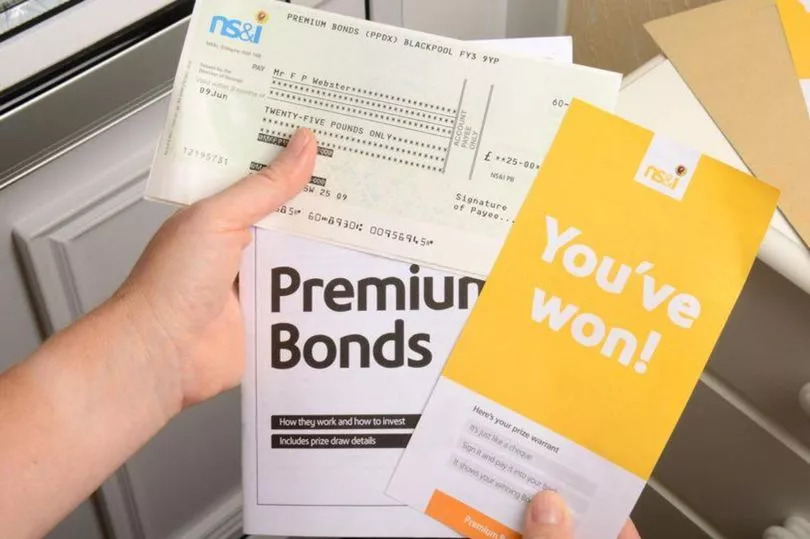

Premium Bonds savers who are state pensioners have been warned their savings could be better off elsewhere. National Savings and Investments (NS&I) Premium Bonds prize rate has fallen from 3.8 per cent to 3.6 per cent.

Rosie Hooper, chartered financial planner at Quilter Cheviot, said the chances of winning are “relatively low”. She said: “For some, it’s less about returns and more about the enjoyment and peace of mind they offer.

“That said, Premium Bonds aren’t the most effective way to grow your money over time, particularly if you are young.” She said: “In later life, however, Premium Bonds can still play a valuable role.

READ MORE Pensioners urged not to withdraw money in ‘panic’ before November change

“They’re capital secure, easy to access, and any winnings are tax free. For someone living on a fixed income, they can act as a flexible emergency fund that provides both financial security and a little monthly excitement.”

It comes as The Economic Secretary to the Treasury has announced that Luke Jensen has been appointed as Interim Chair to the Board of National Savings and Investments (NS&I).

This follows previous Chair, Lord Gerard Lemos CMB CBE, stepping down in July 2025 following his appointment to the Whip’s Office within the House of Lords.

Labour Party Emma Reynolds MP said in a statement: “NS&I plays a key role in delivering cost-effective finance for the Government, and I would like to thank Lord Lemos for his contributions to the Board over the past year.

“I am pleased to welcome Luke Jensen as Interim Chair, to continue to deliver cost-effective finance for the Government and progress its Transformation Programme whilst we recruit for Lord Lemos’ successor.”

NS&I is one of the largest savings organisations in the UK, offering a range of savings and investments. All products offer 100 [er cent capital security because NS&I is backed by HM Treasury.