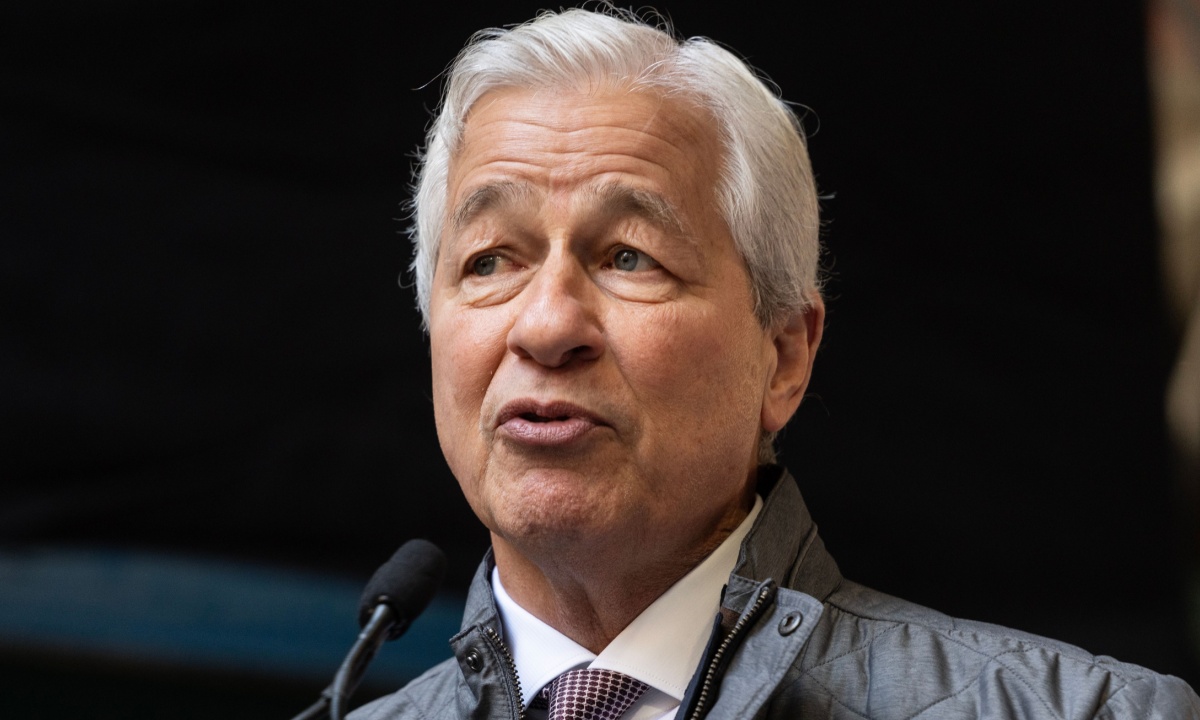

JPMorgan Chase CEO Jamie Dimon declined to rule out the possibility of a recession in 2026, saying Tuesday (Oct. 7) that he will “hope for the best, plan for the worst.”

During an interview with Bloomberg Television, when asked if he is “worried about” the possibility of a recession in 2026, Dimon said: “I think it could happen in 2026. I just, ‘I’m not worried about it,’ is a different statement.”

“We’ll deal with it, we’ll serve our clients, we’ll navigate through it,” Dimon said. “A lot of us have been through it before. You don’t wish it because certain people get hurt, but it could happen in 2026.”

Dimon pointed to positives and negatives that are affecting the economy. He said deregulation, animal spirits and the stimulus in the One Big Beautiful Bill are among the things having a positive impact on the economy. Earlier in the interview, he said geopolitical issues and lingering inflation are among the negatives impacting the economy.

On Sept. 9, Dimon sounded a warning on the economy after revised labor market data showed that fewer jobs had been created than was previously thought.

“I think the economy is weakening,” Dimon told CNBC’s “Halftime Report.” “Whether it’s on the way to recession or just weakening, I don’t know.”

Advertisement: Scroll to Continue

PYMNTS reported at the time that Dimon is known for blunt, cautious prognoses about the economy, consumers and corporate outlooks.

The Conference Board said Sept. 30 that the Consumer Confidence Index fell for the second consecutive month in September, declining 3.6 points to 94.2.

“The Present Situation Index dropped sharply by 7.0 points to 125.4,” marking its steepest monthly decline in a year. Expectations also weakened, with the index slipping to 73.4, a level that “remains below the threshold of 80 that historically signals recession risk.”

The Conference Board said in a Sept. 30 press release that the share of consumers thinking that a recession is very likely over the next 12 months rose to the highest level since May, and that more consumers thought the economy was already in a recession.