BTC crossed $125k for the first time over the weekend as markets rose across the board last week. Following BTC’s latest record run, we’re exploring BTC’s price drivers and price discovery mechanisms. In particular, we look at the role of spot exchange-traded funds on prices, questioning a common assumption that they are the main driver of BTC’s price.

- Bumper week for BTC ETFs

- Why flows don’t necessarily signal price changes

- The importance of market structure improving

Trend of the Week

Despite the latest U.S. government shutdown, markets are buoyant across the board. Broad based equity indices are near all-time highs, as is gold and now so is BTC. Its latest rally leaves it up over 160% since the launch of spot ETFs in January 2025.

Last week, the spot BTC ETF cohort took in more than $3.2 billion, with just over $1.8 billion coming directly from BlackRock’s IBIT. This follows a pattern: in January, May, and July, spot ETFs recorded net inflows in excess of $2 billion each time as BTC set new record highs. This raises a question that has been persistently asked since the launch of these products: is Wall Street driving BTC prices?

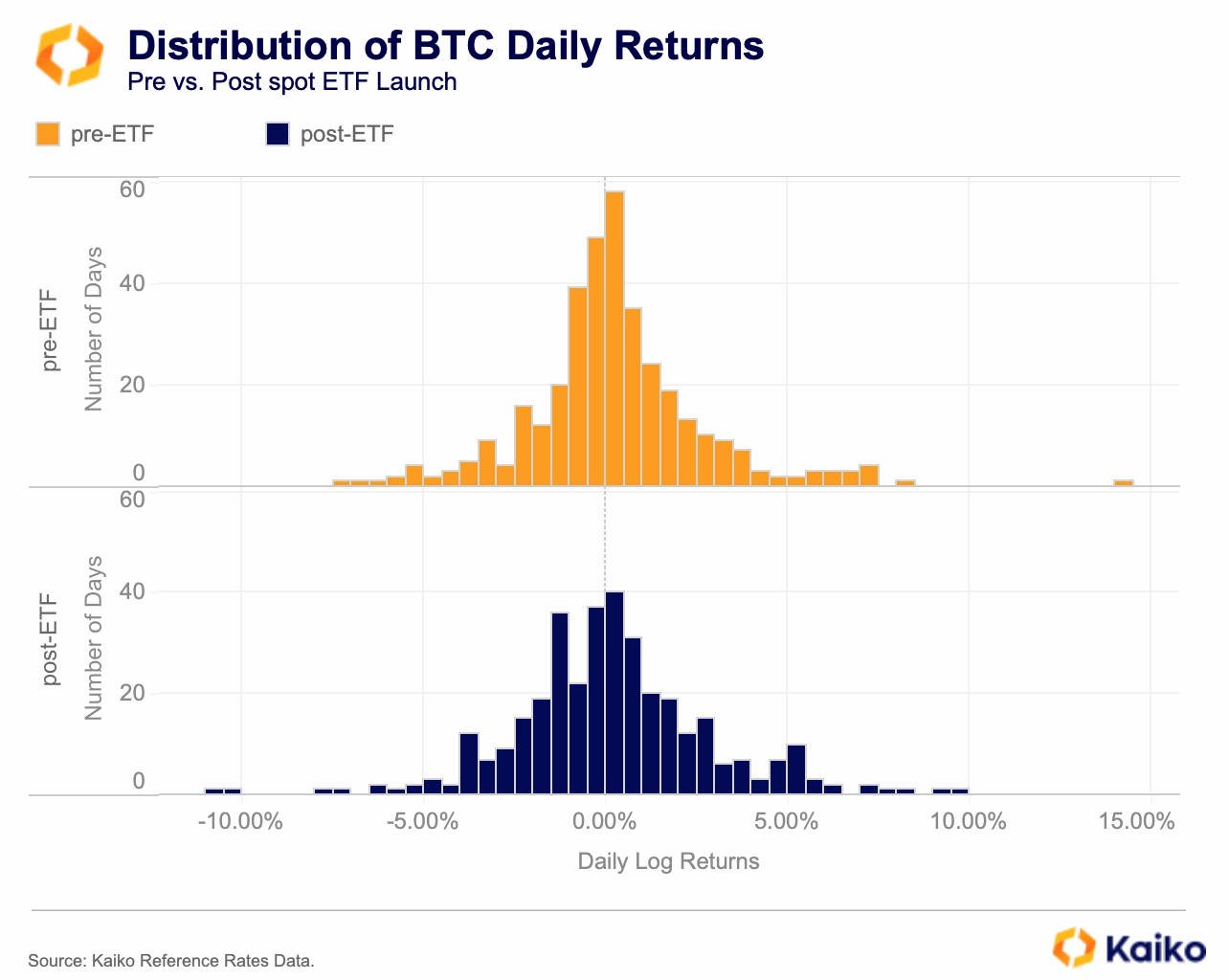

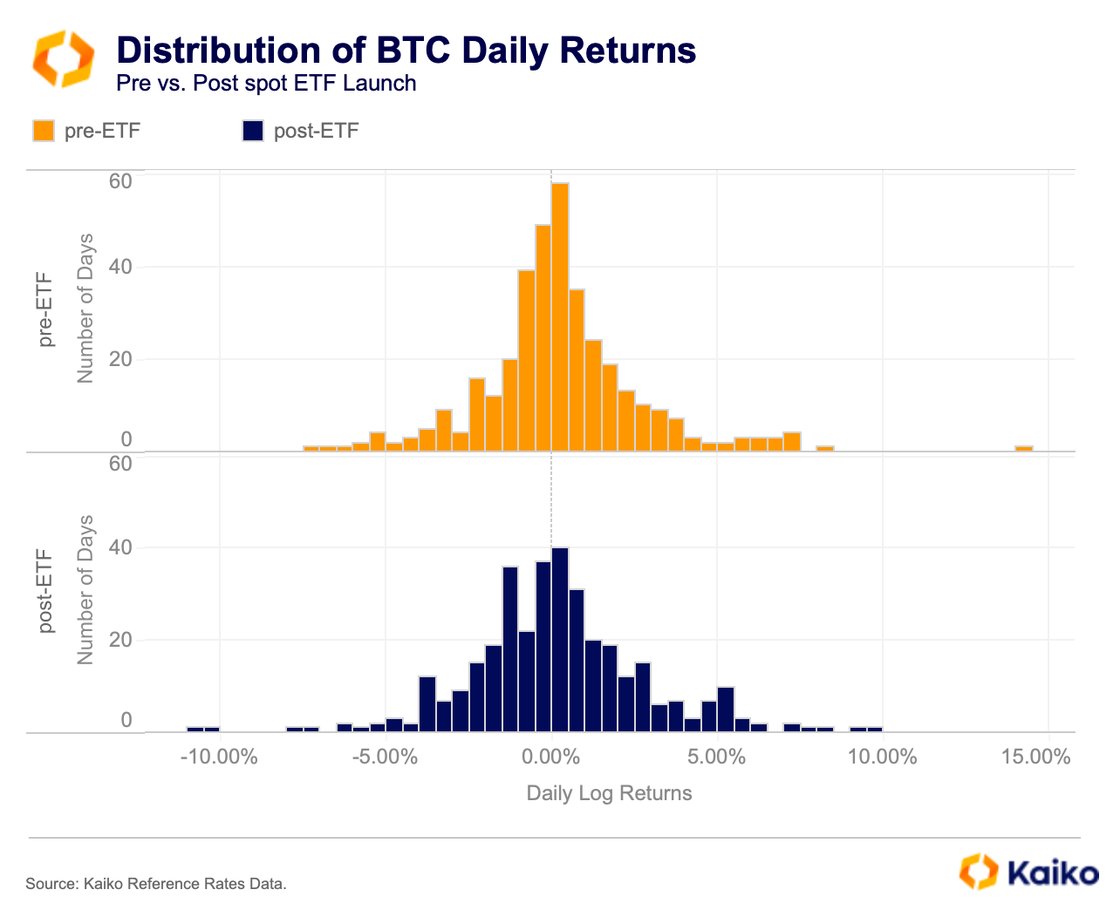

While our research shows there’s been more extreme returns since ETFs launched, and a higher probability of large returns, the products alone aren’t driving returns.

We explore the statistical significance of ETFs, why liquidity matters, and encouraging signs in the options markets in the full report. Sign up below to read more.