DSV recently broke ground on a new US$14.5 million, 88,258‑square‑meter regional headquarters and logistics facility in Mesa, Arizona, which will consolidate air, sea, road, and contract logistics services and ultimately employ about 160–200 people. By positioning this hub near Phoenix‑Mesa Gateway Airport to support sectors such as semiconductors and advanced manufacturing, DSV is tying its growth plans to Arizona’s expanding high‑tech supply chain ecosystem. We will now examine how this new Mesa logistics hub, closely linked to semiconductor supply chains, shapes DSV’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

What Is DSV’s Investment Narrative?

For DSV, the investment case still hinges on it being a global logistics platform that can convert scale into cash generation, despite currently tight margins, high debt and a premium earnings multiple versus peers. Near term, investors are watching for evidence that earnings can re‑accelerate after recent EBIT guidance was trimmed, and that returns improve from what is still a relatively low ROE. Against this backdrop, the new Mesa facility looks more like a targeted, sector‑specific bet than a thesis‑changer: at US$14.5 million it is small versus the billions in annual revenue, but it reinforces DSV’s exposure to semiconductors and advanced manufacturing, which many investors see as higher‑value freight. The key question is whether these kinds of projects can justify the valuation without stretching the balance sheet further.

However, there is one financial pressure point here that investors should not overlook.

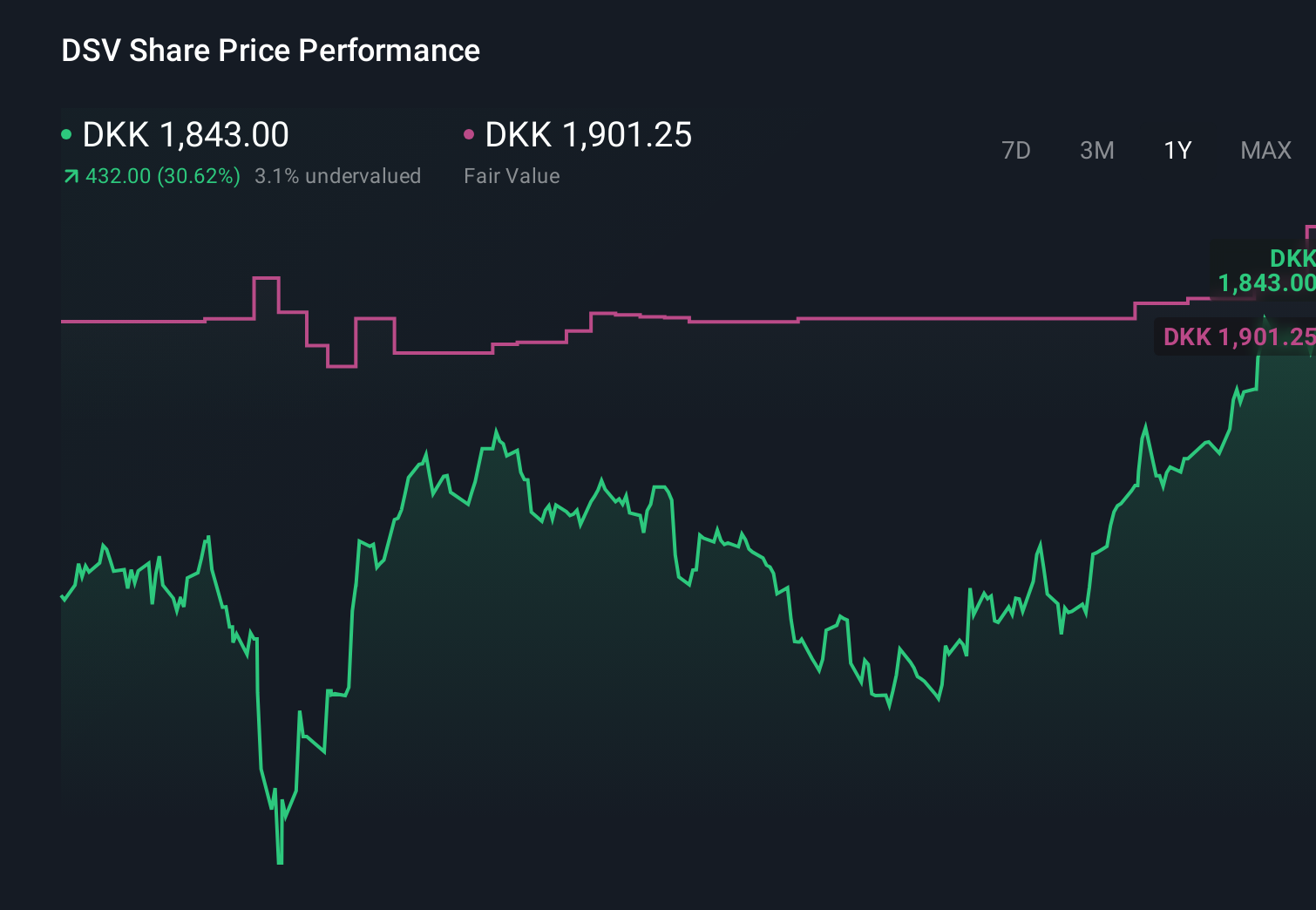

DSV’s shares have been on the rise but are still potentially undervalued by 26%. Find out what it’s worth.Exploring Other Perspectives CPSE:DSV 1-Year Stock Price Chart Five Simply Wall St Community fair value estimates span roughly DKK1,400 to DKK2,400, underlining how far views on DSV differ. Set against this wide range, the Mesa semiconductor hub adds fresh optionality but also reminds you that execution, not footprint, will be central to future profit quality and balance sheet resilience.

CPSE:DSV 1-Year Stock Price Chart Five Simply Wall St Community fair value estimates span roughly DKK1,400 to DKK2,400, underlining how far views on DSV differ. Set against this wide range, the Mesa semiconductor hub adds fresh optionality but also reminds you that execution, not footprint, will be central to future profit quality and balance sheet resilience.

Explore 5 other fair value estimates on DSV – why the stock might be worth 20% less than the current price!

Build Your Own DSV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com