Hims & Hers Health launched a compounded oral semaglutide pill as a low cost alternative to a major weight loss drug. Novo Nordisk responded by accusing the company of illegal mass compounding and threatened legal and regulatory action. The dispute centers on patient safety, intellectual property, and how compounded GLP 1 weight loss drugs are marketed and sold.

Hims & Hers Health (NYSE:HIMS), trading at $24.4, is moving aggressively into the weight loss drug category, a high profile area for both telehealth and traditional pharma. The stock has seen a 189.4% gain over 3 years, although it is down 27.0% year to date and 42.2% over the past year. This frames the new product launch against a backdrop of recent volatility.

For investors, the clash with Novo Nordisk brings legal, regulatory, and reputational questions to the forefront, alongside potential customer demand for lower cost weight loss options. The outcome could influence Hims & Hers pricing power, product mix, and its position in the broader GLP 1 weight loss market, so this is an area that may warrant close monitoring in upcoming disclosures and management commentary.

Stay updated on the most important news stories for Hims & Hers Health by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Hims & Hers Health.

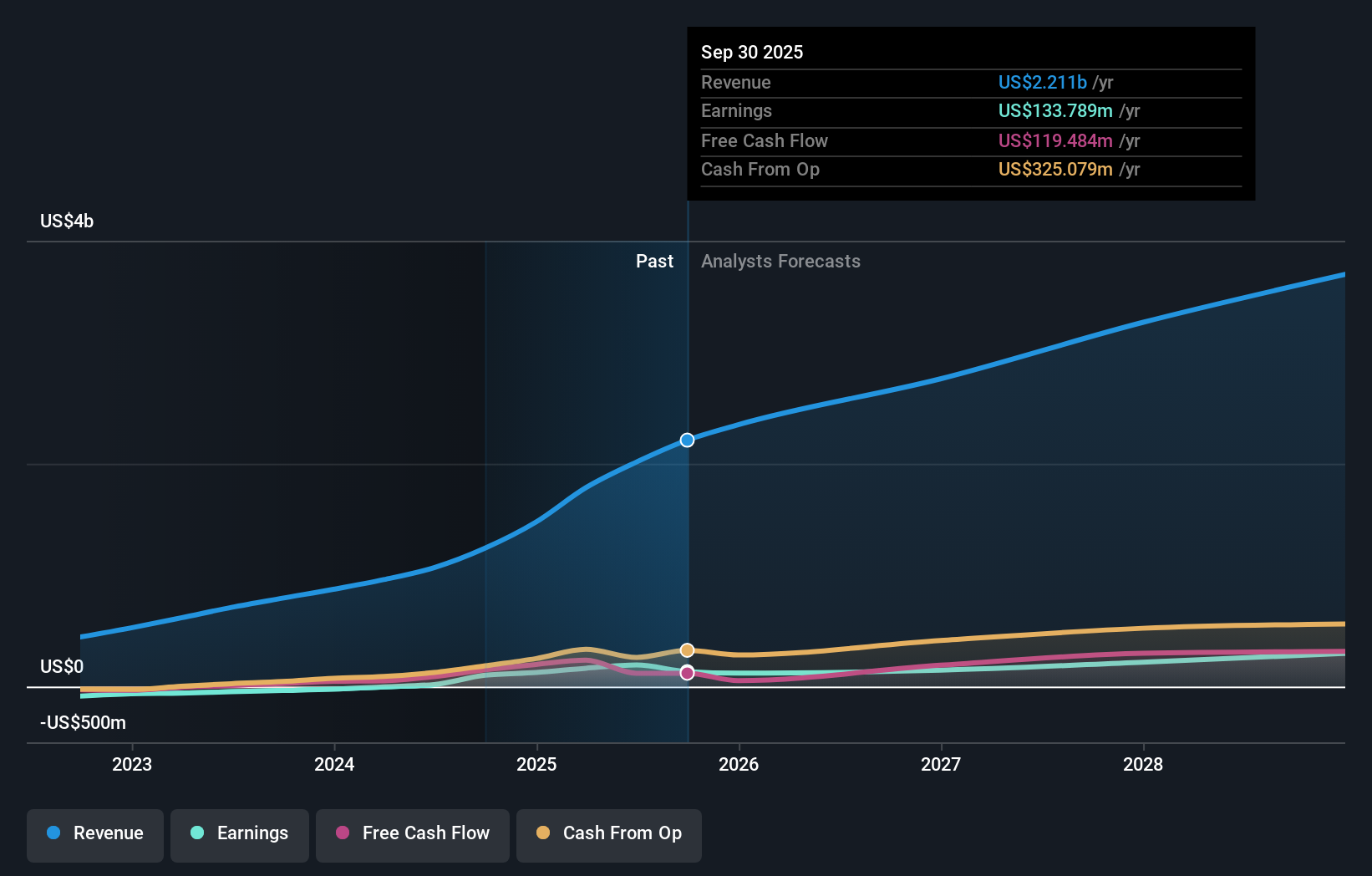

NYSE:HIMS Earnings & Revenue Growth as at Feb 2026

NYSE:HIMS Earnings & Revenue Growth as at Feb 2026

How Hims & Hers Health stacks up against its biggest competitors

The compounded semaglutide pill pushes Hims & Hers deeper into high-demand weight loss, using its telehealth, pharmacy, and fulfillment footprint to offer a needle free option at a headline price of US$49 for the first month, then US$99 on a multi month plan. For you as an investor, this pits the platform more directly against big pharma players like Novo Nordisk and Eli Lilly, but with a consumer-first, subscription model that leans on convenience, price, and bundled care.

How This Fits The Hims & Hers Health Narrative

This launch lines up closely with the existing narrative that Hims & Hers is building a broad, end-to-end, personalized health platform rather than a single category pill seller. The compounded pill, labs offering, and cancer test all point to the same pattern, using its growing infrastructure and customer base to widen into prevention, diagnostics, and chronic condition management on one subscription style platform.

Risks and Rewards Investors Should Weigh ⚠️ Legal and regulatory uncertainty around compounded GLP 1s, especially with Novo Nordisk alleging illegal mass compounding and safety issues, could affect future availability, costs, and brand reputation. ⚠️ Heightened scrutiny from the FDA and potential IP disputes may increase compliance spend and reduce the economic appeal of compounded products if rules tighten. 🎁 The low entry price point and telehealth model may help Hims & Hers attract more customers who are priced out of branded GLP 1s from Novo Nordisk or Eli Lilly. 🎁 Expanding the weight loss portfolio alongside labs and early cancer detection can deepen subscriber engagement, which may support cross selling and higher revenue per customer over time. What To Watch Next

From here, key signposts will be any formal legal or regulatory actions from Novo Nordisk or authorities, how Hims & Hers addresses safety and quality concerns around compounding, and whether management calls out early demand, churn, or pricing updates for the new pill in upcoming results. If you want a broader context on how this product fits into the long term story, check community narratives on the company’s page to see how different investors are thinking about Hims & Hers now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com