Report Overview

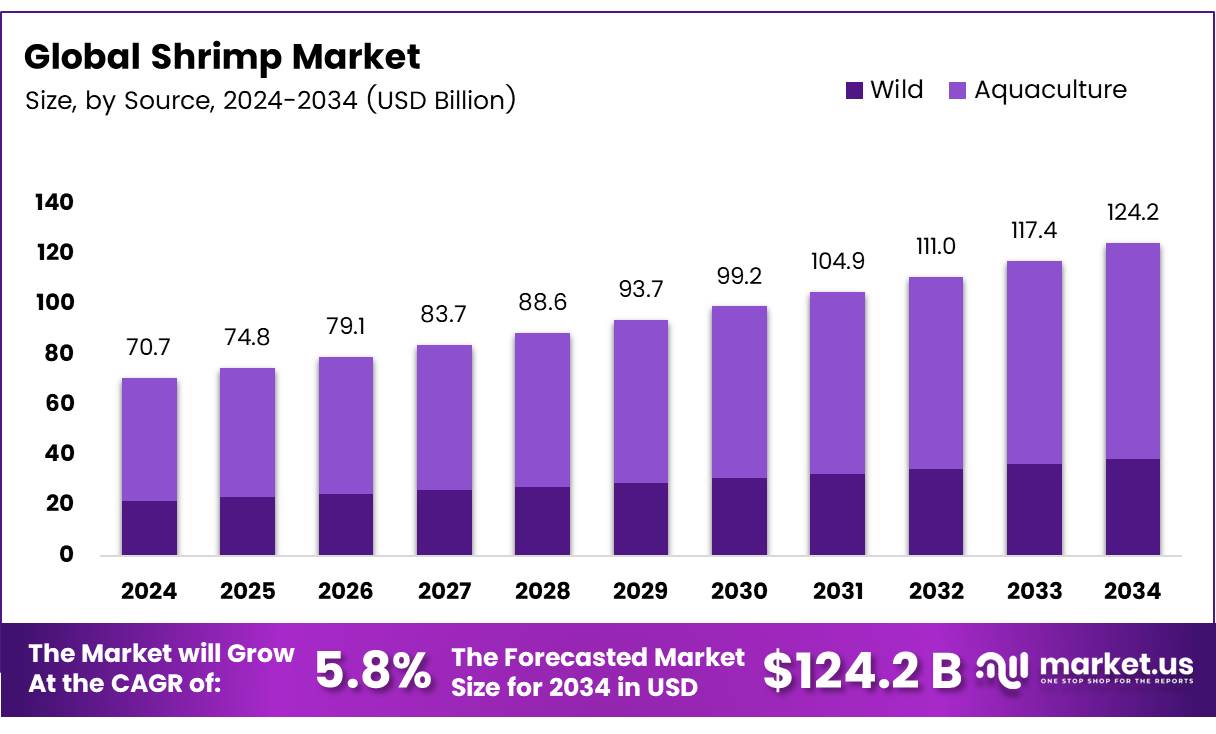

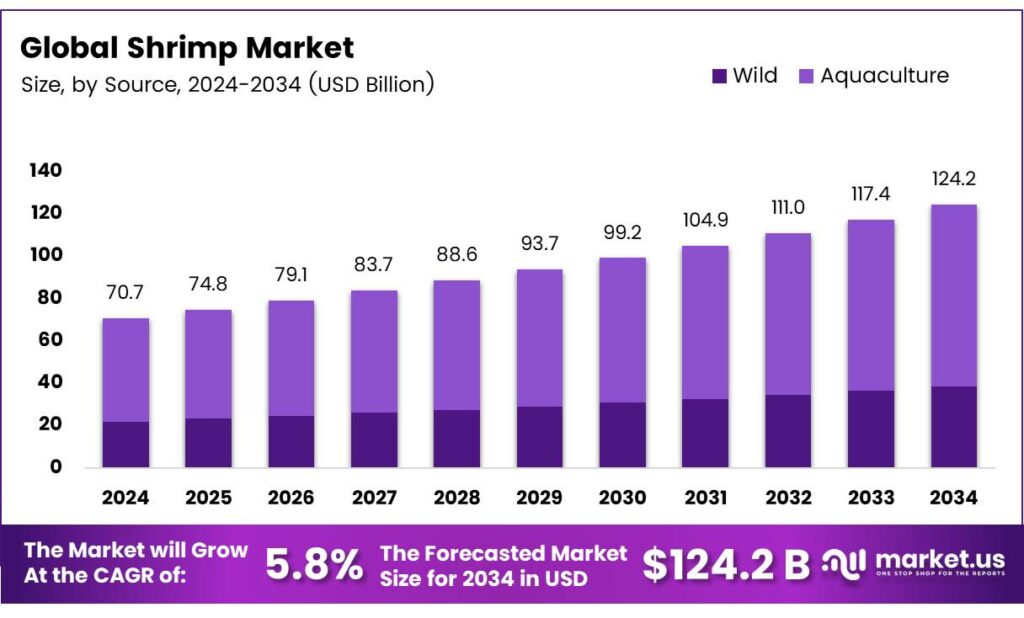

The Global Shrimp Market size is expected to be worth around USD 124.2 billion by 2034, from USD 70.7 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Shrimp, a widely consumed seafood, is harvested from both temperate and tropical waters, making a significant contribution to global diets and aquaculture. Valued for its unique taste, texture, and nutritional benefits, it is a major internationally traded shellfish. Its high perishability stems from the presence of free amino acids, high moisture, and non-nitrogenous compounds that promote microbial growth and melanosis. Spoilage occurs due to autolysis, microbial growth, ATP degradation, melanin formation, and lipid peroxidation.

Shrimp farming has grown rapidly since 1970, with an annual growth rate of at least 18%, producing 75% of consumed shrimp. The industry relies heavily on black tiger shrimp (Penaeus monodon) and white Pacific shrimp (Penaeus vannamei). This dependence, coupled with rapid growth, has increased disease prevalence, particularly white spot disease caused by the white spot syndrome virus (WSSV). This disease severely impacts productivity and threatens the sustainability of shrimp aquaculture.

Machine vision systems have advanced shrimp measurement techniques, enabling precise and efficient size and weight estimation. High-resolution imaging and intensity thresholding allow accurate length measurements, with a linear model yielding a precision of 0.43 mm. Algorithms like the OSTU method and classical thinning extract the shrimp’s skeleton line, correlating well with actual length (R² up to 0.946). These automated systems process large datasets quickly, with CPU times as low as 0.01 seconds per shrimp.

- Machine vision and regression models have improved shrimp weight estimation from view area in pixels, using linear, power, and forced-power equations with high accuracy. Non-linear regression on sushi shrimp achieved low errors (MAE: 0.20 g, RMSE: 0.25%). A 3-ounce (85-gram) shrimp serving provides 84.2 calories, 20.4 g protein, and essential minerals like iron, phosphorus, and iodine. Shrimp is rich in omega-3 fatty acids, supporting thyroid function, brain health, and overall wellness. These advancements highlight machine vision’s potential for automated, accurate shrimp weight and size determination.

Key Takeaways

- The Global Shrimp Market is projected to grow from USD 70.7 billion in 2024 to USD 124.2 billion by 2034 at a CAGR of 5.8%.

- L. vannamei led the species segment in 2024 with a 42.1% share due to its rapid growth and disease resistance.

- Aquaculture dominated the source segment in 2024 with a 69.3% share, driven by advanced farming practices in India, Vietnam, and Ecuador.

- Green/Head-off shrimp held a 31.2% share in the form segment in 2024, favored for easier packaging and longer shelf life.

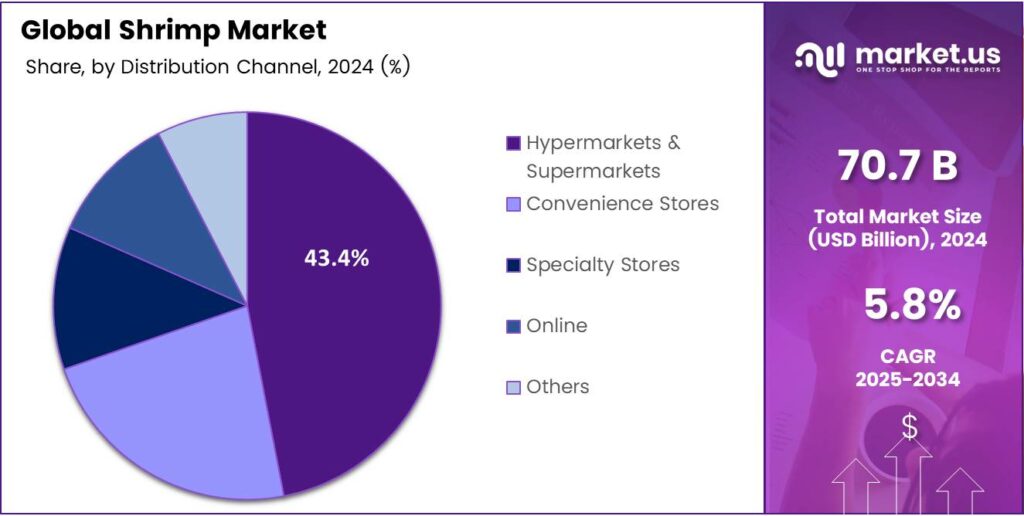

- Hypermarkets and supermarkets led distribution channels in 2024 with a 43.4% share, supported by diverse offerings and cold-chain facilities.

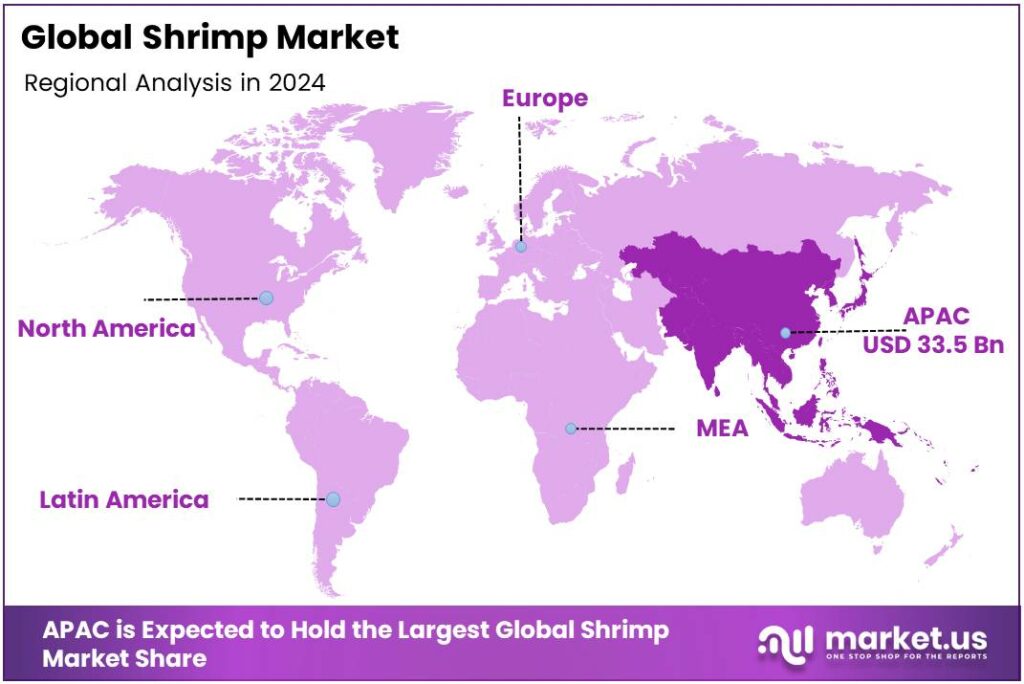

- Asia-Pacific commanded a 47.4% market share in 2024, valued at USD 33.5 billion, due to extensive aquaculture and a favorable climate.

By Species

L. vannamei dominates with 42.1% due to its higher adaptability and global demand.

In 2024, L. vannamei held a dominant market position in the By Species Analysis segment of the Shrimp Market, with a 42.1% share. This dominance is driven by its rapid growth rate, disease resistance, and efficient feed conversion ratio. Its popularity among aquaculture producers boosts export volumes across Asia-Pacific and Latin America.

Trachipenaeus curvirostris contributes a stable share owing to its presence in coastal and estuarine regions. Its regional demand in East Asian seafood markets supports steady trade, while its medium size and mild flavor make it favorable for frozen and processed shrimp categories in regional cuisines.

Pleoticus muelleri exhibits moderate growth due to its niche presence in South American waters. Known as Argentine red shrimp, it commands premium prices in European and North American markets because of its rich taste and high protein content. However, limited natural stocks and high fishing regulations restrict large-scale supply.

By Source

Aquaculture dominates with 69.3% due to sustainable production and rising seafood consumption.

In 2024, Aquaculture held a dominant market position in the By Source Analysis segment of the Shrimp Market, with a 69.3% share. Expanding shrimp farming practices, better hatchery management, and improved feed formulations have supported this dominance. Countries like India, Vietnam, and Ecuador lead the export-driven aquaculture expansion.

Wild-caught shrimp retains a smaller market share but is valued for its natural flavor and texture. It remains significant in premium seafood categories and regional dishes. However, declining wild stocks and fishing restrictions have limited its supply, pushing processors and distributors toward farm-raised alternatives.

By Form

Green/ Head-off dominates with 31.2% due to easier processing and wide export use.

In 2024, Green/ Head-off held a dominant market position in the By Form Analysis segment of the Shrimp Market, with a 31.2% share. The preference for head-off shrimp comes from easier packaging, longer shelf life, and suitability for frozen and processed products in export markets.

Green/ Head-on shrimp remains preferred in certain Asian cuisines where presentation and freshness are valued. The segment caters mainly to local wet markets and restaurants, emphasizing premium quality and flavor retention during cooking.

Peeled shrimp continues gaining traction due to convenience in home cooking and ready-to-eat products. Food processors and retailers promote peeled variants in frozen sections, especially in Europe and North America, where demand for quick-cooking seafood is rising.

By Distribution Channel

Hypermarkets and Supermarkets dominate with 43.4% due to product variety and consumer convenience.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Shrimp Market, with a 43.4% share. The availability of diverse shrimp types, promotional offers, and advanced cold-chain facilities strengthens their leadership in both urban and suburban areas.

Convenience Stores capture moderate growth as they cater to quick-purchase consumers in urban settings. Their smaller inventory limits variety, but easy accessibility and ready-to-cook packs attract working consumers seeking fast meal solutions.

Specialty Stores focus on premium and sustainably sourced shrimp products. They cater to niche consumers, emphasizing traceability and high quality. Their role in promoting organic and certified seafood continues to expand in North American and European markets.

Key Market Segments

By Species

- L. vannamei

- Trachipenaeus curvirostris

- Pleoticus muelleri

- P. monodon

- Acetes japonicus

- Pandalus borealis

- P. chinensis

- Others

By Source

By Form

- Green/ Head-off

- Green/ Head-on

- Peeled

- Cooked

- Breaded

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Emerging Trends

The Rise of Sustainable and Brackish-Water Shrimp Aquaculture

One major emerging trend in the global shrimp sector is the growing shift towards sustainable brackish-water aquaculture of shrimps — especially farmed varieties — driven by rising demand, production innovation, and stronger government support.

- The Food and Agriculture Organization of the United Nations (FAO), global shrimp imports in 2024 dropped by 1.6% in volume and 5.9% in value, signalling pressures in traditional capture markets. Meanwhile, reports show that farm-based shrimp production now makes up more than half of global shrimp supplies — one estimate puts it at 55%.

On the production front, farmed shrimp volumes have been increasing steadily. For example, one industry survey noted that from 2015-18. Another recent source estimated global shrimp production at 5.88 million metric tons in 2024, a 4.8% rise year on year.

Drivers

Rising Demand for Healthy, High-Quality Protein

- One of the key driving factors behind the growth of the shrimp sector is the strong global shift towards healthier eating habits and more affordable, high-quality protein sources. According to the Food and Agriculture Organization of the United Nations (FAO), global apparent consumption of aquatic animal foods reached 162.5 million tonnes in 2021, up from just about 9.1 kg per person in 1961 to around 20.6 kg per person in 2021.

In the case of shrimp specifically, the industry has highlighted that farmed shrimp production is growing at one of the fastest rates in aquaculture: the World Wildlife Fund notes that in 2005 the farmed shrimp industry was about USD 10.6 billion, and that production has been growing at approximately 10% per year.

From the human perspective, this means people in both developed and developing economies are able to enjoy shrimp more frequently — not just as a luxury item, but as part of everyday meals. For shrimp-farmers and coastal communities, this translates into a growing market, which in turn creates livelihoods and can help rural incomes.

Restraints

Disease & Environmental Impacts in Shrimp Farming

One of the biggest obstacles facing the shrimp industry is the twin problem of disease outbreaks and environmental degradation, which together act as a brake on growth and sustainability. According to the Food and Agriculture Organization of the United Nations (FAO), disease outbreaks in aquaculture are causing major production losses and will grow in importance as production intensifies.

The FAO, disease outbreaks in aquaculture are causing major production losses and will grow in importance as production intensifies. For example, one FAO estimate states that diseases wiped out about 70,000 tonnes of shrimp in a single year in one region, or roughly 40% of production in that area.

- Globally, the aquaculture industry (which includes shrimps) is thought to be losing about US$6 billion per year from diseases. On the environmental side, shrimp farming has contributed significantly to the loss of key coastal ecosystems: in one example, about 80% of mangrove conversions in a particular Indian delta (the Godavari) were attributed to shrimp ponds. Also, a broader estimate suggests that 38% of global historic mangrove loss is tied to shrimp aquaculture.

Opportunity

Expanding Aquaculture as a Reliable Protein Source

- A major growth driver for the shrimp sector is the rapid expansion of aquaculture, which is helping meet the world’s rising demand for sustainable, high-quality protein. The Food and Agriculture Organization of the United Nations (FAO), global aquaculture production reached a record 130.9 million tonnes, of which 94.4 million tonnes were aquatic animals — marking the first time aquaculture surpassed capture fisheries in animal production terms.

This milestone is significant not only for fish but also for crustaceans such as shrimp, which benefit from aquaculture growth. The rising contribution of farmed aquatic animals signals that shrimp farming is part of a broader food-system shift. For example, the FAO notes that 51% of aquatic animal production now comes from farming.

Feed improvements, disease control, and infrastructure are getting more attention—and investment, and so are the value chains and export opportunities. In human terms, small-scale farmers can access shrimp aquaculture systems and thereby gain stable livelihoods, while consumers in both urban and rural areas get more reliable access to shrimp as part of their diets.

Regional Analysis

Asia-Pacific leads with a 47.4% share and a USD 33.5 Billion market value.

In 2024, Asia-Pacific held a commanding position in the global shrimp market, accounting for 47.4% of the overall share and achieving a valuation of USD 33.5 billion. The region’s dominance is largely attributed to the extensive coastal aquaculture systems and favorable climatic conditions supporting year-round shrimp farming.

Major contributors such as China, India, Vietnam, Thailand, and Indonesia lead global shrimp production, collectively exporting millions of tonnes annually. According to the Food and Agriculture Organization (FAO), Asia accounts for nearly 80% of global farmed shrimp output, reflecting the region’s entrenched role in global seafood supply chains.

Strong government initiatives further reinforce the market’s growth trajectory. India’s Pradhan Mantri Matsya Sampada Yojana (PMMSY) and China’s ongoing seafood modernization programs are improving cold-chain logistics and sustainable farming practices. Rising disposable incomes across the Asia-Pacific have also driven domestic seafood consumption, adding to export momentum.

Sustainable shrimp aquaculture is advancing with biofloc technology, recirculating aquaculture systems (RAS), and antibiotic-free farming, boosting production efficiency and export compliance. International certifications and demand for traceable, eco-friendly shrimp are driving growth. The Asia-Pacific region is poised to lead the shrimp market, fueled by infrastructure upgrades, innovative breeding, and strong policy frameworks.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Thai Union is a vertically integrated powerhouse renowned for its branded shelf-stable tuna. Its extensive portfolio, including Chicken of the Sea and John West, grants massive retail penetration. Strategically, it focuses on sustainability and value-added product innovation to drive growth. While shrimp is a significant segment, its strength lies in its diversified protein offerings and vast global distribution network, making it a formidable, broad-based competitor in the overall seafood market.

Clearwater Seafoods is a premium wild-catch specialist with a focus on cold-water shrimp and scallops. Its key advantage is exclusive access to coveted Canadian fishing quotas, creating a high-barrier-to-entry business. Clearwater excels in supplying top-tier, sustainably harvested products to global luxury and foodservice markets. This focus on quality and scarcity, rather than volume farming, positions it uniquely in the high-end segment, commanding premium prices and strong brand loyalty.

Avanti Feeds Limited is its fully integrated model, controlling the supply chain from feed production to processing and export. It is a primary beneficiary of India’s booming aquaculture industry, leveraging cost-effective production. The company’s core expertise in high-quality shrimp feed is a critical competitive edge, ensuring healthy harvests for itself and its contract farmers. This integrated approach makes it a volume leader and a key supplier to international markets.

Top Key Players in the Market

- Thai Union Group PCL

- Clearwater Seafoods

- Avanti Feeds Limited

- High Liner Foods

- Surapon Foods Public Company Limited

- Mazzetta Company, LLC

- Aqua Star

- Nordic Seafood A/S

- The Waterbase Limited

- Wild Ocean Direct

Recent Developments

- In 2024, Thai Union Group PCL, a global leader in seafood processing with a strong focus on sustainable shrimp production, has made significant strides. The company launched the Shrimp Decarbonization Initiative in collaboration with The Nature Conservancy and Ahold Delhaize USA, aiming to reduce greenhouse gas emissions in Thailand’s shrimp supply chain through pilot programs on farms.

- In 2024, Clearwater Seafoods, a Canadian vertically integrated seafood company specializing in coldwater shrimp and shellfish, has focused on operational expansions and market positioning amid challenges. Its parent company, Premium Brands Holdings Corporation, announced plans to acquire a seafood business, enhancing Clearwater’s processing capabilities for shrimp and other products.

Report Scope