Discovery Silver (TSX:DSV) is back in focus after reporting its fourth quarter and full year 2025 production update. The report includes gold output from both the Cordero project and the Porcupine Complex operations.

See our latest analysis for Discovery Silver.

That production update lands at a time when the share price has pulled back 4.8% over the last day but still shows a 30.5% 1 month share price return and a very large 1 year total shareholder return. Taken together, these figures point to strong recent momentum after a steep multi quarter climb.

If this kind of move has you looking beyond a single miner, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With the share price already up 30.5% over the past month and trading only about 3% below the current analyst price target, the key question is whether Discovery Silver is still mispriced or if the market is already factoring in future growth.

Most Popular Narrative: 89.8% Undervalued

According to the most followed narrative on Discovery Silver, a fair value of CA$110 sits a long way above the last close at CA$11.21.

With fully diluted shares (~816M) and using very favorable FS cost (US$12.50/oz AgEq), Discovery Silver has a per-share fair value in the US$30-80/sh range under silver = US$100-150 depending on multiple.

More conservative cost assumptions (e.g. US$30/oz AISC) pull that value down to US$25-55/sh range.

According to RockeTeller, this valuation leans heavily on Cordero hitting its production stride, wide FCF margins, and a rich cash flow multiple that mirrors premium growers.

Result: Fair Value of CA$110 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, this hinges on Cordero reaching those cost levels and production targets, and it also depends heavily on silver prices staying well above current levels.

Find out about the key risks to this Discovery Silver narrative.

Another View: Market Ratios Flash A Caution Signal

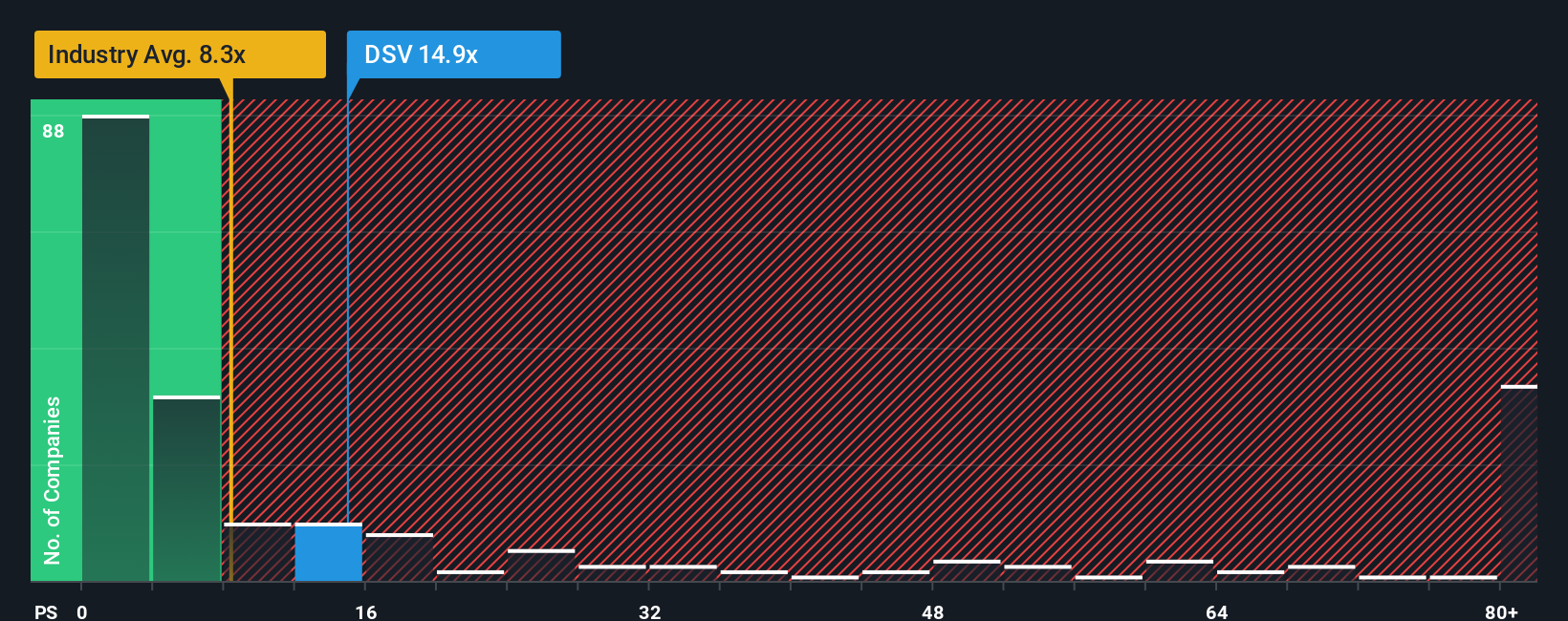

That user-driven fair value of CA$110 sits awkwardly beside how the market is currently pricing Discovery Silver on simple sales ratios. At the last close, DSV trades on a P/S of 17.7x, compared with a fair ratio of 10.1x, the industry’s 9.1x and peer average of 15.2x, which suggests limited room for error if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

TSX:DSV P/S Ratio as at Jan 2026 Build Your Own Discovery Silver Narrative

TSX:DSV P/S Ratio as at Jan 2026 Build Your Own Discovery Silver Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a full Discovery Silver narrative yourself in just a few minutes using Do it your way.

A great starting point for your Discovery Silver research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one stock today, you could miss opportunities that fit your style much better. Use the Simply Wall St Screener to cast a wider net.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com