DSV (CPSE:DSV) has started building a new southwest regional headquarters in Mesa, Arizona. The $14.5 million logistics hub is designed to support air, sea, and road transport for semiconductor and technology clients.

See our latest analysis for DSV.

The Mesa project lands at a time when DSV’s share price has a 90 day return of 26% and a 30 day return of 7.5%, while its 1 year total shareholder return sits at 19.36%, suggesting momentum has been building over both shorter and longer periods.

If this Arizona expansion has you thinking about how logistics supports the tech supply chain, it could be a good moment to scan high growth tech and AI stocks for other ideas in that space.

With DSV trading at Dkr1,735 against an analyst price target of Dkr1,909.25 and an estimated intrinsic discount of about 28%, it is worth asking whether there is genuine value left here or whether the market is already pricing in future growth.

Most Popular Narrative: 8.7% Undervalued

At a last close of DKK1,735 against a widely followed fair value estimate of DKK1,901.25, the current price sits below where that narrative draws the line.

The ongoing large scale integration of Schenker is expected to drive substantial synergy realization through cost efficiencies, operational streamlining, and raising Schenker’s margin profile toward DSV’s higher historical levels, supporting significant operating leverage and future EPS growth.

Curious what kind of revenue path, margin lift, and future P/E this story is built on? The narrative leans on specific growth, profitability, and valuation assumptions that you may or may not agree with. The key question is which of those inputs you think actually holds.

Result: Fair Value of DKK1,901.25 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, the Schenker integration and underperforming Road and Contract Logistics divisions could chip away at the margin story if costs stay higher or operational fixes lag.

Find out about the key risks to this DSV narrative.

Another angle on valuation

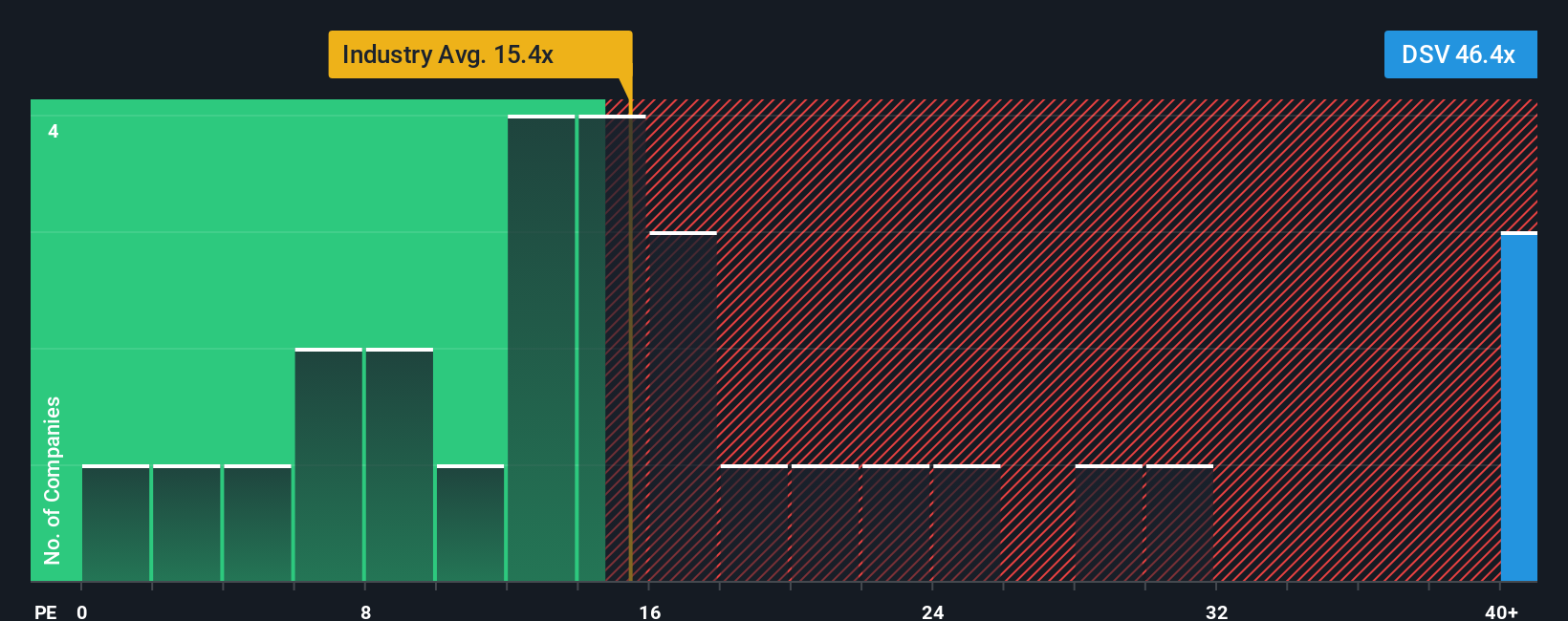

The fair value story suggests DSV is 27.7% undervalued at DKK1,735, but the P/E offers a different perspective. The shares trade on 43.2x earnings, compared with 13.7x for peers and 15.5x for the wider European logistics group. Even so, that premium sits close to a 44.6x fair ratio.

That gap can either close through price, earnings, or both. The key issue is whether you see more risk in the rich multiple or more opportunity if profits catch up.

See what the numbers say about this price — find out in our valuation breakdown.

CPSE:DSV P/E Ratio as at Jan 2026 Build Your Own DSV Narrative

CPSE:DSV P/E Ratio as at Jan 2026 Build Your Own DSV Narrative

If you are not fully on board with this view or prefer to lean on your own checks, you can pull the same data, test your assumptions, and shape a personalised thesis in just a few minutes with Do it your way.

A great starting point for your DSV research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If DSV has sharpened your interest, do not stop here. Use the Simply Wall St Screener to quickly surface other opportunities that match your style and priorities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com