.