A.P. Moller – Maersk A/S delivered solid performance across all business segments in 2025, driven by volume growth, strong operational execution and proactive cost-control measures, allowing results to reach the upper end of the company’s full-year financial guidance.

“We delivered solid performance and high value to our customers in a year in which supply chains and global trade continued to transform amid shifting geopolitical landscapes. Across our operations, volumes grew and asset utilization remained very high. Our Ocean business set a new benchmark for reliability, Terminals delivered record results, and Logistics & Services continued to advance. The year highlighted the need to strengthen and modernize global supply chains and critical infrastructure, reinforcing the relevance of our strategy. Our key to success remains growing in close partnership with our customers, leveraging our unique asset footprint and a continued focus on operational excellence and cost discipline,” said Vincent Clerc, Maersk’s chief executive.

Year in Review

Maersk’s financial performance in 2025 demonstrated the company’s ability to build competitive advantage from its integrated network of logistics, terminal and ocean operations. Annual revenue totaled USD 54.0 billion (USD 55.5 billion), EBITDA reached USD 9.5 billion (USD 12.1 billion), and EBIT amounted to USD 3.5 billion (USD 6.5 billion), landing at the upper end of the year’s financial guidance.

The Ocean business strengthened its competitiveness through high asset utilization and market-aligned volume growth of 4.9%, while profitability declined due to lower freight rates caused by excess industry capacity. The new East–West network was launched with strong reliability, averaging more than 90% on-time arrivals and delivering cost savings above expectations.

The Logistics & Services business sustained its investment pace and improved performance, resulting in higher profitability and operational gains. Despite progress, the segment has yet to reach its full potential, and further performance improvement remains a priority.

Maersk continued to reinforce its position in terminal operations and critical port infrastructure — the backbone of foreign trade for many countries. The Terminals business accelerated growth through the development of new facilities, modernization of existing terminals and the securing of strategic concessions. Revenues rose 20%, supported by record volumes driven by strong demand, improved tariffs and higher storage income, underpinning the best financial results in the segment’s history.

Financial Highlights – Q4 2025

Ocean

Robust volume growth of 8.0%; continued market pressure on freight rates pushed EBIT into negative territory.

EBIT: USD -153 million, compared with USD 567 million in the previous quarter. In Q4 2024, EBIT stood at USD 1.6 billion.

Logistics & Services

Revenue increased 1.9% year-on-year; profitability improved for the seventh consecutive quarter, with the EBIT margin rising by 0.8 percentage points to 4.9%.

Gains were driven primarily by performance in Warehousing and E-fulfilment.

EBIT: USD 194 million, compared with USD 218 million in the previous quarter. In Q4 2024, EBIT was USD 158 million.

Terminals

Revenue rose 13% year-on-year; volumes increased 8.4%, supported by strong demand in the Americas and Europe.

The EBIT margin, excluding an impairment loss in Europe and a write-down in Asia, stood at 30.1%.

EBIT: USD 321 million, compared with USD 571 million in the previous quarter due to one-off effects. In Q4 2024, EBIT totaled USD 338 million.

Dividend and Share Buyback Program

In line with its dividend policy, the Board of Directors will propose to the Annual General Meeting the approval of a dividend of DKK 480 per share, equivalent to approximately USD 1.1 billion, representing a payout ratio of 40%, in line with the previous year.

The Board also decided to launch a share buyback program of up to DKK 6.3 billion (approximately USD 1 billion), to be executed over 12 months. The first phase, amounting to DKK 3.15 billion (around USD 500 million), will run from February 9 to August 5, 2026.

Organizational Cost Reductions

To drive continued productivity improvements, Maersk announced measures to simplify its organization and reduce corporate expenses. As part of the initiative, the company will cut annual corporate costs by USD 180 million across headquarters, regions and country organizations. Of approximately 6,000 corporate positions, about 15% — roughly 1,000 roles — will be affected. Required notification and consultation processes have already been initiated.

Logistics & Services Product Reorganization

Maersk’s Logistics & Services product portfolio will be reorganized into three subsegments: Landside Logistics, Forwarding and Logistics Solutions. The structure mirrors industry-wide segmentation and reflects fundamental differences in how logistics products create value for customers.

As a result, the organization will be adjusted accordingly. Landside Logistics products will be managed locally at the country level, while Forwarding and Logistics Solutions will operate as globally organized products.

Responsibility for the global products will be split between two roles aligned with the new categories. Narin Phol, currently Head of Logistics & Services, is appointed Head of Solutions, while Christoph Hemmann, currently Global Head of Air and Less-than-Container Load (LCL), is appointed Head of Forwarding. With the appointment, Hemmann will join Maersk’s Executive Leadership Team alongside Phol.

Financial Outlook

The financial outlook assumes global container volume growth of between 2% and 4% in 2026, with A.P. Moller – Maersk expected to grow in line with the market. The ranges reflect anticipated overcapacity in the shipping industry and scenarios involving a gradual reopening of the Red Sea during 2026.

Underlying EBIT guidance also incorporates the impact of a change in the estimated useful life of vessels, from 20 to 25 years starting January 1, 2026, with an estimated reduction in depreciation of approximately USD 700 million during 2026.

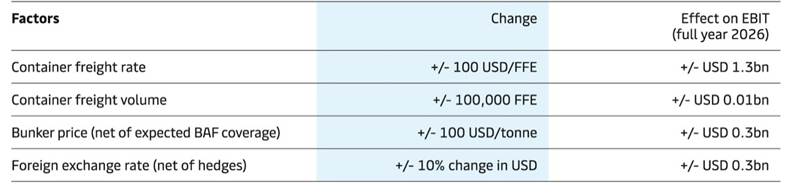

Sensitivity Guidance

Maersk’s financial performance in 2025 depends on several factors and is subject to uncertainties related to macroeconomic conditions, bunker prices and ocean freight rates. All else being equal, sensitivities for 2025 related to four key assumptions are outlined in the table below.

Annual Report Available: Maersk

Annual Report Available: Maersk