Arvind Krishna, during an interview with CRN, says AI provides the channel with opportunities in customer service, software development and enterprise operations. But the real gains from AI, including a 10x improvement in productivity, are a few years down the road.

IBM CEO Arvind Krishna sees opportunities for partners and customers in using AI to boost customer experience and support, software development, and enterprise system automation. But he also declares that “AI is not magic” and that the real productivity gains are some years down the road.

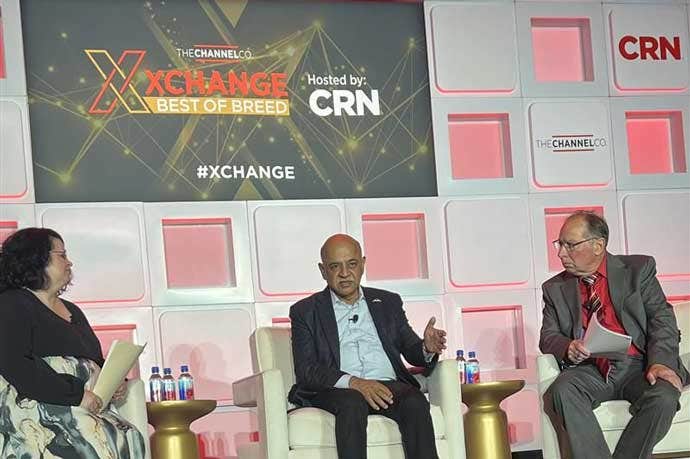

During an interview at the 2025 XChange Best of Breed Conference this week, Krishna also discussed his vision of growing IBM channel sales faster than direct sales—critical for achieving the goal of 6 million customers—and why the IBM and Red Hat partner programs remain separate.

Krishna also acknowledged IBM’s big bets on quantum computing, but he suggested that at this stage of the technology’s development the channel should move slowly and focus on learning how to develop software for the quantum computing age.

[Related: IBM CEO Krishna: Look To A 10-Year Horizon For The Real Impact Of AI]

“To your question of timing and what should partners do to get ready, I would not advise you to jump hard into quantum today. I will tell you, being upfront, it’s three to four years, maybe five,” before it becomes more mainstream, the CEO said in a 45-minute question and answer session at the conference with CRN Executive Editor Jen Follett and Steve Burke, CRN executive editor, news.

In addition to AI and quantum computing, Krishna touched on a number of topics in the wide-ranging interview including the state of the economy, the impact of AI and declining populations on job growth, and hybrid computing.

The following transcription of the interview has been lightly edited for length and clarity.

IBM has scaled up its AI business, both from a revenue perspective and a software product perspective. Your GenAI book of business now stands at over $7.5 billion and that’s 10 percent of revenue. What kind of GenAI engagements are winning the day for customers and what is the lesson for partners here looking to drive AI revenue growth?

So if I look at our business and where we are succeeding, and [where] all of you can succeed, the focus for us is the enterprise. AI is incredibly powerful. But if you’re going to go to an enterprise and you’re going to help them modify an enterprise process, it’s not as simple as AI. AI is incredibly powerful, incredibly competent, but you still need to expend the energy to insert it into the workflow, how work is done. In the context [of] that enterprise, you need to integrate it with the existing systems of record. That, again, requires people with the expertise of knowing the client to bring it there.

AI is not magical. I cannot look at it as very much [more important] than the internet or e-business turned out to be. Many succeeded in building web sites. But the true value change is when people began to connect the back end to the front end. Meaning, can you connect pricing, inventory, supply chain into the [task] of selling. And as all of you began to do that, it dramatically changed how business worked.

AI is going to be exactly the same. How do you make it do procurement? Meaning, you’ve now got to understand the procurement system. What is it that [businesses] care about, who’s a risky supplier, who’s not a risky supplier? Which things matter for speed as opposed to which things matter for cost only? All of that can only be done by somebody who understands a particular enterprise and understands what the technology can do.

I don’t believe you need to be expert on large language models or foundation models, you need to know how to use them and what are the guardrails you need to put around that. And that’s where we can help you with some of those—I won’t say all of those. And we can help you begin to understand how do you begin to deploy those things in the context of an enterprise?

When you look at the enterprise, AI opportunities specifically, let’s say generative AI. Do you feel like the opportunity right now is overhyped, underhyped, or appropriately hyped, particularly to the channel partners in this room?

I would tell you that if you look at the next two or three years, you are going to be somewhat underwhelmed, because [AI] will be growing slower than you would want and it is not growing at the pace that you read about from the media…And if you look at it in [terms] of a 10-year horizon, you’re going to be shocked, because it’s going to be bigger than the biggest aspirations of today.

And by the way, every technology goes through that. In the short term it kind of surprises you to the downside, and in the long term it surprises you to the upside. So if I look at [AI], I think that this is going to be another 10x revolution in productivity, but that would take a couple of decades to play out. The advantage for our clients becomes those who begin to embrace it somewhat early. I like to use sports analogies, just because they’re easy to follow. If we think of this as a baseball game, we’re in the first inning.

Is there an example you can give of an AI solution you’ve seen for enterprise use that you just thought, wow, this is really going to change the world?

I tend to be a pragmatic person. So I’ll give you three that I think are fundamentally important, that if any of your clients are not doing all of these three, they will fall behind.

Number one: customer service and customer experience. If you’re not using AI for customer service and experience, then your clients are losing out. Why do I say that? Yes, you get some cost efficiency. But that is by far the smallest part…AI is great. It doesn’t get angry, it doesn’t get upset, it doesn’t react to the emotion of the person calling or chatting. It gives you a straightforward response. People always talk about the accuracy.

You want to get those advantages and, of course, infinite scale, when there is a rush and people are all trying to call customer service. But if I go beyond customer service to customer experience, all ought to be using AI to make your customers feel more desired and be able to go leverage that. I call these, by the way, low risk use cases.

The second is around programming. We recently had Tech Exchange…where we let our technical users come in and talk with our engineers. And we showcased how one of the tools we built is causing 45 percent productivity [gains] in the [development] teams that are using it. This was 45 percent across the board. So that includes requirements, code writing, testing, documentation, et cetera…And I think that 40 to 70 [percent improvement] is the rate I would expect.

People then say, “Doesn’t that result in less employment [in] development and programming?’ I think it will create more. Do more productive companies gain or lose market share? If you gain market share because you’re productive, you’re going to actually have more code to do. What [AI will] let you do is build products that previously were considered too expensive, and now you can.

And the third is around enterprise operations: accounts payable, procurement, HR, you can go on and on—so many of the processes we use to run our enterprises, why can’t we use AI to make every one of them more productive, more error free, less fraud.

Those are the three use cases, I think, that I would call relatively low risk. But they need knowledge of the enterprise to get that.

You have such a large product portfolio available to your partners. Where do you point to, to say this is the quickest point of entry for partners that want to work with IBM and specifically to monetize the AI opportunity?

I’ve got to talk a little bit about our client segmentation because it’s going to matter there. So we have, I’ll call it our largest clients. Let’s forget the names, we put about 600 of them into that bucket. That is the set of clients that tend to embrace IBM’s entire portfolio. Then there is, I’ll call it the next 1500 or so. They tend to embrace a large part of the portfolio. Here is where you’ll find…the people who buy storage, something that many of you work on. These are people who buy security that we work on together, with other partners that we work with [in] networks. This is where they tend to buy from all [of IBM’s] software portfolio.

Then there is the next 80,000. That is where you’re going to be very focused on fewer sets of products. That doesn’t mean you can’t sell the whole portfolio. But, I will tell you that is where you are going to find a lot of focus on AI, on Red Hat, and on certain products of the automation portfolio there [that] are a lot easier to consume, and where pricing is a lot easier, because that makes it a lot easier for our channel partners to work with clients in those things. I will call out AI and in automation I’m really calling out products from [IBM acquisitions] Apptio and from HashiCorp as two examples. And then, of course, some of the storage flash products are going to work there. So I would begin to focus in on those.

Where do you really need help from your partners right now?

Everywhere. Look, we are direct only to about 600 clients. If I look at the goal of 6 million or so named enterprises…that means everywhere else we want to work, either with a partner that’s the next 1500 or kind of partner only, if I go after that. That’s where we are very focused and where we want you to develop skills.

There’s so many big AI mega deals happening right now. There’s a lot of concern that we’re in an AI bubble. What’s your take on that?

I’m not sure the word bubble would be appropriate. Is there a lot of frothy, money raising things? Yes. Will all these investments pay off? Don’t know. If I go back to my opening, your very first question to me was, is AI going to be as big as you think or smaller? If you think it’s going to be bigger, all these investments will pay off.

Now, I’ll say a bit tongue-in-cheek, maybe not for the person putting capital into that, maybe they’ll get wiped out. But the world at large will benefit from all of this infrastructure getting built. This reminds me so much of the fiber days in circa 2000. All that fiber is useful today…So I think some things are expensive, is the word I would use. I don’t think we are in a bubble. And the way I figure, if something is expensive, a limited number may get a correction, but not the vast market. A bubble means that you’re going to get a crash and then things are going to regress backwards about four, five, seven years. And that means it takes that much time to get out of it.

You are coming up on six years as CEO. You talked about doubling partner revenue over the next five years. Can you talk about what kind of performance you see in terms of revenue growth for the channel and then what your goals are for the future?

So my goals should make you all excited and maybe afraid. Excited, because if I remember correctly, we now do about $15 billion that gets touched by the channel in some way or form. That’s a good number. That’s probably up from maybe [$7 billion to $10 billion] when I took the [CEO] role. So we got the 50 percent increase that I was talking about.

But I would like to say the following: If $15 billion is touched by the channel, that means we have $45 [billion], $50 [billion] that is not touched by the channel. My personal view: The two sides should be equal revenue touched by the channel and revenue not touched by the channel. That’s where I would like IBM to go. And when we reach that point, the revenue touched by the channel will keep increasing, and the other will grow at a much smaller rate. That’s what I think makes for a really healthy business and that is where I would like to go.

So we’re talking about expanding the number of channel-only clients [and] that means putting not just words, but action behind that. Investing in products that can make it much easier for all of you to take them to our customers is putting some action behind those words.

And then we’re going to have to keep fine-tuning in terms of the actual programs. I think our Partner Plus Program was a step in the right direction, but I don’t think it’s the whole journey. I think it’s a step in the right direction. We succeed, and hopefully you succeed, when our clients get a victory.

We really want to lean-in to those partners who can make the recurring revenue grow, who can make all of the consumption revenue growth. That’s the signal that the clients are finding value, and that is where we’d like to go.

You called this move to hybrid cloud early on. How do you see the partner model evolving with agentic AI, with all these agentic AI solutions out there interacting with one another? And where do partners have to make the investment to be successful in this agentic AI era?

This reminds me a lot of when I learned about hybrid cloud. So back in 2017 I held a point of view that, I would say, at that time was heresy…because everybody said, ‘What are you talking about? Everyone is just going to pick one public cloud. 100 percent of all workloads will move to a single public cloud.’

If I look at it today, the number of clients on only one public cloud is like 5 percent, the majority use two, if not more. If you add up all the SaaS properties they use, it’s probably a half dozen because many SaaS properties don’t run on any public cloud. But SaaS, as far as you’re concerned, is coming from a public source. The top 5000 clients are going to be on a mixture of two or more public clouds, probably a half, plus SaaS properties, and lots of on-premises deployment. But on premise may be a private cloud, which could be an instance running on a public cloud—it depends where the infrastructure is. That’s the majority of the top 5000.

Once you get below that, people will leverage multiple public clouds. But the questions they face are the same: ‘How do I optimize my spending? How do I make sure I get resilience? How do I make sure that these things can all talk to each other? And if there’s a problem, can I fix it?’

So now let’s go to agentic AI. So you’re going to have, in the end, AI agents are simply operating on what we just described. So you’re going to have AI agents that have to deal with data at one place and data in another place. They may have to take data from one place to make an inference in order to take action in another place. So you still have to operate in hybrid environments.

So if I look upon our partners and our clients, they have to make sure that their AI capabilities can operate in this hybrid environment where you do your training, where you don’t do influencing, what properties you take actions upon—that’s kind of what makes an enterprise, right?

Looking at Red Hat and IBM, you have the two distinct partner programs, and you look at what’s going on with the IBM portfolio, building out the tools, and even Red Hat, building out more AI tools. Do you see those two programs coming together? Is there much overlap between the two?

So at a broad level it’s a coherent and cohesive strategy. It’s not an oppositional, orthogonal or ignorant strategy. And I would say this is the classic operating system-versus-applications divide that has gone on since the beginning of computing. Over time, more and more capability goes into the operating systems. As it does the applications have to go higher in the stack.

So when you talk about more AI capability in the Red Hat stack, both into Red Hat Enterprise Linux and [Red Hat] OpenShift, that is a very conscious strategy. As AI gets more mature, it should go into those layers…But how do you deploy? How do you optimize? How do you make sure that things can run with resilience? How do you scale? All of those capabilities are going to go into the infrastructure, which for us is captured in the Red Hat products.

Then, you say at the channel level, Red Hat is very much a mass scale distribution model. And so that’s why, while they’re not orthogonal, the Red Hat and IBM channel strategies are a little bit different. Red Hat offers a lot more for every hardware vendor out there. That’s not so relevant for IBM. And so that is why their strategies are going to be: they have to partner with Dell, they have to partner with Lenovo. The last I saw there were at least 400 or 500 different hardware vendors that Red Hat had to partner with.

That’s very different than IBM, who finds channel partners much more in people who are trying to resell [and] provide service to the enterprise.

When you look across your customer base, what are you seeing as far as spending trends and how those trends are being influenced by AI, particularly the clients that are serviced by your channel partners?

So I have actually have this view that is somewhat contrarian. Everyone earlier this year was talking about GDP going down, maybe global [growth] from three to two and a half [percent]. I’ll be really happy to see that through all the uncertainties… GDP is going to remain between two-and-a-half to three percent growth. Tech [industry] growth, if you go from that two and a half to three, has consistently been about three points above GDP. That takes you to six, five, maybe five and a half. So I see that that 5 to 6 percent growth of technology is going to stay. And all of you can look and say, ‘Hey, wait a moment. How can something that is getting this big grow three points about GDP?’ I would say that’s the right thing for another five to 10 years—it’s going to grow that much faster [than the overall economy] because tech is the source of competitive advantage.

So you feel optimistic about the state of the economy?

I feel very good about the economy for [20]25 and [20]26.

What about the impact on hiring? You touched on a little bit earlier. Can you tell us how you feel? AI is going to impact hiring and job creation going forward?

I’ll talk about ourselves first and then I’ll talk about the world at large, just so that it’s pretty synchronous.

There’s always going to be what I call churn in the job market. Some roles are going to be more in demand, and some roles are going to be less in demand. If I look at IBM, our head count has been kind of flat. By the way, we were hiring 20,000 people a year before. We haven’t decreased the hiring. It keeps going, only there is churn if you look under the covers.

Will we keep hiring in software development, absolutely. Will we keep hiring in sales and marketing, absolutely. Will we keep hiring in service delivery for our clients, absolutely. I see all of those areas growing.

When I look at the economy at large, I think that unemployment in the U.S. has gone from what 3.5 to 4.3 [percent], somewhere there. I will tell you that the entire developed world has a demographic problem, meaning the number of people of working age is going to decrease for the next 50 years. By the way, I think we can talk however we like. Nothing is going to change that. Now this is the first time in human history, with one exception during the black plague. Other than that, world population has only increased. So I don’t think people have a mental model of how to deal with decreasing population.

The U.S. [population], by the way, is decreasing. The million or two [through] immigration keeps that flat. You take that away, the U.S. will decrease. However, the number of people who are not of working age is increasing, people over, let’s say 65, that means it’s fewer people of working age.

Even in that optimistic picture, that means we need technology to do the work or we’re going to face declining standards of living. So to me we need all of this, and that means everybody who’s capable of getting a job. I use the word capable. I do put the onus of getting skills back on people. And this is where I think that policy ought to go in terms of how do you upscale and rescale people?…You are going to have to learn new tools. I don’t mean that everybody has to go become an AI inventor. That’s not what I mean. But can you use AI to make your job better? The same way as machine operators had to learn how to use computers in order to run machines. Not invent computers but use computers.

I think that’s going to be the change, and that’s how policy ought to work. And anybody with just a base level of skills around what I described is going to find it easy to get a job.

IBM has made a huge investment in R&D around quantum computing. You recently had a big breakthrough with a financial services firm, HSBC, in real world bond trading. How quickly do you see quantum emerging and what do partners need to do to get ready for that? How big of a disruptor is that and how do you see it playing out with AI?

So first of all, it’s an add. We had normal computers and we had AI…Your retail banking, your e-commerce, are very much done using normal computers. And then AI was added. Quantum will be additive. It’s not going to replace either of these two at least for the next 20 years.

To your question of timing and what should partners do to get ready, I would not advise you to jump hard into quantum today. I will tell you, being upfront, it’s three to four years, maybe five. And I’ll give you probabilities: Three years to be ultra useful, less than 30 percent likelihood. Four years, maybe 50 to 70 [percent], five years, above 90 [percent].

I’d say quantum today is where GPUs were in 2015 or 2016. So that gives you a sense—people inside knew what was coming. But most people would not get very involved with GPUs with AI until 2020. So that’s where it is.

What should you do to get ready? If a partner wants to, I would advise you to learn how to use a quantum computer. [Take], for example, one of our classes on QISTIT. That’s what HSBC used. They brought four or five really smart people to learn how to program a quantum computer. Once they learned how to program it, then they give it some real data and ran it to prove their advantage.

What I’m telling you is, because it takes a couple of years to learn how to use it… you kind of have to get ready for it. And that’s what I would do. Forget the hardware, just learn how to program it and use it for algorithmic development. You want to learn how to use it because that will have huge value in three to five years.