Sulfur Market Overview

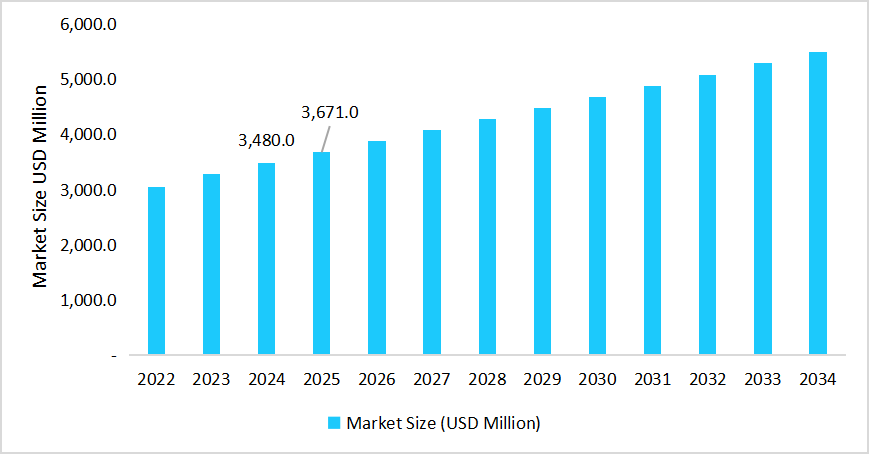

The global sulfur market size is estimated at USD 13.94 billion in 2025 and is projected to reach USD 20.63 billion by 2034, growing at a CAGR of 4.08% during the forecast period. Market growth is primarily driven by increasing demand from the fertilisers, chemicals, and petroleum refining sectors. Additionally, a significant transition toward environmentally green sulfur recovery practices is occurring, propelled by stringent emissions regulations, such as the European Union’s Green Deal and the International Maritime Organization’s Mediterranean SOx Emission Control Area. Industry leaders observed allocating substantial investments to advanced Claus process technologies and innovative by-product utilization strategies, thus achieving reduced environmental footprints while improving operational efficiency.

Key Market Trends & Insights

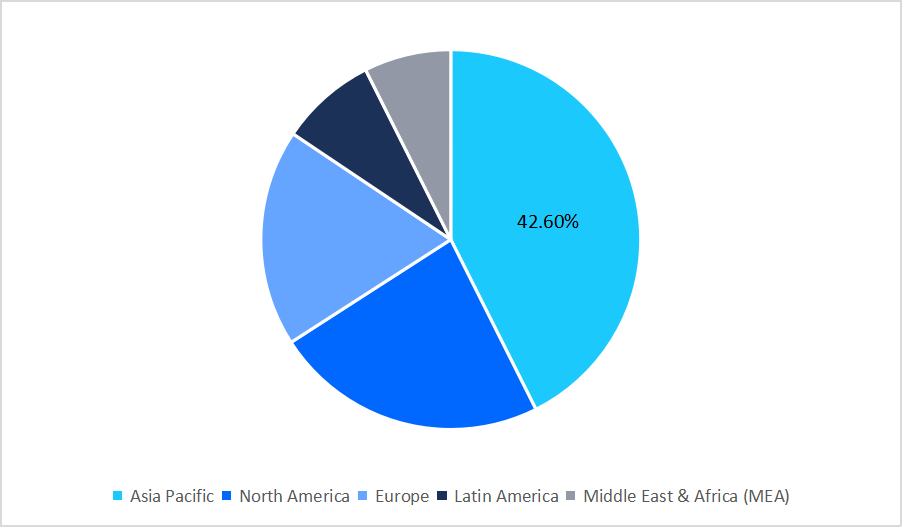

- Asia Pacific led the global sulfur market in 2025, accounting for a share of 42.60% of total revenue.

- North America accounted for 23.3% of the regional market in 2025 and emerged as the fastest-growing region.

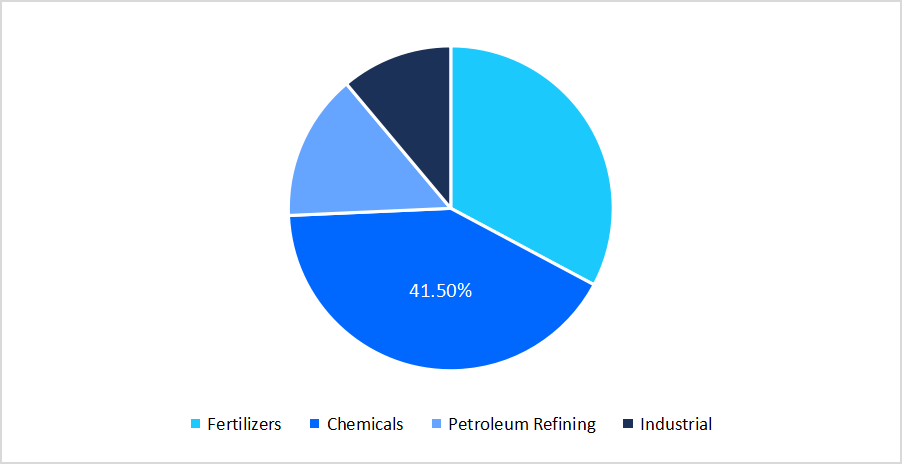

- The Chemicals segment held the largest market share of 41.5% in 2025.

- The Fertilisers segment is projected to record the fastest CAGR of 5.6% during 2026–2034.

- Industrial-grade sulfur dominated the market with a revenue share of 46.8% in 2025.

- China dominated the regional sulfur market with a revenue estimate of USD 3.48 billion in 2025.

Figure: China Sulfur Market Size

Source: Straits Research

Sulfur is typically yellow in appearance and exists in crystalline form or as elemental powder. It is chemically reactive and widely used in the production of Sulfuric acid, fertilisers, and chemicals. Sulfur’s high availability and applicability in agricultural and industrial processes support its use across fertilisers, chemicals, petroleum refining, and industrial manufacturing sectors.

Market Size & Forecast

- 2025 Market Size: USD 13.94 billion

- 2034 Projected Market Size: USD 20.63 billion

- CAGR (2026–2034): 08%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

Latest Market Trends

Strategic Reserves and Localization of Sulfur Supply Chains

Sulfur is considered a critical mineral due to its role in agriculture and chemical production. Countries such as China, India, and the U.S. are implementing local production and stockpiling initiatives to reduce import dependence. For example, India increased domestic Sulfur recovery from petroleum refining and fertilizer production to ensure a consistent supply for industrial and agricultural purposes.

Sustainable Production Practices and Shifting Global Supply Dynamics

Companies are adopting sustainable recovery methods, including Sulfur extraction from petroleum, natural gas, and industrial by-products. These measures reduce environmental impact and secure a stable supply. Countries such as China, India, and Canada are increasing production to meet rising global demand, while Middle Eastern nations remain major exporters due to their petroleum refining capacity.

Sulfur Market Driver

Growing Fertiliser and Chemical Industries Drive Sulfur Demand

Sulfur is a raw material in fertilizer and chemical production. It is used as a soil nutrient in fertilizers and as a precursor in Sulfuric acid production, which is a key input for phosphate fertilizers. With increasing global food demand and intensified agricultural activities, especially in emerging markets like the Asia Pacific and Latin America, Sulfur demand in fertilizer production is expected to rise steadily. According to the International Fertilizer Association, global demand for sulfur-containing fertilizers is projected to increase at a CAGR of 3.8% annually through 2032.

Market Restraint

Impact of Regulatory Frameworks on Sulfur Market Growth

The Sulfur market faces constraints due to environmental regulations on sulfur dioxide emissions and chemical handling practices. Compliance often requires investments in emission control and safety measures. The U.S. Environmental Protection Agency (EPA) limits Sulfur emissions from industrial facilities, and non-compliance can result in penalties. Regulatory requirements may increase manufacturing costs and limit market growth in regions with strict oversight.

Market Opportunity

Expanding Industrial Applications Driving Sulfur Consumption

Beyond fertilizers, Sulfur is used in chemicals such as Sulfuric acid, carbon disulfide, and other Sulfur-based compounds. These chemicals serve sectors including textiles, rubber, pharmaceuticals, and detergents. Industrialization in Asia is expected to increase Sulfur consumption in chemical manufacturing. The National Bureau of Statistics of China reported 9% growth in the chemical sector in recent years, supporting higher Sulfur consumption.

Regional Analysis

Asia Pacific held the largest share of the global Sulfur market at 42.60%, driven by fertilizer and chemical production in China and India. The surge in sulfur-based fertilizers, particularly for high-yield crops like rice and oilseeds, reflects efforts to address widespread soil nutrient deficiencies amid rising food security concerns. Rapid industrialization fuels demand for sulfuric acid in battery manufacturing and metal processing, while stricter environmental regulations push companies toward advanced sulfur recovery technologies. The region’s dominance is propelled by its vast agricultural base and growing investments in green chemical production.

China is the largest producer and consumer of Sulfur globally, with the growth of the fertilizer and chemical industries significantly supporting market demand. The push for sulfur-coated fertilizers stems from the need to enhance crop productivity in sulfur-deficient soils, supporting national food self-sufficiency goals. Additionally, the battery sector’s growth, particularly for electric vehicles, drives sulfuric acid demand. Government policies promoting low-emission technologies and domestic overcapacity in sulfur production encourage exports, positioning China as a key global supplier.

North America Market Insights

North America emerged as the fastest-growing region with a CAGR of 5.1% from 2026-2034. In North America, the sulfur sector is experiencing a robust shift toward sustainable recovery technologies, fuelled by stringent environmental regulations that mandate reduced emissions from refineries and gas processing plants. This drives investments in advanced Claus units and byproduct utilization, transforming sulfur from a waste stream into a valuable resource for fertilizers and chemicals. Additionally, the resurgence in shale gas extraction across the Permian Basin enhances domestic supply chains, fostering export growth to fertilizer-hungry regions like Latin America.

Within the United States, sulfur dynamics are marked by a surge in cleaner extraction methods, propelled by federal incentives for carbon-neutral refining and enhanced sulfur recovery from natural gas operations. This aligns with broader energy transition goals, where sulfur plays a pivotal role in sulfuric acid production for battery materials and clean fuels. The agricultural heartland’s emphasis on balanced fertilization further accelerates uptake, as Midwest farmers integrate sulfur to optimize yields in corn and soybean rotations facing nutrient imbalances. Meanwhile, tariff adjustments on imports bolster local production, stimulating domestic capacity expansions in key states like Texas and Louisiana.

Figure Regional Share in % 2025

Source: Straits Research

Latin America Market Insights

Latin America is witnessing steady growth in the global Sulfur market, supported by agricultural expansion and industrial chemical production. The increasing use of fertilisers to enhance agricultural exports, particularly in soybeans and sugarcane, drives Sulfur consumption in Brazil. Investments in modern farming techniques and fertilizer adoption further reinforce market growth.

Brazil’s sulfur demand is attributed to agribusiness intensification and bioenergy mandates, where the relentless expansion of soybean and sugarcane plantations demands sulfur-enriched fertilizers. This, intertwined with ethanol production targets under the RenovaBio framework, accelerates the sulfur’s penetration into blended nutrients and optimizes yields. Concurrently, mining sector reforms in Minas Gerais and Pará enhance byproduct recovery from copper and phosphate operations, streamlining supply for downstream industries like sulfuric acid for battery precursors.

Europe Market Insights

Europe represents a mature Sulfur market, supported by chemical manufacturing, fertilisers, and petroleum refining sectors. Germany’s chemical and fertiliser applications maintain consistent Sulfur demand, underpinned by the country’s large industrial base and focus on high-quality chemical production.

Germany’s sulfur market is shaped by a strong push for clean chemical production and stringent environmental regulations. The demand is driven by the automotive battery sector and green fertilizer applications for sustainable agriculture. Investments in advanced Claus process technologies are increasing to meet EU Green Deal emissions targets, while industrial applications in metal refining remain steady. The primary driving force is Germany’s commitment to decarbonization and circular economy principles, spurring innovations in low-emission sulfur recovery and utilization.

Middle East & Africa (MEA) Market Insights

The MEA region is a key exporter of Sulfur, driven by petroleum refining activities in countries such as Saudi Arabia and the UAE. Sulfur generated as a by-product from petroleum refining constitutes a major export commodity, supporting regional demand. Government-led expansions in oil and gas production continue to sustain Sulfur supply and consumption.

Saudi Arabia’s sulfur market is expanding due to increased production from oil and gas refining and surging demand for sulfur-based fertilizers and chemicals. The country is enhancing sulfur recovery with advanced technologies to meet global environmental standards, while boosting exports to Asia for agricultural and industrial uses. The key driver is Saudi Arabia’s role as a leading sulfur supplier, leveraging abundant by-product sulfur from its energy sector to support global food security and chemical manufacturing needs.

Application Insights

According to Straits Research, the chemicals segment held the largest revenue share in the sulfur market in 2025, accounting for 41.50%. This is primarily due to its use as a soil nutrient and as a key input in the production of Sulfuric acid, which serves as a precursor for phosphate fertilisers. High agricultural activity in countries such as China, India, and Brazil significantly contributed to this segment’s revenue, reflecting the increasing demand for crop productivity and adoption of modern fertilisation practices. Fertiliser applications remain the leading segment due to government initiatives promoting sustainable agriculture and soil enrichment programs in major producing nations.

Fertilizers emerged as the fastest-growing region for sulfur with a CAGR of 5.32% from 2026 to 2034. The market is thriving due to a surge in demand for sulfuric acid in battery production and green chemical synthesis. The fastest-growing segment is driven by the global push for sustainable technologies, particularly in lithium-sulfur batteries for electric vehicles. Stricter environmental regulations, like the EU Green Deal, are spurring investments in low-emission processes, positioning this segment as the leader in sulfur applications.

Application Market Share (%), 2025

Source: Straits Research

Grade Insights

Industrial-grade sulfur dominated the market with a revenue share of 46.8% in 2025. Growth is supported by its application in chemicals, petroleum refining, and industrial manufacturing, where high purity and consistent quality are essential. Industrial-grade Sulfur is increasingly preferred for chemical synthesis, production of specialty chemicals, and refining operations, reflecting the evolving sophistication and scale of global industrial processes.

Agricultural-grade Sulfur is projected to be the fastest-growing grade with a CAGR of 4.9% during the forecast period (2026–2034). The primary catalyst for market growth is the intensifying need for enhanced crop yields to sustain a global population projected to reach 8.5 billion by 2030, compounded by sulfur deficiencies impacting approximately 40% of arable land worldwide. Agricultural producers are increasingly utilizing sulfur-based fertilizers to optimize nutrient absorption in sulfur-dependent crops such as oilseeds, pulses, and cereals, bolstered by governmental initiatives like India’s Soil Health Card Scheme, which advocates balanced nutrient management. Furthermore, the cost-effectiveness of elemental sulfur and its adaptability in formulations like sulfur-coated urea position it as a critical input, surpassing demand in alternative applications such as chemical processing or metallurgy.

Competitive Landscape

The global sulfur market is moderately consolidated, with major players such as Nutrien Ltd., Mosaic Company, Saudi Arabian Mining Company (Ma’aden), Vale S.A., and Indian Farmers Fertiliser Cooperative Limited (IFFCO) holding significant market share. These companies focus on expanding their market presence through strategic initiatives, including partnerships, capacity expansions, and clean production methods.

Emerging Player: Coromandel International Ltd

Coromandel International Ltd is a key Agri-solutions provider, offering a wide portfolio of products and services across the agricultural value chain. The company began operations at India’s first fertiliser plant in Ranipet, Tamil Nadu, in 1906. Over more than a century, it has evolved by providing customised farm solutions and advisory services.

The trust built over decades has positioned the company as India’s largest private-sector phosphatic fertiliser producer. The company is also a significant player in Sulfur production and the world’s largest neem-based bio-pesticide manufacturer, the leading marketer of organic fertilisers, and operates the country’s largest agri-retail chain with over 1,000 stores.

- March 6, 2025: Coromandel International Ltd commissioned its second sulfur manufacturing facility at its fully backward-integrated Visakhapatnam unit in Andhra Pradesh, which produces 0.12 million tons of complex fertilisers, phosphoric acid, and sulfuric acid annually

List of key players in Sulfur Market

- Nutrien Ltd.

- Mosaic Company

- Ma’aden Mining Company

- Vale S.A.

- IFFCO

- Adani Enterprises Ltd.

- Yara International ASA

- Thiess Sulfur Mining Co.

- Reliance Industries Ltd.

- K+S Group

- SulphChem LLC

- Saudi Arabian Mining Company (Ma’aden)

- Air Products and Chemicals, Inc.

- Occidental Petroleum Corporation

- SABIC (Saudi Basic Industries Corporation)

- PT Petrokimia Gresik

- Fertiglobe

- Freeport-McMoRan Inc.

- Coromandel International Ltd

- Others

Strategic Initiatives

- In June 2025, the Government of India implemented anti-dumping duties on insoluble sulfur imports from China and Japan to protect domestic manufacturers from unfair pricing practices. Concurrently, Flexsys announced a price increase of USD 0.25 per kg for insoluble sulfur in the Indian market, attributing the adjustment to rising raw material costs and increased investments in research and development

- January 15, 2025: Ma’aden, the Saudi Arabian Mining Company, awarded three major construction contracts worth a combined USD 922 million to Chinese and Turkish firms for its third phosphate fertilizer project, known as “Phosphate 3.” This expansion aims to add 3 million metric tonnes annually to Saudi Arabia’s phosphate production capacity

- July 3, 2024: Nutrien Ltd. invested in new Sulfur recovery units to meet the rising fertilizer demand in North America. This strategic move is part of Nutrien’s efforts to enhance its production capabilities and support the growing agricultural sector

Report Scope

Details

By Grade,

By Region.

Europe,

APAC,

Middle East and Africa,

LATAM,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Sulfur Market Segmentations

By Applications (2022-2034)

- Fertilizers

- Chemicals

- Petroleum Refining

- Industrial

- Others

By Grade (2022-2034)

- Industrial-Grade

- Agricultural-Grade

- Chemical-Grade

By Region (2022-2034)

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

The global sulfur market size is estimated at USD 14.68 billion in 2026.

Strategic reserves, localization of sulfur supply chains, sustainable production practices, and shifting global supply dynamics are key factors driving market growth.

Prominent players operating in this market include Nutrien Ltd., Mosaic Company, Ma’aden Mining Company, Vale S.A., IFFCO, Adani Enterprises Ltd., Yara International ASA, Thiess Sulfur Mining Co., Reliance Industries Ltd. and K+S Group.

Asia Pacific held the largest share of the global Sulfur market at 42.60%, driven by fertilizer and chemical production in China and India.

According to Straits Research, Industrial-grade sulfur dominated the market with a revenue share of 46.8% in 2025.