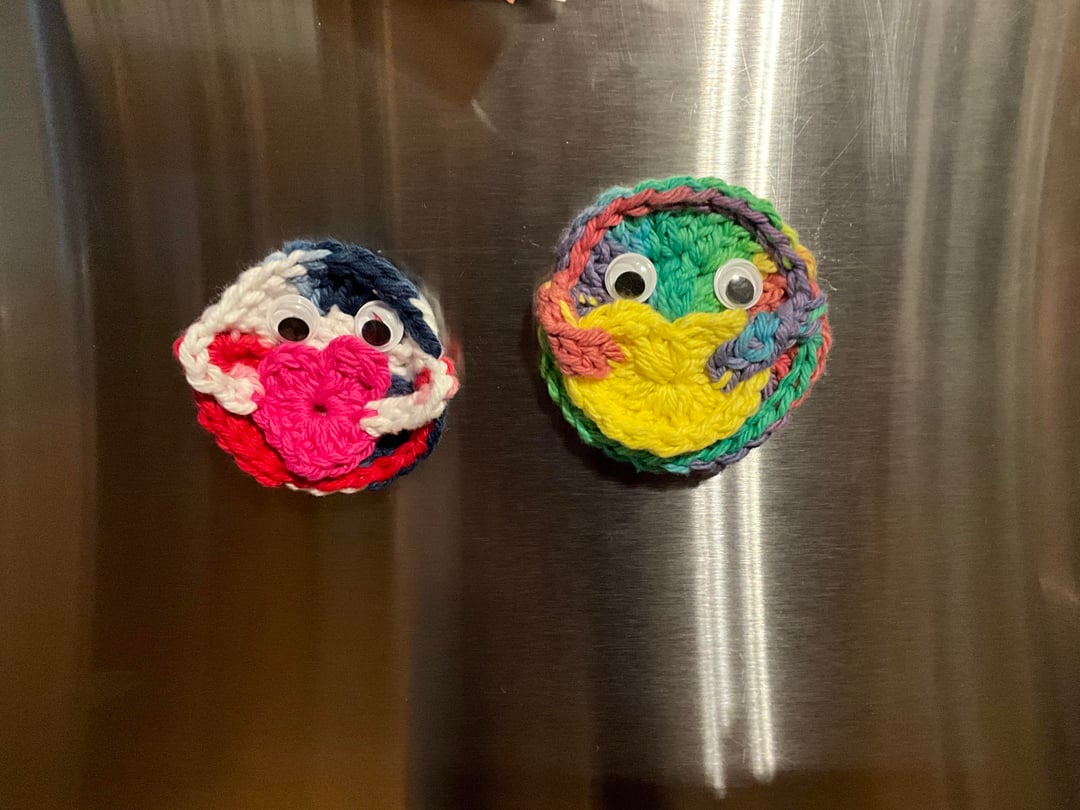

My son lives in Wien and I sent him a tiny package for Christmas. I sent him 2 little crocheted hugs and a hand stitched card (pictured above). He just went to pick it up and they charged him €34. It’s all homemade and has no financial worth. Is it because I mailed it from US? Is there anything he can do to challenge the fee?

Apologies for everything the US government has done, and will do, to Austria. I’m a Canadian citizen living in the US. I would never have voted for him. I don’t have a vote even though I have lived here since 1975. I was 7 when we moved here from Canada.

Thanks for listening.

—

sglanders444

5 comments

It’s the normal import fee, nothing you can do as far as I know.

Unfortunately, this is normal and not a mistake.

Since July 1, 2021, all packages sent from outside the EU into Austria are subject to import VAT, even if they are gifts and even if the items are handmade and have no commercial value. The only gift exemption is for private-to-private gifts under €45, and even then the customs declaration must list a realistic material value. If no value (or “no value”) is declared, customs will estimate one.

Your son can try to challenge it by asking for a reassessment and explaining that it was a private gift with very low material value, but realistically:

VAT is rarely waived completely

The handling fee is almost never refunded

For future packages, it helps to clearly mark them as “gift/handmade items” and declare a low but non-zero material value (yarn, fabric, etc.), ideally under €45.

It should be free as far as I can see.

I do know that postal workers may still charge a handling fee.

Please Translate this:

„Für private Geschenksendungen besteht die Abgabenfreiheit bis zu einem Warenwert von 45 Euro. Private Geschenksendungen sind Warensendungen von einer Privatperson aus einem Nicht-EU-Staat an eine andere Privatperson in der EU, wenn sie

gelegentlich erfolgen,

sich ausschließlich aus Waren zum Eigenbedarf zusammensetzen und nach Art und Menge keine Einfuhr zu geschäftlichen Zwecken vermuten lassen und

die Empfängerin/der Empfänger ohne irgendeine Bezahlung erhält.“

https://www.bmf.gv.at/themen/zoll/post-internet/postverkehr.html

The post office charges processing fees and in some cases also storage fees if the custom declarations are incomplete or the value is deemed too low. Without knowing what the customs declaration on the package looked like it’s hard to say what happened in your case. But generally speaking, rip offs like this are common in Austria, unfortunately.

Hello from Vienna,

I had to google it due to not having the exact regulations words in mind. Result:

1. Duty-Free Allowance (The €45 Limit)

Gifts sent from a private person in the USA to a private person in Austria are completely free of taxes and duties if the total value (including shipping costs) is under €45.

2. Costs if the Value exceeds €45

If the total value is over €45, the following charges apply:

– Import VAT (EUSt): Usually 20% of the total value (items + shipping).

– Customs Duty: Only applicable if the value exceeds €150.

– Handling Fee: The carrier (e.g., Austrian Post) usually charges a service fee for customs clearance (approx. €12 to €15).

3. Key Requirements for “Gifts”

To qualify for the exemption, the shipment must meet these criteria:

– Private to Private: Sender and receiver must be private individuals (no companies).

– Occasional: The shipment must be for an occasion (like Christmas).

– No Payment: The recipient must not pay for the goods.

– Declaration: The package must be labeled as a “Gift” with a detailed list of contents and their values on the customs form (CN22/CN23).

I assume you did not fill out the declaration?