In a high-stakes debate, Ram Ahluwalia and Vinny Lingham weigh gold’s stability against stocks’ growth potential amid rising global debt and uneasy macro conditions.

Gold’s torrid 2025 is making investors wonder if it is the real growth asset moving forward.

(ChatGPT)

Posted October 3, 2025 at 8:46 pm EST.

Gold is often seen as the ultimate hedge, the final port in a storm, and the safest of havens. And many times throughout its 5,000+ year history, it has served this role.

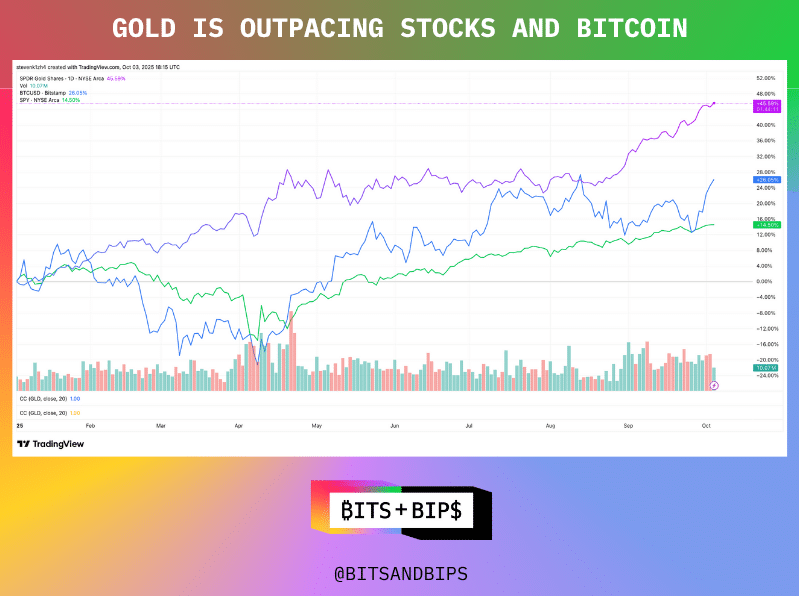

However, some readers may find it curious that gold is outperforming both bitcoin and the S&P 500 this year, despite each of the latter two having set multiple new highs in 2025.

This story is an excerpt from the Bits + Bips newsletter.

Subscribe here to get these updates in your email for free

Golden Demand

Many reasons explain this unexpected result, including growing demand from central bank balance sheets as they move away from treasuries, passive purchases around the world — namely in China — and increased uncertainty about the global economic climate as a result of President Trump’s transformative trade policies.

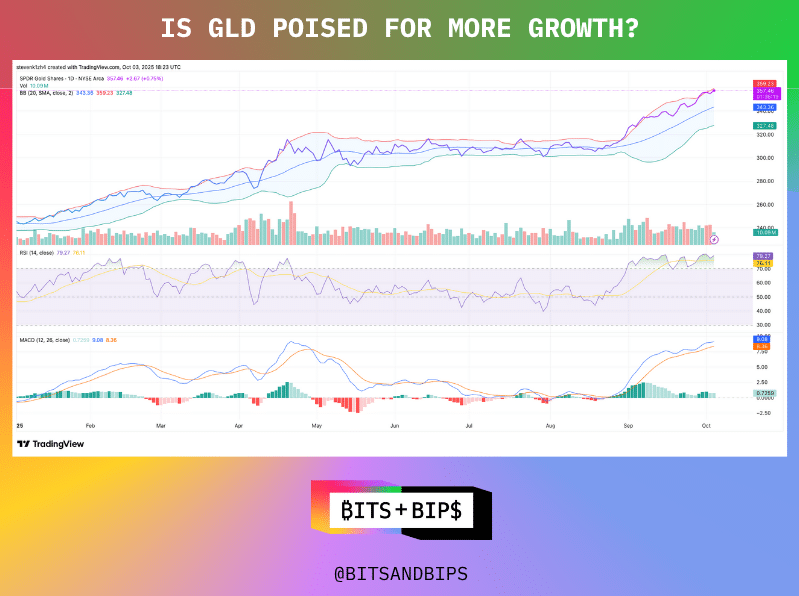

But as any seasoned investor knows, past performance is not indicative of future results. In fact, gold’s technical chart tells a conflicting story. On the one hand, its Relative Strength Index suggests overbought territory. But steady volume for GLD (the largest gold ETF) and widening Bollinger Bands indicate a consistent though perhaps slowing bullish trend. Gold bulls are expecting this trend to continue and predicting $5,000 an ounce.

Read more: Bitcoin Kicks Off ‘Uptober’ With Rally Past $121,000

Can they be right? And if so, what does this mean for stocks?

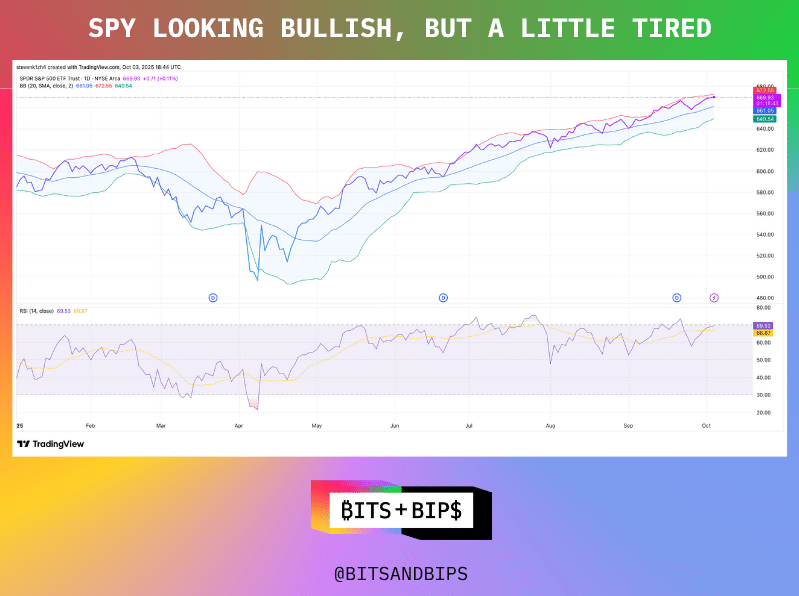

SPY Flying High

Much like gold, indices like the S&P 500 and Nasdaq 100 continue to set highs. A lot of their bullish momentum comes from perhaps overblown concerns about Trump’s tariffs, and a healthy dose of optimism regarding artificial intelligence and future productivity across industries. Truth be told, AI hopium is writing some big checks that will need to be cashed in the coming years.

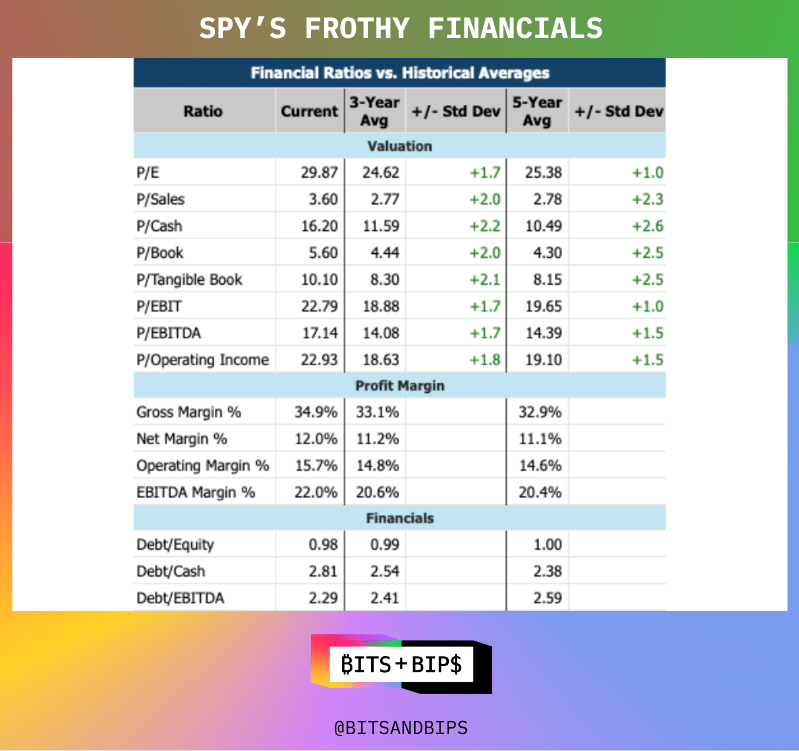

The following chart shows how the index’s financial valuation metrics could show some overheated territory.

As does its price chart.

But at the same time, these companies are still earning healthy margins. Can they continue? Is a crash coming? Would it be better to get ahead of this reversion through gold?

Gold vs. Stocks

Nobody knows the future, and there are valid reasons for each asset class to outshine the other. But we wanted to move the conversation along. So on Oct. 2, Unchained’s Bits +Bips podcast hosted a special debate between Ram Ahluwalia from Lumida and Vinny Lingham from Praxos Capital Management.

Read more: Tether Launches Omnichain Gold Stablecoin on TON

Vinny played the role of the gold bull, while Ram advocated for stocks. And while they walked away with a healthy appreciation for each other’s viewpoints, they stuck with their convictions.

So much so that they made a $10,000 bet on which asset would outperform between now and July 4, 2026.

Check out the full video for yourself and see who you thought won.