U.S. Polyols Market Summary

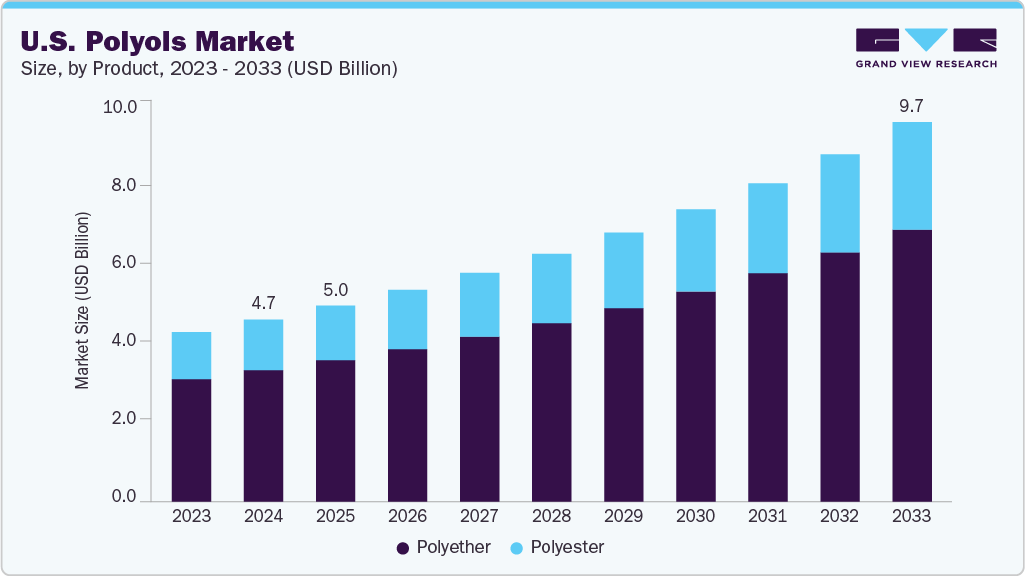

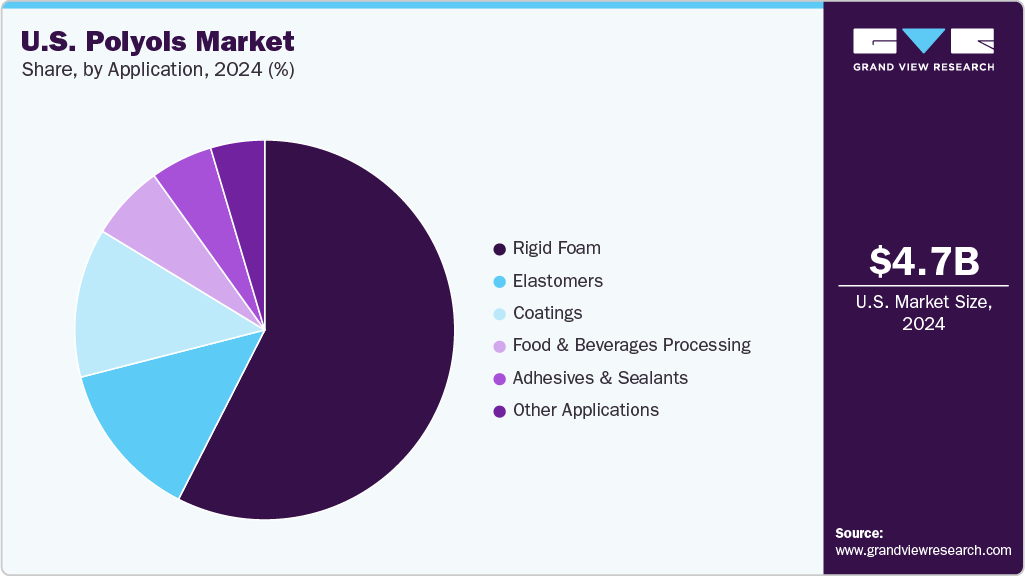

The U.S. polyols market size was estimated at USD 4,678.3 million in 2024 and is projected to reach USD 9,747.9 million by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The market is growing steadily as industries such as construction, automotive, and furniture increase their demand for polyurethane products.

Key Market Trends & Insights

- By product, the polyether segment dominated the market and accounted for the largest revenue share of 72.3% in 2024.

- By application, the adhesives & sealants segment is expected to grow fastest with a CAGR of 9.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4,678.3 Million

- 2033 Projected Market Size: USD 9,747.9 Million

- CAGR (2025-2033): 8.6%

Market expansion is supported by innovations in bio-based and high-performance polyols. Companies are developing environmentally friendly polyols to comply with regulations and meet the demand for sustainable materials. Growth in automotive applications, especially lightweight materials, and the need for energy-efficient building insulation are encouraging broader adoption. Flexible and rigid foam technologies also create opportunities for manufacturers to develop specialized products for niche markets.

Challenges such as fluctuating raw material costs and regulatory pressures can influence production strategies and pricing. Competition from alternative materials like recycled plastics or non-polyol-based foams may affect market penetration. On the other hand, the focus on sustainability, lightweight automotive solutions, and high-performance insulation presents growth opportunities. Companies investing in research and development for eco-friendly and specialty polyols are positioned to capture these emerging market segments, reinforcing the long-term expansion potential in the U.S.

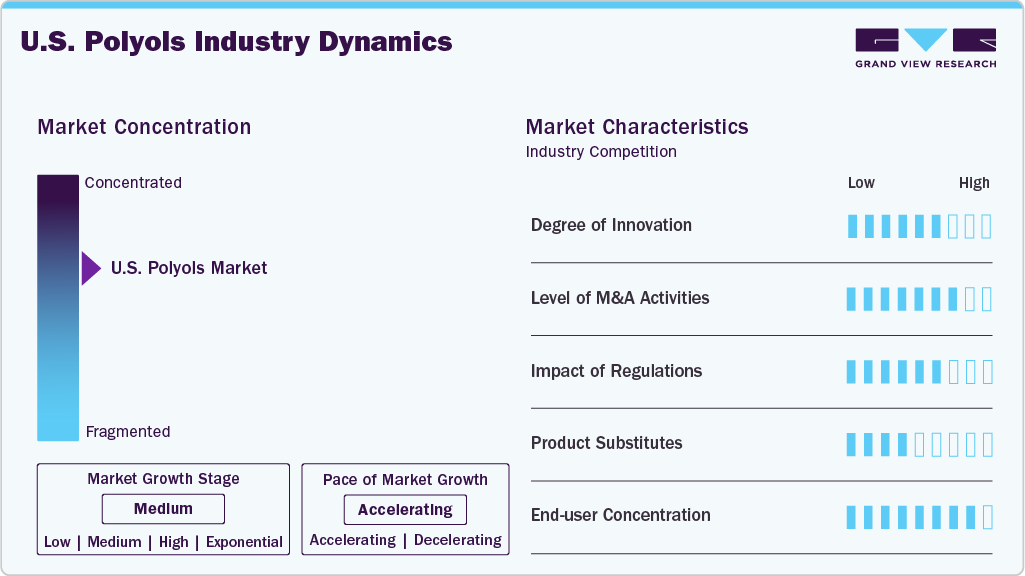

Market Concentration & Characteristics

The U.S. polyols industry is moderately concentrated, with several key manufacturers significantly influencing production and distribution. These companies have established strong supply chains, technical expertise, and relationships with end-use industries, allowing them to maintain a competitive edge. Innovation and product differentiation, particularly in high-performance and bio-based polyols, are important characteristics that shape market dynamics and set leading players apart.

Market characteristics include a reliance on raw material availability and price stability, as polyols are derived from petrochemical feedstocks. The market is driven by demand from the construction, automotive, and furniture industries, making it sensitive to trends in infrastructure development and consumer spending. Sustainability and regulatory compliance are increasingly shaping product development, encouraging manufacturers to focus on environmentally friendly solutions. The market also exhibits steady growth potential due to technological advancements, performance-driven applications, and ongoing investments in research and development.

Product Insights

The polyether segment dominated the market and accounted for the largest revenue share of 72.3% in 2024. The dominance of the polyether segment is driven by its widespread use in flexible and rigid polyurethane foams, which are essential in construction, furniture, and automotive applications. Its cost-effectiveness, versatility, and ease of processing make it the preferred choice for large-scale production. Strong demand for insulation, lightweight automotive components, and comfort products further reinforces its leading revenue share in the market.

The polyester segment is expected to grow fastest with a CAGR of 8.8% from 2025 to 2033 due to rapid growth and increasing adoption in coatings, adhesives, sealants, and elastomers, where high performance and durability are critical. Rising demand for bio-based and environmentally friendly polyesters also contributes to growth, as industries focus on sustainability. Technological advancements enabling customized polyester formulations for specialized applications are expected to drive market expansion over the forecast period.

Application Insights

The rigid foam segment dominated the market and accounted for the largest revenue share of 57.5% in 2024. The rigid foam segment leads the market due to its extensive use in insulation for buildings, refrigeration, and construction applications. Its excellent thermal resistance, durability, and lightweight nature make it ideal for energy-efficient structures and commercial projects. Continuous infrastructure development and rising demand for energy-efficient solutions in residential and industrial sectors have reinforced its dominant position and contributed to the largest revenue share.

The adhesives & sealants segment is expected to grow fastest with a CAGR of 9.0% from 2025 to 2033. The adhesives and sealants segment is projected to experience rapid growth driven by increasing industrial and construction applications that require strong bonding, flexibility, and chemical resistance. Growing adoption in automotive, electronics, and packaging industries, along with a shift toward high-performance and sustainable formulations, is expected to fuel demand. Technological advancements enabling customized solutions for specialized uses further support the segment’s accelerated growth trajectory.

Key U.S. Polyols Company Insights

The two key dominant manufacturers in the market are Huntsman International LLC and Covestro LLC.

-

Huntsman International LLC is a U.S. chemical company known for its wide range of polyols and polyurethane solutions. The company focuses on innovation and sustainability, developing advanced products for the construction, automotive, and furniture industries. Huntsman’s research-driven approach emphasizes high-performance formulations and environmentally friendly alternatives, strengthening its position in both commodity and specialty polyols. Its ability to adapt to market trends and invest in new technologies allows it to maintain a leadership role in the U.S. market.

-

Covestro LLC is a leading producer of polyols and other polymer materials, emphasizing sustainability and high-quality performance. The company is recognized for developing innovative solutions for insulation, adhesives, coatings, and elastomers. Covestro’s focus on energy-efficient and eco-friendly products aligns with growing demand for environmentally responsible materials. By leveraging technological advancements and responding to evolving industry requirements, the company maintains a strong presence and plays a significant role in shaping the U.S. market.

Key U.S. Polyols Companies:

- Palmer Holland

- Coim Group

- Huntsman International LLC.

- Shell plc

- Covestro LLC.

- Dow Inc

- BASF SE

- Cargill Inc.

- Ingredion Incorporated

- Mitsui Chemicals, Inc

- ADM

Recent Developments

-

In December 2024, Dow Inc. announced the production of VORANOL WK5750, an advanced polyether polyol, at its Freeport polyol plant. Designed for soft and hypersoft foams, it enhances comfort in mattresses, furniture, and automotive seating. The polyol’s unique formulation is a powerful cell opener, extending its utility to viscoelastic and high-resiliency foam applications.

-

In September 2024, Cargill Inc. introduced three 100% bio-based polyols, including Priplast, at FEICA. The portfolio eliminated isocyanates, incorporated rPET-based formulations, and provided fully bio-based alternatives with enhanced performance attributes.

U.S. Polyols Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,038.5 million

Revenue forecast in 2033

USD 9,747.9 million

Growth rate

CAGR of 8.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Palmer Holland; Coim Group; Huntsman International LLC; Shell plc; Covestro LLC; Dow Inc.; BASF SE; Cargill Inc.; Ingredion Incorporated; Mitsui Chemicals, Inc.; ADM

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Polyols Market Report Segmentation

This report forecasts revenue growth at the U.S., regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. polyols market report based on product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)

-

Application Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 – 2033)