Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

Novo Nordisk (CPSE:NOVO B) has publicly challenged Hims & Hers over a cheaper, compounded version of its new oral Wegovy pill in the US.

The company argues that mass compounding of semaglutide in this way is illegal and has raised concerns about patient safety, intellectual property, and regulatory integrity.

Novo Nordisk has signaled potential legal action as it seeks to protect its obesity franchise and the framework around FDA approved medicines.

Novo Nordisk, known for its diabetes and obesity treatments, is at the center of the fast growing market for GLP 1 weight loss drugs. The dispute with Hims & Hers highlights how powerful branded treatments like Wegovy can quickly attract lower cost compounded competitors, particularly when a new formulation such as an oral pill becomes available.

For investors, the confrontation raises questions about how original drug developers will enforce intellectual property and safety standards when lower cost alternatives appear. The outcome could influence how future obesity drug entrants, telehealth platforms, and compounders approach GLP 1 products in the US market.

Stay updated on the most important news stories for Novo Nordisk by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Novo Nordisk.

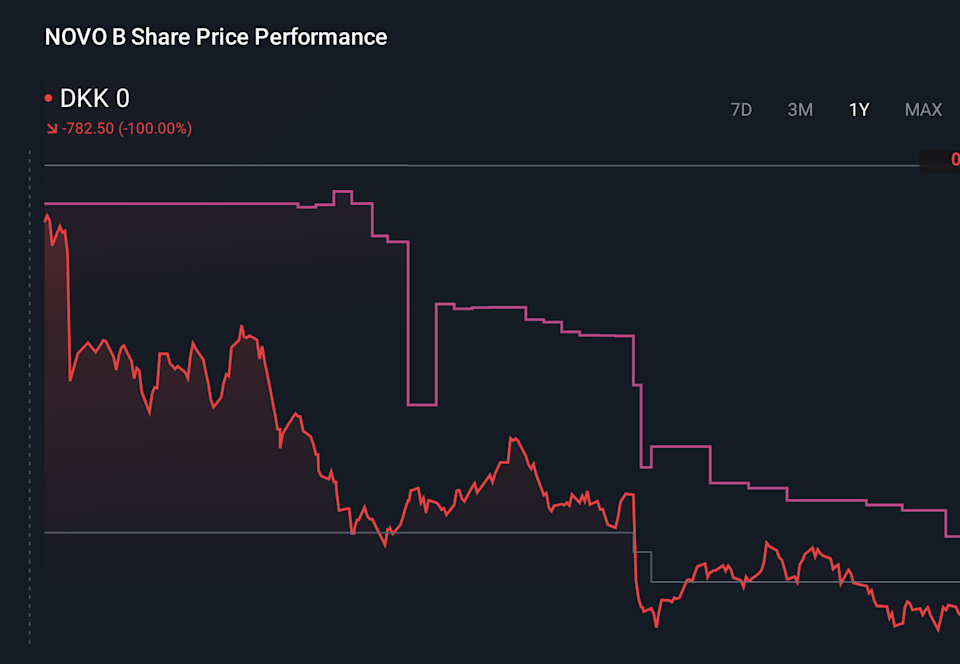

CPSE:NOVO B 1-Year Stock Price Chart

CPSE:NOVO B 1-Year Stock Price Chart

Is Novo Nordisk financially strong enough to weather the next crisis?

Novo Nordisk’s hard line on Hims & Hers fits with its broader push to defend the newly approved Wegovy pill in a US market where pricing pressure, copycat products, and government discount schemes are already weighing on 2026 sales guidance. By framing the dispute around patient safety, intellectual property, and the integrity of FDA approval, the company is not only trying to protect its obesity franchise from cheaper compounded rivals, but also signaling to other telehealth platforms and compounders that it is prepared to contest mass-compounding practices that could undercut its branded pricing.

For investors following long-term narratives that focus on GLP-1 weight-loss drugs as a key growth engine, this legal stance sits alongside several other moving parts. These include the early uptake of the Wegovy pill, pressure from Eli Lilly and potential future entrants like Pfizer, and Novo Nordisk’s efforts to expand its pipeline with drugs such as CagriSema. The response to Hims & Hers shows how protecting the Wegovy brand and oral formulation is becoming just as central to the story as rolling out new products or scaling manufacturing.

⚠️ Risk: Legal action could be costly and prolonged, adding uncertainty around how aggressively compounders and telehealth players can keep pushing cheaper semaglutide alternatives.

⚠️ Risk: If regulators or courts do not fully back Novo Nordisk’s view of “illegal mass compounding,” it may encourage more lower cost rivals and deepen pricing pressure in obesity care.

🎁 Reward: A clear ruling or enforcement action in Novo Nordisk’s favor could reinforce the value of FDA approved products, supporting branded pricing versus compounded copies.

🎁 Reward: Strong IP enforcement around the Wegovy pill and its oral formulation technology could support the company’s ability to invest in next generation GLP-1 and combination therapies.

From here, the key things to track are any formal lawsuits or regulatory complaints Novo Nordisk files, how US agencies respond to its safety and IP arguments, and whether other players such as Eli Lilly or smaller GLP-1 developers face similar compounding challenges. If you want to see how different investors are thinking about these legal risks and the long term obesity opportunity, check out the community narratives on Novo Nordisk’s dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NOVO-B.CO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com