Bloomberg

(Bloomberg) — A four-day rally that sent shares of the unprofitable vegetarian foodmaker Beyond Meat Inc. up more than 1,000%, only for a big chunk of the gains to vanish in a flash. A record-setting surge in gold prices, followed by the worst two-day selloff in years. Billions of dollars of inflows into risky ETFs that track volatile cryptocurrencies like Bitcoin and Solana.

Everywhere you look these days, it’s hard to miss signs of individual retail traders cementing themselves as a dominant force in markets. And while they’re often cited as reliable buyers of dips who keep prices buoyant, their tendency to crowd into whatever appears to be the next big thing has a way of causing pain for anyone late to the momentum chase.

Most Read from Bloomberg

A particularly vivid example of the dangers has been playing out in recent sessions among quantum computing stocks, many of which ran up 1,000% or more over the last year. Stocks like Rigetti Computing Inc., D-Wave Quantum Inc. and IonQ Inc. have been sliding almost nonstop for a week, with each tumbling 6% or more Wednesday.

“The market is more narrative-driven than ever and traders are looking for good stories and good catalysts,” said Kevin Xu, a former retail trader who is now founder and chief executive of Alpha, an AI-powered chat app for traders. “Once they have an idea, that story travels very fast and a snowball gets bigger.”

While the retail onslaught can be dated to the sudden prevalence of free trading in 2019 and has rarely ceased to be news since then, data shows engagement among amateur traders is only getting stronger. Average daily volume of US-listed stocks has been nearly 12 billion shares since the 2019 price war among retail brokerages made trading free almost everywhere, about 75% above the pace seen in the prior six years, according to data compiled by Bloomberg. In the past 12 months, daily volume has been even higher, averaging about 16.7 billion shares.

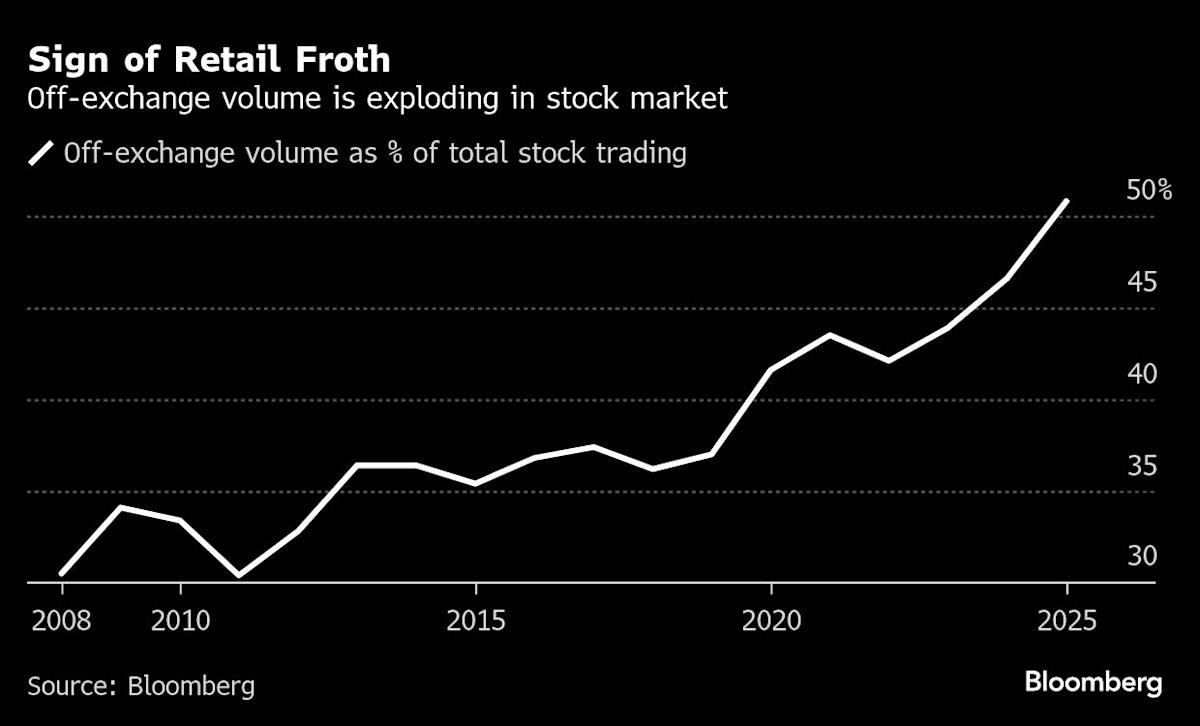

One proxy for retail involvement in the market is the volume of stocks executed by off-exchange venues such as those run by equity wholesalers serving clients like Robinhood Markets Inc. Those trades are poised to make up 50% of the total this year for the first time ever, data compiled by Bloomberg show.

One thing retail can be counted on to do is buy the dips in US equities — and use options to amplify returns. As President Donald Trump’s tariff policy reignited trade-war jitters on Oct. 10, the non-professional crowd bought call options at a record pace, data from Citadel Securities shows. The cohort’s demand for calls has exceeded puts for 24 consecutive weeks, which ties for the longest streak since the firm started tracking the data in 2020.

Story Continues

At the Goldman Sachs Group Inc. US shares sales-trading desk in New York, the explosive volumes in penny stocks is raising eyebrows. The top 10 most-active stocks early Wednesday afternoon were all either trading for less than $1 or companies otherwise known to be loved by retail traders, according to the desk led by John Flood. So far this year, buyers in this group have far outweighed sellers, causing 146 days with a “buy imbalance,” a higher number than even during the market frenzy in 2020, according to the Goldman traders.

Individual amateur investors are particularly drawn to lightly regulated marketplaces such as OTC Markets Group Inc. There, about $59 billion of shares have changed hands on average each month this year, approaching the peak during pandemic-era meme-stock frenzy, according to a Bloomberg analysis of data from Financial Industry Regulatory Authority.

They’re finding profitable opportunities in larger caps as well. Citigroup Inc.’s basket of stocks most-favored by non-professional investors, which includes companies like Tesla Inc., SoFi Technologies Inc. and Riot Platforms Inc., is up 55% since the start of the year, beating the S&P 500’s gain of 14%.

Yet the focus-du-jour of retail traders is a constantly moving target, making high flyers vulnerable to sudden reversals. The decile of stocks that did the best from Aug. 1 to Oct. 14 is down an average of 5.7% since then, while deciles 3-10 are actually up, according to data from Bespoke Investment Group.

It’s not just the stock market where retail traders are embracing risk with both fists. From crypto to options, the frenzy is evident in almost every corner of the market, at least going by flows into exchange-traded funds. ETFs tracking cryptocurrencies have lured $47 billion of fresh money this year, while those using options to generate income and supercharged returns have added almost $10 billion, data compiled by Bloomberg Intelligence show.

And the momentum created by an influx in retail investors can show up in strange places. Even gold, one of the oldest and most-reliable haven assets, has attracted massive interest from retail traders chasing its price higher by buying bullion-backed ETFs.

“Gold has become a momentum/meme asset,” Bill Gross, the co-founder of Pacific Investment Management Co., posted on X on Oct. 17, when the precious metal traded as high as almost $4,380 an ounce. “If you want to own it, wait awhile.” By Wednesday afternoon, he was right: Gold was trading as low as about $4,004.

For professional investors trying to navigate the choppy waters of markets increasingly under the influence of hot-money retail traders, caution is warranted. On BlackRock Inc.’s systematic equities team, co-head Jeff Shen says it’s important to be cognizant of the retail flows — “they are all risk-on” — and don’t be too aggressive when it comes to taking the other side.

“From a risk-management perspective, you don’t necessarily want to bet against those names heavily,” he said, at least in the short term. “But the fundamentals will have gravity over time.”

–With assistance from Felice Maranz.

(Adds quantum computing stocks to third graph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.