Dublin, Oct. 21, 2025 (GLOBE NEWSWIRE) — The “E-commerce Apparel Global Market Report by Type, Transaction, Countries and Company Analysis 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

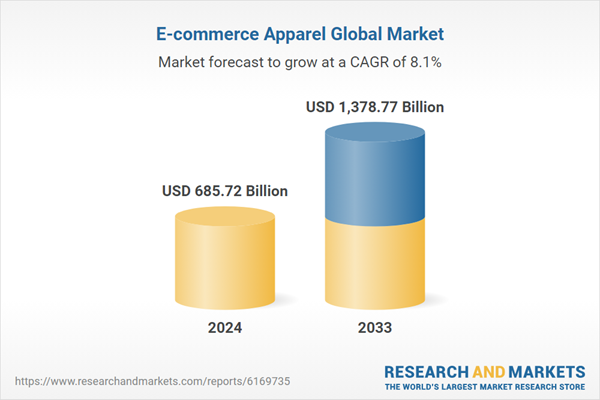

E-commerce Apparel Market is expected to reach US$ 1.37 trillion by 2033 from US$ 685.72 billion in 2024, with a CAGR of 8.07% from 2025 to 2033

Technological developments, changing consumer habits, and growing smartphone penetration are driving the global e-commerce apparel market’s steady rise. Forecasts point to further increase in both developed and emerging regions. With significant acceptance in North America, Europe, and Asia-Pacific, the e-commerce apparel business is flourishing on a global scale. Because of their youthful populations and expanding digital infrastructure, emerging economies in Latin America and the Middle East also offer attractive prospects.

By providing customers with easy access to a wide selection of clothes and accessories, the e-commerce apparel sector has completely changed the fashion retail scene. Digital shopping has become popular among both urban and rural communities as a result of the widespread use of smartphones and rising internet penetration. Since online platforms offer a wide range of options, affordable prices, and customized experiences, many people prefer to buy for clothing online.

With the help of virtual try-ons, AI-based advice, and effective logistics, major industry players are still innovating. Ethical sourcing and sustainability are emerging as key issues that appeal to customers who care about the environment. Furthermore, social media integration and influencer marketing have made a substantial contribution to clothing businesses’ customer acquisition and retention plans. Traditional retail hierarchies are being upended by digital-native firms and direct-to-consumer business strategies.

Recent statistics show that about 40% of Asian fashion sales are now made online, underscoring the swift uptake of e-commerce in the region. By 2024, there will be 2.71 billion online shoppers worldwide, accounting for 33% of the global population, suggesting a huge opportunity for market growth.

There are many opportunities in this industry, especially when it comes to utilizing cutting-edge technologies to produce more engaging and customized customer experiences. Furthermore, the market is anticipated to increase to $1.2 trillion by 2025 from a historic $1 trillion in 2024, demonstrating strong economic potential.

The expansion of the online clothing market is also made possible by governments around the world investing in digital infrastructure, maintaining cybersecurity, and enacting laws that are beneficial to e-commerce. To fully realize the market’s potential, businesses must comply with the rules they are enforcing, which include requirements for consumer rights, data protection, and transparency.

Key Factors Driving the E-commerce Apparel Market Growth

Internet and Mobile Penetration

Global smartphone use and reasonably priced internet connectivity have greatly accelerated the expansion of the e-commerce clothing business. Online shopping platforms are now available to consumers around-the-clock, making it easy for them to browse, compare, and buy. User experience is improved with mobile-friendly interfaces, specialized apps, and easy payment methods.

Additionally, consumers’ trust in online purchases has increased due to advancements in digital literacy and payment security. Companies are better positioned to take advantage of this expanding mobile-first consumer base if they optimize mobile experiences and use real-time data.

Innovations in Technology and the Integration of AI

Online clothing retail is undergoing a change thanks to the incorporation of cutting-edge technology like machine learning, augmented reality, and artificial intelligence. Chatbots, virtual changing rooms, and personalized recommendations increase consumer happiness and conversion rates.

Retailers can forecast trends, analyze large amounts of customer data, and effectively manage inventories with the aid of AI. By enabling customers to see things before they buy them, augmented reality try-on systems lower return rates. These developments produce interesting, customized purchasing experiences that boost market penetration and consumer loyalty.

Shifting Lifestyle Trends and Customer Preferences

Convenience, variety, and customization are top priorities for modern consumers, and e-commerce platforms easily provide these. Particularly driven by social media trends and influencer endorsements, millennials and Gen Z are looking for fashion that is stylish, reasonably priced, and responsibly made. E-commerce platforms leverage user-generated content, loyalty programs, and quick inventory updates to meet these expectations.

Demand patterns have also changed as a result of the growth of remote employment and informal dress trends. Stronger engagement and repeat business are observed for brands that reflect the beliefs and changing lifestyles of their customers.

Challenges in the E-commerce Apparel Market

High Return Rates and Problems with Logistics

Managing high return rates resulting from sizing problems, color mismatches, and unfulfilled expectations is one of the largest challenges in the e-commerce garment sector. Returns have a detrimental effect on inventories and sustainability initiatives in addition to raising operating expenses.

Accurate sizing tools and effective reverse logistics are essential. The supply chain is further strained by customs delays, last-mile delivery inefficiencies, and the complexity of international shipping. To solve these problems, strong logistics alliances and technological investments are needed to expedite the fulfillment process and lower returns.

Price wars and fierce market competition

With a combination of fast fashion stores, specialized businesses, and multinational behemoths, the market is extremely competitive. Because of this saturation, aggressive price tactics and frequent reductions are used, which can reduce brand value and profit margins.

New or smaller competitors could find it difficult to stand out. Increased spending on advertising across platforms is also driving up the cost of acquiring new customers. Brands must make profitable investments in sustainable operations, distinctive value propositions, and customer engagement tactics if they want to stay competitive.

Household Appliances in the Types Section

The home appliance segment of the e-commerce industry comprises both small appliances like vacuum cleaners, coffee makers, and microwaves as well as larger equipment like air conditioners, ovens, refrigerators, and washing machines. Because of the convenience, increased product selection, and affordable prices, these things are being sold online more and more.

Consumers may make well-informed judgments with the help of comprehensive specifications, user reviews, and comparison tools. To improve the value proposition, brands frequently include installation services, extended warranties, and packaged deals. The transition to IoT-enabled, smart, and energy-efficient appliances also fits with changing customer desires. The expansion of this market is being supported by e-commerce platforms that optimize delivery and after-sales services, particularly during promotional campaigns and seasonal sales events.

Key Attributes:

Company Analysis: Overview, Key Persons, Recent Developments, SWOT Analysis, Revenue Analysis

- Alibaba.com

- Amazon.com Inc.

- ASOS

- Best Buy

- Ebay Inc.

- Flipkart Inc.

- Groupon Inc.

- JD.com Inc.

- Shopify Inc

- Walmart Inc.

Market Segmentations

Type

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Others

Transaction

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

Regional Outlook

North America

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

For more information about this report visit https://www.researchandmarkets.com/r/5g45cz

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.