027 by roughly 13% and 15%. Even so, it argues DSV’s scale – as the largest freight forwarder – should help it absorb volatility and take share as the industry consolidates.

Why should I care?

For markets: Guidance sets the tone.

When a sector leader guides below consensus, the market often resets expectations for the whole group. That shifts the debate from who can ride a volume rebound to who can defend margins through cost control and pricing discipline. It can also pressure smaller rivals, which tend to have less room to absorb weak freight rates or invest through a downturn.

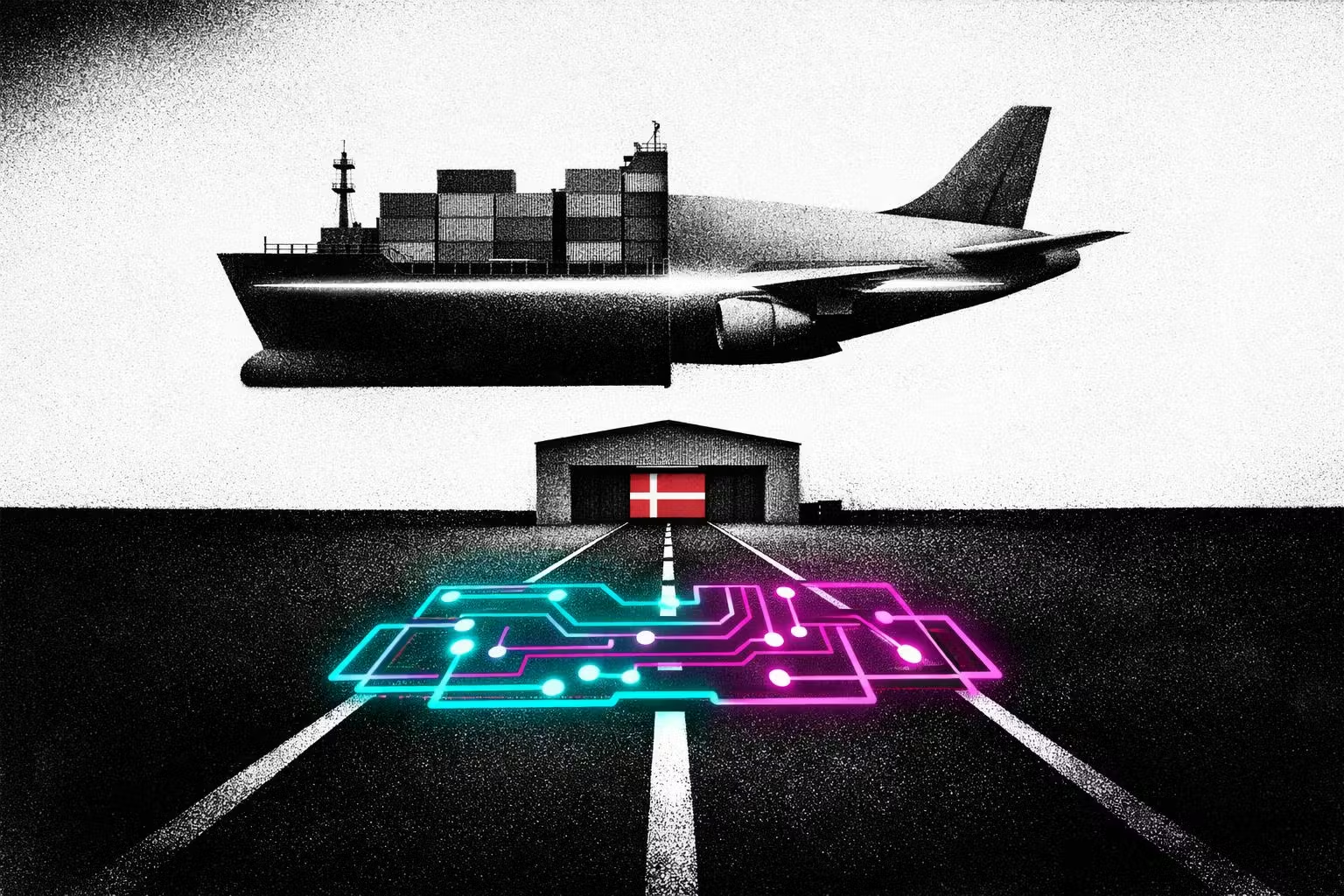

Zooming out: Efficiency tech could favor the biggest networks.

Bernstein sees AI’s near-term role as unglamorous but useful – automating back-office work, improving labor productivity, and maybe sharpening pricing. The catch is that savings are hard to pin down today, so execution risk stays high while forecasts get marked down. If the tools work, large operators like DSV can spread tech spending across bigger volumes, potentially widening the gap with smaller forwarders.