Desalination Chemicals Market Summary

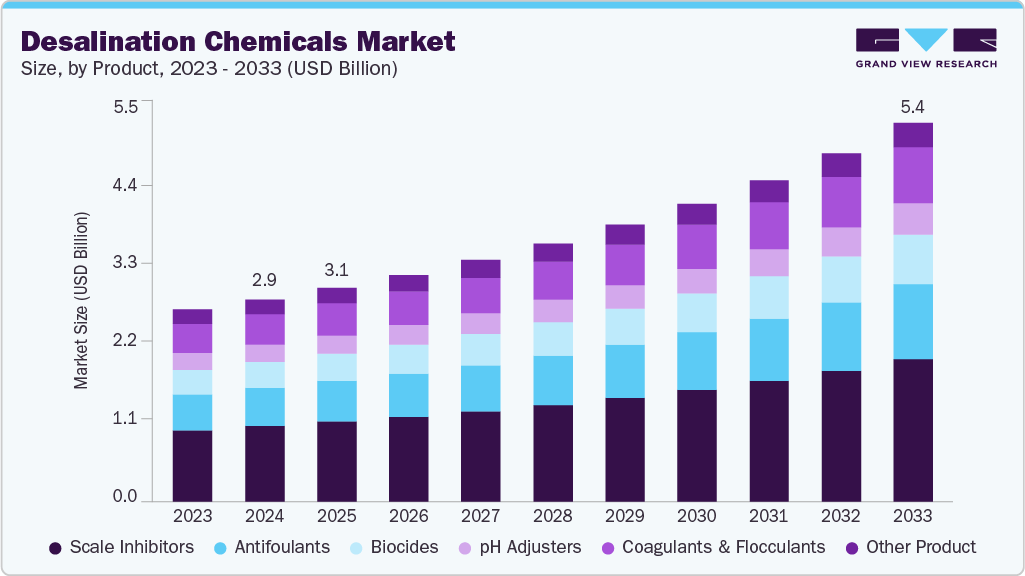

The global desalination chemicals market size was estimated at USD 2,895.1 million in 2024 and is projected to reach USD 5,424.1 million by 2033, growing at a CAGR of 7.4% from 2025 to 2033. The demand is rising as water-stressed regions expand desalination capacity to secure reliable freshwater; chemical formulations that prevent scale, control biofouling, and enable membrane longevity directly influence plant performance and operating costs, making these products essential for efficient, continuous desalination operations across coastal and inland sites.

Key Market Trends & Insights

- The desalination chemicals market in North America is expected to grow at the fastest CAGR of 7.4% from 2025 to 2033.

- By product, the scale inhibitors segment led the market with the largest revenue share of 37.3% in 2024.

- By application, the industrial water treatment segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033.

Market Size & Forecasts

- 2024 Market Size: USD 2,895.1 Million

- 2033 Projected Market Size: USD 5,424.1 Million

- CAGR (2025-2033): 7.4%

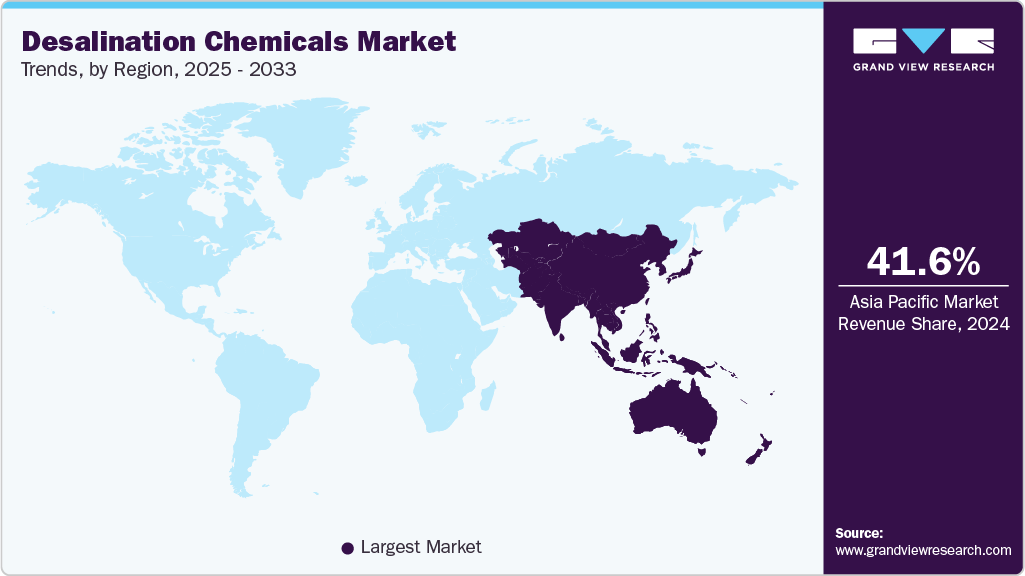

- Asia Pacific: Largest market in 2024

Growth in this desalination chemicals industry reflects expanding desalination projects and stricter water quality standards that push operators to adopt advanced pretreatment and cleaning regimens. Suppliers tailor antiscalants, biocides, corrosion inhibitors, and membrane cleaners to varied feedwaters, while service models increasingly bundle chemical supply with monitoring to reduce downtime. Cost pressures encourage formulations that extend membrane life and cut cleaning frequency, creating value through lower total lifecycle expenses. Improvements in membranes and energy integration lower operating costs, making smaller plants economically viable and widening the customer base.

Market dynamics are shaped by regulatory limits on brine discharge and reuse targets, fluctuations in energy prices that influence overall desalination economics, and collaboration between chemical producers and plant engineers to optimize system integration. The Middle East supports large-scale seawater plants, coastal industrial users require continuous high-quality supply, and remote communities prioritize low-maintenance solutions. Supply-chain resilience and local presence affect vendor selection, especially where rapid replenishment is critical. Environmental scrutiny raises demand for chemicals with clear ecotoxicity profiles and for vendors who can document lifecycle impacts; manufacturers that provide transparent efficacy data, third-party validations, and tailored training increase operator confidence and lock in longer contracts.

Opportunities exist in developing environmentally benign chemistries that reduce harmful byproducts and in digital dosing systems that lower consumption while maintaining performance. Service-based models that tie chemical usage to performance guarantees create incentives for both suppliers and operators to maximize efficiency. Partnerships with membrane makers and integrators can accelerate adoption of package solutions that simplify operations. Companies investing in field trials, robust documentation, and regional technical teams can convert pilots into repeat business. Emerging financing models and outcome-based contracts further incentivize suppliers to demonstrate measurable savings and environmental benefits.

Market Concentration & Characteristics

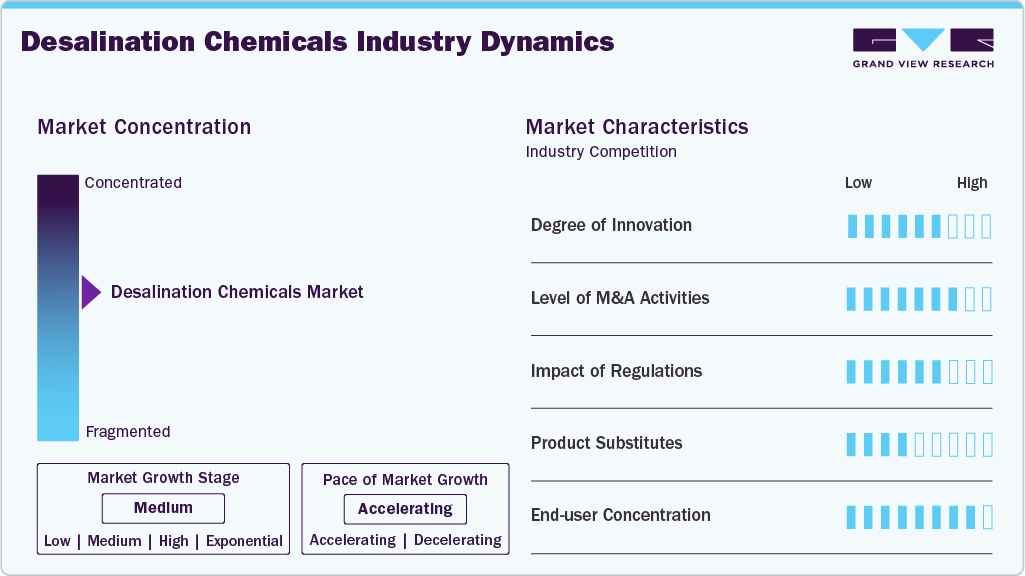

The desalination chemicals industry demonstrates moderate concentration, with a mix of global producers and specialized regional suppliers. Large multinational firms dominate through established product portfolios, technical expertise, and long-standing relationships with desalination plant operators. At the same time, smaller companies focus on customized formulations, niche applications, and rapid service delivery, creating a balanced competitive landscape where innovation and performance often determine market share rather than size alone.

The market’s characteristics are defined by high technical requirements, consistent demand stability, and a strong emphasis on operational reliability. Product performance is closely linked to system efficiency, making quality assurance and compatibility critical in supplier selection. Environmental compliance, product safety, and supply continuity increasingly shape purchasing decisions. Continuous R&D in membrane compatibility, eco-friendly formulations, and integrated dosing systems defines the evolving competitive edge, while collaboration between chemical manufacturers and plant operators reinforces long-term partnerships and shared performance objectives.

Product Insights

The scale inhibitors segment led the market with the largest revenue share of 37.3% in 2024, due to their essential role in preventing mineral scaling within reverse osmosis and thermal desalination systems. Scaling is one of the most significant operational challenges in desalination plants, reducing membrane efficiency and increasing energy consumption. Continuous advancements in environmentally compliant and high-performance inhibitor formulations have strengthened their adoption across both municipal and industrial desalination projects.

The antifoulants segment is expected to grow at the fastest CAGR of 7.9% from 2025 to 2033, driven by the increasing need to manage organic and biological fouling in membrane-based desalination systems. As desalination facilities expand into regions with variable water quality, operators prioritize chemicals that extend membrane lifespan and reduce cleaning frequency. Growing emphasis on sustainable and biodegradable antifoulant formulations also supports stronger market adoption in upcoming desalination projects.

Application Insights

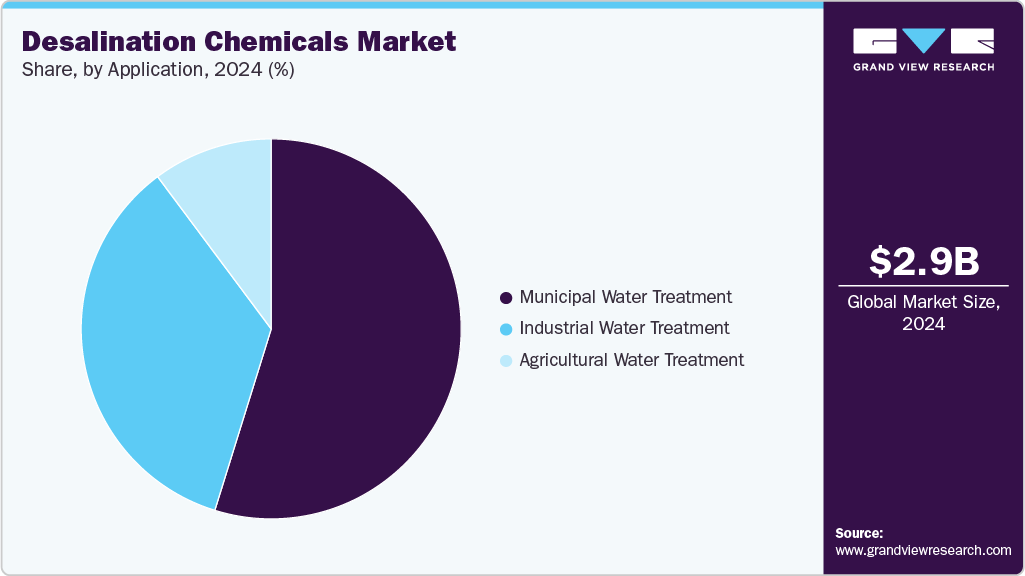

The municipal water treatment segment led the market with the largest revenue share of 54.8% in 2024, as governments and public utilities increasingly relied on desalination to meet the rising demand for safe drinking water in water-scarce regions. Large-scale municipal projects emphasize consistent water quality and operational reliability, driving higher consumption of chemicals that prevent scaling, corrosion, and biofouling. Expanding urban populations and tightening water regulations further reinforce this segment’s leading position.

The industrial water treatment segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033, supported by growing industrial activity in sectors such as energy, manufacturing, and mining. These industries depend on desalinated water for process reliability and resource efficiency. Increasing regulatory scrutiny on wastewater reuse and sustainable operations encourages facilities to adopt advanced desalination chemicals that optimize plant performance and reduce maintenance-related production losses.

Regional Insights

The desalination chemicals market in North America is expected to grow at the fastest CAGR of 7.4% from 2025 to 2033, primarily due to increasing water scarcity in regions such as California, Texas, and parts of Mexico. Rising stress on groundwater reserves and the push for drought-resilient infrastructure are fueling new desalination projects. Strong environmental regulations and the adoption of advanced membrane technologies encourage the use of high-performance, eco-friendly desalination chemicals across municipal and industrial applications.

U.S. Desalination Chemicals Market Trends

The desalination chemicals market in the U.S. is expected to grow at a steady CAGR during the forecast period, due to increasing water stress in arid states like California, Arizona, and Texas. Aging water infrastructure and recurring droughts drive investments in both seawater and brackish water desalination plants. Industrial sectors such as power generation and semiconductor manufacturing also demand high-quality water, creating a robust market for antiscalants, antifoulants, and corrosion inhibitors tailored to strict regulatory and environmental standards.

Asia Pacific Desalination Chemicals Market Trends

Asia Pacific dominated the desalination chemicals market with the largest revenue share of 41.6% in 2024, driven by growing investments in desalination infrastructure across countries such as China, India, and Australia. Rapid population growth, agricultural water demand, and recurring droughts have intensified the need for sustainable freshwater sources. Government-backed projects, combined with expanding industrial zones along coastal areas, have accelerated the adoption of desalination chemicals to ensure stable water quality and reliable plant performance.

China held over 53.6% revenue share of the Asia Pacific desalination chemicals market. The China desalination chemicals market is expanding rapidly, supported by coastal industrialization, urban water demand, and government initiatives to secure sustainable water supply. Frequent water scarcity in northern provinces and stricter water quality regulations push desalination operators to adopt effective chemical solutions. Large-scale municipal projects, combined with growing desalination adoption in energy and manufacturing sectors, increase reliance on chemicals that enhance membrane performance and extend plant longevity.

Europe Desalination Chemicals Market Trends

The desalination chemicals market in Europe growth is driven by Mediterranean countries like Spain, Italy, and Greece, where freshwater scarcity is recurrent. Environmental compliance and sustainable operations strongly influence chemical selection, encouraging eco-friendly and low-impact formulations. The region’s focus on energy-efficient desalination, regulatory oversight of brine discharge, and integration of renewable energy into water treatment plants further support the demand for advanced chemical solutions to maintain operational efficiency and water quality standards.

Latin America Desalination Chemicals Market Trends

The desalination chemicals market in Latin America is growing due to water stress in arid regions of Chile, Peru, and Mexico. Mining operations, agriculture, and municipal supply projects create a consistent need for reliable desalination systems. Investments in large-scale and off-grid desalination plants, coupled with increasing focus on minimizing environmental impacts of brine discharge, drive the adoption of high-performance chemicals such as scale inhibitors, biocides, and membrane cleaners to optimize water recovery and plant longevity.

Middle East & Africa Desalination Chemicals Market Trends

The desalination chemicals market in Middle East & Africa dominates desalination globally due to extreme water scarcity in Gulf countries, Saudi Arabia, UAE, and parts of North Africa. The region relies heavily on seawater desalination for municipal and industrial supply, creating continuous demand for chemicals that prevent scaling, fouling, and corrosion in large-scale plants. High energy costs and environmental regulations also encourage the use of optimized chemical dosing and eco-friendly formulations, making this market a major hub for desalination chemical consumption.

Key Desalination Chemicals Company Insights

The two key dominant manufacturers in the market are Italmatch Chemicals and Solenis LLC.

-

Italmatch Chemicals specializes in innovative water treatment solutions, offering a range of chemicals designed to enhance desalination efficiency and protect plant infrastructure. Their products focus on preventing scale formation, controlling biofouling, and maintaining membrane integrity, ensuring consistent and reliable water production across municipal and industrial applications.

-

Solenis LLC develops advanced chemical solutions that optimize performance in desalination and water treatment systems. Their offerings include antiscalants, antifoulants, and cleaning chemicals that help maintain operational efficiency and reduce maintenance needs. The company focuses on enhancing the reliability and productivity of reverse osmosis and thermal desalination plants.

Key Desalination Chemicals Companies:

The following are the leading companies in the desalination chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Italmatch Chemicals

- Solenis LLC

- American Water Chemicals, Inc.

- Genesys International Ltd.

- Omya International AG

- Ecolab Inc.

- Veolia Environnement SA

- Kurita Water Industries Ltd.

- Dow Chemical Company

- BASF SE

Recent Developments

-

In October 2025, TotalEnergies and Veolia signed a memorandum of understanding to enhance collaboration in energy transition and circular economy initiatives. The partnership aims to reduce greenhouse gas emissions and water footprint through joint projects in methane reduction, water reuse, and sustainable desalination.

-

In August 2025, Bluemont became the exclusive distributor of Elemental Water Makers’ solar desalination systems in Australia, New Zealand, and the Pacific Islands. This partnership aims to provide sustainable, chemical-free, and off-grid water solutions to remote and climate-vulnerable communities.

Desalination Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,063.8 million

Revenue forecast in 2033

USD 5,424.1 million

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

Italmatch Chemicals; Solenis LLC; American Water Chemicals, Inc.; Genesys International Ltd.; Omya International AG; Ecolab Inc.; Veolia Environnement SA; Kurita Water Industries Ltd.; Dow Chemical Company; BASF SE

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Desalination Chemicals Market Report Segmentation

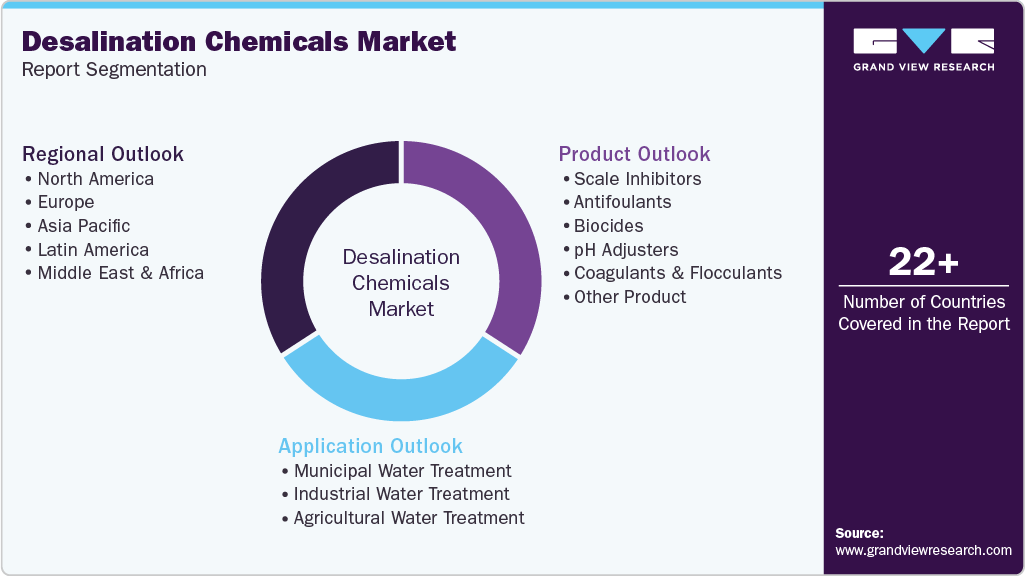

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global desalination chemicals market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 – 2033)

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 – 2033)

-

Municipal Water Treatment

-

Industrial Water Treatment

-

Agricultural Water Treatment

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 – 2033)

-

North America

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-