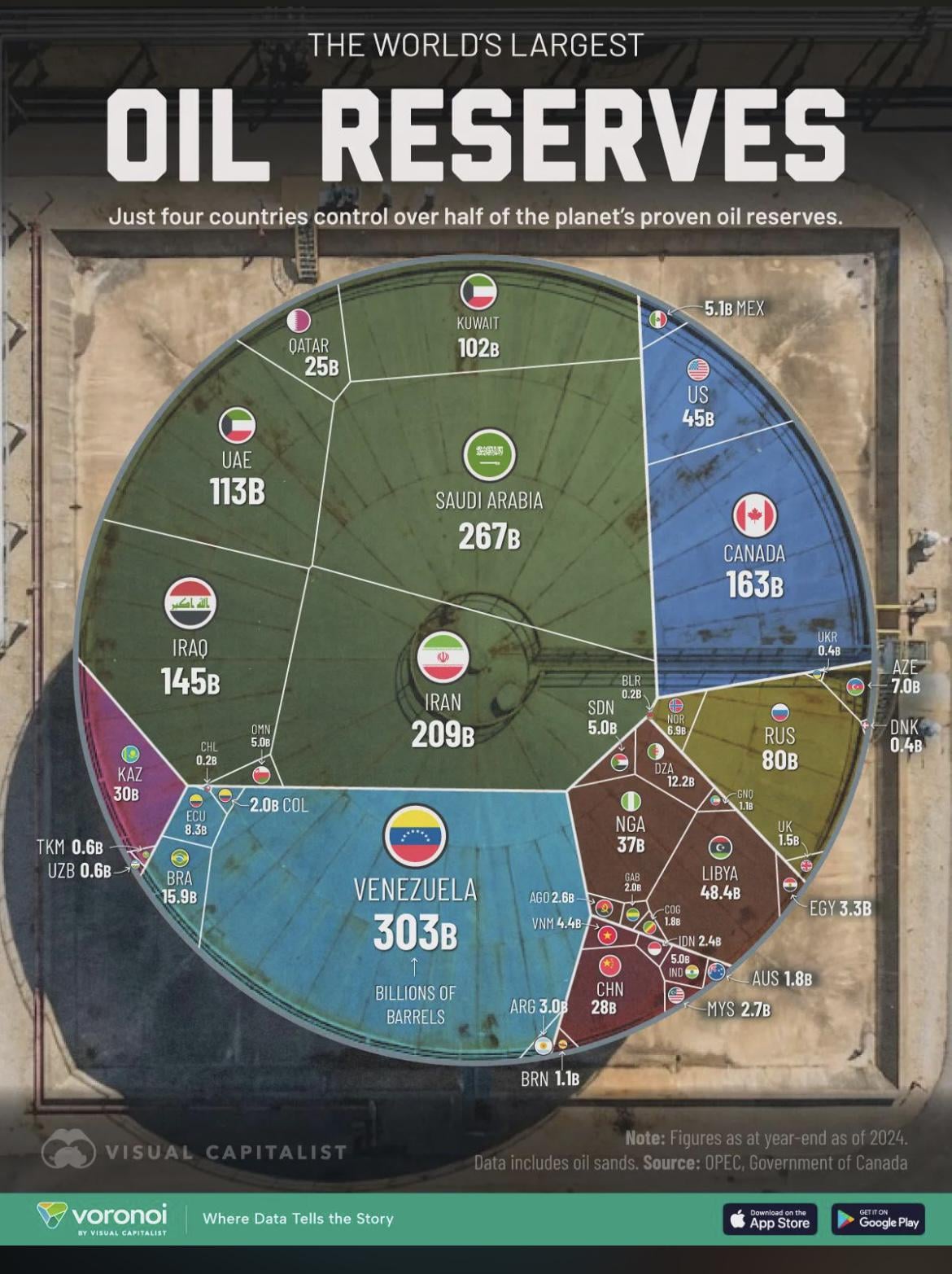

Serious question, why is Norway so rich with so low oil compared to the rest (not necesarilly Venezuela or Iran as I know the regimes are awful there, but Canada? )

—

Sugar_Vivid

Serious question, why is Norway so rich with so low oil compared to the rest (not necesarilly Venezuela or Iran as I know the regimes are awful there, but Canada? )

- 2026-01-02

40 comments

Because Norway puts most of the profits into our sovereign wealth fund, also compared to many other oil rich nations we have relatively little corruption and political stability

Because the state has control of it and its funds.

In other countries private companies got the rights to drill and keep the profits

It’s the sovereign wealth fund which makes it richer than other countries. They’ve managed and invested the oil money very well.

Because Norway’s oil wealth is mostly put into a fund, not spent. Norway’s “active” wealth comes from what is left of wealth distribution policies. Also tiny population.

Low population, we’ve, mostly, avoided Dutch disease, we’re a stable country, and we’ve been planning for the future since the 90s.

Because we have sensible and forward looking government that invest the money into a wealth fund

The state almost immediately introduced a high tax rate on oil extraction after its discovery. Since the 1990s, gas production has increased significantly, but the profits have been placed into a fund that is regularly replenished and well managed. No single company or individual has ever controlled the majority of the revenue. As a result, on paper, the Norwegian state is extremely wealthy.

Because the Norwegian government started a soverign wealth fund pretty much right after they discovered the oil. This fund is actively managed by “Norges Bank”.

Here is a live tracker of the oil fund: [Oljefondet | Norges Bank Investment Management](https://www.nbim.no/no)

Its about 2.1 trillion USD, which in turn “makes” it so each Norwegian has 380K USD.

To clarify this is not money each and every citizen gets, its just a “saying” so to speak.

Norway never sold it’s oil reserves. Companies are given consessions, which secures a good return for the state – which is then largely invested in the oil fund. At present the yield from the oil fund exceeds the oil & gass income by 2-300%. So yeah, right now we’re just a hedge-fund…

Because we have treated our oil as a collective resource, so private companies have not been allowed to secure all of the profits for themselves. (Extra high taxes), as well as having a publicly owned oil company.

Because we tax every operator 72%. And we put it into a wealthfund and very marginally invest it and barly beats the index.

Tax is the key… the tax makes us so rich from oil

A secondary point, perhaps, but alot of Canada’s oil isn’t as accessible like North sea oil. Its costly and not as profitable to extract petroleum from oil sands of which Canada has plenty.

The role of Farouk Al Kasim should not be underplayed. This Iraqi geologist came at the exact right moment and with first hand knowledge about how the oil companies operate, he was vital in laying the legal foundation for hindering the oil companies in literally screwing Norwegians completely over.

[Farouk Al Kasim](https://FaroukAlKasimhttps://share.google/HwCf4lXoN5C0s3l2t)

Saudi princes turn 747 into private jets, we tax the extractors to redistribute the wealth. Simple as that.

Norway has the *crazy* belief that the nations resources should belong to the people of that nation instead of being gifted to billion dollar multi nationals.

Well done Norway. 🇳🇴👍

me: Looking at how Australia gets stitched up by Chevron, Santos, Exxon and Woodside. It hurts to see such poor mismanagement and corruption by our government …and doubly so by seeing the general apathy of Australian people.

Because it didn’t let private / foreign companies rob its off its wealth, and it saved the wealth instead of spending it on consumption right away (like Iran did, for example).

Because oil production and oil reserves are not the same thing

When this started we were 3-4 million people in Norway. So we have quite a lot per capita.

Then the state have direct ownership in (all) licenses, typically 20-30%.

And there is a special profit tax, you get cash refund for investments, but pay a high tax for profits. So total tax for oil profit is 78%. Very much goes to the state, but it’s still extremely profitable for the oil companies.

And finally, all income from oil profit goes into a fund. Tax income may not be used by the government, only the dividends from the fund. This prevents varying governments from doing stupid shit just because we are so rich.

Most answers here are missing the mark. The answer is not mainly policy driven (i.e. sovereign wealth fund albeit that it contributes with significant returns), but that the chart shows 2P reserves and not cumulative historical production per capita. The Norwegian petroleum industry is mature and we have extracted most of the value already and with a small population, that provide significant value per capita.

I just wanted to add a small detail, the chart shows the oil that is left, not the oil that has been sold.

We save the profit.

We are not rich compared to other countries. We have a small population, so the government is rich per capita.

A lot of people rightly points out that Norway has had a smart system that ensures most ofte profits stay in the country, and that much of it (not all!) is saved rather than spent. Plus a small population and low corruption.

But the other part of it is simply that Norway never had reserves as large as those other countries, most of the found oil is already out of the ground.

Oil production peaked in 2001, oil/gas combined in 2004. Gas has not peaked, but has much more variable profitability, although high since Russia started that war.

The other large oil exporters just have much more left over.

Look at the other Scandinavian countries. They rank among the richest in the world with no or very limited oil (Denmark has a little). If you add 500 billion Norwegian kroner on top of that in oil income each year, you get one of the world’s richest countries.

Off topic, but its easy to understand why the US is pursuing regime change in Venezuela and Iran from that infographic

Well 1 its mostly gas, not oil. Piped straight into the most lucrative market for gas: western europe.

Secondly we are a smaller country, so divided by our population it is a lot.

Then how we used this wealth is different than most, we did not directly use it. Instead invested the state revenue gained from petro (all of it). And we have done this since 1990. Then invested it into a fund (global fund) so not invested directly into the local economy or spent on infrastructure/ building projects etc.

From that again, only a % of the fund is withdrawn and used for government expenses (state-national budget). This % is then regulated, capped at 3% now – has shifted somewhat, but regulated so that it is lower than the interest gain generated by the fund. (So that the fund is always growing, nothing is really taken out). That is the idea, during bad years: global recessions/ large market adjustments the fund may still lose some value: but this is very rare.

As it is right now we withdraw ~2.7% of the oil fund (it grows about 6-6.5% every year on average). This 2.7% then again represents now ~20% of the state budget. So with it we can pay for 20% more (roughly) than if we only had our tax/tariff income. So in large part, like the other nordic nations, it is our high taxes that fuels the economy/state. The petro money is used just like well extra butter on the bread in a sense.

Now if the oil fund was 5 times larger: we could actually not have need of any taxes (and retain the same state expenditure as we do now). Not that this is very likely, more probable we would grow the state budget then so still rely on taxes.

And yea we could double the withdrawals up to 6% and have 40% of the budget funded, so lower our tax base. While still having the fund mostly grow year over year. But it is riskier so not put in effect. Still there is some discussion from time to time about raising the cap. Perhaps not quite that much but 4/5% had politicians argue for that.

Low corruption, and the oil money has been used in a smart investment strategy

We gotta…. “bomb Venezuela”

Our money doesn’t come from oil and gas, but from the stock market. Of course, those investments were initially based on petroleum income, but somewhere around 75% of the wealth comes from the stock market. That’s what we did differently; the Norwegian oil and gas reserves belong to the people and is sold to extractors through a special tax of 78%. None of that revenue is spent, but is instead sent directly to the fund. Then every year we allow ourselves to use the expected ROI, which we have now defined as 3%. This has multiple benefits; first, it means that our economy is independent of the petro markets since we don’t use any of that money. But because we’re cautious, it also means that we generally spend less than the _actual_ ROI, which means the fund is snowballing slightly on its own. But a very big one is that because we do it this way, we have no national debt and that means we don’t pay interest on national debt, allowing us to keep more of our money in the country.

Just to be clear; we do technically have national debt, but that debt exists for two purposes; to keep relations and connections alive between different countries, sort of like monetary diplomacy. But the reason I don’t consider this to be debt is that the money is just invested in the markets where it generates more income than we pay in interest. That means it’s not a cost but an income. So it’s like leveraging the market. But that is not the purpose; the purpose is to maintain relationships.

But in summary it is the fund that makes Norway insanely rich, not the oil. There are countries in Africa that could do exactly what Norway has done and become wealthy nations. But it is difficult because it means that a couple of generations would have to forego the wealth for the sake of future generations. That’s not an easy thing to do.

A lot of people mention how the oljefund and high taxes on oil are the reason, which is true, but it’s not the whole story. I think an important part that often gets forgotten is that Norway was *already* very rich when it struck oil in the 60s and 70s, it was also *already* a robust democracy.

As opposed to a lot of other oil-rich countries in the Gulf or around the black sea who had mostly pre-industrial agrarian or pastoral economies when oil was found a lot earlier than the 70s, and who were then completely squeezed by Western companies to exploit the resource.

If someone says that oil&gas is the only reason Norway is rich, they are wrong. One of the main reason is how we distribute our wealth and how we have built a relatively open political system compared to other countries, leading to high trust rate and a system that focuses on benefitting their people instead of a party or certain individuals (for the most part). I would recommend looking up the nordic model and read the history about our hydropower – the oil & gas industry is inspired by the same history – the wealth of our resources shall mainly benefit the people, not a few companies.

Lots of good answers but some

stuff to be considered:

1) you have to look per capita wise. It’s not that different then. Canadas O&G industry only contributes to less than 5% of the GDP.

2) cost of extraction plays a big role, the Middle East is not only rich because it has a lot, but also because it costs nearly nothing to explore, so profit margins are super high, deep sea oil is much more expensive to explore, but also created an entire supporting industry that exported it tech globally (I.e. lots of Norway companies operate in Brazil’s such as Aker Solution).

3) Norway would be a rich country even without oil, it’s a Scandinavian country after all, located in Europe, with rich neighbors and top education, probably would be slightly worse off than Sweden, Finland and Denmark due to not so many top/global companies, but would be above countries like Germany/Lithuania, the oil is more the cherry on top.

4) define rich, Norway is still behind Switzerland, Lux, etc that have basically no natural resources, just high tech industries and services, and not too far off Denmark for example. It’s a rich European nation, but not an outlier.

5) it’s very rare that Oil made countries rich, Middle East is basically the outlier due to the insane amounts per capita, but in general that’s not the case around the world, it’s worth reading a bit about the Oil Curse, and Norway did very well (with the Fund, etc) in order to have an opposing (positive) effect.

I’m surprised quality of oil has not be mentioned. Not all oil reserves are the same. Some oil is relatively easy to extract, comes out hight grade and is readily processed. Norway, Saudi Arabia, some of the US reserves, and others are high grade reserves which more or less just flows out of the ground. Most oil is much harder to get and process. Much of Canada’s oil reserved are in the tar sands, and it takes a lot to extract the oil and process it into useable products. US’s fracking is another example, the gas is generally good quality, but you need to frack and the drilling is more complicated. Another example is there are some oil fields off the coast of Brazil that the oil is essentially like peanut butter, it takes a lot of work to extract and process that oil, and at the current market, it would cost more to do so that it would be worth. There was a time about 20 years when oil companies were setting up to start extracting off of Brazil, irc some even put in some wells, but that was when oil was over $150/barrel.

Also remember Norway only have 5,6 million people lol. Do the math, Norway is rich devided by those people.

Just a few idea off the top of my head.

This is oil not natural gas which Norway also has a lot of.

This is proven oil reserves not oil production.

The quality of oil could be a factor, Venezuela and Canada for example have very heavy crudes that cost more to refine.

Norway has an easy cheap path to a large market being offshore and in Europe.

Norway has been incredibly smart in their management of resources and investing so much back into their country and sovereign wealth fund.

Also: Norway is rich in _gas_, not only oil

Because we had a lucky Iraqi that showed how the Norwegian government could show American interests the finger. Also lower corruption index.

it is the fund that norway created after discovering oil and the fact that it has a population of just 5.5 million.

In adition norway has gas.

Because Norway keeps most of its oil profits instead of letting them be stolen by private capital.

Good fiscal management, low population, low government corruption, high priorities on education, healthcare and public welfare.