Communist Party leaders are meeting in Beijing this week to map out China’s economic strategy for the next five years – doubling down on ambitious plans to dominate high-tech industries and raise the country’s geopolitical heft.

Despite escalating trade friction with the United States and other countries, Chinese leader Xi Jinping has signaled that his top economic priority is boosting China’s manufacturing prowess with across-the-board technological innovation – reflecting confidence that Beijing’s current course is a winning one.

While details of the country’s new five-year plan, covering 2026 to 2030, will be released in coming weeks and months, the main pillars of its industrial policy are clear: increase China’s self-reliance in advanced technologies, while expanding overseas markets to fuel export-driven growth.

Why We Wrote This

The world’s second-largest economy, China, is deciding its economic strategy for the next five years, a decision with high global stakes.

Indeed, experts say that China’s status as the world’s second-largest economy is attracting growing attention to the once obscure, state-led plans, the first of which was launched under Mao Zedong in 1953.

“If we have learned something from the past decade, it should be to take these plans seriously,” says Katja Drinhausen from the Mercator Institute for China Studies (MERICS), a Berlin-based think tank. “The strategic push of the next five-year plan is something that – one way or another – pretty much all countries around the world will feel.”

Withstanding pressure

Mr. Xi’s determination to stay the course on his economic policy has been strengthened by how China has so far weathered the trade-war turbulence unleashed by U.S. President Donald Trump.

Tariffs and other trade barriers imposed on China in recent months by the United States and European Union have had a limited impact on the country’s overall exports.

“Chinese companies have been able to manage the tariff burden,” says Andrew Batson, chief analyst of the Chinese economy at the independent research firm Gavekal Dragonomics. “China has been very effective in the trade diplomacy with the U.S. and averting much worse outcomes.”

Shipping containers fill the port in Qingdao, China, Oct. 20, 2025. A main pillar of China’s new five-year economic plan is to expand overseas markets to fuel export-driven growth.

Moreover, the Chinese government is likely “quite skeptical” of Washington’s willingness to maintain extremely high tariffs on China, such as the 100% levy on U.S. imports from China that Mr. Trump recently threatened, Mr. Batson says.

Trade restrictions by the U.S. and the European Union do “not seem to be blowing them off course at all,” agrees Jonathan Czin, a fellow in the John L. Thornton China Center at the Brookings Institution in Washington.

China’s economy is on track to meet the government target of a roughly 5% increase in gross domestic product this year, having achieved 5.3% GDP growth in the first six months. Robust increases in exports – up 8.3% year-over-year in September alone – along with strong industrial production, have driven that growth, government data shows.

Mr. Xi casts China’s industrial policy as a source of economic stability in an increasingly uncertain world. China must “use the certainty of high-quality development to cope with the uncertainty arising from the rapidly changing external environment,” Mr. Xi urged at a meeting of the Communist Party’s ruling Politburo in April.

Beijing’s confidence about withstanding protectionist pressures is reflected in the effusive tone of official media reports. This month, a commentary in the party-controlled People’s Daily declared that “the giant ship of China is an unstoppable, unbreakable ‘economic aircraft carrier,’ undeterred by wind and rain and forging ahead.”

Road to development

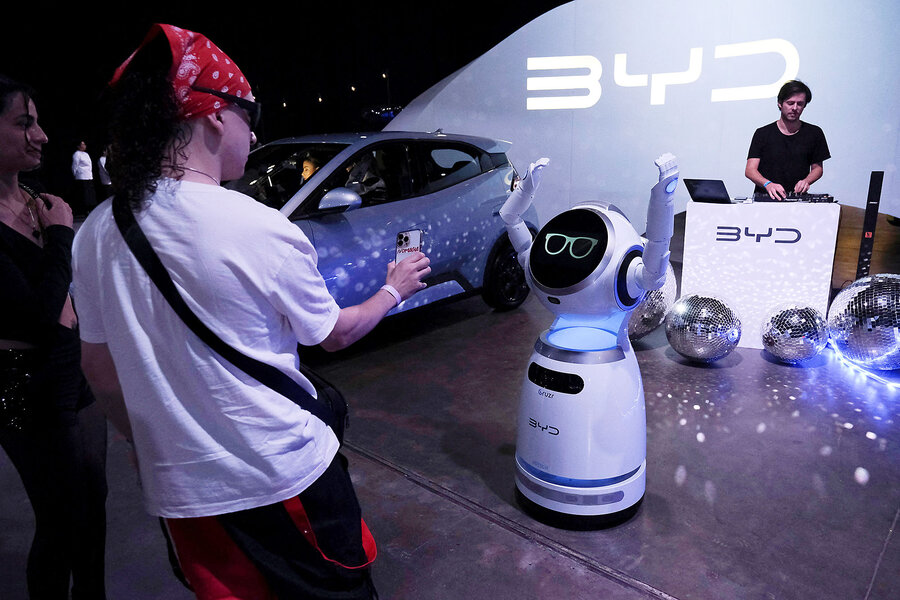

China’s success in recent years in gaining dominance over cutting-edge industries – from electric vehicles and batteries to solar panels – has reinforced its pursuit of technological innovation to boost productivity.

“They see themselves on the precipice of … a technological revolution” that will put them at the center of the world stage, says Alexander Davey, an analyst at MERICS who focuses on China’s policymaking.

Still, the industrial policy has not been without its shortcomings, requiring course corrections.

State support – such as subsidies and tax breaks – has helped nurture young, innovative industries. But it has also led to a proliferation of Chinese companies competing to make similar products, as well as overproduction, price wars, and an erosion of profits.

The government is likely to address this problem in the new five-year plan by encouraging consolidation in industries such as electric vehicles, while also calling for regions to specialize in order to avoid the wasteful duplication of resources. In Beijing’s view, cities should “stop acting like little kingdoms and being protectionist,” says Mr. Davey.

Customers shop for a washing machine at an appliance store in Beijing, Oct. 19, 2025. Communist party leaders are hammering out a new five-year economic plan.

Another pressing issue is to what extent Beijing will balance its industrial policy with support for other stated priorities, such as increasing domestic demand and consumption. Despite much lip service to the goal of improving people’s livelihoods, policies to increase social benefits – such as pensions and other welfare – have been lacking.

Consumption in China is lagging given a lack of confidence in the economy among households – largely a result of ongoing stagnation in the housing market – as well as private businesses. “Private sector confidence has still not substantially recovered from its rock-bottom standing,” says Mr. Davey.

China analysts will also be watching to see whether the new, 15th five-year plan contains specific GDP targets, which were omitted from the previous plan. Such guidance could help ensure that China reaches Mr. Xi’s long-term goal of becoming a “moderately developed country” by 2035, which economists estimate would require average growth of about 4.5% a year.