The feeder cattle market has signalled that the highs are likely in place for the rally that started after the COVID-19 pandemic to end.

In mid-September, a group of Black Angus yearling steers off grass averaging 1,000 pounds traded for $465 per hundredweight southeast of Calgary. In central Alberta, Charolais steers off cows weighing 500 lb. sold for $735 per cwt.

There are a number of factors to consider moving forward that will result in lower prices. I’m not saying the market will fall apart, but the factors that contributed to the recent strength are starting to reverse course.

Feedlot operators have experienced a prolonged period of positive margins. Profitability in the finishing sector will likely continue through December. However, during the first quarter of 2026, feedlot margins will move into negative territory and fall further into red ink in the second quarter. Equity erosion in the finishing feedlot sector during the first half of 2026 will result in lower prices for replacement cattle.

The U.S. and Canadian economies will experience softer growth and higher unemployment, which will cause consumer spending to weaken. Wholesale beef prices are expected to trade lower through the remainder of 2025 and the first half of 2026 as beef demand weakens.

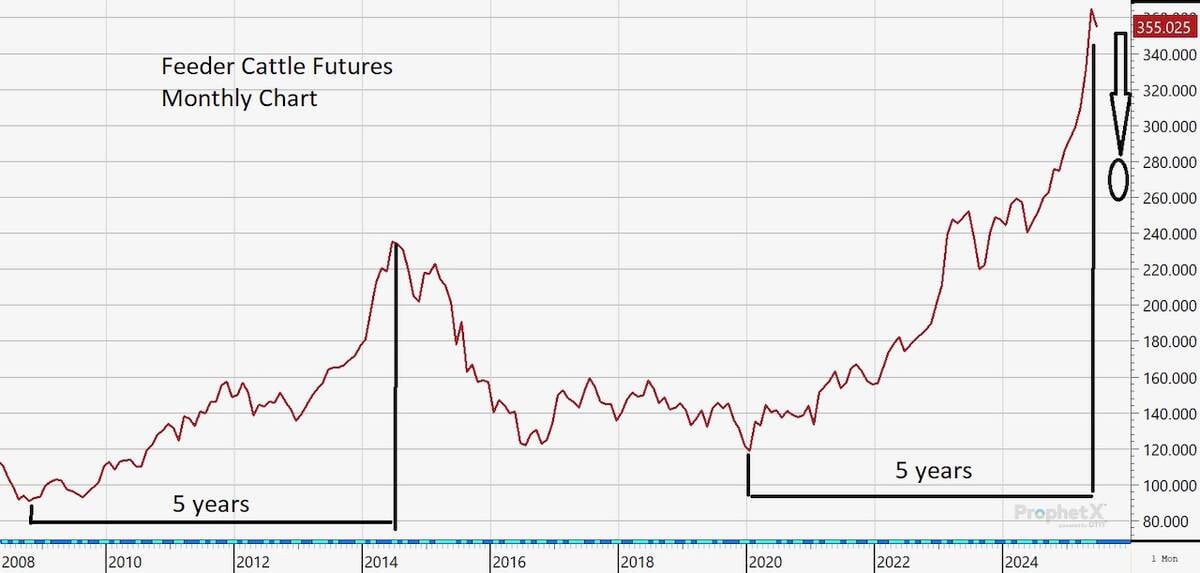

Monthly chart showing feeder cattle prices from 2008 to 2025. Courtesy DTN ProphetX.

Monthly chart showing feeder cattle prices from 2008 to 2025. Courtesy DTN ProphetX.

U.S. restaurant traffic during summer 2025 was up eight to 10 per cent from levels a year ago, while Canadian restaurant visits were up 20 to 30 per cent. During the first half of 2026, demand for beef will start to ease.

Restaurant traffic in 2026 is expected to be slightly below 2025. The key is that demand is not improving but rather stagnating or decreasing.

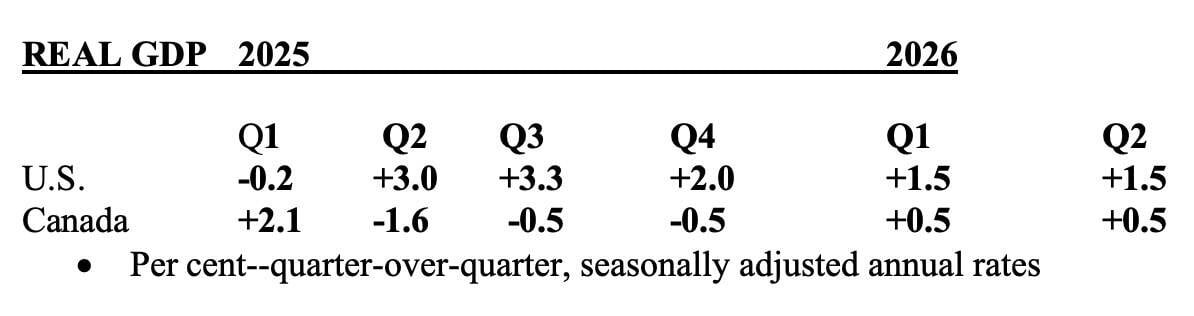

We’ve included our GDP projections for the first half of 2026. The U.S. has experienced stellar growth over the past year. U.S. corporate profits have been at record highs, which contributed to the lower unemployment and stronger consumer spending. Wages were rising and jobs were easy to come by. That will change in 2026.

GDP for Canada and the United States for 2025 and 2026. Photo: Jerry Klassen

GDP for Canada and the United States for 2025 and 2026. Photo: Jerry Klassen

In 2023 and 2024, the U.S. and Canada were contending with a growing job market and wage growth. This situation moderated in 2025. For 2026, job growth will be minimal and wage growth will subside.

The U.S. experienced limited job growth in summer 2025. From January through August, U.S. job growth totalled about 500,000. In Canada, employers shed about 38,000 jobs in the first eight months of 2025. (See the chart on quarterly GDP projections for the latter half of 2025 and the first half of 2026.)

The Federal Reserve Bank of Atlanta’s economic model, GDPNow, pegs third-quarter GDP at 3.3 per cent. Financial industry estimates have U.S fourth-quarter GDP at two per cent, followed by first-quarter growth of only 1.5 per cent. As a rule of thumb, if GDP falls below two per cent the cattle market tends to weaken because consumer spending is not sufficient to sustain beef demand at the current levels.

Read Also

Seven ways to streamline your farm transition

Lyle Wiens, who coaches farm families and advises on grain marketing, sees parallels between marketing and farm transition planning — two decision-making areas in which farmers can feel overwhelmed.

There are a couple of points to consider involving the monthly chart of the feeder cattle futures from January 2009 to September 2025 I’ve included here. The Great Recession occurred in 2009, and feeder cattle futures traded below $100. The market rallied from 2010 through 2014. GDP topped out in the third quarter of 2014 at five per cent, and the feeder cattle futures peaked that September at $235.

During this five-year period, the market rallied about $140 from the 2009 recessionary low to the September 2014 peak. During 2015, quarterly GDP averaged 1.8 per cent. U.S. beef production was lower in 2015 compared to 2014, but the market did not rally as the consumer pulled the reins.

The COVID-19 recession occurred in 2020, and the feeder cattle market bottomed around $120. The market peaked in early September 2025 around $364. During this five-year period, the market rallied $240. U.S. quarterly beef production in 2026 will be lower than in 2025, but the market will not make fresh highs given our GDP projections for the first half of 2026.

From September 2014 to September 2015, the market dropped about 25 per cent. Using this example, we could see the feeder cattle futures trade in the range of $260 to $280 during September 2026.